CFA Level 2

0.0(0)

Card Sorting

1/336

Earn XP

Description and Tags

Last updated 9:44 PM on 11/27/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

337 Terms

1

New cards

cap rate

discount rate - growth rate

(NOI_1)/Value

(NOI_1)/Value

2

New cards

Cost approach to value

Land value + Building replacement cost - Total depreciation

3

New cards

Calculate net operating income (NOI)

NOI = Rental income + Other income - Vacancy and collection loss - Property management costs

4

New cards

Debt Service Coverage Ratio

NOI_1/(Maximum Debt Service)

Loan amount (interest-only loan) = Maximum debt service/Mortgage rate

Loan amount (interest-only loan) = Maximum debt service/Mortgage rate

5

New cards

LTV (Loan to Value)

loan amount / appraised value

6

New cards

The maximum amount of debt that an investor can obtain on commercial real estate is usually limited by either the ratio of the loan to the appraised value of the property (loan-to-value, or LTV, ratio) or the debt service coverage ratio (DSCR), depending on which measure results in the lowest/highest loan amount.

lowest

7

New cards

Formula for Adjusted Funds From Operations (AFFO)

Funds from operations (FFO)

Less: Non-cash rents

Less: Recurring maintenance-type capital expenditures

Equals: AFFO

Less: Non-cash rents

Less: Recurring maintenance-type capital expenditures

Equals: AFFO

8

New cards

Effect of adding cash to information ratio vs sharpe ratio?

The sharpe ratio will remain unaffected while the information ratio will decrease because the numerator (active return) will decr and the active risk will remain the same

9

New cards

Explain Information ratio and provide formula

measure of the consistency of active returns

active return/active risk

active return/active risk

10

New cards

What is break-even inflation rate (BEI) and what is it composed of?

yield on non-inflation indexed bond - yield on inflation indexed bond

composed of expected inflation and a risk premium for uncertainty about actual inflation

composed of expected inflation and a risk premium for uncertainty about actual inflation

11

New cards

The highest squared Sharpe ratio of an actively managed portfolio is

(SR_P)^2 = (SR_B)^2 + IR^2

SR_P = sharpe ratio of portfolio

SR_B = sharpe ratio of benchmark

IR = information ratio

SR_P = sharpe ratio of portfolio

SR_B = sharpe ratio of benchmark

IR = information ratio

12

New cards

Total Value Added

Total Value Added = Asset Allocation + Security Selection

13

New cards

Value Added from Asset Allocation

Sum of (active weight x benchmark return)

14

New cards

Value Added from Security Selection

Sum of (absolute portfolio weight x active return)

15

New cards

Explain how adding cash to a portfolio will change information ratio but not sharpe ratio

The numerator in information ratio will change due to a lower active return by adding cash

16

New cards

Would an unconstrained portfolio's information ratio be affected by the aggressiveness of the active weights?

No, because if active weights are tripled, active return and risk both triple leading to no change

17

New cards

Effective spread (buy order)

2 x (+1)(transaction price - midpoint price)

18

New cards

Effective spread (sell order)

2 x (-1)(transaction price - midpoint price)

19

New cards

Difference between explicit and implicit trading costs

-Explicit trading costs include brokerage, taxes, and fees one would expect to receive for such costs

-Implicit costs are harder to measure and include bid/ask spread, market or price impact costs, opportunity cost and delay costs (slippage)

-Implicit costs are harder to measure and include bid/ask spread, market or price impact costs, opportunity cost and delay costs (slippage)

20

New cards

What is Information Coefficient (IC)?

-it is a measure of a manager's skill

-IC is the ex-ante, risk weighted correlation between active returns and forecasted active returns

-IC is the ex-ante, risk weighted correlation between active returns and forecasted active returns

21

New cards

What is Transfer Coefficient (TC)?

-transfer coefficient is the cross-sectional correlation between the forecasted active returns and the actual weights adjusted for risk

22

New cards

Explain Breadth

-number of independent active bets taken per year

-Example, if a manager takes active positions in 10 securities each month, then BR = 10x12 = 120

-Example, if a manager takes active positions in 10 securities each month, then BR = 10x12 = 120

23

New cards

The difference between the yield on a zero-coupon, default-free nominal bond and the yield on a zero-coupon, default-free real bond of the same maturity reflects:

A) investors' expectations about future inflation only.

B) a premium for the uncertainty of future inflation only.

C) both, investors' expectations about future inflation and a premium for the uncertainty of future inflation.

A) investors' expectations about future inflation only.

B) a premium for the uncertainty of future inflation only.

C) both, investors' expectations about future inflation and a premium for the uncertainty of future inflation.

C is correct. The difference between the yield on a zero-coupon, default-free nominal bond and the yield on a zero-coupon, default-free real bond of the same maturity is known as the break-even inflation rate. This break-even inflation rate will incorporate the inflation expectations of investors over the investment horizon of the two bonds, plus a risk premium to compensate investors for uncertainty about future inflation. Break-even inflation rates are not simply the market's best estimate of future inflation over the relevant investment horizon, because break-even inflation rates also include a risk premium to compensate investors for their uncertainty about future inflation.

24

New cards

Explain Intertemporal Rate of Substitution and provide formula

MU_tomorrow / MU_today

where MU = marginal utility of consumption

explains an investor's trade off between real consumption now and real consumption in the future

where MU = marginal utility of consumption

explains an investor's trade off between real consumption now and real consumption in the future

25

New cards

Explain inverse relationship between real rates and intertemporal rate of substitution

higher intertemporal rate of substitution, lower real interest rates

lower intertemporal rate of substitution, higher real interest rates

lower intertemporal rate of substitution, higher real interest rates

26

New cards

Formula for Optimal amount of active risk for an unconstrained portfolio

= [(IR)/(SR_B)] * (SD_B)

IR = information ratio

SR_B = benchmark sharpe ratio

SD_B - benchmark SD

IR = information ratio

SR_B = benchmark sharpe ratio

SD_B - benchmark SD

27

New cards

Formula for Sharpe Ratio of a portfolio with an optimal level of active risk

sqrt[(SR_B^2) + (IR^2)]

28

New cards

formula for IR for an unconstrained portfolio

IR = IC*sqrt(BR)

29

New cards

formula for expected value added by active management for an unconstrained portfolio

IC*sqrt(BR)*optimal level of active risk

30

New cards

formula for IR for a constrained portfolio

(TC)*IC*sqrt(BR)

31

New cards

formula for expected value added by active management for a constrained portfolio

(TC)*IC*sqrt(BR)*optimal level of active risk

32

New cards

Formula for Optimal amount of active risk for a constrained portfolio

= [(TC)*(IR)/(SR_B)] * (SD_B)

IR = information ratio

SR_B = benchmark sharpe ratio

SD_B - benchmark SD

TC = transfer coefficient

IR = information ratio

SR_B = benchmark sharpe ratio

SD_B - benchmark SD

TC = transfer coefficient

33

New cards

formula for Information Coefficient (IC)

IC = 2*(% correct) - 1

34

New cards

arbitrage gap

- the price band of the NAV that the ETFs trade within

- tends to be wider for ETFs with illiquid holdings

- also tends to be widers for ETF's on a foreign index due to time zone differences

- tends to be wider for ETFs with illiquid holdings

- also tends to be widers for ETF's on a foreign index due to time zone differences

35

New cards

ETF authorized participants create and redeem ETF shares in the (primary/secondary) market.

ETF secondary market trades are transactions between buyers and sellers of existing ETF shares. No new ETF shares are created by trades in the secondary market. ETF authorized participants create and redeem ETF shares in the primary market.

36

New cards

Assuming arbitrage costs are minimal, which of the following is most likely to occur when the share price of an ETF is trading at a premium to its intraday NAV?

a) New ETF shares will be created by the ETF sponsor.

b) Redemption baskets will be received by APs from the ETF sponsor.

c) Retail investors will exchange baskets of securities that the ETF tracks for creation units.

a) New ETF shares will be created by the ETF sponsor.

b) Redemption baskets will be received by APs from the ETF sponsor.

c) Retail investors will exchange baskets of securities that the ETF tracks for creation units.

A is correct. When the share price of an ETF is trading at a premium to its intraday NAV and assuming arbitrage costs are minimal, APs will step in and take advantage of the arbitrage. Specifically, APs will step in and buy the basket of securities that the ETF tracks (the creation basket) and exchange it with the ETF provider for new ETF shares (a creation unit). These new shares received by APs can then be sold on the open market to realize arbitrage profits.

37

New cards

ETF bid-ask spreads are generally less than or equal to the combination of the following:

± Creation/redemption fees and other direct costs, such as brokerage and exchange fees

+ Bid-ask spread of the underlying securities held by the ETF

+ Compensation for the risk of hedging or carrying positions by liquidity providers (market makers) for the remainder of the trading day

+ Market maker's desired profit spread

− Discount related to the likelihood of receiving an offsetting ETF order in a short time frame

+ Bid-ask spread of the underlying securities held by the ETF

+ Compensation for the risk of hedging or carrying positions by liquidity providers (market makers) for the remainder of the trading day

+ Market maker's desired profit spread

− Discount related to the likelihood of receiving an offsetting ETF order in a short time frame

38

New cards

Assumptions of Arbitrage Pricing Theory (APT)

- Unsystematic risk can be diversified away in a portfolio.

- Returns are generated using a factor model

- No arbitrage opportunities exist

- Returns are generated using a factor model

- No arbitrage opportunities exist

39

New cards

Probability of an up-move

U = (1 + rf - D)/(U - D)

40

New cards

Hedge Ratio

the fractional share of stock needed in the arbitrage trade

h = [C(+) - C(-)]/[S(+) - S(-)]

C(+)/(-) = call up/down move payoff

S(+)/(-) = stock up/down move payoff

h = [C(+) - C(-)]/[S(+) - S(-)]

C(+)/(-) = call up/down move payoff

S(+)/(-) = stock up/down move payoff

41

New cards

assumptions of the Black-Scholes-Merton option valuation model

1) underlying asset price follows a geometric brownian motion process

2) The (continuously compounded) risk-free rate is constant and known. Borrowing and lending are both at the risk-free rate.

3) The volatility of the returns on the underlying asset is constant and known.

4) Markets are "frictionless."

5) The (continuously compounded) yield on the underlying asset is constant

6) Options are European

2) The (continuously compounded) risk-free rate is constant and known. Borrowing and lending are both at the risk-free rate.

3) The volatility of the returns on the underlying asset is constant and known.

4) Markets are "frictionless."

5) The (continuously compounded) yield on the underlying asset is constant

6) Options are European

42

New cards

Compare and contrast delta for a call and out option

A call option's delta will increase from 0 to e^(-rt) as stock increases. For a non dividend paying stock, delta will increase from 0 to 1 as stock price increases.

A put option's delta will increase from -e^(-rt) to 0 as stock increases. For a non dividend paying stock, delta will increase from -1 to 0 as stock price increases.

A put option's delta will increase from -e^(-rt) to 0 as stock increases. For a non dividend paying stock, delta will increase from -1 to 0 as stock price increases.

43

New cards

Interpret a gamma of 0.04

A gamma of 0.04 implies that a $1 increase in the price of the underlying stock will cause a call option's delta to increase by 0.04 making it more sensitive to changes in the stock price

44

New cards

When is gamma at it's highest?

for at-the money options. Deep in the money or deep out of the money have low gamma.

45

New cards

number of short call options needed to delta hedge formula

= number of shares hedged / delta of call option

46

New cards

number of long put options needed to delta hedge formula

= - number of shares / delta of put option

47

New cards

Describe the goal of a delta neutral portfolio

to combine a long position in a stock with a short position in a call option so that the value of the portfolio does not change as the stock price changes

48

New cards

Describe gamma risk

Consider a delta hedge involving a long position in stock and short position in calls. If the stock price falls abruptly, the loss in the long stock position will not equal the gain in the short call position. This is the gamma risk of the hedge.

49

New cards

Describe how implied vol is used in options trading

1) can use implied vol to gauge market perceptions

2) can use implied vol to quote option prices since options with different exercise prices and maturity dates can be quotes using the same unit of measurement

2) can use implied vol to quote option prices since options with different exercise prices and maturity dates can be quotes using the same unit of measurement

50

New cards

Describe option delta

option delta is the relationship between changes in asset prices and changes in option prices

(+) for calls, (-) for puts

(+) for calls, (-) for puts

51

New cards

According to the Black model, the value of a payer swaption can be described as the

swap component minus the bond component

52

New cards

The two fundamental rules of the arbitrageur are

(a) do not use your own money

(b) do not take any price risk

The arbitrageur does not spend proceeds from short selling transactions but invests them at the risk-free rate. The arbitrageur does not take market price risk, even though each step of the transaction may individually involve price risk. Because the steps are undertaken simultaneously, however, the price risk is offset.

(b) do not take any price risk

The arbitrageur does not spend proceeds from short selling transactions but invests them at the risk-free rate. The arbitrageur does not take market price risk, even though each step of the transaction may individually involve price risk. Because the steps are undertaken simultaneously, however, the price risk is offset.

53

New cards

Valuation of a Swap

V(swap) = [r(fixed at time of initiation) - r(fixed at time we are valuing)] x sum of DF x notional

54

New cards

FP(on an equity index) with continuous dividends

S x e^(CCRF rate - CCDY)(T)

CCRF = continuously compounded risk free rate

CCDY = continuously compounded dividend yield

CCRF = continuously compounded risk free rate

CCDY = continuously compounded dividend yield

55

New cards

Explain carry arbitrage if the forward is overpriced to make a profit

borrow money => go long the spot asset => go short asset in the forward market

56

New cards

Explain reverse carry arbitrage if the forward is underpriced to make a profit

borrow asset => short spot asset => lend money => long forward

57

New cards

Explain the notation of a 2x3 FRA

a contract that expires in 60 days and the underlying loan is settled in 90 days. The underlying rate is 30 day LIBOR

58

New cards

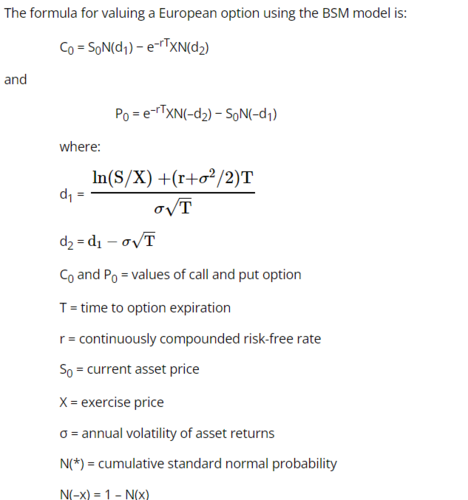

Formula for deriving European option using the BSM model

59

New cards

explain a call and put option using BSM

-a call option can be interpreted as a leveraged stock investment where N(d1) units of stock are purchased using e^(-rT)XN(d2) borrowed funds (short position in bonds)

-a put option consists of a long position in N(-d2) bonds and a short position in N(-d1) stocks

-a put option consists of a long position in N(-d2) bonds and a short position in N(-d1) stocks

60

New cards

Explain N(d2) and N(-d2)

N(d2) is the risk neutral probability that a call option will expire in the money

N(-d2) is the risk neutral probability that a put option will expire in the money

N(-d2) is the risk neutral probability that a put option will expire in the money

61

New cards

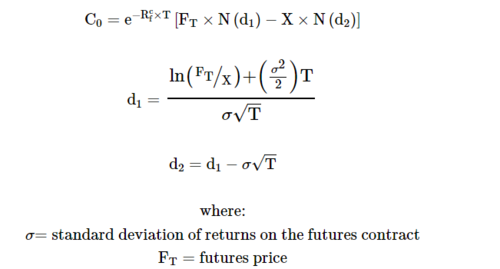

Formula for modeling options on forwards and futures using the Black model

62

New cards

Explain how options on futures can be modeled with the Black model

-The value of a call option on futures is equal to the value of a portfolio with a long futures position (the PV of the futures price multiplied by N(d1)) and a short bond position (the PV of the exercise price multiplied by N(d2)).

-The value of a put option is equal to the value of a portfolio with a long bond and a short futures position.

-The value of a call can also be thought of as the present value of the difference between the futures price (adjusted by N(d1)) and the exercise price (adjusted by N(d2)).

-The value of a put option is equal to the value of a portfolio with a long bond and a short futures position.

-The value of a call can also be thought of as the present value of the difference between the futures price (adjusted by N(d1)) and the exercise price (adjusted by N(d2)).

63

New cards

Capital gains yield Formula

In the Gordon growth model, Total return = Dividend yield + Capital gains yield

64

New cards

Sustainable Growth Rate (SGR)

ROE x (1 - payout ratio)

65

New cards

Explain the difference between return on invested capital and return on capital employed

ROIC is a return to both equity and debt and is preferable to ROE because it allows for comparisons across firms with different capital structures

Return on capital employed is similar to ROIC but uses pretax operating earnings in the numerator to allow comparison between companies that face different tax rates

Return on capital employed is similar to ROIC but uses pretax operating earnings in the numerator to allow comparison between companies that face different tax rates

66

New cards

ROIC formula

NOPLAT/Invested Capital

NOPLAT = EBIT x (1 - eff tax rate)

Invested Capital = operating assets minus operating liabilities

high ROIC is sign of competitive advantage

NOPLAT = EBIT x (1 - eff tax rate)

Invested Capital = operating assets minus operating liabilities

high ROIC is sign of competitive advantage

67

New cards

formula for PVGO

V = (EPS_1/r) + PVGO

value of company w/o reinvestment

value of company w/o reinvestment

68

New cards

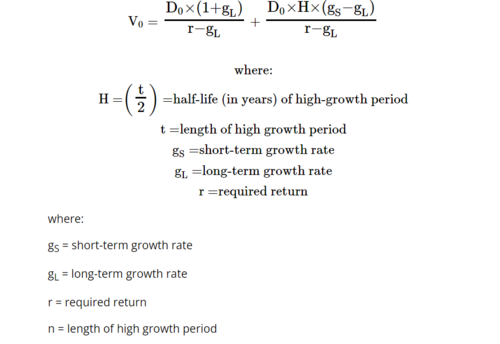

H-Model Formula

69

New cards

Calculating FCFF from NI

NI + NCC + [INT x (1-tax rate)] - FCInv - WCInv

70

New cards

FCInv formula

Equal to the difference between capital expenditures and the proceeds from the sale of long term assets

71

New cards

WCInv

Equal to the change in working capital, excluding cash, cash equivalents, notes payable, and the current portion of LT debt

72

New cards

Formula to calculate FCFE from FCFF

FCFF - [INT x (1 - tax rate)] + net borrowing

where net borrowing equals long and short term new debt issues - long and short term debt repayments

where net borrowing equals long and short term new debt issues - long and short term debt repayments

73

New cards

Value of the firm under FCFF?

Equity Value under FCFF?

Equity Value under FCFF?

(FCFF_1)/(WACC - g)

Equity value = Firm value - Market value of debt

Equity value = Firm value - Market value of debt

74

New cards

Formula for Value of equity under FCFE

(FCFE_1)/(r - g)

75

New cards

Formula FCFE using debt ratio

FCFE = Net income - (1 - DR) × (FCInv - Depreciation) - (1 - DR) × (WCInv)

76

New cards

Discount for Lack of Control (DLOC)

1 - (1 / (1 + control premium))

77

New cards

Total Discount for DLOC & DLOM

1 - ((1-DLOC)(1-DLOM))

78

New cards

Formula and explain PEG Ratio

ratio of P/E multiple to earnings growth rate

lower PEGs are more attractive than stocks with high PEGs, assuming that risk is similar

lower PEGs are more attractive than stocks with high PEGs, assuming that risk is similar

79

New cards

Fed model

considers the overall market to be overvalued (undervalued) when the earnings yield (i.e the e/p ratio) on the S&P 500 index is lower (higher) than the yield on 10 year US treasury bonds.

80

New cards

Yardeni Model

It incorporates the expected growth rate in earnings:

CEY = CBY - b x LTEG + residual

CEY: current EY on the market index

CBY: current Moody's A-rate corporate bond yield

LTEG: consensus 5-year earnings growth rate for the market index

b: the weight the market gives to five-year earnings projections

CEY = CBY - b x LTEG + residual

CEY: current EY on the market index

CBY: current Moody's A-rate corporate bond yield

LTEG: consensus 5-year earnings growth rate for the market index

b: the weight the market gives to five-year earnings projections

81

New cards

explain method of historical average EPS to find normalized EPS

average EPS over some recent period

82

New cards

method of average ROE to find normalized EPS

average ROE multiplied by current BVPS

83

New cards

How to calculate residual income from Net Income

NI = EBIT - interest expense - income tax expense

RI = NI - equity charge

where equity charge = equity capital x cost of equity

RI = NI - equity charge

where equity charge = equity capital x cost of equity

84

New cards

Single-stage residual income valuation model

V_0 = B_0 + [(ROE - r) x B_0 / (r-g)]

85

New cards

What is a persistence factor

the projected rate at which residual income is expected to fade over the life cycle of the firm (between 0 and 1)

86

New cards

high persistence factors are associated with...

-low dividend payout ratios

-historically high residual income persistence in the industry

-historically high residual income persistence in the industry

87

New cards

low persistence factors are associated with...

-high ROE

-significant levels of non-reoccurring items

-high accounting accruals

-significant levels of non-reoccurring items

-high accounting accruals

88

New cards

Economic value added (EVA®)

measures the value added for shareholders by management during a given year

NOPAT - (WACC x total capital)

NOPAT - (WACC x total capital)

89

New cards

FCInv

= CAPEX = Ending Net PPE - Beg Net PPE + Deprec

90

New cards

justified trailing P/E

[(1 - b)*(1 + g)]/(r - g)

b = Retention Ratio

1 - b = DPR

b = Retention Ratio

1 - b = DPR

91

New cards

justified leading P/E

(1 - b)/(r - g) = (D_1/E_1)/(r - g)

1 - b = DPR

1 - b = DPR

92

New cards

Justified P/B

(ROE - g)/(r - g)

93

New cards

Justified P/S

= Net Profit Margin x Justified Trailing P/E

94

New cards

Justified P/CF

Two Step Process:

1. Calc P using DCF model

2. Divided result by CF

Justified P/CF will increase, all else equal, if:

-CF increases (numerator increases more than denomiator)

- Growth rate increases

- Required return decreases

- same relationship as all other ratios

1. Calc P using DCF model

2. Divided result by CF

Justified P/CF will increase, all else equal, if:

-CF increases (numerator increases more than denomiator)

- Growth rate increases

- Required return decreases

- same relationship as all other ratios

95

New cards

Justified EV/EBITDA multiple

-Positively related to the growth rate in FCFF and EBITDA

-Negatively related to the firms overall risk level and WACC

-Negatively related to the firms overall risk level and WACC

96

New cards

Justified Dividend Yield Formula

(r - g) / (1 + g)

97

New cards

Explain the Fed Model

considers the overall market to be overvalued (undervalued) when the earnings yield (E/P) on the SP500 is lower (higher) than the yield on 10yr US Treasury Bonds

98

New cards

Interpret the PEG ratio

P/E ratio / g

-P/E per unit of expected growth

-lower PEGs more attractive than stocks with higher PEGs, assuming risk is the same

-does not account for risk

-relationship between P/E and g is not linear

-doesn't reflect duration of high growth period for a multi-stage model

-P/E per unit of expected growth

-lower PEGs more attractive than stocks with higher PEGs, assuming risk is the same

-does not account for risk

-relationship between P/E and g is not linear

-doesn't reflect duration of high growth period for a multi-stage model

99

New cards

earnings plus non-cash charges (CF)

= net income + amortization + depreciation

-used as proxy for cash flow

-used as proxy for cash flow

100

New cards

Enterprise Value

Market Value of Equity + Debt - Cash and Investments