PC 7.2: Modeling Return

1/3

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

4 Terms

What does the rolldown return assume?

No change in yield curve

In layman’s terms, what are the 5 aspects of FI return?

Coupon payment

Rolldown return - price return assuming no change in yield (rolldown yield curve)

If there is a change in yield, use duration and convexity measures to find price impact

If there is a change in spreads, use duration and convexity measures to find price impact

FX

coupon return

Rolldown return

Rolling yield

Expected price change due to change in benchmark yield

Expected price change due to change in credit spreads

Expected g/l vs. investor’s currency

Overall projected return

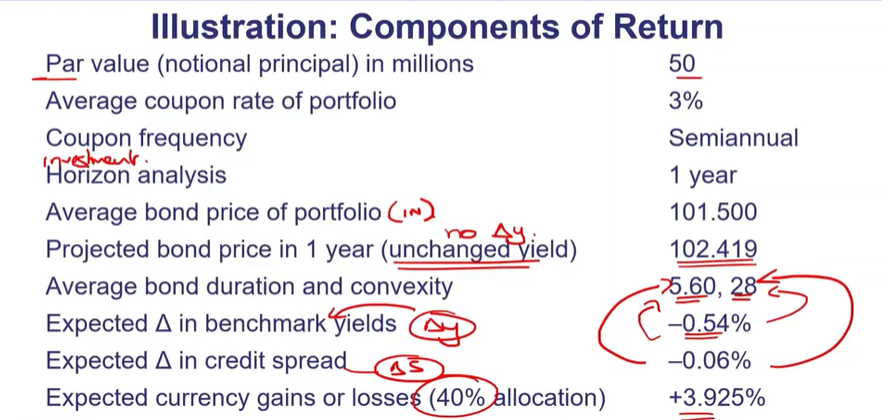

3 / 101.5 = 2.956%

(Proj. END / BEG price) - 1 = (102.419 / 101.5) - 1 = 0.905%

2.956 + 0.905 = 3.861%

%change value = (-MD x CHNG y) + (1/2)(C)(CHNG y²) = (-5.6)(-0.0054) + (1/2)(28)(-0.0054²) = 3.065%

%change value = (-MD x CHNG s) + (1/2)(C)(CHNG s²) = (-5.6)(-0.0006) + (1/2)(28)(-0.0006²) = 0.337%

expected appreciation x % foreign = 3.925% x .4 = 1.570%

2.956 + 0.905 + 3.065 + 0.337 + 1.570 = 8.833%

x

x