economic growth/policies

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

38 Terms

economic growth

an increase in national output as measured by rGDP

occurs in the long term or long term

short term economic growth

occurs when there are any changes to the components of AD (C+I+G+(X-M))

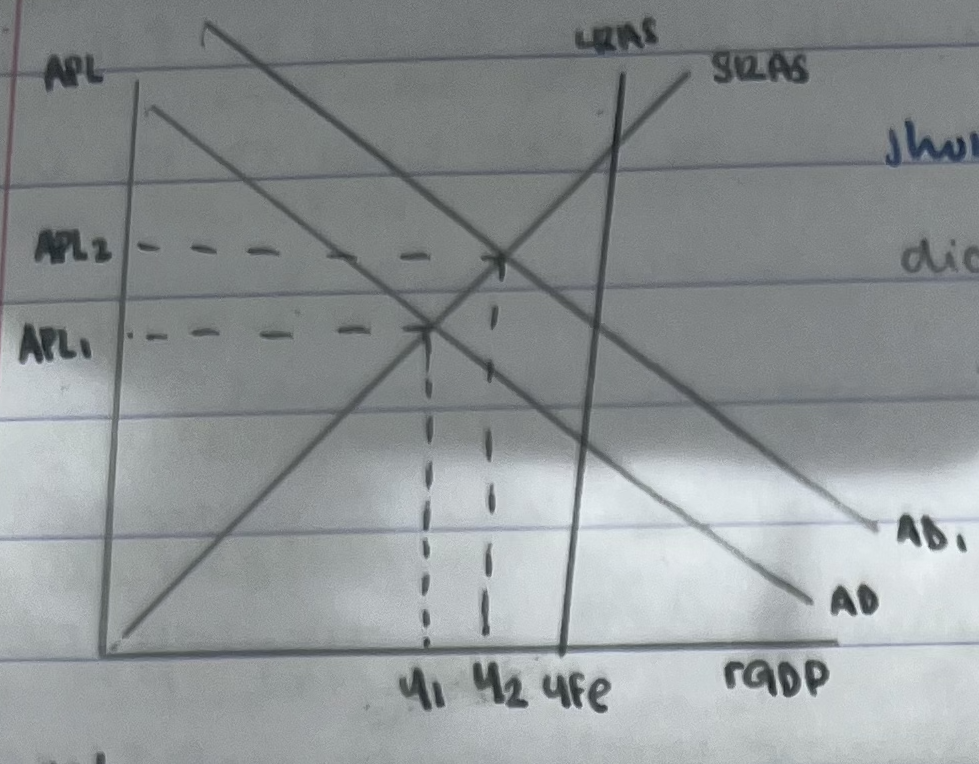

short term economic growth on AD/AS diagram

an increase in C,I,G, net exports has caused AD curve to shift to the right AD-AD1

the current real output has increased from y1-y2 which represents economic growth

increase in rGDP= economic growth

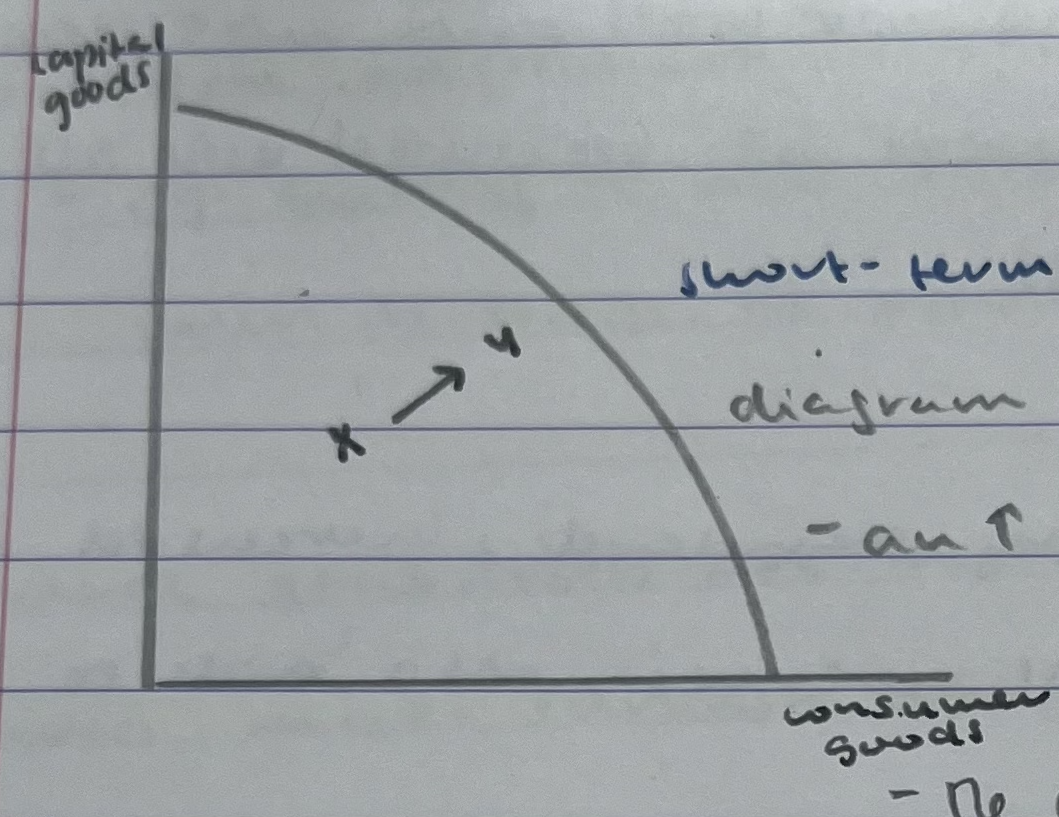

short term economic growth on PPC

an increase in production has caused a shift in the production combinations X-Y

the current real output has increased moving closer to the maximum possible output of the economy

represents an increase in rGDP

increase in rGDP= economic growth

long term economic growth

caused by any improvements to the determinants of AS

changes in quality and quantity of FOPs

technological advances

efficiency improvements

changes in institutions

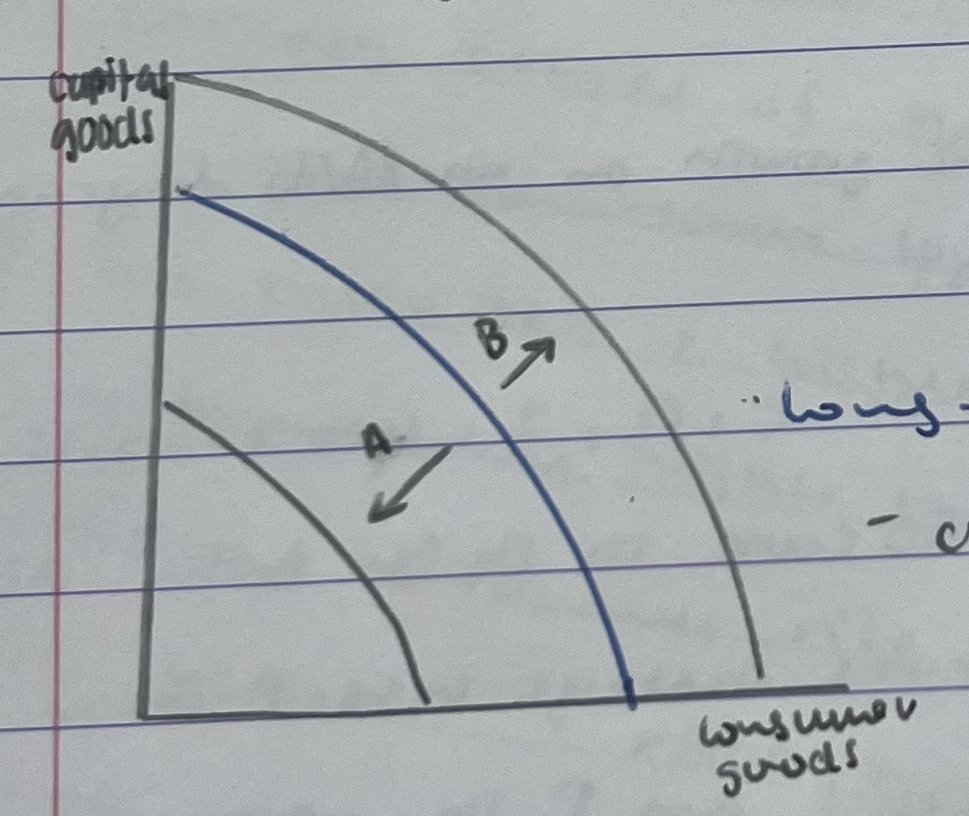

long term economic growth on PPC

changes in AS determinants have increased the potential output of the economy, demonstrated by the outward shift of the entire curve

more consumer and capital goods can now produced using all available resources

A: inward shift: economic decline

B: outward shift: economic growth

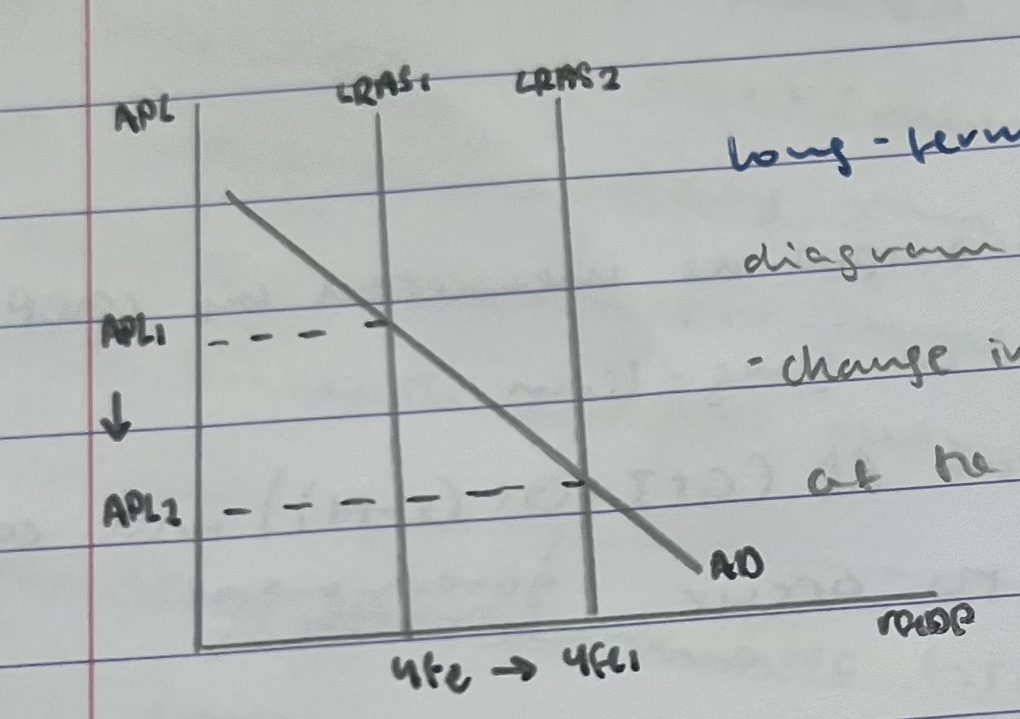

long term economic growth on an AD/AS diagram

changes in AS determinants have increased the potential output of the economy yfe-yfe1

what does economic growth lead to?

higher living standards

increased employment opportunities

improved government revenues

aids reduce poverty and inequality over time

nominal GDP ($)

C+I+G+(X-M)

using expenditure approach

rGDP($)

(nominal GDP/price deflator)x100

if < 100: deflation

if > 100: inflation

strengths of fiscal policy

spending can be targeted at specific industries

highly effective in restoring confidence in an economy during a deep recession

redistributes income through taxation

increased consumption of merit goods/services

automatic stabilizers

automatic fiscal changes, that occur as the economy moves through stages of the business cycle

in a recession: automatically lowers tax revenue, as income falls, households are taxed less + higher unemployment benefits = increase in rGDP

in a boom: automatically higher tax revenue due to the nature of progressive taxation - as income rises households are taxed more + less unemployment benefits + rGDP being lower

weaknesses of fiscal policy

political pressure: policies can fluctuate significantly when new governments are elected: long term projects such as infrastructure may lack follow-through

unsustainable debt: increased government spending can create budget deficits which are added to national debt

time lags: It is difficult to predict exactly when the desired effect on the economy will occur

fiscal policy will take longer time to plan and implement than monetary policy

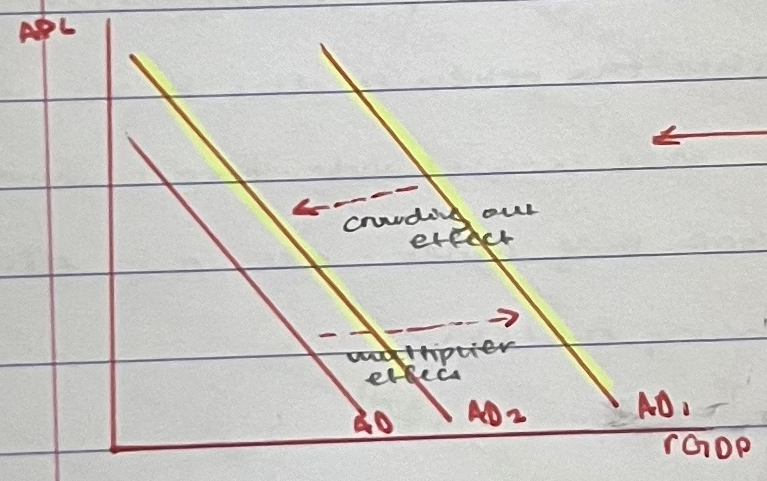

crowding out

the phenomenon where expansionary fiscal policy, particularly government spending can result in a reduction of private sector spending or investment

governments borrowing results in competition with others in the economy who want to borrow the limited amount of savings available

diagram:

private forms are crowded out of the market

as investment falls, AD shifts back to AD2

expansionary fiscal policy

when the government increases the money supply in the economy using budgetary instruments to either raise spending or cut taxes: generatce further economic growth

contractionary fiscal policy

occurs when the government raises the tax rates or cuts government spending, shifting AD to the left: slowing down economic growth

strengths of monetary policy

central banks can operate independently (without government intervention)

can consider the long-term outlook

takes less time than fiscal policy to plan and implement

contractionary policy is often effective when there is an inflationary gap

targets inflation and maintains stable prices

rate changes can quickly be condemned or reversed in necessary

weaknesses of monetary policy

C+I might be interest inelastic

limited effectiveness when the economy is in a deep recession

instead of borrowing, firms and consumers might simply repay debts

conflicting government objectives

falling growth might require expansionary monetary policy however high inflation might suggest contractionary monetary policy is needed

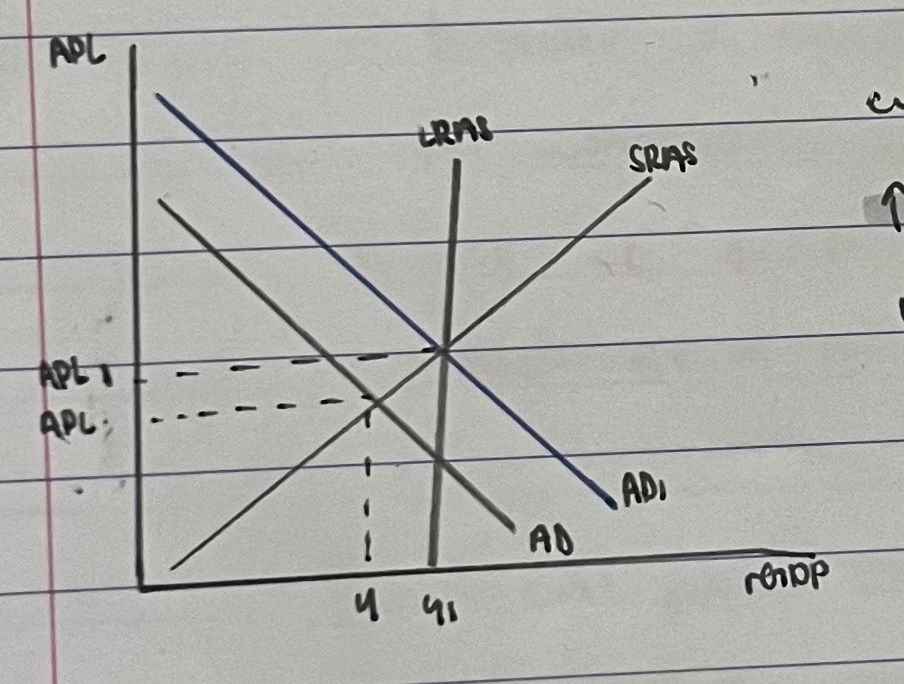

expansionary monetary policy diagram

economy if experiencing a deflationary gap

therefore, the central bank increases money supply

this decreases interest rates

which results in more people borrowing and investing

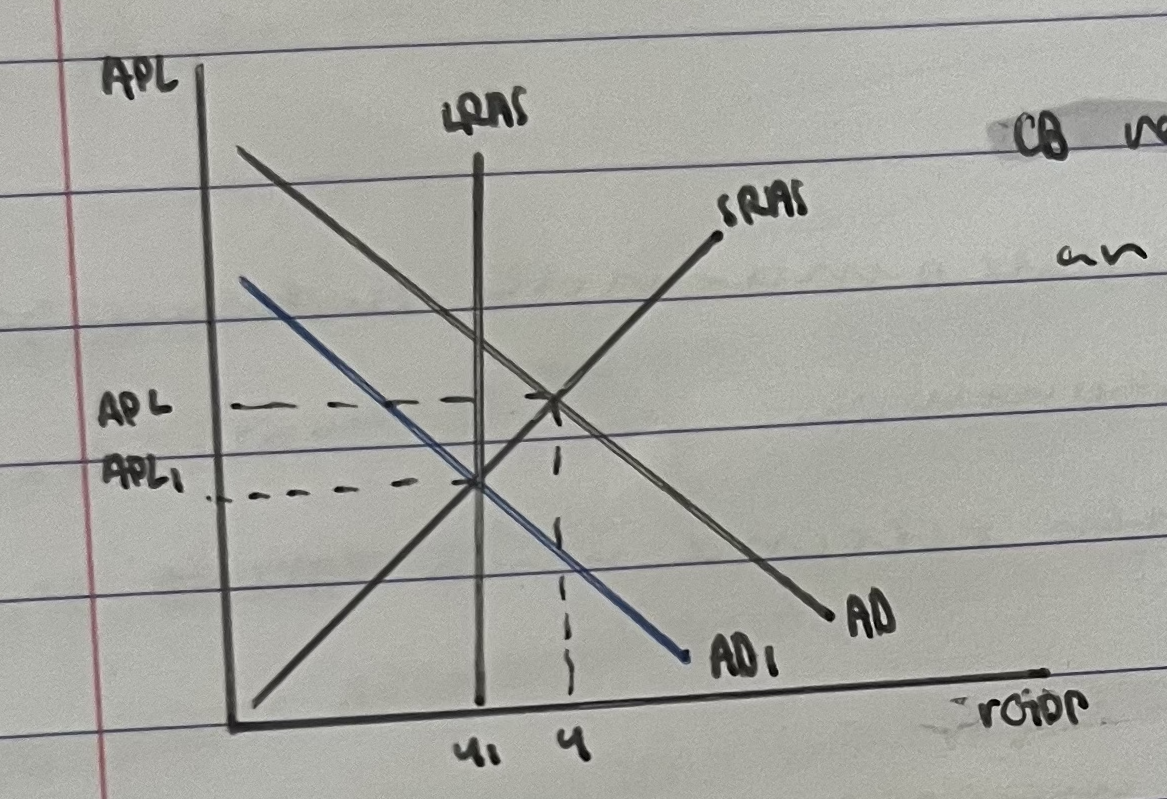

contractionary monetary policy diagram

central bank reduces money supply when the economy is experiencing an inflationary gap

expansionary monetary policy

expand monecy supply and boost economic activity by keeping interest rates low to encourage borrowing by consumers, individuals and banks

contractionary monetary policy

reduces government spending or rate of monetary expansion by cenmtral bank

monetary policy

the control of the quantity of money available in an economy and the channels by which new money is supplied

economic growth strengths

living standards:

increased income = better living standards

increased employment = resolves some of the social impacts of unemployment

income distribution:

decreased levels of absolute poverty

increased levels of employment = more tax revenue to redistribute or welfare payments

the environment

improvements in the quality/quantity of environmentally friendly tech

economic growth weaknesses

living standards:

rising AD causes demand-pull inflation and purchasing power of some people on fixed income might fall

increased income usually leads to greater consumption of demerit goods

income distribution:

lack of equity in the distribution of income - the rich get richer and the poor get poorer

environment:

damage caused by negative externalities of production and consumption

resources are depleted rapidly

constant price

price levels that have been adjusted for inflation

current prices

nominal price levels

challenges of sustaining economic growth

high inflation erodes purchasing power and can lead to uncertainty reducing investment and consumption

central banks must strike a balance between stimulating growth and controlling inflation through monetary policy

policies leading to short-term growth

expansionary fiscal

expansionary monetary

policies leading to long-term growth

supply-sside policies

market based

interventionist based

supply-side policies

government policies which seek to increase the productivity and efficiency of the economy

aim to increase long-term competitiveness and productivity

in the long run, supply-side policies can help increase the level of employment in an economy as firms expand and grow.

market based policies strengths

improved resource allocation: focus on improving the workings of the market system based on the operation of demand and supply, therefore expected to = in improved efficiency in resource allocation

may not burden the government budget: do not need government funds to be implemented as they are based on private initiative

ability to reduce inflationary gap

market based policies weaknesses

time lags

negative impacts on the environment

negative effects on equity

interventionist based supply-side policies weaknesses

time lags

negative impact on government budget: heavily based on government spending, therefore might create a budget deficit for the nation

interventionist based policies strengths

direct support of sectors important for growth

ability to create employment: enables workers to aquire skills, provide assistance to workers to relacate (structural)

potential ability to reduce inflationary gap

privatization

transfer of ownership of a firm from the public to the private sector

can increase efficiency due to improved management and operation of privatized firms

intervenstionist supply-side policies

presupposes that the free market economy alone cannot achieve the desired results in terms of increased potential output and therefore governments intervention is required