Variations in economic activity

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

aggregate demand (AD)

The total value of all goods and services consumers are willing and able to purchase in an economy over particular time period, at different possible price levels

calculated using expenditure approach

if AD increases, economic growth has happened

AD curve

average price level on y-axis, real GDP on x-axis

downward sloping

changes in average price = movement along AD curve

increase in AP = contraction

decrease in AP = expansion

movement along AD curve

changes in average price = movement along AD curve

shifts of entire AD curve

causes by change in non price determinant of AD

increase in non price determinant = shift right

decrease in non price determinant = shift left

factors influencing consumption

consumer confidence

the stronger the economy, the higher the consumer confidence

consumption increases and saving decreases

interest rates

increased interest rates = greater incentive to save

hence less consumption

wealth

consumer wealth increases = consumption increase

income taxes

taxes increase = disposable income decrease

hence less consumption

expectation of future price level

if it’s believed prices will rise in future, consumers incentivised to spend now

indebtedness of household

higher debt = less disposable income for consumption

factors affecting investment

interest rates

decreased interest rates = higher investment

business confidence

longer period of economic growth = higher business confidence

technology

when firm identifies new technology which reduces costs and raises output, they’re incentivised to invest

business taxes

higher taxes = less profit = less money for investment

corporate indebtedness

higher debt = less money available for investment

factors influencing gov spending

political priorities

some parties believe the state should provide more goods and spending increases, others believe role of gov in society should be small

economic priorities

depends on fiscal policy

expenditure related to gov’s objectives

factors influencing net exports

income of trading partners

household income of trading partners increases = foreigners purchase more products, exports increase

exchange rates

when domestic currency value rises, consumers money can buy more abroad - imports increase

exports are also more expensive for foreigners - exports decrease

trade policies

if import tariffs increase, decreased demand for imports

aggregate supply

total quantity of goods and services produced in an economy over a particular time period, at different price levels

short run = period which wages and other factors are inflexible

long run = period in which there is full wage and factor price flexibility

SRAS curve

upward sloping

AS is the combined supply of all individual supply curves

as real GDP increases, firms must spend more to increase production

increase in AP = expansion of real GDP (Y)

decrease in AP = contraction of real GDP (Y)

shifts of SRAS curve

decrease in cost/increase in productivity shifts the SRAS curve right

increase in cost/decrease in productivity shifts SRAS curve left

changes to costs of raw materials - impact on SRAS

as price of raw materials increase, fewer goods can be made with the same amnt of money

SRAS shifts left

as price of raw materials decrease, more goods can be made with same amnt of money

SRAS shifts right

change in indirect taxes - impact on SRAS

decrease in taxes = decrease in costs = more output

SRAS shifts right

increase in taxes = increase in costs = less output

SRAS shifts left

neo classical LRAS

LRAS is perfectly inelastic at a point of YFe of all available resources

believe that LRAS will always return to FE, all changes in the LR will be at AP

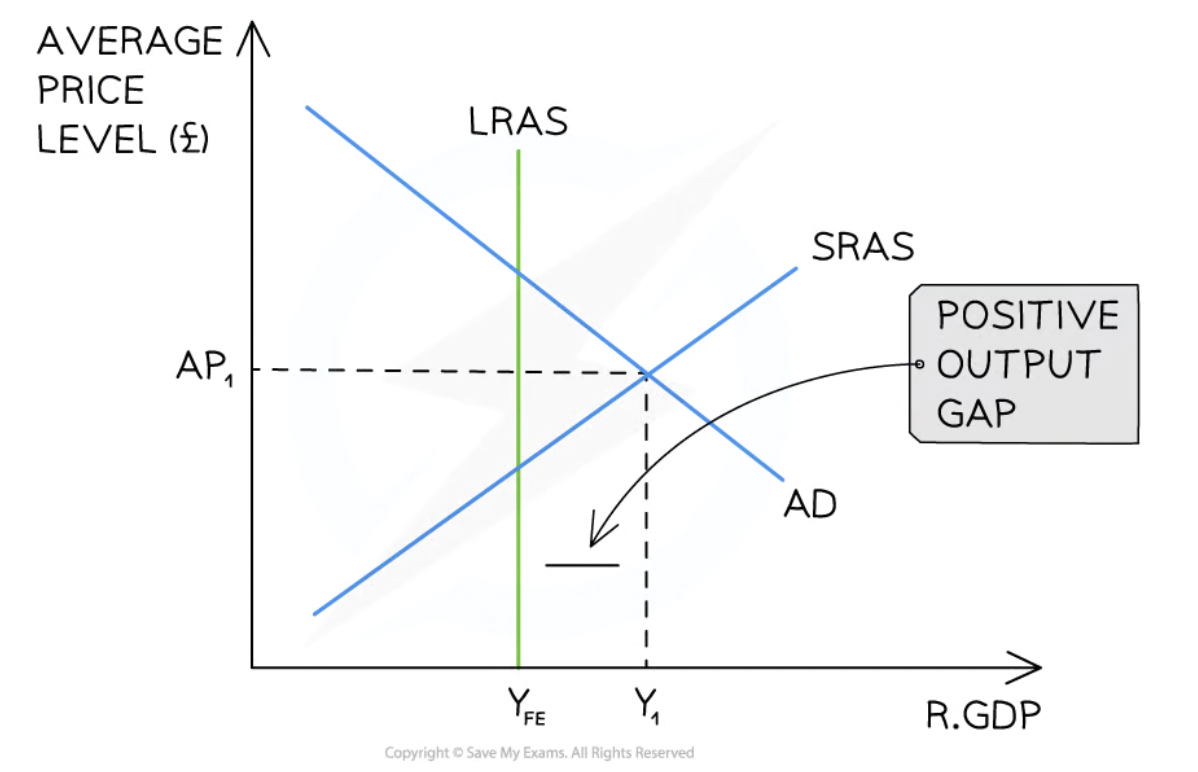

during extreme periods of growth, there can be inflationary gap

will self correct and return to LR level, but at higher AP

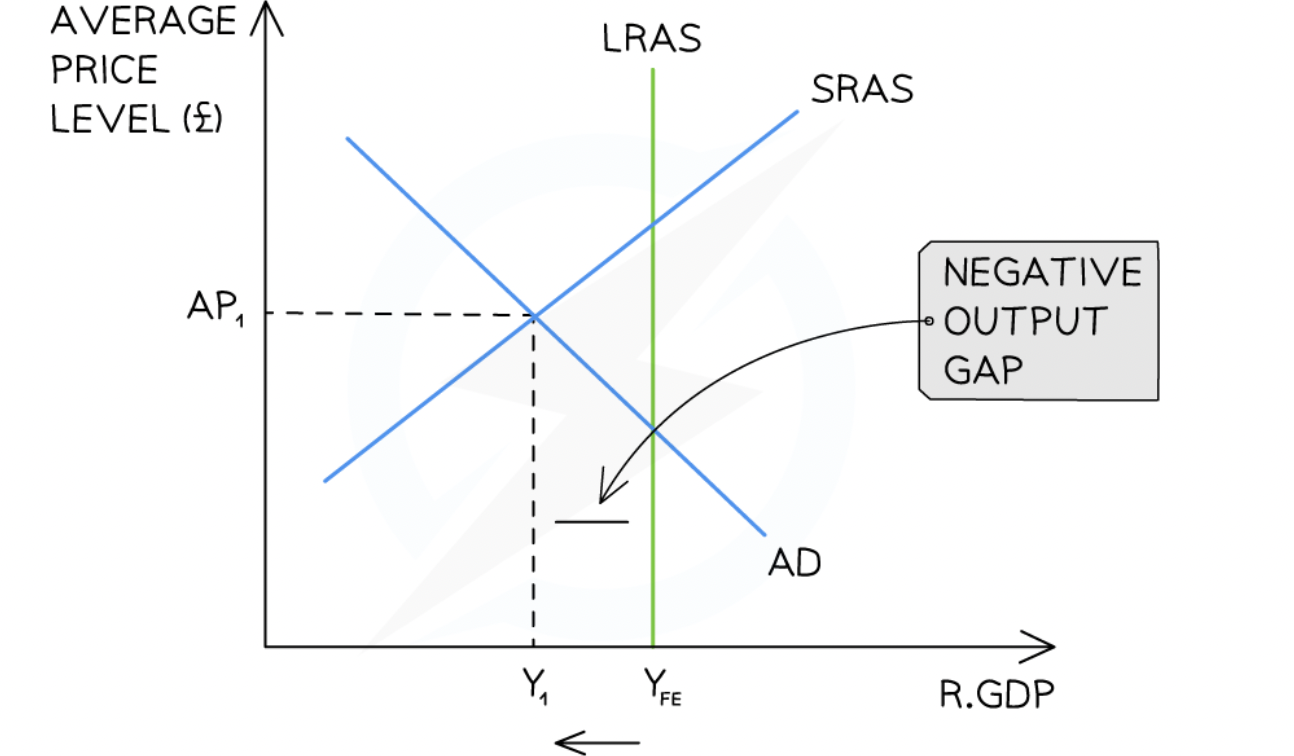

during recessions , can be recessionary gap

will self correct and return to LR level but at lower AP

inflationary/recessionary gaps

inflationary: when real GDP is greater than potential real GDP

deflationary: when real GDP is less than potential real GDP

deflationary gap neo classical

inflationary gap neo classical

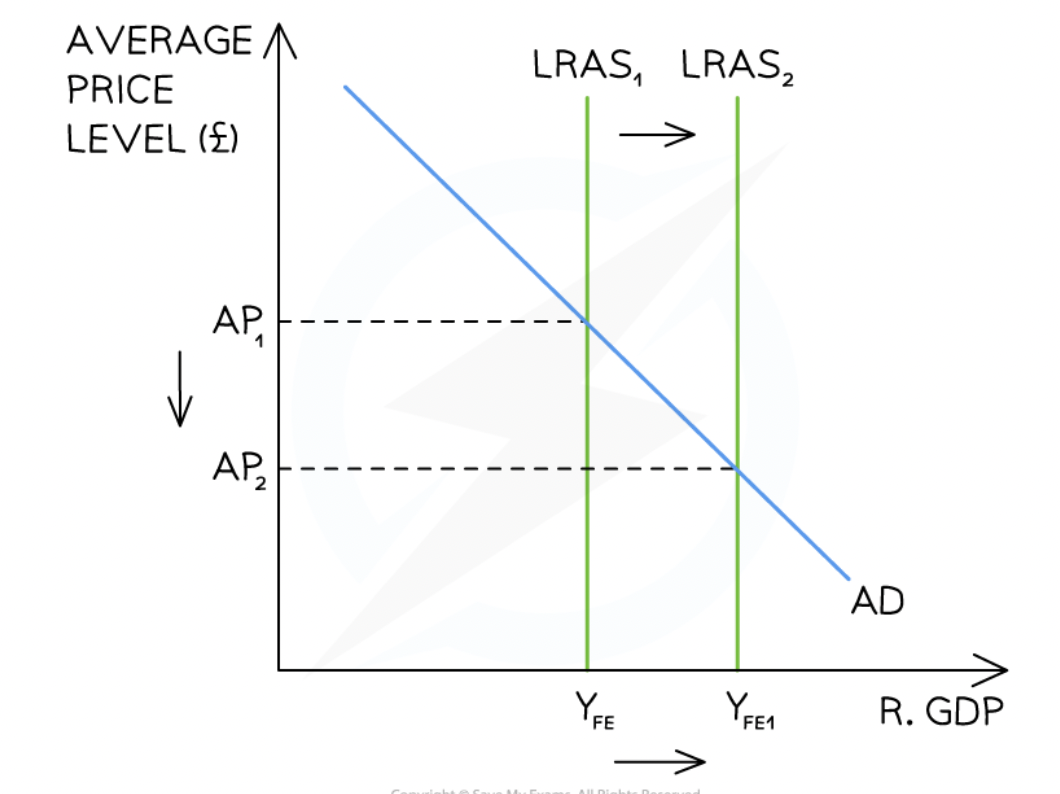

factors that shift LRAS

changes in quality/quantity of FOP

increase in this causes increase in production possibilities (outward shift of PPC

technology advances

efficiency improvements

changes in institution

e.g implementation of new legislations, increasing financial institutions

classical LRAS model

initial equilibrium at A1Yfe

increase in quality of labour causes LRAS to shift right

extra supply in economy allows prices to fall and output to increase

new equilibrium at A2Yfe1