Investment Banking Concepts

1/192

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

193 Terms

What is accrual accounting and how is that different from cash accounting?

Recognize revenue and expenses when you receive or provide a product or service. Cash accounting tracks spending when cash is received or spent.

What does an income statement show?

Shows revenues, expenses, and profits (net income)

Go line-by-line through an income statement

Revenue

-COGS (Direct Costs - would not exist if product was not being made)

Gross Profit

-Operating Expenses (SG&A) (Indirect Costs - not directly traceable to product)

EBITDA

-Depreciation & Ammortization

EBIT

-Interest Expense

-Other

Pre-Tax Income (EBT)

-Taxes

Net Income

What does a cash flow statement show us?

Our change in cash by bridging net income to cash

What does a cash flow statement look like?

Net Income

+ Depreciation & Amortization

- Gain on Sale

+Loss on sale

- Increase in NWC (Current Assets & Liabilities)

CFO

- Capex

+Proceeds from Sale

CFI

+ Borrowings

- Repayments

- Dividends

+ Issuances

- Buybacks

CFF

If an asset account increases balance, what happens on the cash flow statement?

It gets subtracted from net income in the cash flow from operations section

If a liability or shareholder’s equity increases in balance, what happens to that line on the cash flow statement?

It gets added

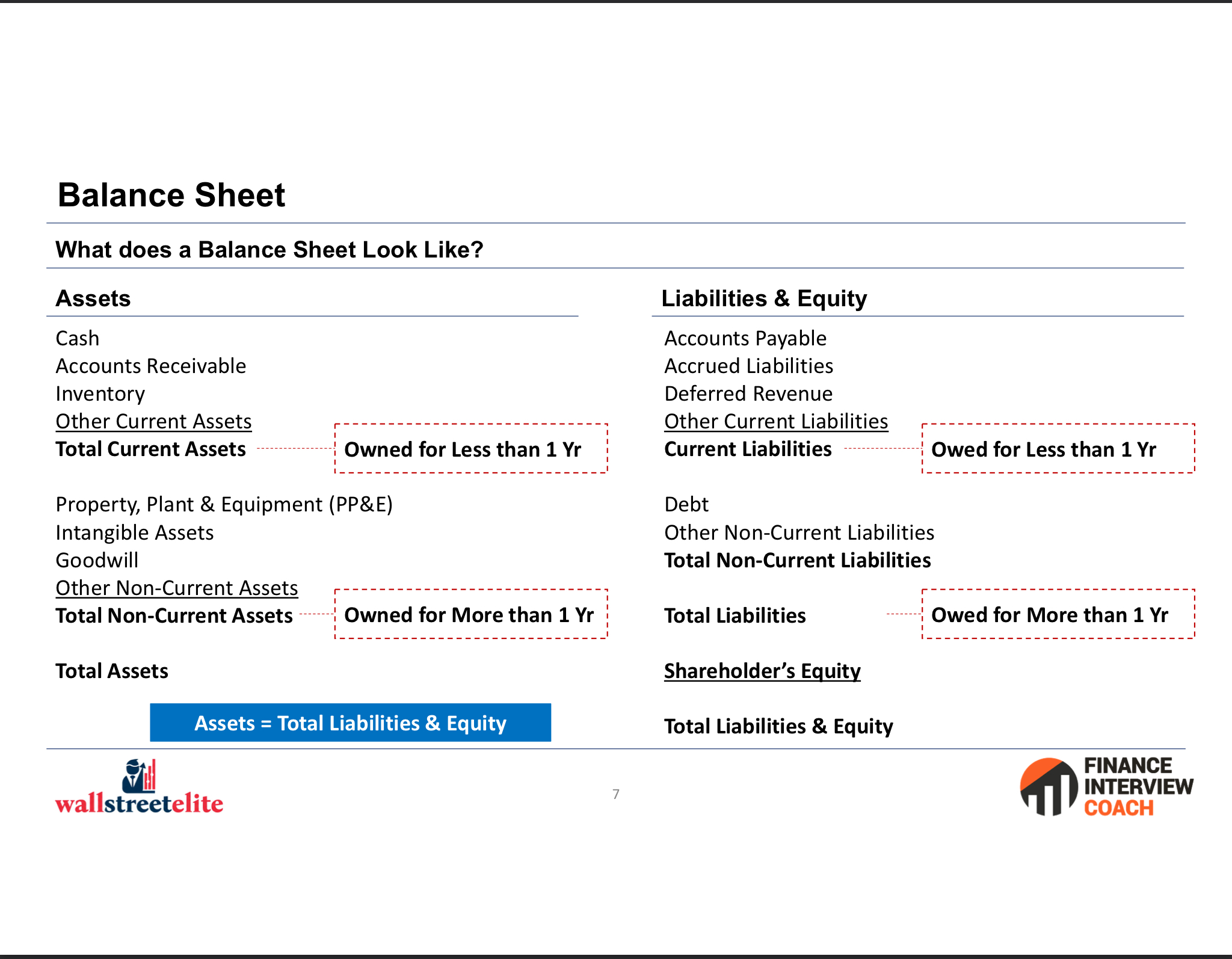

What is a balance sheet?

shows us the stuff we have (assets) vs. how we finance those assets (liabilities and shareholder’s equity)

What is the balance sheet formula?

Assets = Liabilities + Shareholder’s Equity

What does a balance sheet look like?

How do the 3 statements flow into each other?

Income statement ends with net income

Net income from the income statement flows to the first line of the cash flow statement and ends with cash

Cash from the cash flow statement flows to the balance sheet and ends with shareholder’s equity (which is net income from the income statement)

If you could look at 1 financial statement to analyze an investment, what would it be and why?

The Cash Flow Statement

Shows cash flows

Shows net income

Shows Net Working Capital Items

If you could only look at 2 financial statements to analyze an investment, which would they be and why?

The Income Statement and Balance Sheet

The income statement and the Balance sheet can create the Cash Flow Statement

Each line from the Balance Sheet flow to line items in the cash flow statement

What is the inventory equation?

Ending Inventory = Beginning Inventory + Purchases - COGS

Describe the difference between FIFO and LIFO?

FIFO

COGS is calculated with inventory we purchased first

LIFO

COGS is calculated with inventory purchased last

If costs are rising, does FIFO or LIFO provide the lowest COGS?

FIFO, because the earlier inventory is cheaper

What happens when a company buys PPE through the 3 statements in Year 0?

Income Statement

Nothing happens in year 0

Cash Flow Statement

Subtract Capex in CFI

Add any debt used for the transaction

Balance Sheet

Cash from CFS

PPE increase for transaction amount

(If debt is used, there should be a line item increasing debt)

What happens when a company buys PPE through the 3 statements in Year 1?

Income Statement

Depreciation Expense on Income Statement

(If debt is used, interest expense as well)

Cash Flow Statement

Add back depreciation in CFO

Subtract Interest Expense in CFF (Repayment)

Balance Sheet

Cash from CFS

Decrease PPE by Depreciation

Decrease Debt by Interest Expense (if funded by debt)

Net income from Income Statement = Shareholder’s Equity

When there is a write-down of PPE, what happens on the three statements?

Income Statement

Subtract the book value of PPE

Add back book value of debt (if applicable)

Cash Flow Statement

Add back book value of PPE (CFO)

Subtract Debt (CFF)

Balance Sheet

Cash from CFS

Decrease PPE by Book Value

Decrease Debt by Book Value

Bring over Net Income for Shareholder’s Equity

What happens to the 3 financial statements when there is a sale of PPE (gain)?

Income Statement

Gain on sale gets added before taxes are taken out

Cash Flow Statement

Subtract your gain on sale from Net Income

Add your proceeds from your sale (sale price)

Subtract your book value of debt

Balance Sheet

Cash from CFS

Decrease PPE by Book Value

Decrease Debt by Book Value

Bring over Net Income for Shareholder’s Equity

What is Net Working Capital?

The cash tied up in the daily operation of your business

When you buy inventory in Y0 with cash, what happens to your financial statements? How does that change when you buy on credit?

Income Statement

Nothing because nothing has been sold yet and cannot be transferred to COGS

Cash Flow Statement

Since Inventory is an Asset, and the balance is increasing, it gets subtracted from Net Income on the CFS

Balance Sheet

Cash from CFS

Increase inventory by amount purchased

When You Buy on Credit

The only thing that changes is on your cash flow statement, your accounts payable increases, and since it is a liability, it will be added to Net Income on the CFS (subtract inventory still)

On your balance sheet, instead of having a cash line item with inventory purchase amount, you will have a liability

What Assets and Liabilities are considered Net Working Capital?

Assets

Accounts Receivable

Inventory

Prepaid Expenses

Other Current Assets

Liabilities

Accounts Payable

Accrued Liabilities

Deferred Revenue

Other Current Liabilities

What is deferred revenue?

received revenue upfront, but the services or product have not yet been delivered

What are prepaid assets?

pay for an expense upfront, but have not yet received the product or service

What are accrued expenses?

Expenses which have not been paid for or do not have na invoice

EX: wages payable

What is shareholder’s equity and how is this different than market cap?

Your original cost plus cumulative net income

Market cap is the current value of the cost in the market today

What is the formula for market value / market cap?

#shares X share price

What is the formula for calculating shareholder’s equity?

Beginning SE + Net Income - Dividends + SBC + Issuances - Buybacks

Why doesn’t dividends impact the income statement?

Because dividends are a decision AFTER net income, we do not realize it on the income statement

What is the impact of stock based compensation on the 3 financial statements?

Income Statement

Subtracted before Pre-Tax Income

Cash Flow Statement

Add back SBC to Net Income

Balance Sheet

Line item for Cash from CFS

Line item for SBC (SE)

Line item for Retained Earnings (NI)

What is the concept of the time value of money?

Money today is more valuable than money tomorrow

What is the present value of a perpetuity?

Perpetuity Cash Flow / (1 + discount rate)

What is a discounted cash flow?

about finding how much future cash flows are worth in today’s money

Walk me through a DCF

Make assumptions

Project out future cash flows (5-10 years)

Calculate the terminal value

Exit Multiple: find mature comparables of EV / EBITDA and take the median to multiply it by the last year’s EBITDA

Perpetuity Growth Method: take the last year’s FCF and multiply it by 1+g and divide it by WACC - g

Discount the projected cash flows back using the discount rate (WACC) to find the PV

Add all the FCF together to find the enterprise value

Do a sensitivity analysis

What is an unlevered free cash flow? What is the formula?

An unlevered free cash flow does not include debt

UFCF = EBIT(1-tax rate)+D&A-Change in NWC - Capex

Who does UFCF belong to and why?

It belongs to both debt and equity holders because debt has not yet been paid out

Why do we use UFCF in a DCF? Why?

When debt is not core to the business

Including debt in calculations make it complicated and adds potential for error

What does free cash flow represent?

how much cash the core business is making in its day to day operations

Why don’t we include items from CFF in our calculation of UFCF?

Because we are looking at cash flows BEFORE we pay out capital holders

Why doesn’t NOPAT and UFCF not include interest tax shield?

The tax shield represents how much tax you save by deducting interest first

Why do we subtract D&A to get EBIT and add it back later?

We subtract D&A to decrease our EBIT and therefore our taxes, we add it back later because it is a non-cash expense

Who does levered free cash flow belong to?

It belongs to equity holders because debt holders have been paid

When would we use levered free cash flows in a DCF?

When debt is core to the business

EX: Banks and Insurance Companies

What is the formula for calculating levered free cash flows?

LFCF = Net Income + D&A - Increase in NWC - Capex - Mandatory Debt Repayments

Does levered free cash flows include the interest tax shield?

Yes, because it uses net income instead of EBIT (1- tax rate), it already deducts interest expense before calculating taxes

How do you go from UFCF to LFCF?

LFCF = UFCF - interest expense X (1-tax rate) - mandatory debt repayment

What do we discount UFCF by?

The Weighted Average Cost of Capital

What would we discount LFCF by?

The Cost of Equity

How do you calculate the WACC?

Cost of Equity (Weight of Equity) + (Cost of Debt)*(1- Tax Rate)*(Weight of Debt)

How do you calculate your cost of equity?

CAPM formula

= risk free rate + beta(average stock market return - risk free rate)

Equity Risk Premium / Market Risk Premium

= (average stock market return - risk free rate)

What are preferred shares?

Classified as equity, but they get paid out first like debt holders (not tax deductible)

How do we incorporate preferred shared into the WACC formula?

WACC = (% equity)*(cost of equity) + (%debt)(after-tax cost of debt)+(% of preferred shares)*(cost of preferred shares)

What is the cost of equity?

Investors need to be compensated for the risk of investing in the stock market, so it represents the return that investors needs to compensate them for the risk of investing in market

What do we use as the risk free rate and why?

Government bonds 10yr rate because governments in developed countries are not likely to default, making them somewhat risk free

They are also the most liquid and it aligns with a 5-10 year forecast

What does the equity risk premium represent?

Excess return above the risk free rate to compensate investors for the risk of the stock market

What does Beta represent?

the market risk; it shows how sensitive a company’s stock price is to the market

How do we find beta for a private company?

Use public comps

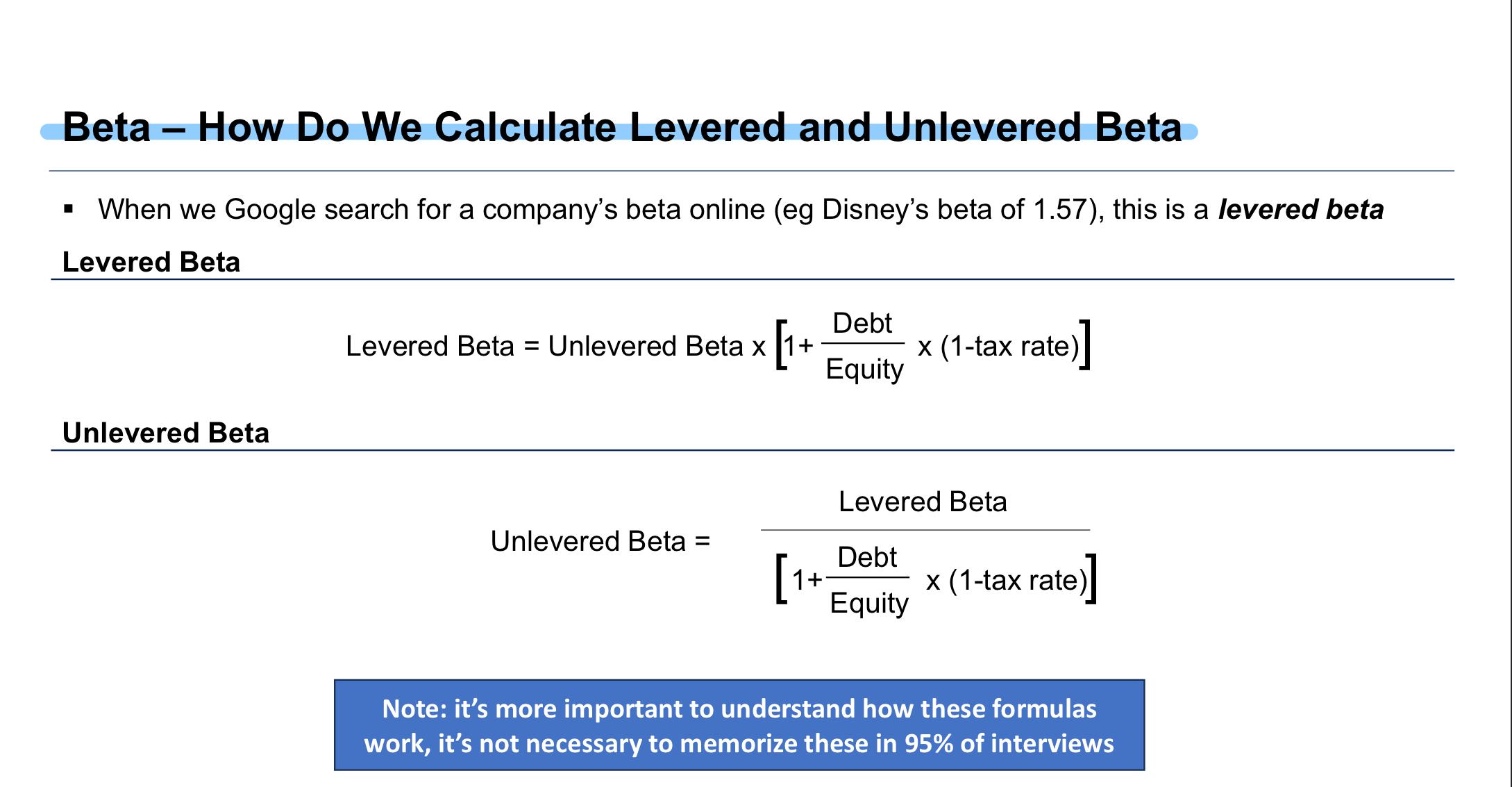

Is a Beta that you find online for a public company levered or unlevered?

Levered

Why do we need to unlever the beta when using comps for a private company?

If debt increases risk, then different companies with different debt levels will hae different risk levels therefore the betas are not comparable

What is the formula to unlever Beta?

What are the steps for Beta Comps?

Find Betas of Comps

Unlever Betas and Find Median

Relever to Target Company’s Capital Structure

Do we use marginal cost of debt or existing cost of debt when calculating WACC?

Marginal cost of debt because it is the cost of debt TODAY, whereas the existing cost of debt is the cost of debt in the PAST

How to find cost of Debt?

10k filings (look at notes)

Yield of most recently issued bonds

Bond yields of comparable companies

Apply a spread to a benchmark rate based on company credit rating

Can the cost of equity ever be less than the cost of debt?

No! Because equity holders take on more risk than debt holders. Debt holders are paid out first and they are tax deductible

How does increasing debt impact WACC?

If you borrow too much, lenders get worried you won’t pay it back, so equity holders demand more return to compensate for higher risk

What should terminal value be with a 5 year and 10 year projection period as a percent of enterprise value?

5 Year

60% - 80% of enterprise value

10 Year

50% of enterprise value

If terminal value is too high as a percent of EV, what should we do?

Extend the projection period

What happens to EV when you increase the tax rate?

Lower Free Cash Flows → Lower EV

Increased taxes means lower free cash flows

Lower After Tax Cost of Debt → Higher EV

Increase of Tax Shield → Decrease After Tax Cost of Debt → Decrease WACC → Increase EV

Lower Cost of Equity → Higher EV

Increase Tax Shield → Decrease Levered Beta → Decrease Cost of Equity → Decrease WACC → Increase EV

Do you get the same EV using UFCF and LFCF?

UFCF will get us EV, LFCF will get us equity value

What is an LBO?

buying a company using debt and equity, but usually more debt using the cash flows from the company to pay down the debt, selling within 5-10 years

Why do PE firms use debt in an LBO?

Allows diversification (investing in other companies)

Debt increases returns because you don’t have to put in as much equity

What Makes A Good LBO Candidate?

Stable Revenue Growth

Stable, Healthy Margins

Strong market position and exit opportunities

Low Capital Intensity

Synergies with Existing Portfolio Companies

Large Tangible Asset Base

Walk me through an LBO

Make Assumptions:

Entry / Exit Multiple

Financing Structure

Create Sources and Uses:

calculates initial required equity

Project 3 Financial Statements without the effects of debt

adjust balance sheet for the transaction

Build Debt Schedule

use LFCF to determine debt repayments, then link interest and repayments to 3 statements

Determine the IRR and MoM

Perform Sensitivity Analysis:

finding IRR by sensitizing exit, entry, and leverage multiple

What is a paper LBO?

A simplified version of an LBO used in interviews

How do you calculate the MoM (Money on Money)?

Ending Equity / Beginning Equity

What are the other terms for MoM?

Multiple of Invested Capital (MoM)

Multiple of Capital (MoC)

Cash on Cash (CoC)

What are the rules for the IRR using MoM?

2x | 72 | |

3x | 114 | |

4x | 144 |

How do you find IRR for a paper LBO?

Your rule as a percent / number of years in hold period

What does the IRR represent?

How much the equity investment has grown per year

Why do we use IRR to measure returns in an LBO?

It accounts for the impact of time

Walk me through a paper LBO

Year 0

LTM EBITDA and Purchase Price

Find Enterprise Value using EBITDA and entry multiple

Debt & Equity

Find the Equity Value

Enterprise Value - Debt

Interim Years

Find LFCF

Forecast every year or find average LFCF

Find Total Cash Accumulated

Sum up all LFCF in all years

Exit Year

Exit Enterprise Value

Last year EBITDA multiplied by the exit multiple

Exit Equity Value

Exit Enterprise Value - Debt

Debt = Entry Debt - Sum of LFCF

Find MoM and IRR

How do you know cash flows are linear for a paper LBO?

Revenue increases by the same $ amount each year

COGS and SG&A are the same % of revenue

D&A, NWC, and Capex are constant over the term of the cash flows

When cash flows are linear in a paper LBO, how do you find your cash flows to subtract from debt in your exit?

Take the midpoint of your holding period (in the case of 5 years, Y3 should be your midpoint)

Find the EBITDA and calculate your LFCF

5 Year IRRs to Memorize

2x | 72 | 15% |

3x | 114 | 23% |

4x | 144 | 29% |

What are the sources of financing an LBO?

Senior Debt

Revolver

Term Loan A (TLA)

Term Loan B (TLB)

Junior Debt

Unsecured or Subordinated Debt

High Yield Bonds

Mezzanine or Convertible Bonds

Equity

Preferred Stock

What is PIK interest?

Interest compounding on debt balance before being paid at sale

How does $100 of PIK debt issuance affect the 3 financial statements in Y0?

Income Statement

None

Cash Flow Statement

Add $100 of borrowing to NI

Cash = 100

BS

Cash = 100

Debt = 100

How does $100 of PIK Debt Issuance Affect the 3 financial statements in Y1? 10% Interest, 40% tax rate

Income Statement

Interest Expense (10)

Tax Shield 4

Net Income = (6)

CFS

Net Income (6)

Interest Expense - PIK 10

Cash = 4

Note: Interest Expense gets added because PIK is a non-cash expense

BS

Cash: 4

Debt: 10

RE / SE: (6)

What is a dividend recap?

A PE portfolio company borrows money and pays the investors a dividends to help increase returns

What happens in Y0 with a $100 dividend recap?

Income Statement

None

Cash Flow Statement

Add $100 of borrowing to NI

Subtract $100 of dividends from NI

Cash = 0

BS

Cash = 0

Debt = 100

SE = (100) ← Paying out dividends

What are Maintenance Covenants?

Requires the borrower to maintain a certain ratio or metric at all times

Think of it similar to the reserve ratio in economics

What are the common maintenance covenants?

Senior Debt Leverage Ratio: Senior Debt to EBITDA

Leverage Ratio: Total Debt to EBITDA

Fixed Charge Coverage Ratio (Interest Coverage Ratio)

EBITDA / Interest Expense

(EBITDA - Capex) / (Cash Interest Expense + Mandatory Amortization of Debt)

What is an incurrence covenant?

restrictions or requirements on specific actions

Why are LBOs monthly models?

Covenants are tested monthly

What are 9 drivers of IRR?

Using more debt to finance the deal

Lower interest rates → paying lower interest expense

Add on acquisitions → increased revenue

Price Increases → increased revenue

Synergies with existing portfolio companies

Applying best practices to reduce costs

Pay lower price or entry multiple

Exit at higher multiple

Dividend recap

What is enterprise value?

the total value of a business regardless of how it is financed

What is equity value?

the value of what you own excluding debt

How do you calculate enterprise value (simple)?

Equity Value + Net Debt

How do you calculate Net Debt?

Debt - Cash