Finance

1/43

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

What is finance?

Finance is the process of acquiring and managing money for a business.

What is accounting?

Accounting is the process of recording money flows and assets for a business.

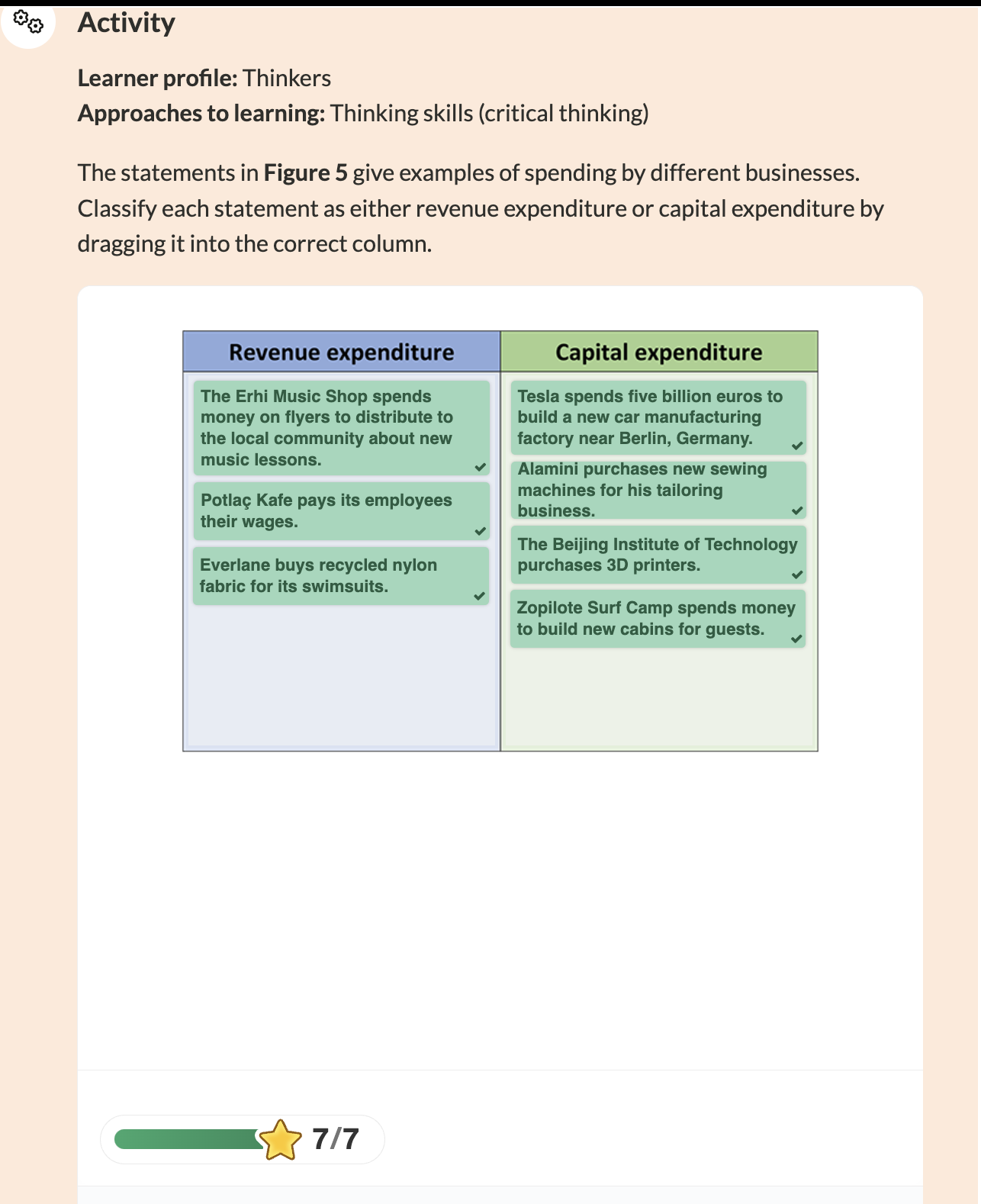

What is capital expenditure? Give examples

What are fixed Assets? Give examples

The finance spend on fixed assets(non-current assets).

eg: Long term loans

eg: Mortgages

These are assets which a company holds onto for longer than 5 years

eg: factories

eg: machineries

What is procurement?

It is the process of purchasing goods and services for a business

What is used to fund capital expenditure

Long term finance (peep 3.2)

Revenue expenditure + examples

financing the operational activities of a business

This spending will enable the business to generate ongoing revenue.

daily, weekly or monthly

eg: rent, salaries, electricity bills

What is used to fund reveunue expenditure

Short term finance (peep 3.2)

Revenue vs Capital

What happens if company cannot pay its revenue expenditure

It becomes insolvent (unable to pay debts)

Checklist 3.1

What are three sources of internal finance

sale of assets

retained profit

persona funds

PSR

One disadvantage of internal source of finance for money

significant opportunity cost involved - once used it cannot be available for other purposes

The money lost by not selecting a particular option in the decision making process

Define one pitfall of using internal sources of finance (particularly sale of assets)

Cost on missing out on an opportunity after choosing one option over an other

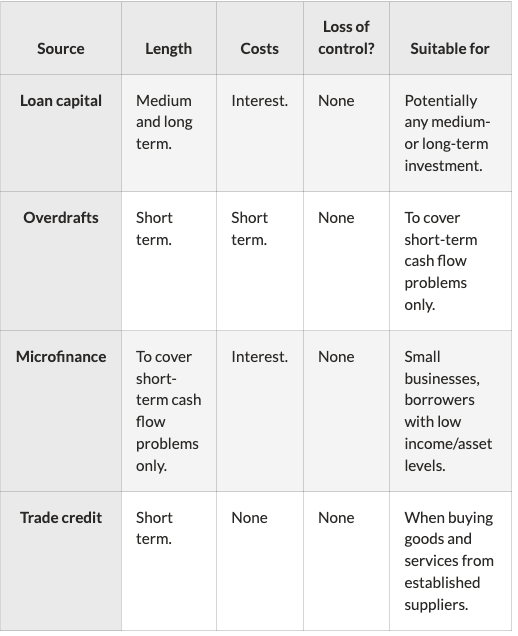

Three types of external finance

D ebt finance

E quity finance

O ther sources

Acronym for Debt Finance

M icrofinance

O verdrafts

L oan Capital

T rade Credit

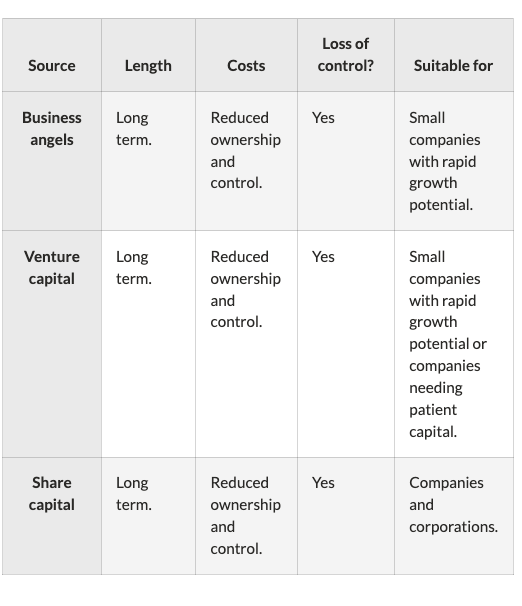

Acronym for Equity FInance

Venture Capital

Share Capital

Business Angels

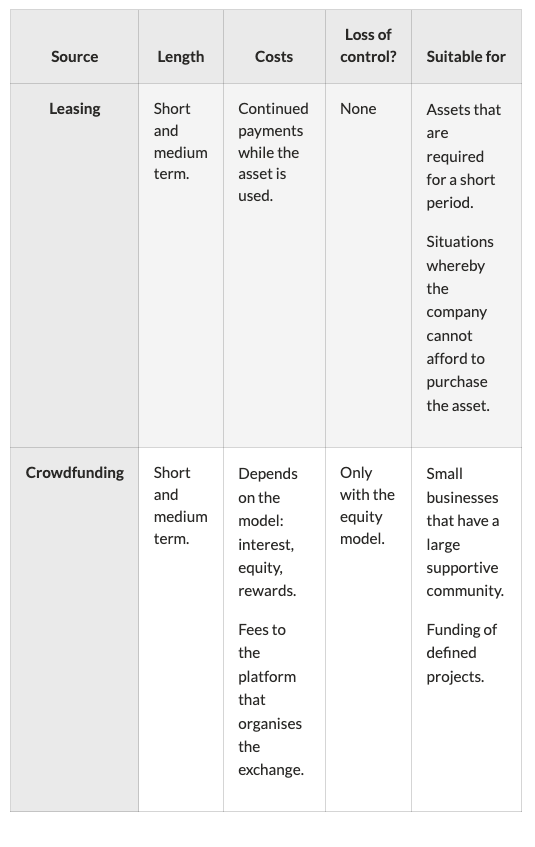

Other sources of finance

Crowd Funding

Leasing

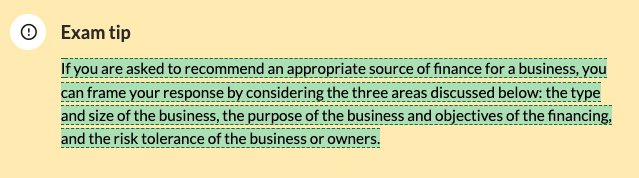

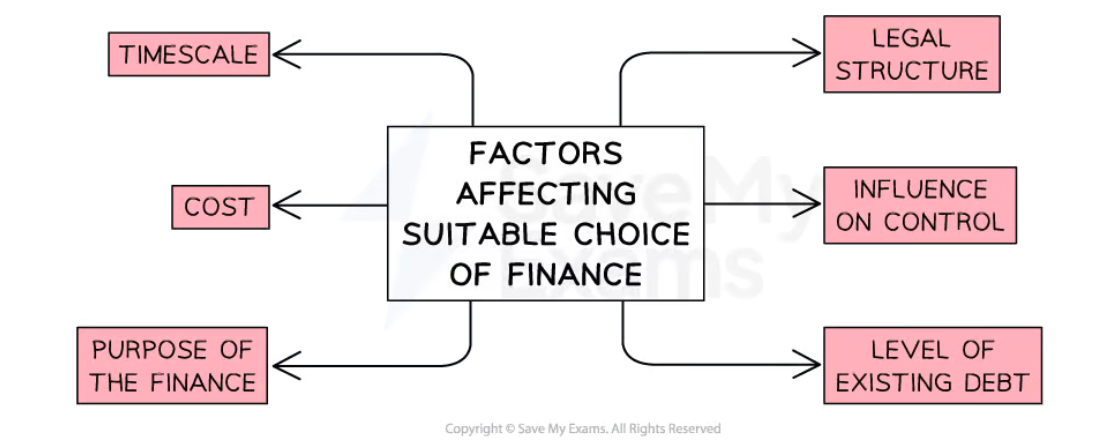

Tip

Choice affecting type of finance

What word for “profit” for non profit organizations

SURPLUS

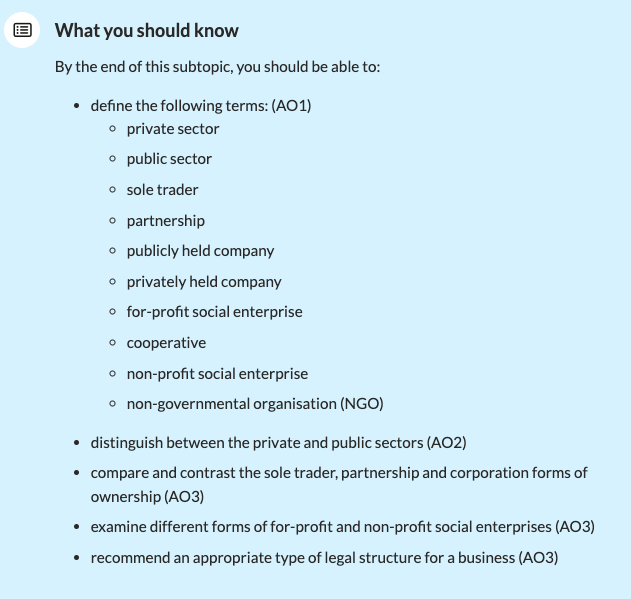

Check List 3.2

D

How is trade credit helpful for both buyer and seller

Main disadvantage of debt finance

Main advantage of debt finance

have to repay amount with interest (for loans, overdrafts)

do not need to give up equity in the company (DIRECTLY)

Main disadvantage of equity finance

Main advantage of equity finance

have to give up equity stake in a company

need not repay the finance provided to you

Venture capital

from group of people who are clients of company who invests for shares, and will probably sell them later at a higher value

Business Angel

Individual Personal money invested in exciting new businesses, generally have high risk

Share capital

Thru IPO- issuing shares on stock exchange for money, in exchange will give equity + dividends every year to SHAREHOLDERS

UNLIMITED LIABILITY FOR- ?

Partnerships

Sole proprietorship

Debt factoring

business sells its accounts to a third party in exchange for quick finance, to help ameliorate their working capital cycle

are all sources of finance assets or liabilities

Liabilities for the most part

What is cahs flow proportionate to

companies solvence (ie ability to pay off debts)

Formula for equity

Share Capital + Loan Capital + Retained Earnings

liquidity

Liquidate

Conversion of asset into cash

Cash → debtors → stock

profit

total revenue - total cost

cash flow

inflow + outflow of money in a business

working capital

the capital set aside by a business to finance its day to day activities

working capital cycle

process of converting current asset to cash to purchase resources to produce a product

best way to improve working capital cycle

extend payment terms w/ supplier

cheaper suppliers

convert debtors to stock

make use of short term borrowings

sell excess stock

tap into new revenue streams

just make all things CASH!

equity

shared capital + retained earnings + loan capital

investment

purchase of assets that are expected to generate value over time (revenue stream example)

free cash flow

cash after deducting expenses and outflows