Success in Jesus Name Fin 411

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

Market to Book Ratio (aka Price to Book Ratio)

A financial metric used to assess a company's market value compared to its book value. It is calculated by dividing the market price per share by the book value per share,

It tells how much investors are willing to pay for each dollar of the company's assets.

(Also equal to Market capitalization/ total book value)

CML (capital market line)

Is the Capital Allocation Line (CAL) when the tangency portfolio is the market portfolio. So you’re seeing the risk return trade off of a portfolio consisting of a risk free asset and the market portfolio

All the portfolios on the Capital Market Line are a combination of the risk free asset and market portfolio and are perfectly related.

CAL (capital allocation line)

represents the risk return trade offs of a portfolio consisting of a risky asset and a risk free asset. It shows the best combinations of risk and return based on how an investor chooses to proportion their investment in the assets

Sharpe Ratio

The slope of the capital allocation line

It shows the return per unit of risk.

(the higher the sharpe ratio the more return per unit of risk)

SML (security market line)

Is a graphical representation of CAPM and shows the relationship between expected return of an asset and its systematic risk (beta)

if p-value is less than 0.1 you then reject the null hypothesis (alpha=0)

Meaning that the data is statistically significant (meaning alpha is different from 0 and suggesting CAPM mispriced)

αi (alpha)

Intercept (excess returned unexplained by CAPM in regression)

ei (error term)

Idiosyncractic risk (firm specific risk or diversfiable risk)

R Squared

Percentage of variance explained by independent variable in regression

When the M/B is greater than 1

then the firm is a growth firm

When M/B ratio is less than 1

then firm is a value firm (like utilities little growth opportunties)

You should invest in projects that have a ROE>K

Because this means their is attractive profit opporotunties in the project that will enhance the value of a firm

The Basic Assumptions of CAPM

Every market is competitive

We are dealing with a common single period investment horizon

All transactions are tradable

No transaction costs

Investors are rational (meaning they are risk averse and mean-variance optimizers)

All investors face the same frontier and choose the same risk free asset and risky asset (homogeneous expectations)

Make SURE TO

Discount the present value of stage ll dividends by k (just like you did for stage 1 dividends)

Covariance of I and J

BiBJ*O2m

An efficient portfolio

is a portfolio that has the highest expected return for a given standard deviation

Minimum variance portfolio

is the portfolio that provides the lowest variance (meaning it has the lowest standard deviation) among possible portfolios of risky assets

A portfolio is inefficient (or can be reffered to as being dominated)

if another portfolio combination yields a higher average return with the same standard deviation of returns

Yesu Mukama

sharpe ratio

= risk premium / STD

= (portfolio return - risk free rate) / (portfolio std deviation)

Indifference curves

represent combinations of risk and expected return that give the investor the same level of satification

Optimal portfolio

is one that is along the efficient frontier and tangent (touches) to the indifference curve

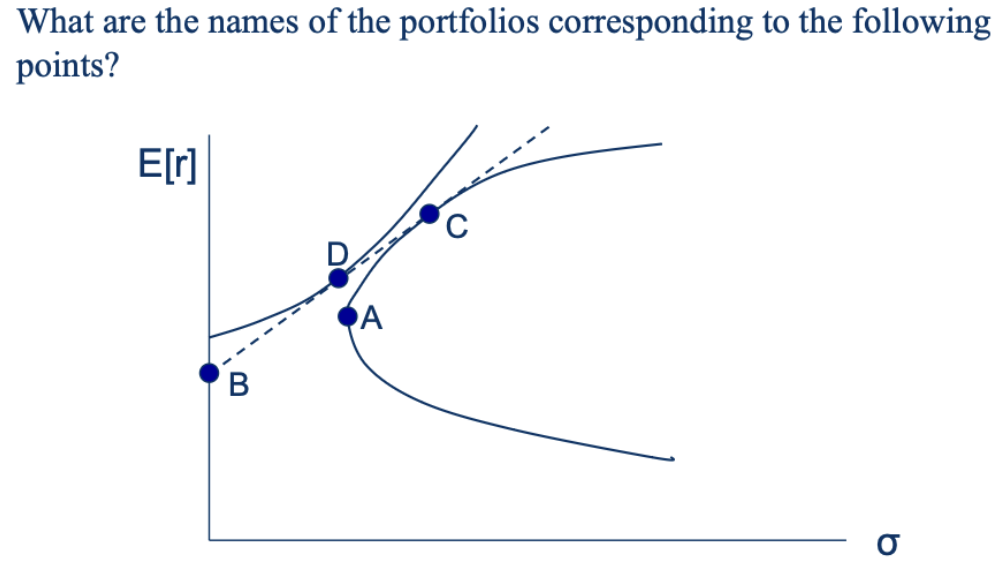

Point B: Risk free portfolio or portfolio completely composed of risk free asset

Point D: Optimal Complete Portfolio (a portfolio client choose given the indifference curve)

Point A: Global Minimum Variance Portfolio

Point C: Mean variance efficiency portfolio (tangency portfolio)

Investors are mean-variance optimizers (a CAPM assumption)

Investors make portfolios having in mind to maximize expected return for a given level of risk (variance)

CAPM assumptions

market is in competitive equilibrium

common single period investment horizon

Investors are rational mean variance optimizers

No transaction costs, no taxes

All assets are tradable

Homogeneous expectations across investors

CAPM vs Single Index Model

The CAPM is for expected returns while the Single Index Model is for realized Returns

The CAPM predicts that alpha will be zero

Effective Annual Yield (EAY)

Takes into consideration the compounding effect period

EAY = (1+r/n)n-1

YTM and Bond Price

have a inverse relationship

Expectations hypothesis

Assumes investors are risk neutral

meaning that investors choose the maturity of their bonds to maximize HPR

forward rates of the year n is equal to the expected future 1 year interest rate in year n

usually flat curve (if changes in interest rates are small)

Liquidity Preference Theory

Assumes that forward rate exceeds the expected future short term interest rate (otherwise short term investors would not be willing to hold long term bonds due to added risk and lower liquidity)

Segmented market Theory

Assumes investors trade either short terms bonds or long term bonds, and interests rate are determined by supply and demand among these 2 difference segments of investors

Longer the time to maturity and the smaller the coupon

then the higher the price sensitivity to changes in interest rates (higher duration)

An increase in a bond’s YTM results in a smaller price decline than the price gain associated with a decrease of equal magnitude in the YTM

because of convexity

low coupon bonds

are more sensitive to changes in the interest rates than higher-coupon bonds (lower coupon bonds have a higher duraiton)

In expectations hypothesis (EH)

the Liquidity premium is zero so forward rate is equal to future short term interest rate

predicts flat yield curve if future interest rates stay constant

In Liquidity premium theory (LP)

the forward rate is larger than future short interest rates

predicts upward slopign yield curve even if future rates stay constant

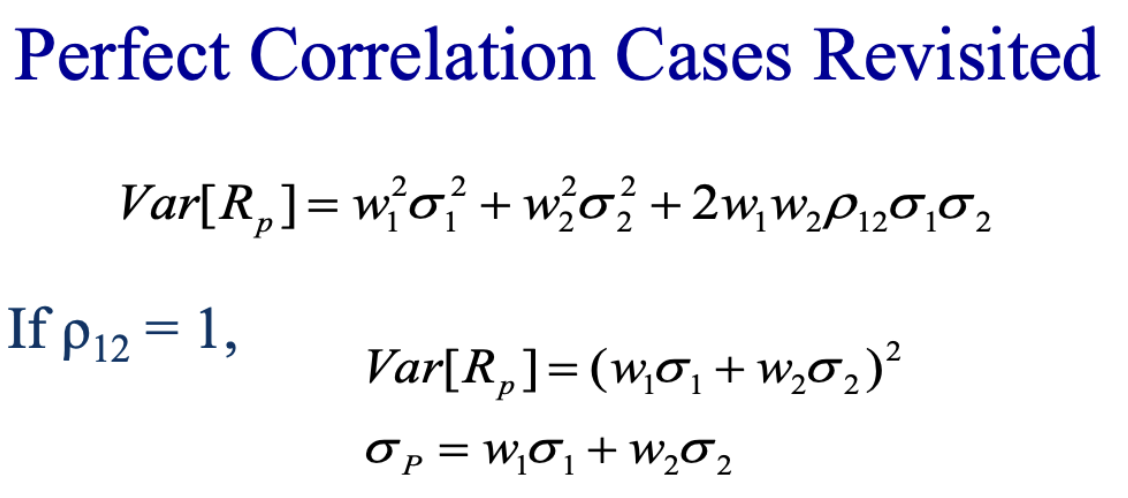

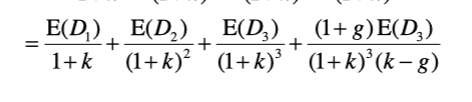

Two-Stage Dividend Discount Model

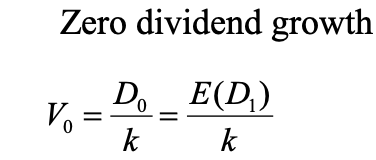

Zero dividend growth model

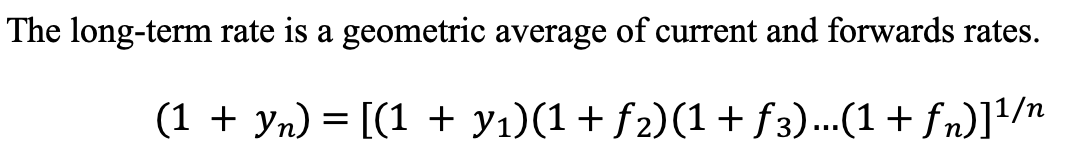

Forwards rates

weak form market efficiency

stock prices reflect all past information

Only fundamental analysis is helpful (TA not useful)

but arbitrage is possible

semi-strong form

stock prices reflect all publicly available information

arbitrage is not possible (except by private information/insider)

FA analysis is not useful nor Technical

Strong form market effiency

stock prices reflect all public and private information

no abnormal returns even by insider information

Price goes up on average

after takeover annoucnments

value anomaly (violation of EMH)

value firms (those with low b/m ratio) have higher abnormal returns than growth stocksJ

January/small firm anamoly (violaiton of EMH)

There is abnormal returns if you buy small firm stocks on dec 31st and sell them on Jan 31