Lecture 5- monetary policy and the Phillips curve

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

52 Terms

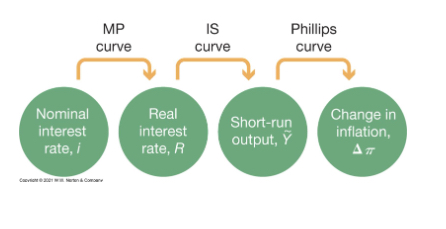

Diagram showing structure of the Short-run- Model

Who sets the bank rate and what is it

The bank of England sets the Bank rate

And it is a nominal intrest rate that BoE charges banks to borrow funds

What must match the central bank lendinf rate

Commercial banks borrowing from each other daily at the overnight rate

cannot charge a higher rate

Everyone would use the central bank

Banks cannot charge a lower rate

Everyone would borrow at the lower rate and lend back to the central bank at a a higher rate(arbitrage)

The lender would run out of resource quickly

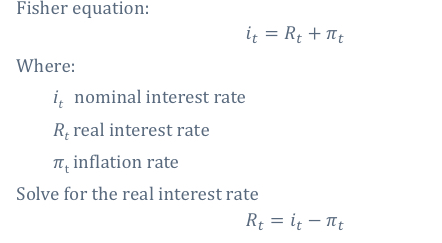

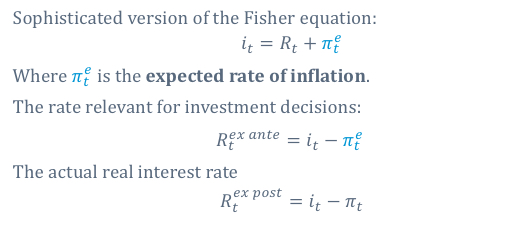

What is the fisher equation

What are the sticky equation assumptions

What does sticky inflation allow central banks to do

What is the sophisticated version of the fisher equation

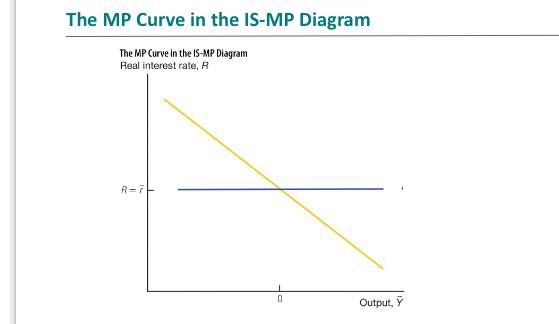

What is the MP and the IS curve

Show the MP curve in the IS-MP diagram

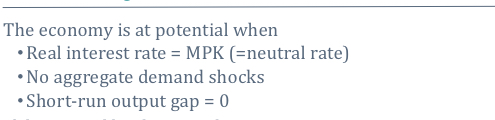

When is the economy at its potential

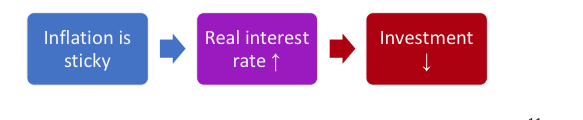

What happens if the central bank raises the interest rate

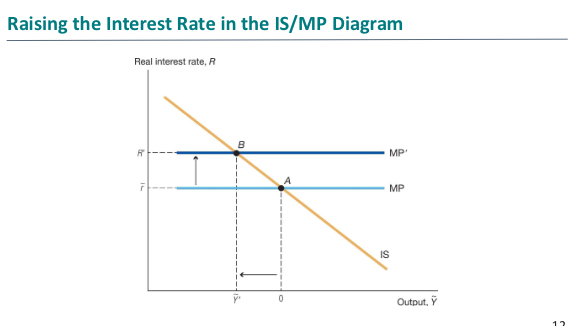

What happens if the intrest rate is raised in the IS/MP diagram

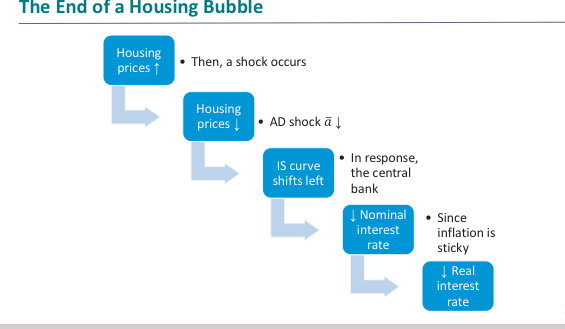

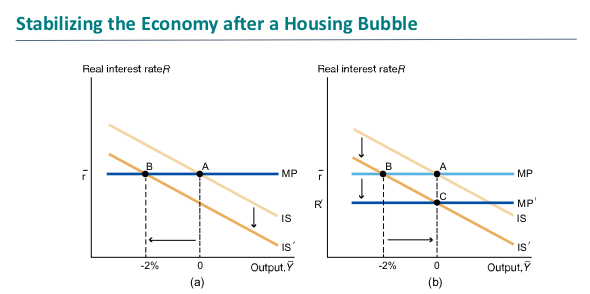

Diagram showing the ends of a housing bubble

Graph showing the economy after a housing bubble

For economic actors what are the most important rates

central banks controls the overnight interest rate

Most important is the market intrest rates

Why is the market intrest rate different

-cost of commercial banks

-default risk

Duration of loans varies from 1 to 30 years

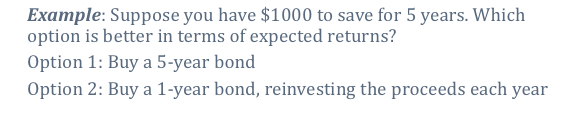

Example question

Answer words

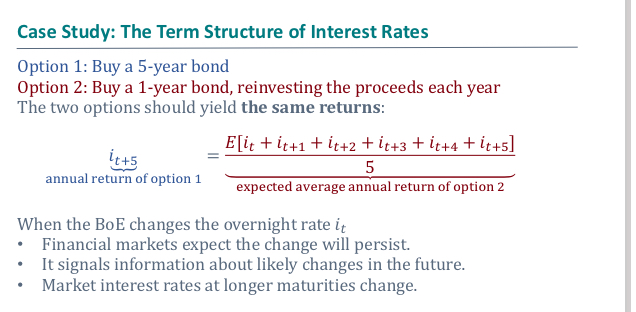

Annualised intrest rates on investments of differential lengths should yeild the same returns

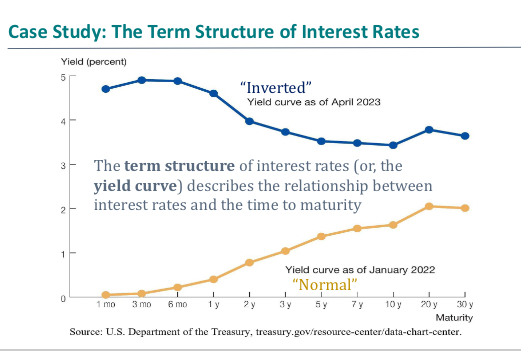

What is the term structure of interest rates and graph

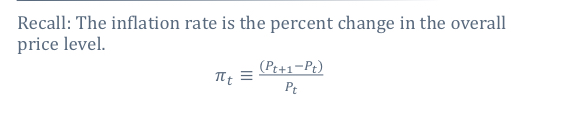

What is the inflation rate

What do firms set their prices based on

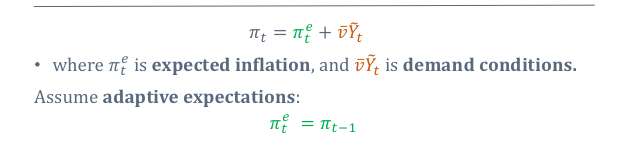

What is the Phillips curve equation with expected inflation and demand conditions

Then assuming adaptive expectations

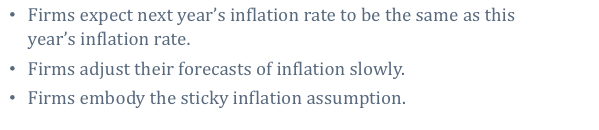

What do firms do according to this

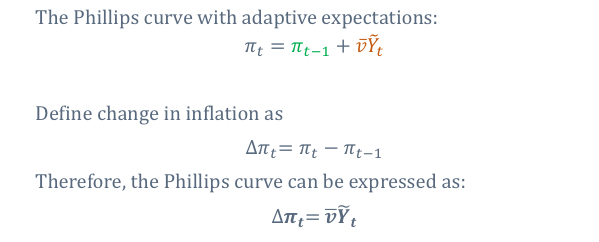

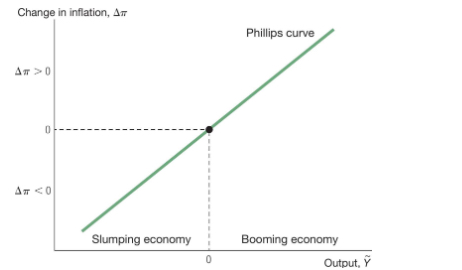

Using this equation define change in inflation and therefore express the Philips curve as

What is the Philips curve equation graph

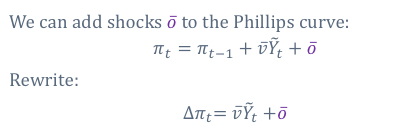

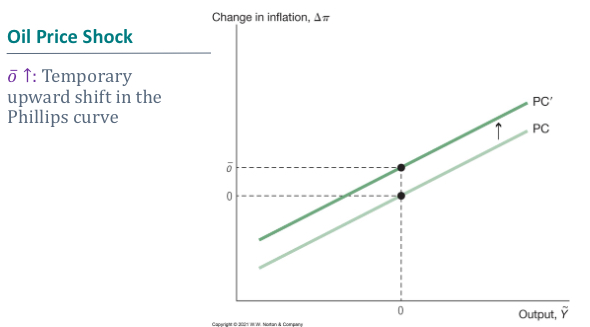

What does the Philips curve equation look like when you add shocks o dash to the Philips curve

What does inflation depend on

Expectations of inflation

Demand conditions

Shocks to inflation

What is the effect of a change in the Phillips curve After an oil price shock

What is cost push inflation driven by

What is demand push inflation driven by

Changes in short-run output

Due to shocks to aggregate demand( C,I,G,EX-IM)

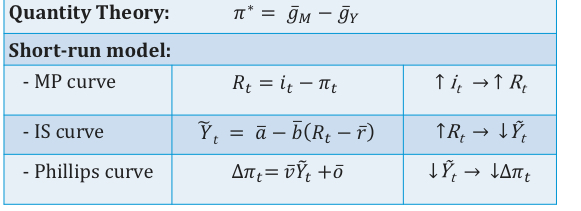

Recap table

Quantity theory of money equation

Short run model

Mp curve

Iscurve

Phillips curve

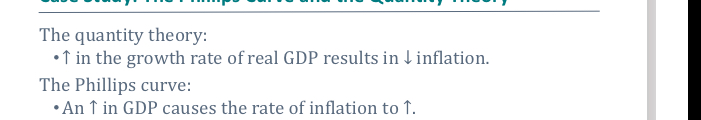

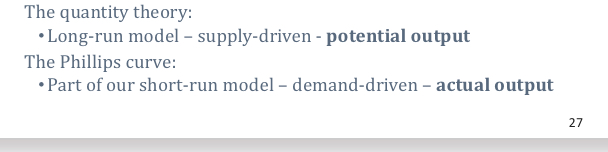

Which is correct

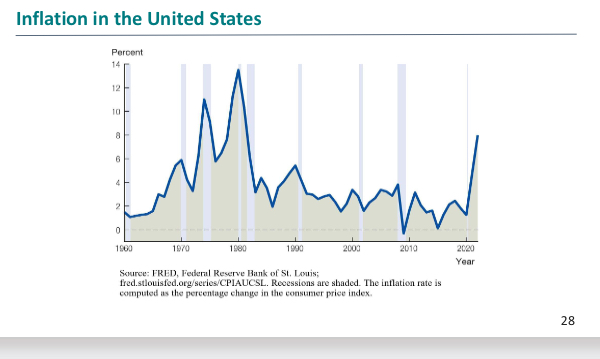

History of inflation in the US table

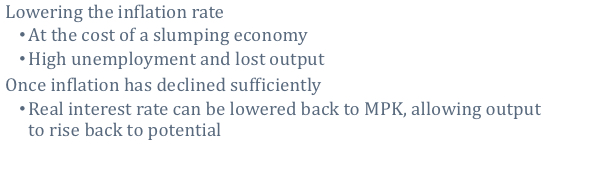

What does reducing the evil of inflation in the long run require and why

Tight monetary policy

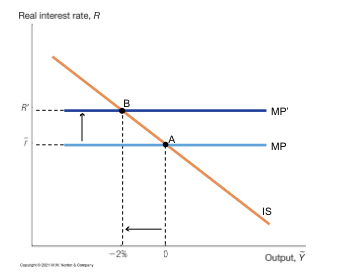

Is curve showing tightening monetary policy

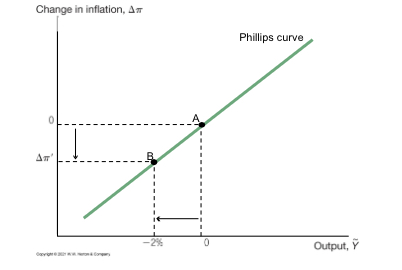

Phillips curve showing a recession and falling inflation

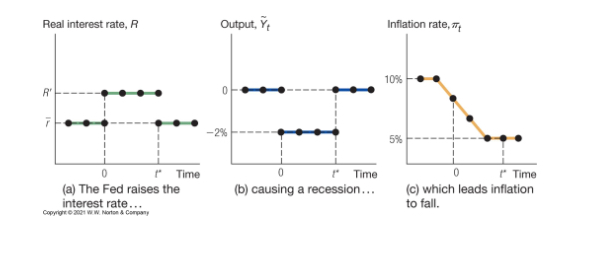

Overall what is volcker disinflation

Real intrest output and inflation rate graph showing disinflation over time

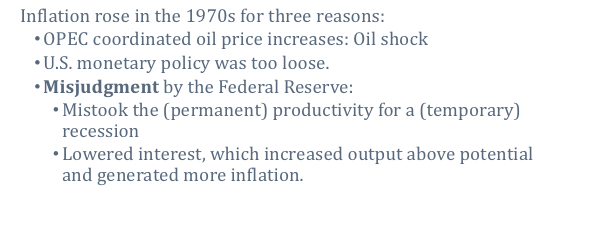

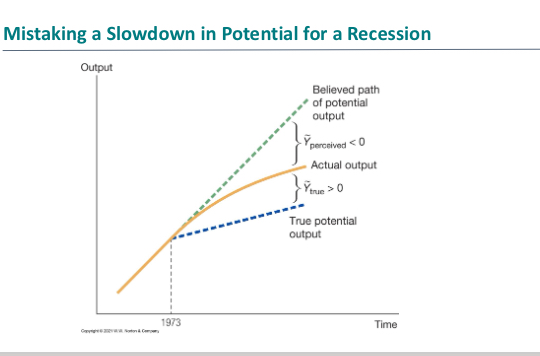

What was the great inflation of the 1970s and what was the three reasons

Graph showing mistaking a slowdown in potential for a recession

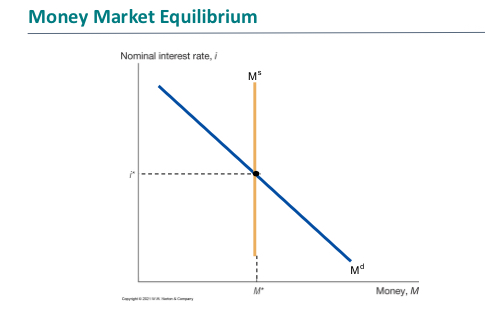

What is the money supply controlled by

Controlled by the central bank

vertical line at the desired level of money supply

What is money demand

Households can either hold money (cash) or buy bonds that pay a nominal intrest rate i

Money demand decreases in i

What is the nominal rate of money demand and what does the curve look like

Is the opportunity cost of holding money

Is downward sloping

What does the money market equilibrium look like

How does the central bank control the nominal interest rate

By supplying the money that is demanded at that rate

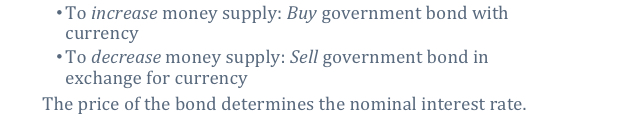

What does the central banks controls the money supply through

To increase the money supply

To decrease the money supply

Open-market operations

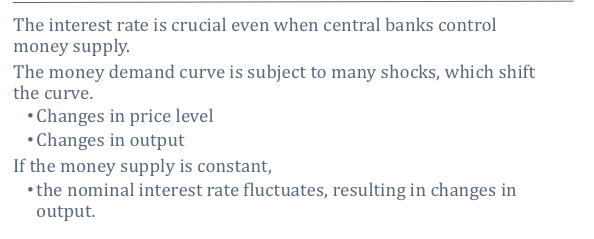

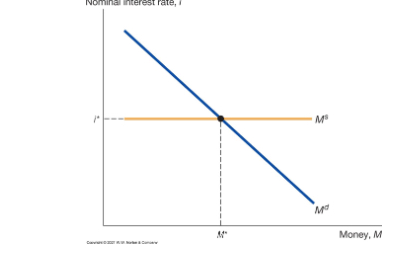

Why I t instead of Mt

Targeting the nominal intrest rates graph

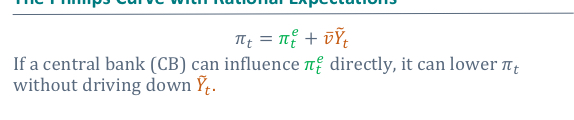

What is the Philips curve with rational expectations equation

What is a soft landing one high inflation