2. Merchandise Purchases

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

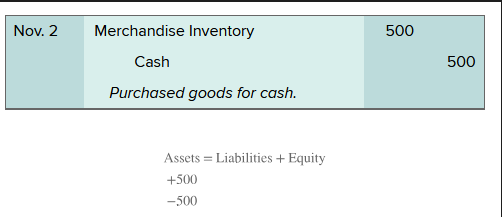

If you are a merchandiser and purchase merchandise with or without a cash discount, how should the transaction be recorded?

debit Merchandise Inventory and credit Cash (assuming paying with cash)

The purchase of goods on credit require…

credit terms

What does credit terms include?

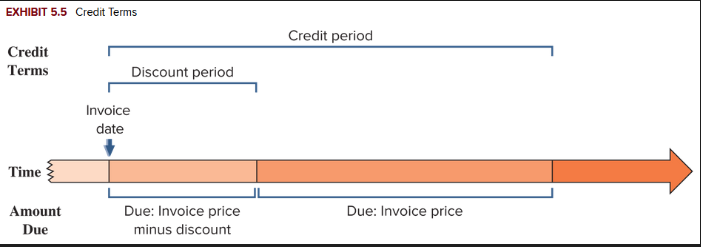

The amounts and timing of payments from a buyer to a seller.

When sellers require payment within 60 days after the invoice date, credit terms are written as…

n/60

What does n/60 mean

net 60 days, meaning the buyer has to pay the invoice within 60 days.

What is the credit period?

the amount of time allowed before full payment is due.

Sellers can grant a _____ to encourage buyers to pay earlier. Any cash discounts are described on the invoice.

Sellers can grant a cash discount to encourage buyers to pay earlier. Any cash discounts are described on the invoice.

A buyer views a cash discount as a…

purchases discount.

A seller views a cash discount as a…

sales discount.

What does credit terms of 2/10, n/60 mean?

Full payment is due within a 60-day credit period, but the buyer can deduct 2% of the invoice amount if payment is made within 10 days of the invoice date. This reduce payment is only for the discount period.

Review invoice figure under Purchases with Cash discounts section.

Review Z-Mart example under Gross Method section under Purchases with Cash Discounts.

On the purchase date, we do not know if the payment will…

occur within the discount period

The gross method records the purchase…

at its gross (full) invoice amount

Why is the gross method used?

It complies with new revenue recognition rules, is used more in practice, and is easier and less costly to apply.

If you are the merchandiser and made purchases on credit what would the journal entry look like?

debit merchandise inventory and credit accounts payable

Good cash management means that invoices are…

not paid until the last day of the discount or credit period. This is because the buyer can use that money until payment is required.

If you paid the purchase invoice off within the discount period, what would the journal entry look like to record the transaction?

debit Accounts payable, credit merchandise inventory for the discount amount (not the percentage the actual discount amount), credit cash

When paying off the invoice within the discount period, how much should cash be credited for?

The amount owed minus the discount.

Why do we credit merchandise inventory for the discount amount?

to ensure that the inventory account accurately reflects the net cost of the merchandise purchased. This follows the Cost principle.

If we didn't credit Merchandise Inventory for the discount, our inventory asset would be…

overstated, as it would still show the higher original invoice price even though we paid less.

After the $10 discount with the $500 initial amount, what does the merchandise inventory account balance equal?

equals the $490 net cost of purchases

If you are the merchandiser and paid off the invoice after the discount period how is this entry recorded?

debit accounts payable and credit cash

What are purchases returns?

merchandise a buyer purchases then returns

What are purchase allowances?

refers to a seller granting a price reduction (allowance) to a buyer of defective or unacceptable merchandise.

If you the purchaser, is granted a $30 allowance from the company you purchased from how would this transaction be recorded?

debit accounts payable and credit merchandise inventory (if cash is refunded instead, debit cash instead of accounts payable)

review example under purchases allowances

If you return some of the goods purchased how should this transaction be recorded?

debit accounts payable and credit merchandise inventory

Returns of inventory are recorded at…

the amount charged for that inventory.

Review example under purchases returns.

Review

The buyer and seller must agree on who is responsible for paying freight (shipping) costs and who has the risk of loss during transit. This is the same as asking what point ownership transfers from the seller to the buyer.

What is the point of transfer called?

FOB (free on board) point

What is FOB shipping point?

the buyer accepts ownership when the goods depart the seller's place of business.

Who pays for shipping costs and risk of loss in transit with FOB shipping point?

the buyer

With FOB shipping point, during transit whoes inventory are the good a part of?

The goods are part of the buyer's inventory when they are in transit because ownership has transferred to the buyer.

What is FOB destination?

ownership of goods transfers to the buyer when the goods arrive at the buyer's place of business.

Who pays for shipping and has the risk of loss in transit with FOB destination?

The seller.

What does the seller wait til to record revenue for FOB destination?

The seller waits until the goods arrive at the destination.

When a buyer is responsible for paying transportation costs, the payment is made to…

a carrier or directly to the seller.

The cost principle requires that transportation costs of a buyer be part of the…

cost of merchandise inventory.

If you agree with the seller for FOB shipping point, what would the recording entry look like if you paid $75 for freight charge to UPS?

debit Merchandise inventory and credit cash

When the seller is responsible for paying shipping costs, how does it record these costs?

It records these costs in a Delivery expense account, also called transportation-out or freight-out, is reported as a selling expense in the seller's income statement.

In summary, purchases are recorded as…

debits to merchandise inventory.

Purchases discounts, returns, and allowances are…

credit to Merchandise inventory.

Transportation-in (FOB shipping point) is…

debited (added) to Merchandise inventory

Review itemized costs of purchases figure

Review need-to-know 5-2