Price Discrimination

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

what is price discrimination?

where firm sells same product at different prices to different customers

what is the aim of price discrimination?

to further maximise profits by extracting some or all of consumer surplus

what are the types of price discrimination?

first degree

second degree

third degree

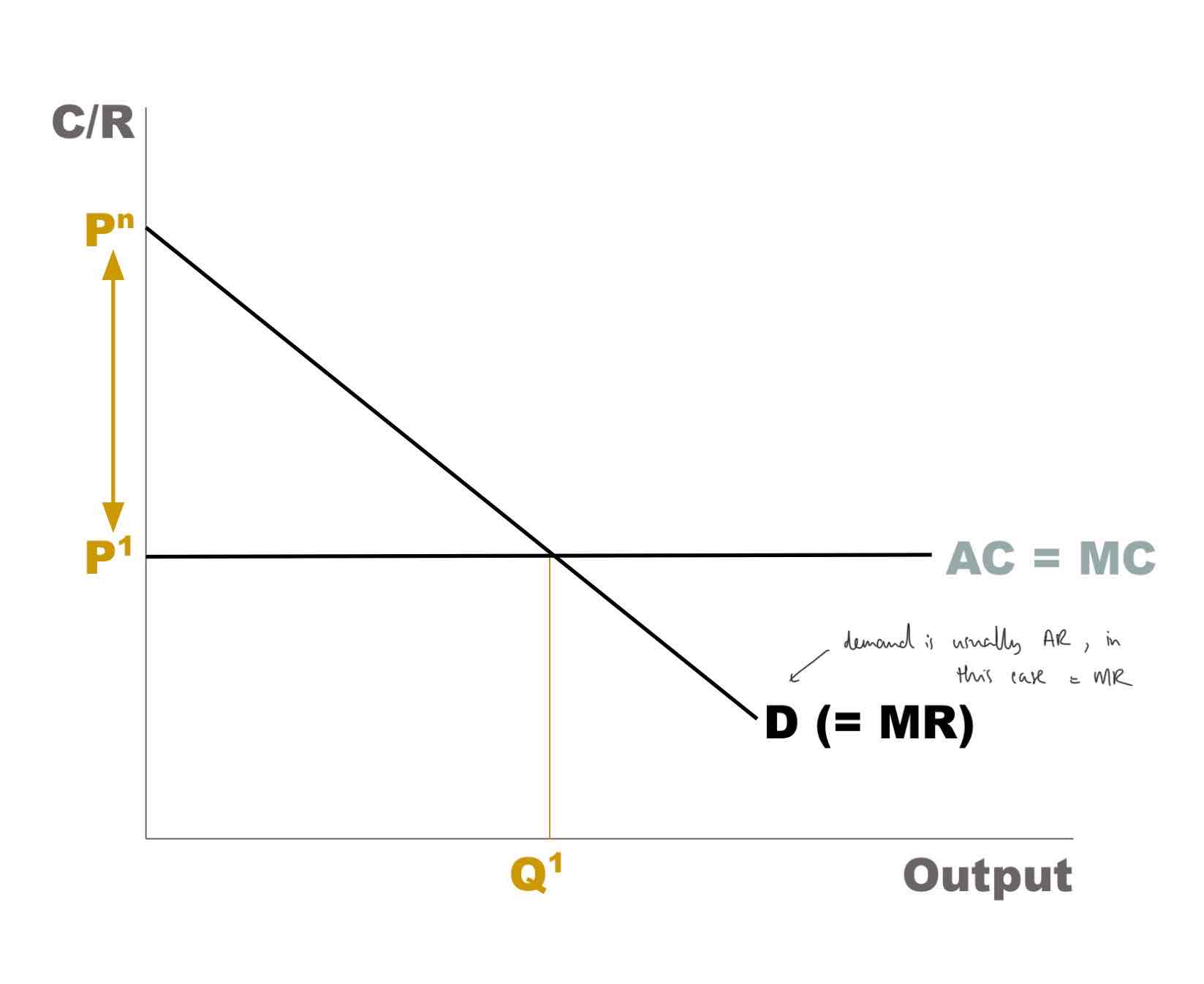

first degree price discrimination

where firm charges each and every customer the max price they are willing to pay;

attempting to extract ALL consumer surplus and turn it into producer surplus

D curve becomes MR curve

evaluation of first degree price discrimination

this is unlikely to happen as cost of finding out every individual’s price preferences would be well in excess of any potential profits gained

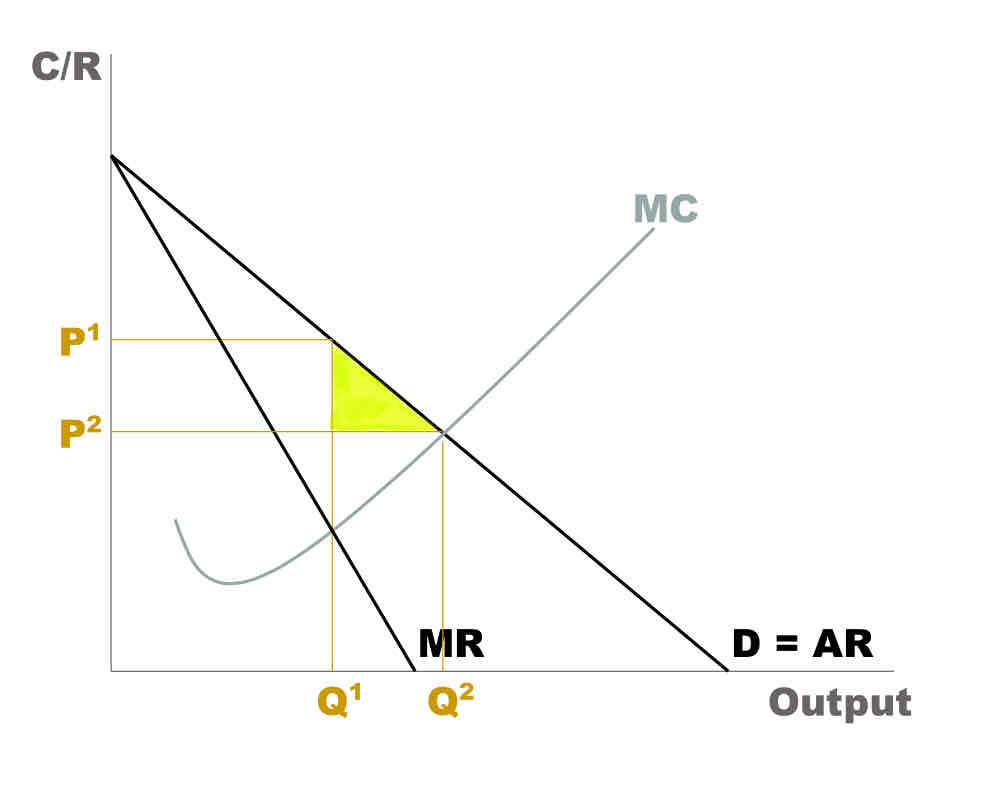

second degree price discrimination

firm seeks at profit maximising output then sells any excess capacity cheaply

typically where FC are very high

so any marginal output - even sold at MC - will bring in some additional outcome (something is better than nothing)

an example of second degree price discrimination

AIRLINE INDUSTRY

very high fixed costs

standard pricing strategy will cover these fixed costs and all related marginal costs.

however, any unsold seats will be sold off last minute at a discount, as long as the price simply covers the marginal cost.

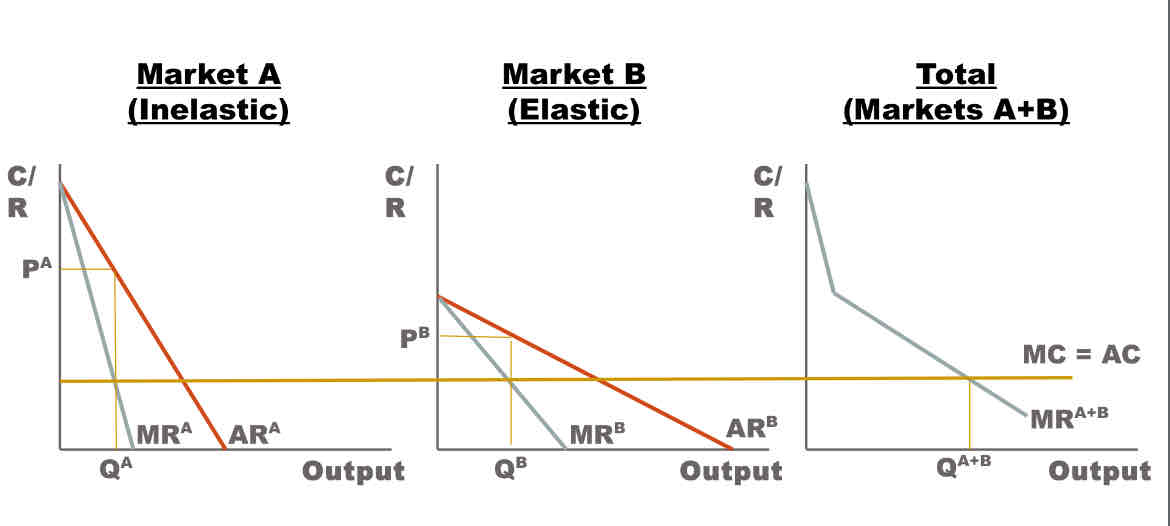

third degree price discrimination

firm splits market into diff customer groups

charge a diff price to each sub group

illustrated through 3 panel diagram

evaluation for third degree price determination

the cost of separating the market into sub groups must not exceed the increase in profits gained

what conditions are necessary for price determination to succeed?

Firm must have some degree of market power

Downward sloping AR curve

hence the firm can vary prices

Identifiable market segments, each with a different PED

Charge lower price in elastic market

Higher price in inelastic market

No possibility of arbitrage

i.e. where customers buy the product in the low-price market and resell it in the high-price market

This would take away the firm's high-price market

Thus the firm would have no more incentive to practise

costs of price discrimination

allocative inefficiency

inequalities

anti-competitive pricing

Price discrimination operates mainly in the interests of producers as they extract consumer surplus and turn it into extra profit

Can be used as a pricing tactic to reduce competition and reinforce the market dominance of leading firms

May lead to manipulation of groups with a price inelastic demand, not all of whom are on high incomes

Can be perceived as unfair or inequitable to certain groups e.g. alleged gender pricing

Exploitation of the consumer - the majority of consumer still pay more than marginal cost

Extraction of consumer surplus turned into higher producer surplus / supernormal profit

Possible use of discrimination as a limit pricing tactic / and a barrier to entry to rival firms

Ultimately, if successful, it reinforces the monopoly power / dominance of existing firms

benefits of price discrimination

dynamic efficiency

economies of scale

some consumers benefit

cross subsidisation

Makes better use of spare capacity leading to less waste and unsold stock. There are potential environmental benefits from this strategy.

Helps generate cash flow for businesses which can ensure their survival during a recession / tough economic times

Can help fund the cross-subsidy of goods and services e.g. premium prices for some can fund discounts for other groups

Higher monopoly profits can finance research which drives improved dynamic efficiency and can lead to important social benefits

social benefits i.e. charging much lower prices for drugs in lower & middle-income countries

making better use of spare capacity - this can have environmental benefits - e.g. less waste

It brings new consumers into market - who would otherwise excluded by a 'normal' higher price

Use of monopoly profit for research - this is a stimulus to innovation / dynamic efficiency gains

the welfare case against price targeting

exploitation of the consumer - the majority of consumer still pay more than marginal cost

extraction of consumer surplus turned into higher producer surplus / supernormal profit

possible use of discrimination as a limit pricing tactic / and a barrier to entry to rival firms

ultimately, if successful, it reinforces the monopoly power / dominance of existing firms

arguments in support of price targeting

potential for cross subsidy of activities that bring social benefits i.e. charging much lower prices for drugs in lower & middle-income countries

making better use of spare capacity - this can have environmental benefits - less waste etc

it brings new consumers into market - who would otherwise excluded by a 'normal' higher price

use of monopoly profit for research - this is a stimulus to innovation / dynamic efficiency gains

other pricing strategies

cost-plus pricing

predatory pricing

limit pricing

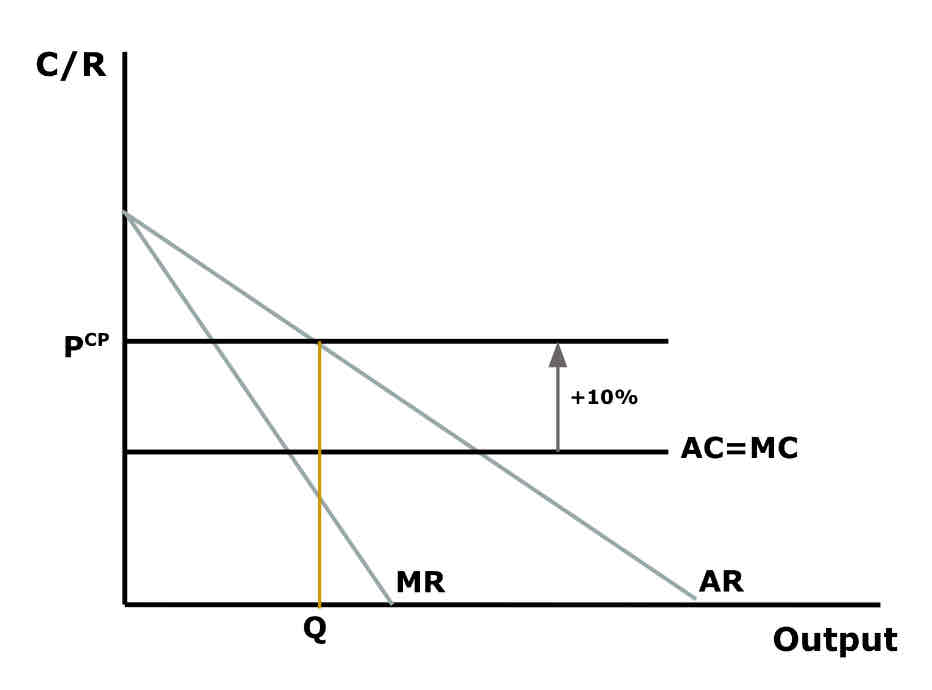

cost-plus pricing

AKA ‘mark-up’ pricing

where firm sets its price as:

AC + desired profit margin

without any reference to D curve

e.g. if AC =10

desired profit margin without any reference = 20%

price = £12

advantages of cost-plus pricing

easy to calculate, low cost of computation

pricing decisions can be made at a relatively junior level in a business based on formulas

Price increases can be justified when costs rise

Price stability may arise if competitors take the same approach (and if they have similar costs) - reduces the costs of price

pricing stability gives consumers confidence in a business as price increases can be deemed as profiteering and decreases as the actions of a struggling business

disadvantages of cost-plus pricing

not necessarily profit max (MC = MR)

however, over time the mark up may be changed based on attempting to maximise profits based on the level of competition and other factors

fluctuations in prices

rises viewed as profiteering

falls viewed as sign of weakness / poor market performance

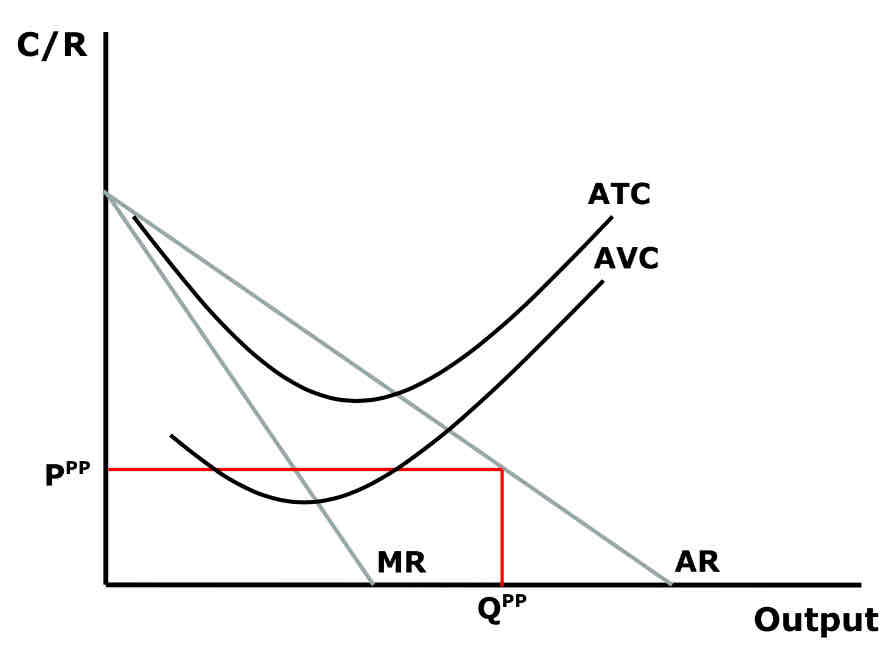

predatory pricing

a short-run strategy where a firm

sets price below AVC (i.e. P < AVC)

in order to force existing rivals out of the market..

...to achieve market dominance and greater SNP in the long run

how is the firm able to make a loss and still survive using predatory pricing?

in the short-run

cross-subsidisation of losses

in the long-run (once competitors have left the market):

raise price above previous competitive levels...

in order to recoup any losses incurred during the period when P < AVC

examples of predatory pricing

Esso and Shell face allegations of 'predatory pricing' over fuel cost (2013)

Wal-Mart convicted in 3 cases in Germany and USA of essential items e.g. Milk (2000)

Newspaper group (subsidiary of Daily Mail group was fined by the OFT for predatory pricing (free advertising space) and trying to eliminate its main competitor. Aberdeen Journals were fined £1.3million.

Debatable: Microsoft's decision to offer its web browser (Internet Explorer) helped to make it very difficult for its main competitor (Netscape) who was also forced to offer its web browser for free.

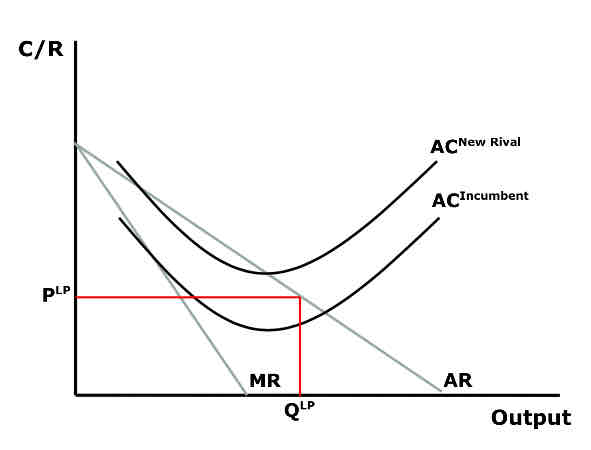

limit pricing

where price is set below the AC of potential rivals, in order to prevent new competitors entering the market

incumbent firm will

have the benefit of economies of scale and therefore a lower AC curve

thus can reduce price to just above its own АС..

..and guarantee that any small new entrant will make a loss

a powerful disincentive for new firms to enter the market

Limit-pricing is therefore a man-made entry barrier