Accounting

1/103

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

104 Terms

* assets, liabilities, and equity

* Comparability is the goal; consistency helps to achieve that goal.

* omission of reports to make it understandable could make it misleading

* financial reports are made for users knowledgeable though they may still even need an adviser

* cost

* accounting period of twelve (12) months ending on December 31

* financial obligation that a entity has to pay at the end of an accounting period to a person or a business as a result of past events

* inflow or increase in asset or

* decrease in liability that results in increase in equity,

other than contribution from equity participants.

* includes revenues and gains

* outflow or decrease in asset or

* increase in liability that results in decrease in equity,

other than distribution to equity participants.

* includes expenditures and losses

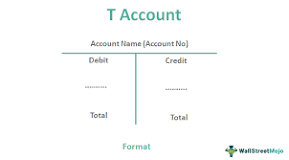

t-accounts

illustration of basic accounting equation, representing increase and decreases of each account, and its total balance

to aid in preparation for financial statements

* right: credit (liabilities, equity, income)

Usual balance assuming proper accounting has been made

If total debits exceed total credits, the account balance is called a debit balance, otherwise, it is called a credit balance.

* ledger- entire set of accounts where transactions are summarized in individual accounts; “Book of Final Entry”

steps of the accounting cycle

transactional analysis

journal entry

ledger posting

trial balance

adjusting entries

10-column worksheet

financial statement

closing entry

post-closing trial balance

\- ex: purchase of assets on account result to increase in asset and increase in liability

for every debit entry, there must be a corresponding credit entry

business entity

businesses are considered distinct and separate from the owners of the business

accounting entity

an organization or section of an organization that is accounted for as a separate economic unit

matching principle

profit or loss that is computed by deducting the expenses incurred from the income earned during an accounting period

monetary unit

assumes that the business events are quantifiable in those terms

historical cost

most commonly and objectively used measurement,

cash or its equivalents that was given up to acquire the assets

amount of proceeds, cash or its equivalents in exchange for the obligation that is expected to be paid to satisfy the liability

revenue recognition principle

method to determine whether or not income has met conditions of being earned and realized

sale of goods- revenues recorded at date of delivery or receipt

sale of service- revenue recorded at completion of service or important progress if service is meant for a long period

materiality principle

information is material if omitting or misstating it could influence the decision of users

cost-constraint

cost must be justified by the perceived benefits from reporting and using the information

simple vs compound journal entry

simple entry- only one account is debited; one account is credited

compound entry- more than one account is involved in either both the debit and credit

chart of accounts

list of all accounts and their respective account numbers

six basic end-of-period adjustments

accrued expense

accrued income

prepaid expense

unearned income

depreciation

doubtful accounts

accrual method

recognize the asset and liability; only recognize expense and income once there is the delivery of goods or service

deferral method

recognize when payment is given or provided, make adjustments for when goods and services are delivered

prepayment

in the perspective of the customer to receive the goods or service; either asset or expense method; accrued expense and deferred expense

precollection

in the perspective of the seller to deliver the goods or service; accrued income and deferred expense

depreciation

normal wearing out or loss of usefulness of a long-term asset

residual value

at the end of the economic useful life of the asset, it may still command a price

straight line method

method for determining depreciation,

annual depreciation = (cost-residual value)/useful life

accumulated depreciation

contra-asset account, provides retainment of the cost of depreciation while allowing for continual depreciation

carrying value or book value

difference between asset’s cost and the accumulated depreciation

doubtful accounts or bad debts

existing customer credits which a company doubts would ever be settled and rather considers it as uncollectible in the future

direct write-off method

expense attributed to the doubtful account is recorded by direct transfer from asset to expense account

allowance method

allowance as contra-account for doubtful accounts to accumulate uncollectible accounts

worksheet

columnar device to facilitate preparation of financial statements to transfer data from trial balance to the financial statements

content statement of comprehensive income

revenues, expenses, miscallenous expense, finance cost (interest expense, interest income, income tax expense)

content of statement of changes in equity

beginning of balance of equity, additional investments, profit or loss, withdrawals, ending balance of equity

contents of statement of financial position

formal statement of the assets, liabilities, and owner’s equity as of given date

closing entries

separate accounts for income, expense, and withdrawal are set to facilitate in preparation of income statement (profit or loss) and would be closed to the equity account

procedure for closing nominal accounts

income summary

debit income and credit income summary

credit expense and debit income summary

closing income summary

conclude whether it is a profit or loss balance

profit: debit withdrawal

loss: credit withdrawal

capital accounting

debit withdrawal; credit to capital (would increase equity)

credit withdrawal; debit to capital (would decrease equity)

post-closing trial balance

to check equality of debits and credits in the ledger after adjusting and closing entries

business

organization formed to engage in commercial transactions and exchange of goods and/or services with the primary objective of earning profit

forms of business enterprise

service, merchandising, manufacturing

service business

sale of services to customers; main way of generating revenue is through charging fees

merchandising business

trading of goods by simply buying the goods and selling the same to its customers; they earn revenue by imposing mark-ups from the supplier

manufacturing business

sale of finished goods which were processed by the enterprise itself; involves purchase of material and labor with the transformation

legal forms of businesses

sole proprietorship, partnership, corporation

sole proprietorship

owned by proprietor, minimal regulatory from Department of Trade and Industry (DTI)

partnership

owned by partners, regulated by Securities and Exchange Commission (SEC), involves 2 or more persons, profit is divided according to agreement, can dissolve through agreement, withdrawal, death or incapacity

limited partnership

lower share to business profit and lower risk of business loss

general professional partnership

partnership for exercise of profession are exempt from income tax, while general partnerships are taxable as a corporation

corporation

owned by stockholders or shareholders (min. of 2), created by operation of law and its purposes provided, regulated by Securities and Exchange Commission (SEC), managed by Board of Directors, greatest capacity to raise capital, distribution of profit to stockholders through dividends

one person corporation

corporation with one person as stockholders

inventories

assets of an enterprise that are:

held for sale in the ordinary course of business

in the form of production for such sales, or

in the form of materials or supplies to be consumed in the production process or in the rendering of services

property, plant, equipment (PPE)

tangible items that are:

held for use in the production or supply of goods and services, for rental to others or for administrative purposes

expected to be used during more than one period

supplies

items used to carry out tasks in a company’s operations outside of manufacturing, production, or plant

current assets consumed within a 1 year period

inventory accounts maintained by merchandising entities

inventory of goods for sale (merchandise inventory)

inventory accounts maintained by manufacturing entities

inventory of raw materials (materials or raw materials inventory)

inventory of goods undergoing manufacturing (work-in-progress inventory)

inventory of goods ready and available for sale (finished goods inventory)

how can inventory of a service business be presented

inventories referring to direct materials usable in rendition of services (although some companies refer to them as supplies instead)

cost of inventory

purchase cost

conversion costs

other costs

what are the other costs of inventory

those costs necessary to bring inventories to their present location and condition

storage costs after delivery or completion

insurance costs after delivery or completion

costs of purchase

purchase price

import duties and other direct taxes

transport and handling costs