Economics of organisations - theory

1/74

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

75 Terms

what are the 5 theories of why firms exist?

transaction costs

property rights theory

incentives

adaption

teams

why do we bundle steps of production inside a firm instead of having separate suppliers for each step?

because price/contracts are costly

there are transaction costs

firms centralise the tasks and directs production, eliminating the transaction costs

ie employees don’t make contracts with one another, the manager will decide on any dispute between employees

examples of transaction costs found in markets

search and price discovery

set contracts between individuals

enforcing contracts

renegotiate/resolving disputes

why do contracts break down?

according to Williamson (1975):

bounded rationality and uncertainty

can’t foresee all contingencies or specify all actions ex-ante

ie we can’t predict every single action that could happen and write it into the contract

contracts are there incomplete

opportunism

parties exploit contract gaps: shading, renegotiation threats, misrepresentation

asset specificity creates hold-up problems

overall, costly ex-post bargaining and safeguards are unavoidable

what does hierarchy (present in firms) do well compared to the market?

adaption to shocks (no full renegotiation)

authority for dispute resolution

coordination across interdependent tasks

what does hierarchy (present in firms) not do well compared to the market?

weaker incentives (‘low-powered’)

firms don’t replicate the same changes as in the market

ie if the price of a good goes down, the firm will decrease profits but won’t decrease the wage to the workers

this shows that rich information is not so easily absorbed compared to the market

monitoring/communication limits due to bureaucracy present

loss of market discipline/competitiveness

workers on the same task won’t act competitively in the same firm as they would in the market setting

example of appropriable quasi-rent

a bicycle company was developing a new model which required special wheels,

the wheels cannot be produced by wheel producers who don’t have a special machine that is specific to the wheel design

the wheels cannot be sold to any other producer

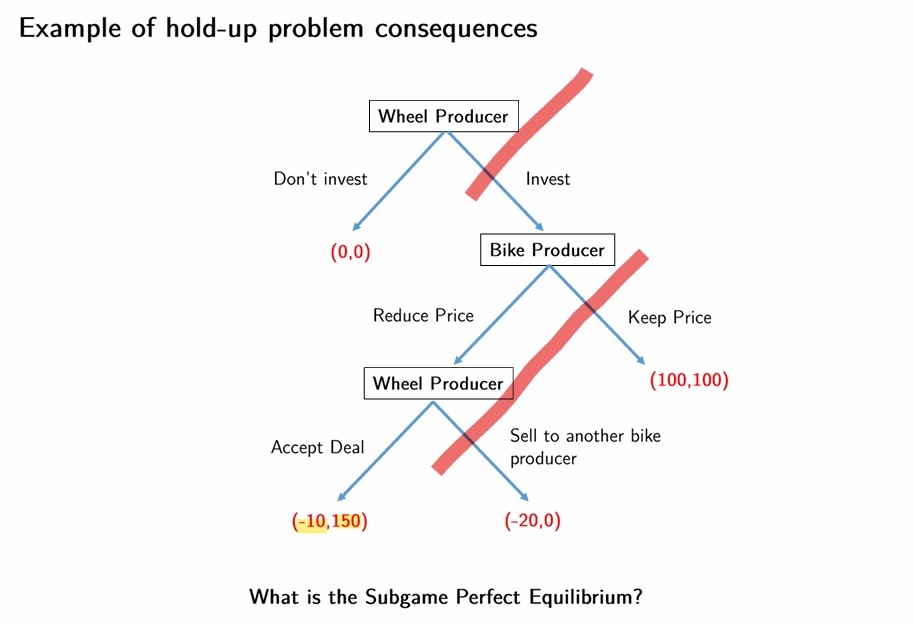

what is the subgame perfect equilibrium?

using backward induction, the wheel producer prefers to accept the deal (-20) to selling to another bike producer (-20)

the bike producer prefers to reduce the price (150) to keeping the price (100)

the wheel producer prefers to not invest (0) to accepting the deal (-10)

therefore, the subgame perfect equilibrium is not invest

therefore, the hold-up problem results in the most efficient outcomes (100,100) not being achieved due to pareto efficiency

are there solutions to solve the ‘hold-up’ problem?

could write a contract to avoid not achieving the most efficient outcome

there’s always ways-out/loopholes

ie claim quality was not good

ways out may be desirable, especially if the asset doesn’t sell

producer could claim ‘unexpected’ costs and raise the price

integrating the transactions into a single firm would reduce the rent-seeking opportunistic behaviour

key idea of transaction cost theory

make or buy

integrate when transaction hazards dominate, ie high appropriable quasi rents, uncertainty, etc

outsource to market when bureaucratic/monitoring costs dominate

all issues are ‘ex-post’ transaction

problems due to rent-seeking after transaction

property rights theory

developed by Grossman, Hart, and Moore

parties combine assets to create value

as ownership gives right to exclude/redeploy the assets, cooperation requires compensating owners enough to participate

ownership determines how the transaction’s value is allocated

problems arise from ex-ante decisions

payoffs not affected by ex-post issues, only by ownership (ie ex-ante non-contractible investments)

this is because investment is needed before a transaction can take place such as training which is not contractable

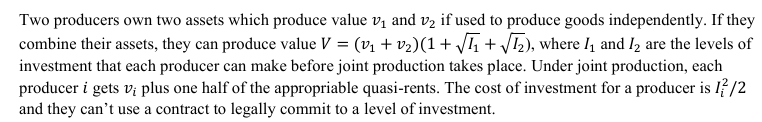

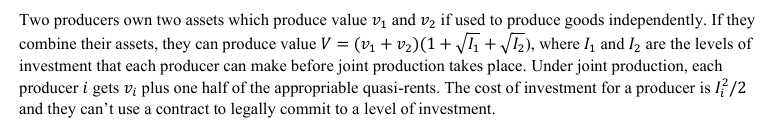

example of property rights theory

input producer owns asset 1 and final producer owns asset 2

asset produces V1 and V2 separately but V >/= V1 + V2 when combined

party i can invest Ii (eg training) that increases the payoff but not the asset price

ie payoff is higher if ownership is higher (similar to stocks)

they can’t write a contract setting the level of investment

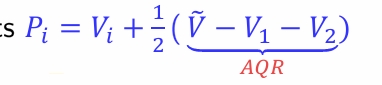

each party i gets what is in the picture

the share of AQR is fixed ex-ante (ie there are no opportunistic issues)

AQR here represents the surplus of the transaction generated

why does the free rider problem occur within the property rights theory?

efficient bargaining results in parties sharing the surplus from their specific investments

party i bears the full cost of investment but receives only a share of the surplus

this results in suboptimal investment due to free riding

however, if party i has a higher level of ownership (eg higher Vi), this increases the party’s incentives to invest

key takeaways from the property rights theory

if V = V1 + V2, there are no incentives to integrate

if I has a large impact on V, then i should own more assets

if V1 + V2 = 0 but V > 0, the assets should have a single owner

incentives theory of firms

firms exist to solve incentive issues (eg moral hazard)

some tasks/transactions may be too costly to integrate

firms implement pay systems, task allocation, technology, etc to mitigate these issues

availability of these tools determine firm boundaries

integration is only optimal if there is good technology to monitor effort

two ways to structure the problem:

if the agent owns the asset, they receive a payment based on measured performance and the asset’s value after production occurs (two incentives)

if the agent does not own the asset, the incentives come from being paid on performance

adaptation theory of firms

collective decisions are costly and slow

delegate authority into a ‘boss’ who can make fast decision

potential problem: bosses may have different objectives to the firm

team theory of firms

teamwork requires supervisors that prevent free riding

who control the supervisors?

need a whole hierarchy just to solve the free riding problem

ownership trade-off in trucking industry (Baker and Hubbard, 2004)

driver

good: incentives to drive carefully which preserve truck’s value

bad: discretion to take external jobs or reject trips

carrier has less incentives to find good ‘backhauls’

carrier company

good: incentives to find backhauls

force drivers to not accept external trips and to accept profitable trips

bad: drivers may not drive carefully, drive fast to have more breaks, blame traffic for delays, etc

how is the trade-off in ownership related to theory? (Baker and Hubbard, 2004)

asset ownership gives different incentives to invest

eg preserving the truck vs coordination efforts, haggling, etc

driver’s actions are hard to monitor

carriers can’t enforce contracts with careful driving, how to drive, etc

carriers can’t specify what to do in every single scenario

how does the trade-off in asset ownership depend on trip/cargo? (Baker and Hubbard, 2004)

long hauls: more likely to drive fast, make up time, etc

more valuable to have a backhaul or else it is very costly

specialized trailers: backhaul is unusual

lowers potential for haggling or bargaining on trips

eg would not expect chilled goods and fuel to have backhaul

what do Baker and Hubbard (2004) study?

the study the trade-offs between asset ownership in the trucking industry

carriers work with a mix of drivers; some own their trucks and others drive company’s owned trucks

study driver vs carrier ownership in two ways:

how it differs for different trips/cargos

what happened after the introduction of a technology (on board computers) that allowed measuring driver’s behaviour accurately

data is not a panel of trucks but instead a repeated cross-section

define: cohort = state*product*trailer*distance

eg long-distance hauls of food in refrigerated vans based in California

each cohort observed before (1987) and after (1992) OBC introduction

minimises within-segment hetereogeneity in haul characteristic that would otherwise tend to bias estimates

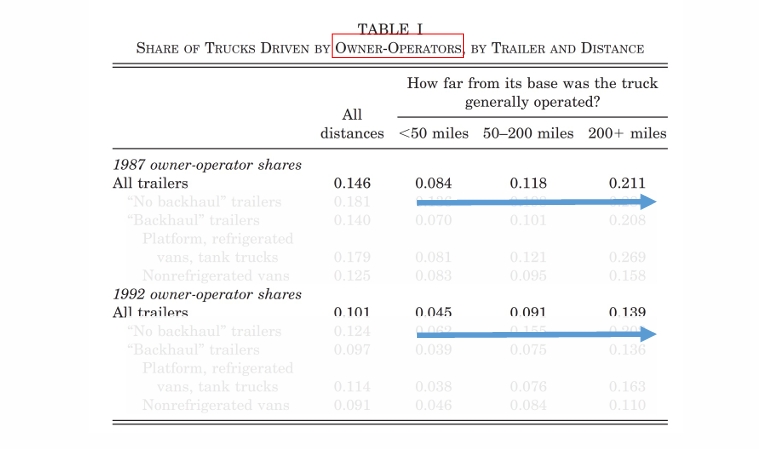

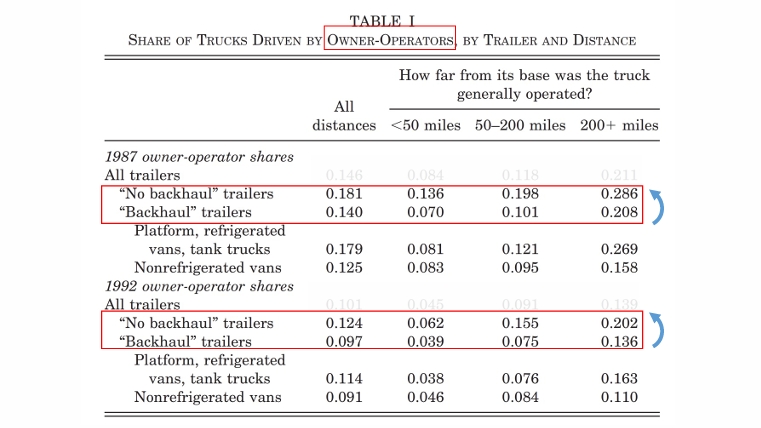

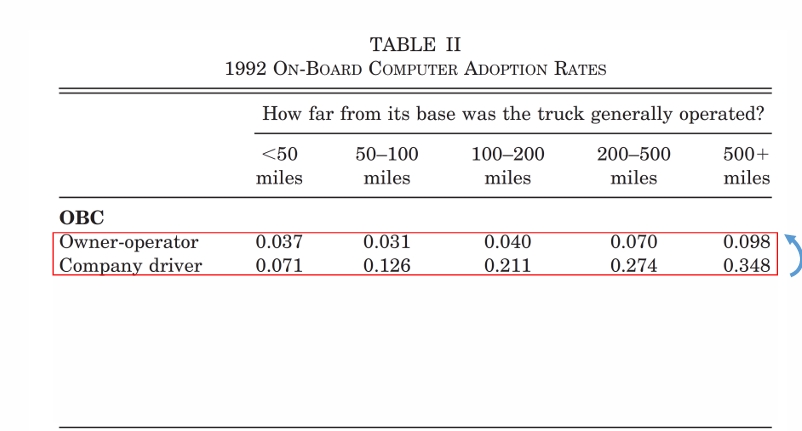

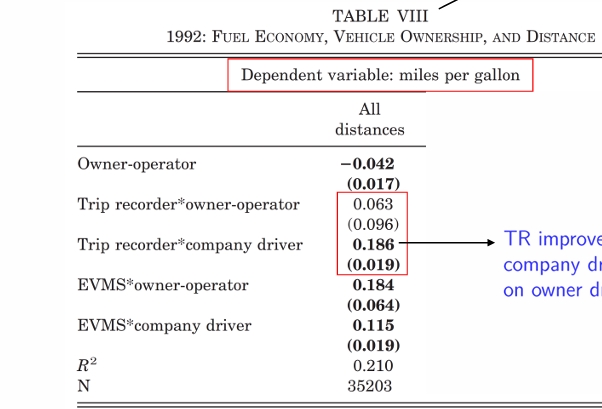

what does this table of results show us? (Baker and Hubbard, 2004)

the share of trucks owned by employees increase as distance increases

consistent with the hypothesis that carrier-owned drivers have less of an incentive to drive carefully

what does this table of results show us? (Baker and Hubbard, 2004)

the share of owner-owned trucks is lower for backhaul trailers

consistent with owner-drivers’ rent seeking behaviour (eg reject trip, bargain commissions)

this means carriers have low incentives to secure backhauls for owner-drivers

predictions about on board computers (Baker and Hubbard, 2004)

more adoption for long hauls and backhauls trailers

most commonly carried out by carrier-owned drivers who are more likely to speed, not drive carefully etc

on board computers makes it easier to monitor drivers and enforce careful driving with contractual clauses

adoption of on board computer should increase carrier-ownership

this is because there is a higher benefit to the carrier company in having the on board computers compared to employees who own their trucks

carrier-drivers should change their driving behaviour more than owner-drivers

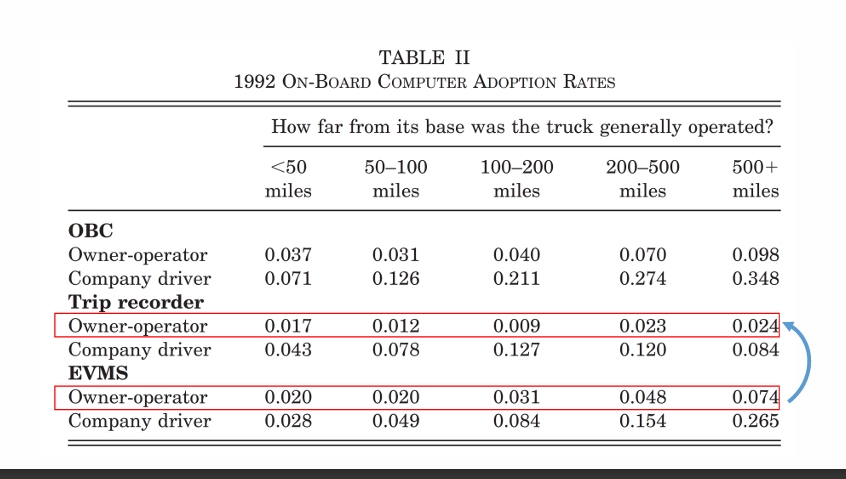

what do these results show us? (Baker and Hubbard, 2004)

company-owned trucks adopted more on board computers

this is because the on board computers has a higher benefit for the carrier company

adoption is higher for longer distances

what do these results show us? (Baker and Hubbard, 2004)

owner drivers are more likely to adopt the on board computers with messaging capability (eg EVMS) as they benefit from receiving traffic updates

benefit from on board computers for coordination rather than for solving ‘careless driving’ issues

still lower adoption rates compared to company owned trucks

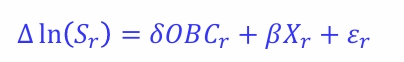

what does this equation show us? (Baker and Hubbard, 2004)

Sr = ratio of carrier vs driver owned trucks in cohort r (triangle = change)

the higher the ratio, the more carrier-owned trucks in that cohort compared to driver-owned trucks

OBCr = share of cohort r that adopted OBC (between 1987 and 1992)

Xr = some characteristics of the cohort

this equation helps us to answer whether the adoption of the computer machines changes the structure of ownership

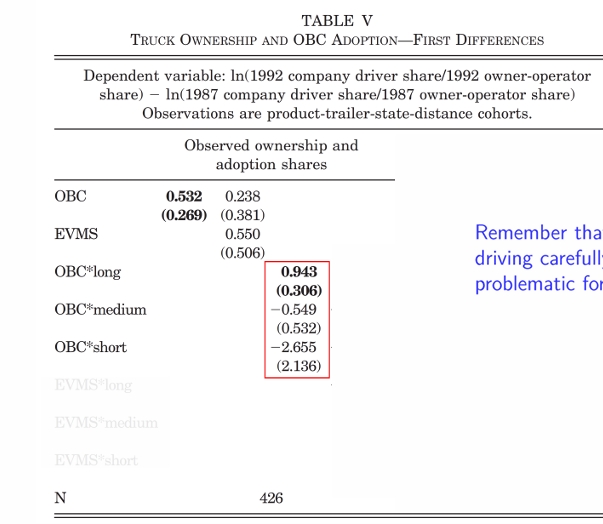

what do these results show us? (Baker and Hubbard, 2004)

on board computers adoption increases carrier ownership

it solves the issue of carriers previously not being able to monitor drivers

solves the main incentive issue

however, this effect is only significant for long trips

this is because the incentives for driving carefully are more problematic for long hauls

what do these results show? (Baker and Hubbard, 2004)

trip recorders encouraged carrier-drivers to drive more efficiently

ie to consume less fuel

fuel consumption is used as a proxy for careful driving as if the driver speeds and breaks harshly, they will use up a lot of fuel

no effect on owner drivers as they already have the incentive to drive carefully

EVMS (on board messaging computer) improved fuel consumption for both employee-owned and carrier-owned drivers

better ‘coordination’ can help with fuel consumption (eg carrier can tell you to avoid a busy route)

key messages from Baker and Hubbard (2004)

ownership of assets affects incentives of parties

depends on the ability to measure and monitor the actions of parties

can be different for different tasks (eg long vs short trips)

new technologies can affect this trade-off and induce changes in ownership and firm’s structure

background into Hansman et al (2020)

setting: Peruvian fishmeal industry

many independent fishing boats supplying processing plants

key friction: the quality of fishmeal (ie the protein content) is hard to contract on

protein content depends on how long fish has been out of water

a matter of hours can make huge differences

only observed ex post, making it difficult to trace quality back to individual boats

questions:

does quality premium increase integration?

integration = boats are owned by processing firm

quality premium = huge price differentials between high and low protein content fish

do integrated suppliers prioritize quality?

data: observe prices and production of each processing plant and over time

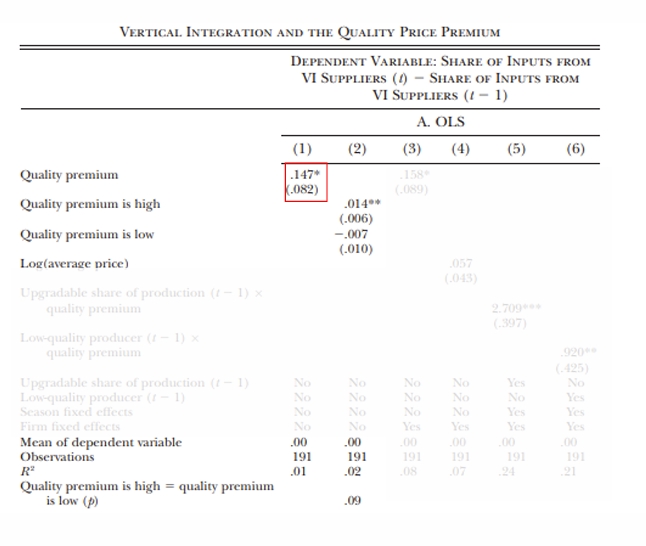

what do these results show us? (Hansman et al, 2020)

we are regressing integration (share of fish bought from owned suppliers) on quality premium

comparing the same plant when the quality premium is low and high

export markets pay large premia for high quality

when quality becomes more valuable, firms are more likely to vertically integrate fishing boats

market contracts fail to induce quality

integration allow direct control of boat behaviour

have GPS to track boats to tell them to return immediately once caught fish

link to theory: firm boundaries shift when markets cannot provide the right incentives

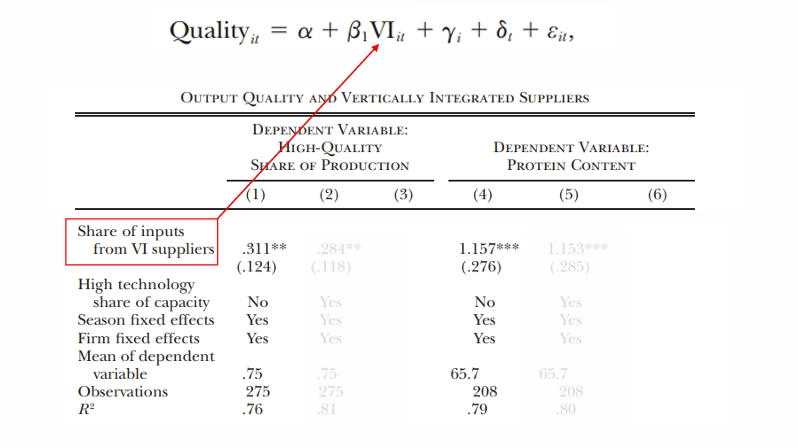

what do these results show us? (Hansman et al, 2020)

we are comparing the same boats before and after integration

including plant and year fixed effects

the higher the share of inputs, the higher the quality of fish

after integration, the same boat will deliver less fish but higher quality fish

under market contracts, suppliers will focus on quantity as quality cannot be observed so cannot have contracts on quality

quality therefore can only be achieved through integration

when does integration become more important?

when contract imperfections are high

what happens when appropriable quasi rents are large?

it makes integration more likely

AQRs makes haggling more likely/costly as it provides a source of private monetary gain

assumptions of rent-seeking/transaction costs theory of firms that are not clear

assumes that integration can stop the haggling induced by the AQRs but it requires an implicit focus on certain types of haggling

eg if haggling was completed through the manipulation of alienable capital, then integration could remove the control rights form the haggler

if haggling was completed by manipulation of inalienable capital, then integration could not stop rent-seeking

suggests that ownership could stop haggling that is undertaken via alienable assets

reasons why hold-ups between firms may not result in integration (according to rent-seeking/transaction costs theory)

the hold-ups use inalienable instruments so the observed hold-ups are unavoidable

integration would do nothing to solve it

the observed hold-ups are actually better than what integration would have provided

comparison of property rights theory and rent seeking/transaction costs theory

rent-seeking theory predicts socially destructive haggling

property rights theory assumes efficient bargaining

rent seeking is consistent with contractible specific investments ex ante

property rights requires non-contractible specific investments

in rent seeking theory, the integration decision determines ex post haggling and hence total surplus

in the property rights theory, the integration decision determines ex ante investment and hence total surplus

rent seeking theory does not say anything about internal organisation

property rights theory defines and evaluates life under integration and non-integration to give benefits and costs of integration

why does owning more assets result in stronger investment incentives, according to the property rights thoeyr?

efficient bargaining results in parties sharing the surplus from their specific investments

surplus share is determined by each party’s investment incentive

each party’s asset ownership determines the party’s surplus share

therefore, owning more assets guarantees a bigger surplus share and creates a stronger investment incentive

if it is more important to maximise one party’s investment, then that party should own all of the asset

if all the parties’ incentives are important, then dividing the asset between parties is efficient

downside of integration

after integration, if the producer can now hold up the supplier, this may reduce the supplier’s incentive to invest

reduced initiative for the acquired firm

how does the incentive theory differ from the property rights and transaction costs theories?

incentive theory: focuses on an incentive problem between a principal and agent

transaction cost/property rights theory: focuses on make-or-buy problem

what is the optimal incentive contract?

depends on ownership structure

if the agent owns the asset, they have the incentive to increase the asset’s value

the optimal contract for an agent who does not own the asset (employee) provides weaker incentives than does the optimal contract for an agent who does own the asset (contractor)

why should we care about vertical integration?

frictions: transaction costs, information asymmetries

overcomes the problem of imperfect contracts

easier for firms to acquire the inputs themselves rather than going to the market to avoid the market frictions present

firms vertically integrate to ensure the quality of their inputs

3 main hypotheses of Hansman et al (2020)

should see a correlation between the proportion of inputs coming from a vertically integrated supplier and the quality of output

when the incentives of the market are larger (ie when the quality premium is larger), firms should source more of their fish from vertically integrated suppliers

ie they should be reacting to prices

vertical integration increases when quality becomes more important

vertically integrated suppliers take more actions to ensure high quality inputs

when firms source more from a vertically-integrated supplier, this has a causal effect on quality of output

how does diseconomies of scale arise?

arises not from variations in scale but from the inability to vary all factors

eg management

it is fixed and cnanot be replicated

advantages of spot markets

efficient adaptation to changes in demand and cost

equilibrium prices and quantities adjust to reflect changes in demand and cost and realize maximum total surplus

cost minimization

a firm will invest in cost reduction until the marginal benefits of cost reduction equals the marginal cost

realisation of economies of scale

these advantages arise as there is not a relationship between a firm and its suppliers, meaning firms can substitute away to a cheaper supplier

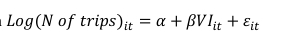

what do the terms in the regression represent?

beta = the effect that X has on Y

causal effect

u = error term

captures everything that is not included in x

what does the hat above parameters mean?

means they are ‘estimated’ from the data

what does the bar above parameters mean?

average

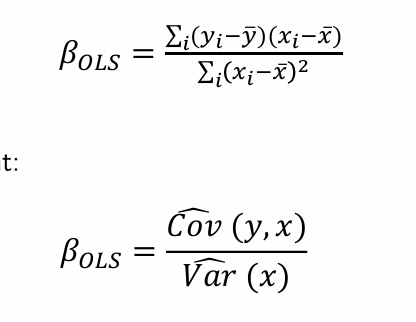

OLS formula (with one regressor)

if we divide the numerator in the first equation by N, it becomes the covariance

if we divide the denominator in the first equation by N, it becomes the variance of x

therefore, beta measures the correlation between y and x

this does NOT imply causality though

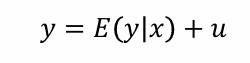

do we really need the ‘true’ model to be linear?

no

for any two variables (y and x), we can write what is in the picture

u = a residual uncorrelated with x

E(y I x) = conditional expectation function which captures the ‘average’ relation between y and x

tells us how x affects y on average

can take any form, including non-linear

looking at what the average of y is when x is held constant and we do this for several values of x to create a best fitted line

even if the true relation is not linear, can we use OLS?

yes

this is because we can show that the best linear approximation to the conditional expectation function is a line with slope cov (y, x) / var(x)

this is just OLS !!

reasons why beta will not measure the ‘true’ causal beta

omitted variable bias / selection

measurement error

reverse causation

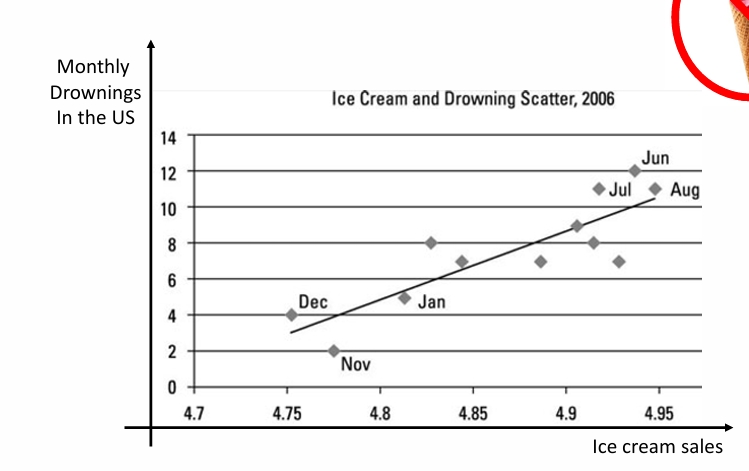

what is the omitted variable in this?

temperature/ weather

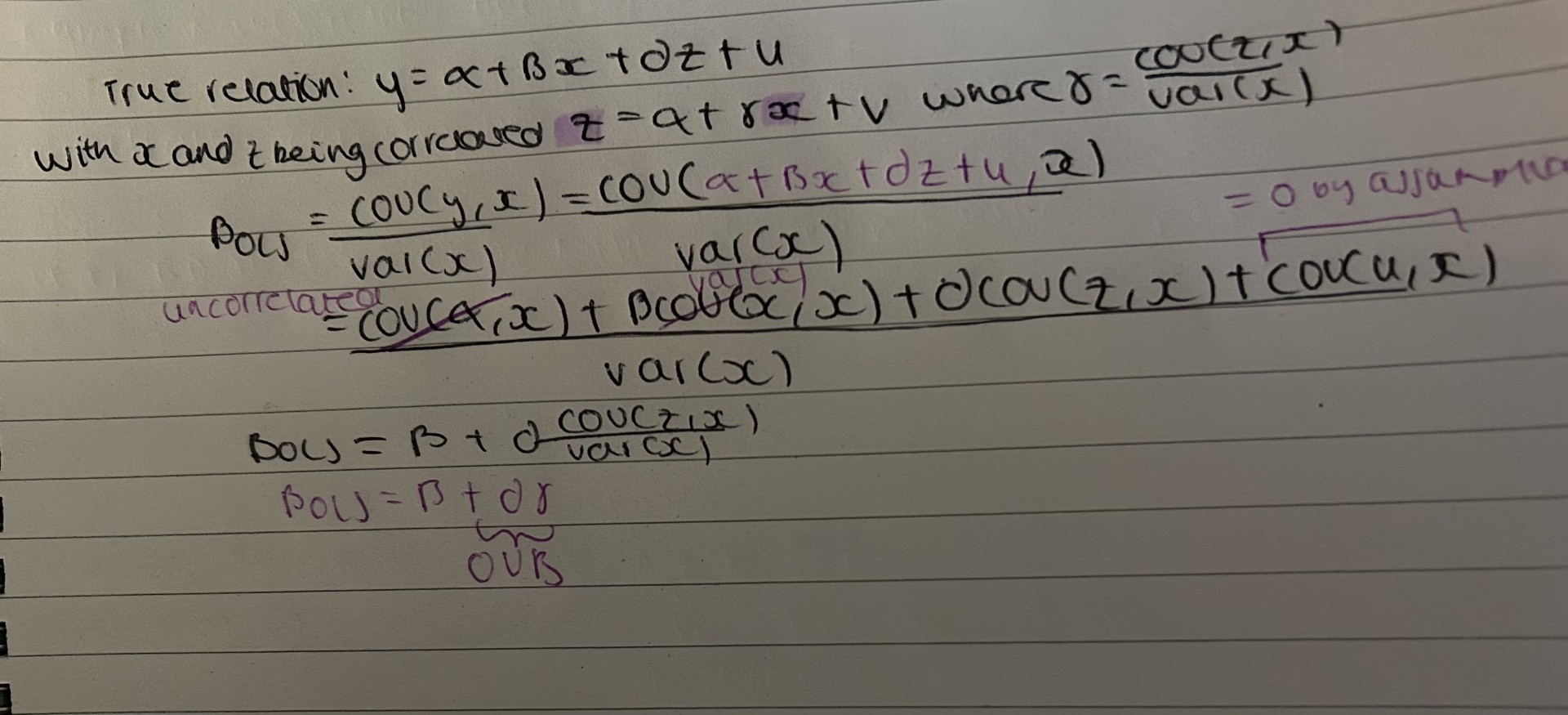

OVB formula

the problem is the beta picks part of the effect of z on y

there is no OVB if gamma = 0 (ie x and z are uncorrelated)

what could be the omitted variable in this?

the type of organisation

ie more horizontal firms may be able to implement working from home but there may be less promotional opportunities

what is the omitted variable when we we regress profits on CEO pay?

CEO experience

we would expect high experienced CEOs are paid more

we would also expect experienced CEOs increase profits

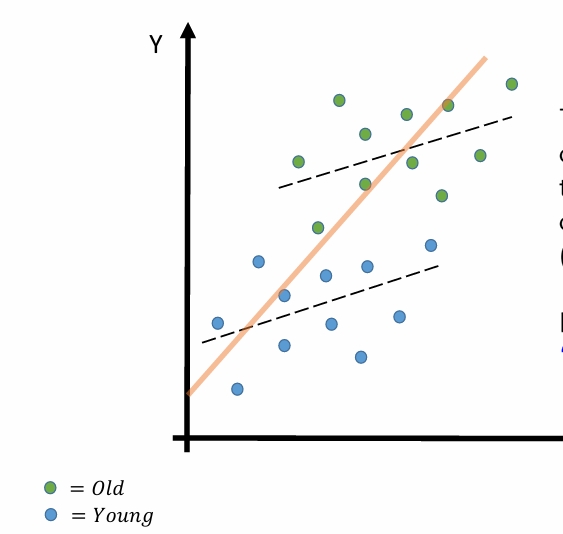

how would we solve this problem where there are two identifiable groups with different outcome values?

solve this by controlling for the omitted variable

ie have a dummy variable to differentiate the two groups

if we don’t do this, we would conclude that the effect of X on Y is much higher than the true one

results in an extra constant

results in two different intercepts

notes about OVB

in a multiple regression, beta is interpreted as the effect of X on Y conditional on other controls

can be interpreted as the effect of X on Y after netting out the effect of other controls

need to control for a variable if it affects Y and is correlated with the variable of interest (ie X)

can’t interpret the correlation as causal if there is OVB

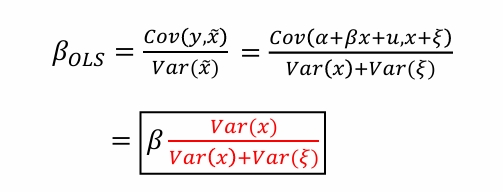

beta formula with measurement error

don’t observe x but observe a noisy version of it

noise is uncorrelated with any variable

the higher the noise (ie the higher variance of the noise), beta is biased towards to zero

ie it observes attenuation bias

can’t fix it but if it is very small, we can ‘ignore’ it

if the attenuation bias is high, then the regression line is flatter

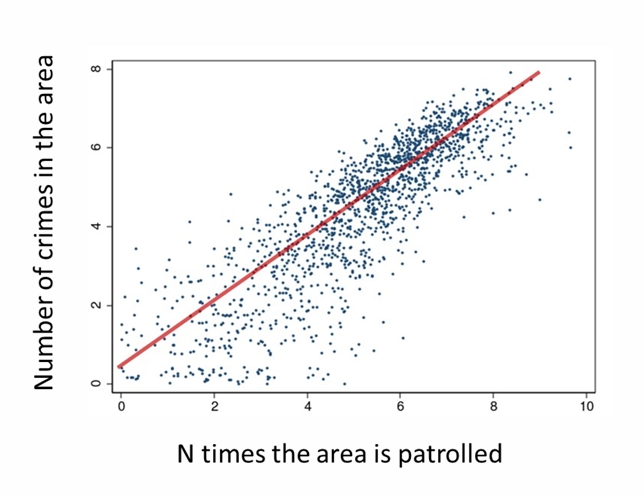

what is the problem with this graph?

looks like when there are more police, crime is higher so the police are not good at their job

they are actually capturing when crime is higher, more police will patrol that area

OLS cannot distinguish in which direction the relation goes

there could be a causal effect but OLS will pick the total effect so we may overestimate the effect we are wanting to study

this happens when the reverse relationship is very large

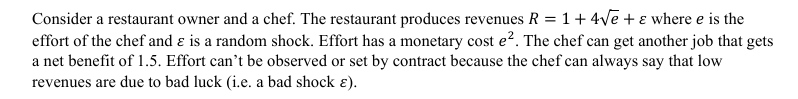

Which theory of the firm is consistent with this setting?

the property rights theory

claims that the issues determining the boundaries of the firm (which transaction should be internalized) are due to ex-ante investments that parties can make to increase the value of the transaction

due to contracting problems (and the fact that asset ownership confers the right to decide on the asset’s use), the parties can’t commit to make these investments

in this context, integrating transactions (eg a common owner of assets) can be efficient

What is the optimal level of investment if producers could commit to it with a contract?

Discuss why the owner will not hire the chef if they have to pay a fixed wage

as effort is not observable (thus no penalties can be imposed on it), the chef has no incentives to put any effort

on average, R = 1, while the paid wage has to be at least equal to 1.5 (so the chef would accept it as this is equal to the outside option)

Based on the example of the semi-skimmed milk vs yoghurt production, explain why incomplete contracts are problematic (Hansman et al, 2020)

when producing something very standard as semi-skimmed milk, different parts of the production process can be done by separate firms

eg the farmers and the milk processing

it is easy to specify in a contract what are the requirements of the transacted products and related terms

when you need to produce something much more specific such as a certain type of yoghurt, it is more difficult to establish the requirements of the products into a contract

particularly, things related to quality that is difficult to observe and measure (in a short period) become difficult to contract

we expect more integration when unobserved quality of the inputs are important for the final value of the product

what we see in Hansman et al (2020)

why is it difficult to monitor the behaviour of the boats in order to specify in a contract the way in which they should manage catchment? (Hansman et al, 2020)

although boats have GPS, this is not observed by the firms

observed only by regulators

also it is not obvious there is a unique strategy for fishing efficiently

eg it may be better sometimes not to do short trips but to stay in a sea area where you would find a lot of fish

thus, a contract about how the boat should behave would have to be contingent on a large number of sea/weather/etc conditions

how does the fact that quality is unobserved affect the decision to integrate? (Hansman et al, 2020)

by integrating vertically (the input and final good producer), they can avoid many transaction costs related to problems with quality checking

as the firm producing the input (responsible for making effort to keep quality standards) and the output producers are both affected by the quality of the inputs, there is no need to rely on complicated contracts to set quality standards

why is it possible (particularly in the context where the study takes place) that problems preventing quality upgrading with market transactions are not solved even if parties can write a very detailed market with all the necessary specifications? (Hansman et al, 2020)

even if quality is easily observable and can be specify into contracts, these problems may not be solved

main reasons:

the poor institutional quality (eg non-efficient judicial system)

high cost of enforcing the contact (eg if your input provider breaks the contract, you need to hire lawyers, go to a court, wait years before court decision, etc)

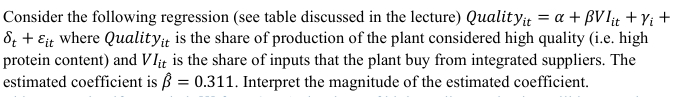

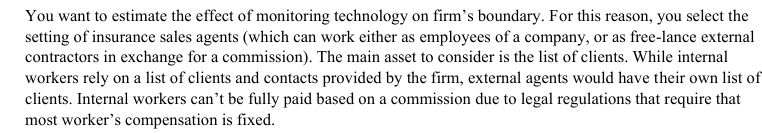

(Hansman et al, 2020)

if we switch VI from 0 to 1, the share of high-quality production will increase by 0.311 ie by 31.1 percentage points

can scale the effect to say that a 10-percentage-point increase in vertical integration raises the share of high-quality output by about 3.1 p.p

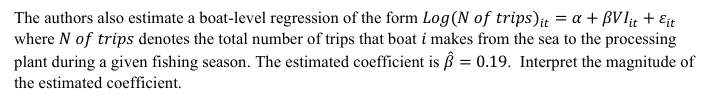

(Hansman et al, 2020)

VI = dummy (important to note for log-level regressions)

ignoring the approximation error, this implies that increasing vertical integration from 0 to 1 (ie the boat becomes fully integrated) raises the number of trips by 19%

if we account for the approximation error, this corresponds to an increase of exp(0.19) - 1 = 0.21 ie a 21% increase in the number of trips made by the boat

This regression includes boat (ie supplier) fixed effects. Explain intuitively what the estimated coefficient (beta) captures. What comparison does the regression implicitly make? (Hansman et al, 2020)

boat fixed effects imply that we are comparing changes within boats

ie we are looking at the number of trips of the same boat, before vs after integration (and then, we get an average of the effect across all boats)

if a boat is always integrated or always not integrated, it does not contribute to the estimation of beta

Consider the baseline regression used by Baker and Hubbard (2004) in the paper about the trucking industry (specifically the effect of OBC adoption on ownership). Discuss what are the main threats to interpreting the estimation as causal?

omitted variables, eg the demand for a particular type of produce at some locations may have increased

carrier companies may have the incentive to buy more trucks to exploit these potential profits

at the same time, they may use these higher profits to invest in new technology which includes OBC

the effect on ownership is not driven by the OBC but the higher profits potential affected both ownership and OBC adoption simultaneously

reverse causality, ie the fact that carrier-ownership expansion may affect the OBC adoption

OBC producers may track, advertise and send their sale agents to talk to carrier companies that have just expanded

measurement error

could happen when an individual lies in a survey or variables are not measured correctly

results in attenuation bias (results are biased towards zero)

Why is Baker and Hubbard (2004)’s specification better than a single cross-section using a single survey year?

their specification is first differences (similar to fixed effects)

first differences means it is controlling for any unobservable time-invariant differences between the different cohorts

eg the price of OBC may differ across states and in states where OBC are cheaper or where carrier companies are bigger so they can buy more of them

any time-invariant characteristic that makes ownership different across states, trailer type, or distances that is also correlated with OBC adoption will show up as OVB in a cross-section regression

Explain the IV strategy Baker and Hubbard (2004) use and discuss the conditions to solve the causality problem

instead of using a single IV, they use 19 dummies indicating the transported product as instruments

intuition behind instruments: they only use the variation in the OBC adoption coming from the fact that OBC is more valuable for some products (independently of the ownership)

ie we would expect OBC to be adopted more for truck hauls with dangerous cargo such as petrol or chemicals

relevance: the dummies are not jointly insignificant

exogeneity: products shouldn’t influence the shift from using an owner-operator to a company driver

however, different products could also be associated to changes in incentives to adopt one type of ownership, ie drivers may be less willing to use their truck for dangerous cargo

Discuss the advantages and disadvantages of having the sales agent vs the insurance company owning the client network

advantage of sales agent:

has the incentive to work in order to get commission

advantage of internal agent:

easier to monitor as they can bypass contracting issues such as the hold-up problem

disadvantage of sales agent:

she may sell products from other company, suggesting to invest in packages that are not best for the company

hard to contract them to do exactly what the company wants them to do

disadvantage of internal agent:

wage is fixed so they don’t have the incentives to make much effort in keeping clients happy