Financial Accounting

1/79

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

80 Terms

Accounting definition

The process of identifying, measuring and communicating information to permit informed judgements and decisions by users of the information

Financial accounting

Information for the users on the outside of a business. Regulated by company law, is always about the past, not very specific information. Balance sheet of big PLCs

Management accounting

Used for people inside the company. Concerns the future and helps make decisions. Highly technical and specific info, no laws to regulate and helps control resources

Types of organisation

Sole trader - still must file accounts but less regulated

Partnerships- usually law firms and if accounts are reported wrong the liability stands with all partners

Not for profit sector - Charities, Council, Government

Companies - Private Limited Companies (LTD) and Public Limited Companies (PLC)

Limited when regarding business

Means they’re only limited to what their shares are worth in the business when they were purchased

3 financial statements

Statement of financial position (Balance sheet)

Statement of Income (Profit or Loss)

Statement of Cash Flow

Who would use accounting info?

Competitors, Regulators, Shareholders, Employees, Government, Investors, Bank etc

Qualities of Financial Statements

Relevant and Reliable

Comparability, Timelines, Verifiability, Understandability

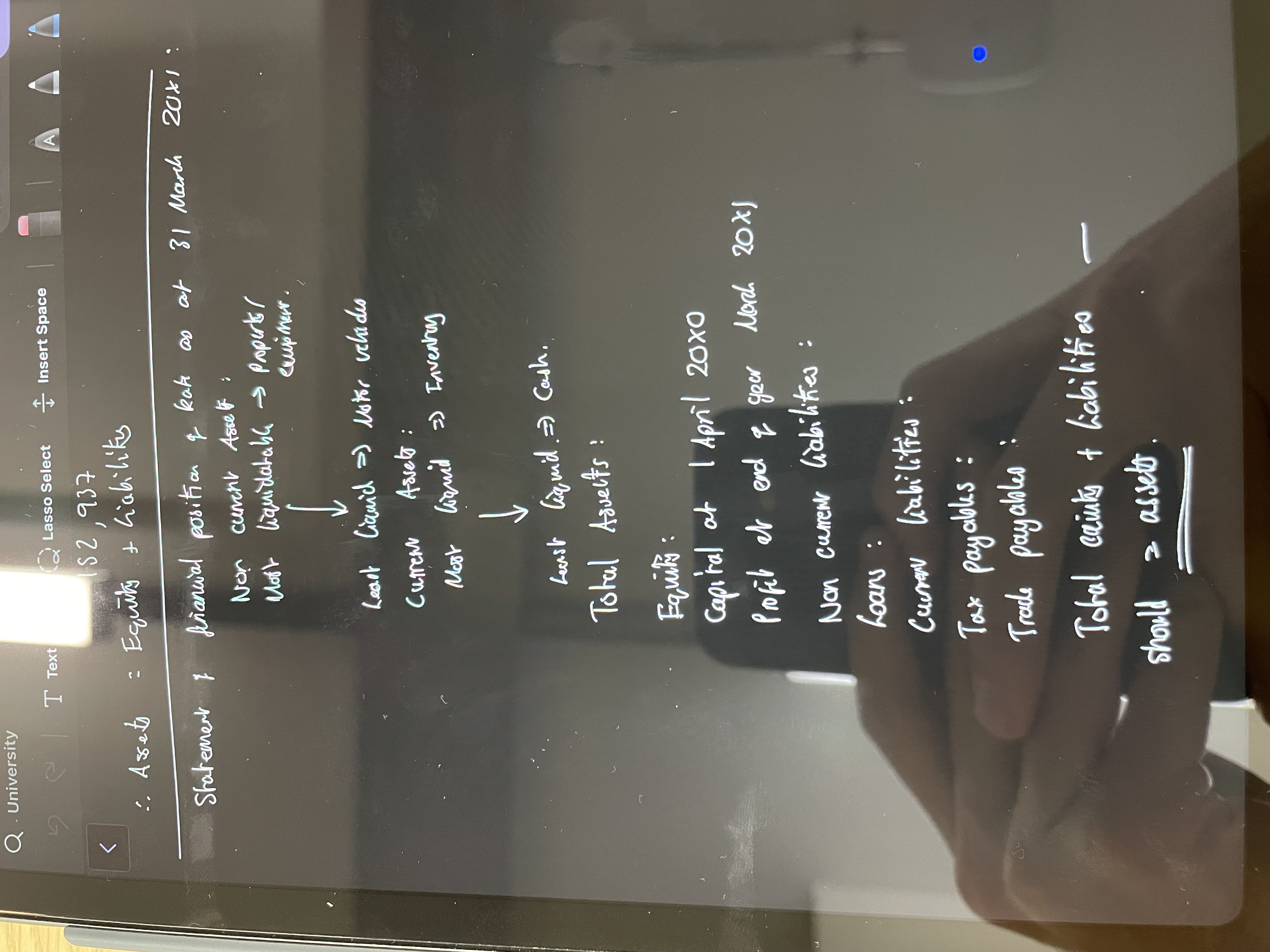

Statement of Financial Position

Assets= Equity + Liabilities

Assets

Non-Current- Generate income in the long term or must by sold over a long period of time (property)

Current - Cash, can be sold within the next 12 months or near cash

Equity

The amount the owner has invested and is able to claim from the business

Liabilities

Claims from organisations or businesses from outside the business that they cannot avoid.

Current - Settled within 12 months

Non Current - Long term loans

4 Accounting conventions

Business Entity Convention

Prudence

Going concern

Matching

Business entity convention

The owner and the business are treated as separate and distinct

Prudence

Financial statements should err on the side of caution. Should not be approximated without knowing true figures

Going concern

The business will continue operation for the foreseeable future without reasonable doubt of otherwise

Matching

The expenses should match the revenues that they helped generate in the same accounting period as the revenues are released

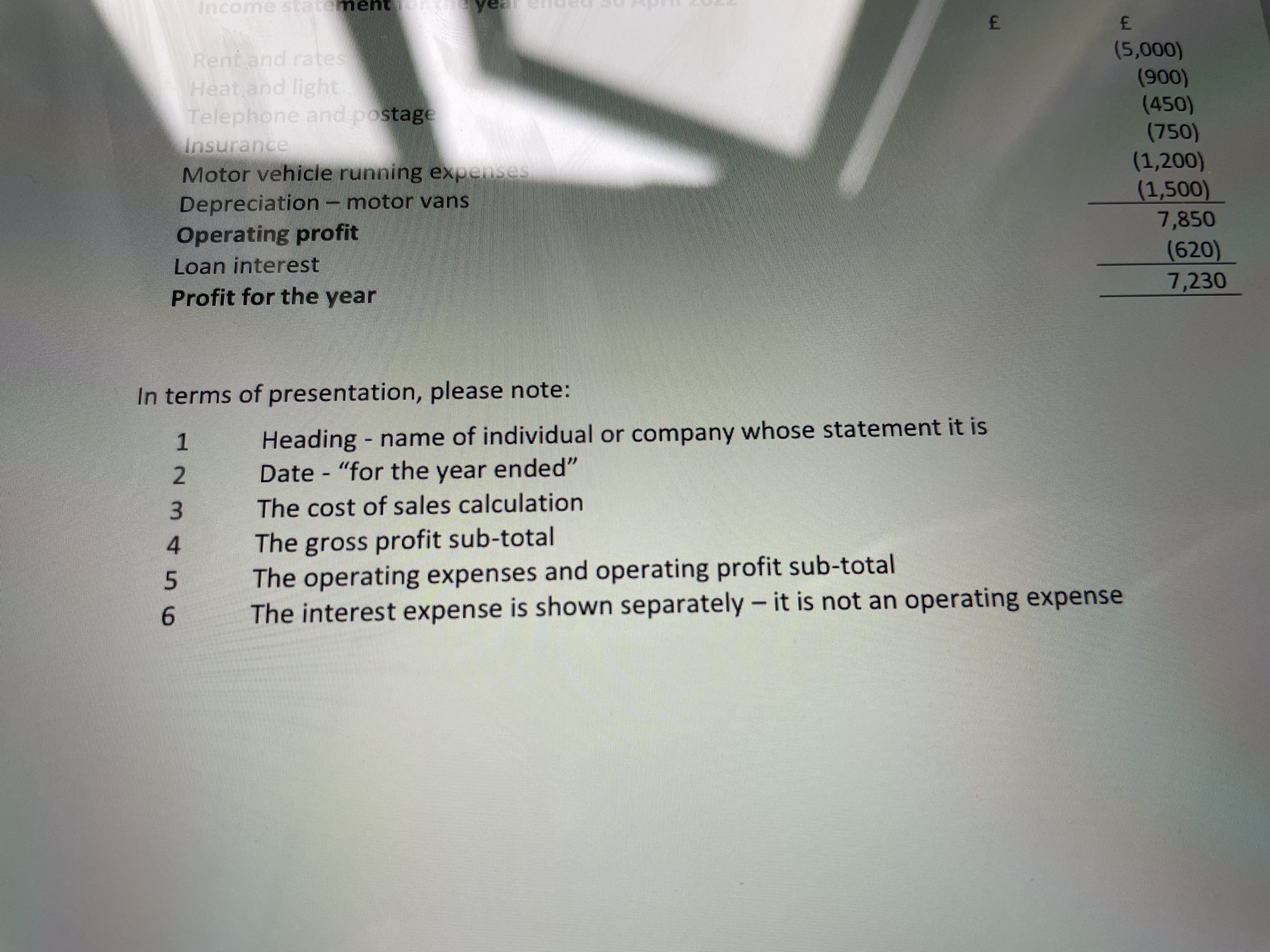

The Income statement

Measures profit or losses over an accounting period

Revenue

Measure of the inflow of assets or reduction in liabilities which arise from a result of trading activities

Usual source of revenue comes from the sales of goods by retail or manufacturing businesses or the provision of a service in the service industry

Criteria for Revenue

Amount can be measured reliably

Probable that the economic benefits will be received

Ownership and control of the items should pass to the buyer (when the goods are being sold)

Expenses

Measure of the outflow of asset (or the increase of liabilities) that is incurred as a result of generating revenues

This may include salaries, wages, rent etc

The accounting equations

Assets= Equity + Liabilities

This can be extended to

Assets = Equity at start of period + profit at end of period + Liabilities

Profit = Revenue - Expenses

Assets + Expenses + Drawings= Equity + Liabilities + Revenue

On left is debits, on right is credits

Debits and Credits

DEAD CLIC

Debits are expenses, assets and drawings

Credits are liabilities, income, capital

Setup of the Income Statement

Th trial balance

The debits and the credits listed, they must equal one another to be valid

Accruals

A business has not paid all of its expenses for an accounting period.

increase expenses and create a current liability

Prepayments

A business has paid amounts towards purchases in the future past the current accounting period

Decrease expenses and create current assets

Closing inventory

The amount you have left in inventory at the end of the accounting year.

This follows over to the opening inventory the next year

This should always be the lower of two options: what you paid for it and what you can sell it for

Cost of sales adjustment

Cost of sales = open inventory + purchases - closing inventory

Methods of depreciation

Straight line depreciation

Reducing balance depreciation

Unit of production

Straight line depreciation

Simple interest, reducing by the same amount each year

Depreciation is taken as an expense in the income statement

Net book value

Historic cost- accumulated depreciation

This is labelled as an asset in the SFP

Reducing balance depreciation

Compound interest

Cost - accumulated depreciation x n%

How is depreciation recorded

Income statement has a depreciation expense

SFP has accumulated depreciation under non current assets next to the historic cost of the asset

Calculating Trade receivables

Take original amount- irrecoverable debt like ones that will never be paid then take the percentage off of that

5 different adjustments

Accruals

Prepayments

Cost of sales

Depreciation

Bad debts

Scrap/ Residual value

The amount of money you could get from selling the item at the end of its useful life (must be estimated but is usually 0)

Amortisation

Depreciation for intangible assets

Choosing a depreciation method

Accouting regulations don’t tell you what one to use

Difficult to measure how much an asset actually wears out during a year

Unpredictable factors effect wear and tear: how careful operation is, maintenance, intensity and variety of use

Choose and apply consistently and disclose what method you use

Perpetual life

A company will continue to exist regardless of changes in shareholders and employees until its existence is legally ended

A company has a separate legal existence away from shareholders

Legal safeguards for companies

Plc or limited after the name to designate that is it a company

Limitations to withdrawals of equity (limited to how much you put in)

Produce financial statement

Have financial statements reviewed by an auditor

Public Limited Companies (plc)

Able to raise capital by selling shares to the public

Minimum issued share capital of £50000

Subject to strict regulations

Shares may be listed on the stock exchange for trading overseas

Private Limited Companies (LTD)

Cannot offer shares to public

Usually shares are held by family members or larger companies

Only need 1 shareholder

Large % of UK companies are LTD

Directors (3 things they must do)

Appointed by shareholders

Report annually about their management

Disclose all material information

Accountability for their actions

Fairness in directors dealings with shareholders

3 different law and regulation centres

Statutory regulation (layout of financial statements)

Financial reporting council (UK accounting standards)

Stock exchange rules

Financial reporting council

There is the international financial reporting council (all companies in EU) and The Financial Reporting Standards which operate in the UK

Corporate Governance

We need governance over the corporate world to ensure that scandals cannot be covered up by dishonest accounting

The 2008 financial crisis triggered widespread re-appraisal of governance systems in the UK and internationally

UK corporate governance code

Published in May 2010, latest version in Jan 2024

Code sets out good practice in relation to

Board leadership

Division of responsibilities

Board composition

Audit, risk and Internal control

Remuneration

Company accounting features

Equity

Dividends

Borrowings

Corporate tax

How a company raises capital

Uses shares

For example to raise £50000, they may release 50000x£1 shares or 100000×£0.50 shares

This is the nominal, face or par value

Types of shares

Ordinary shares- pay dividends which are out of the residual income= profits after all other claims have been met

Dividends will obviously depend on profits

Preference shares - pay a fixed dividend so do not depend profits. They get paid before ordinary shareholders but not after all claims have been dealt with

Shares are placed under assets (bank balance) and equity (share capital)

Profit and reserves

Usually for a sole trader, profit is recorded as capital on the balance sheet however for a company they have profit shown as a reserve called retained earnings

2 types of reserves

Revenue reserves - retained earnings (profits made by the company and not yet distributed to dividends)

Capital reserves - Share premium account arises when shares are issued at more than the nominal value. Revaluation reserve occurs when assets are re valued at higher than their historical cost

What do companies do with this profit

Retain to provide funds for growth

Pay dividends - usually happens twice a year (half way through and at year end)

Borrowings

Normally labelled as non-current liabilities

This may be loan notes which are paid at a fixed interest rate every 6 months

If all or part of the loan can be repayed within the next 12 months then it becomes a current liability

Taxation

Companies pay tax on their profits

Tax charge is based on profit before tax and it is displayed in the balance sheet as a current liability

Companies are taxed under corporation tax whereas sole traders are taxed under personal tax

Statement of Cash Flow

Split up into 3 main sections:

Operating activities

Investing activities

Financing activities

At the end you consider your net change in cash (3 sections added together)

Difference between cash and profit

Profit = revenue - expenses and this can include non cash items like depreciation

Cash measures liquidity not profitability

Profit is an idea , cash is reality (you only record cash when it physically comes to you)

Accrual basis

You record revenues and expenses when they are earned or incurred not when the cash arrives

Net operating cash flows

Cash from revenues minus payments for inventories, expenses, interest, taxe

Cash flows from investing activities

Usually negative cash flows, as it comes from cash payments to acquire new non current assets

Cash flows from financing activities

Issue or repayment of shares, receipt or repayment of borrowings

This is followed by net cash change

Stakeholders

People who have an interest in the business.

This is an umbrella term for all the people that would be interested in financial statements

Company profiling

Companies with similiar financial statements are likely to behave in a similiar way. You can usually tell what type of company they are based off of their financial statement

Financial ratios

Help you compare against previous performance or performance against other businesses

Essentially analyse how well a company is performing

5 most common ratios:

Profitability

Efficiency

Liquidity

Financial gearing

Investment

Benchmarking ratios

They’re only useful when compared to a benchmark, this can be past periods, similiar businesses, or performance targets

Profitability ratio (1) Return on Ordinary shareholders funds (ROSF)

Profit after tax / Ordinary share capital and reserve

A high value for this figure is desirable as long as it is not at the expense of future returns

Profitability ratio (2) return on capital employed (ROCE)

Operating profit / Capital employed

Capital employed = share capital + reserves + non current liabilities

Profitability ratio (3) Gross profit margin

Gross profit / sales revenue

Usually effected by selling prices, sales volume reducing, cost of goods purchased increasing etc

Profitability margins (4) Operating profit margin

Operating profit / sales revenue

Same as gross profit calculation

Efficiency ratios (5) Inventory turnover

Inventory / cost of sales x 365

Indicates how many days it would take to sell inventory

Builders usually have a long turnover as it may take a year or 2 to build a house, retailers have very short

Efficiency ratios (6) Trade receivable days

Trade receivables / credit sales revenue x 365

Efficiency ratios (7) Trade payables days

Trade payables / Credit purchases x 365

Efficiency ratios (8) Sales revenue to capital employed

Sales revenue / capital employed

Indicates how efficiently a company is using its assets

Liquidity ratios (9) Current ratio

Current assets / Current liabilities

Indicates how many times current assets cover current liabilities or can the company pay the liabilities by using their assets

Liquidity ratio (10) Acid test ratio

(Current assets - Inventory ) / Current liabilities

Usually a better measure of how well they can pay their liabilities off

Sources of internal finance

Retained earnings

Better credit control (being proactive and reactive to ensure all payments are made punctually)

Reduction in inventory (handling costs and storage costs will reduce money)

Deferring payments to suppliers

Sources of external finance

Ordinary shares

Leases

Loans

Loans

Must be paid back at the agreed interest rate over the agreed time period

Fixed rate or variable rate

Appear as finance cost or finance expense

When is high gearing better than low gearing

High gearing means you have high levels of interest bearing debt which should be good during expansion as profits should be rising

Low gearing is optimal when profits are falling and you cannot pay off as much debt