Ch 21- Influence of Monetary and Fiscal Policy on Aggregate Demand

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

24 Terms

fiscal policy

levels of gov spending & taxation set by the President and Congress

monetary policy

MONEY SUPPLY set by central bank; made by the FED

OMOs

open-market operations; purchase and sale of US GOVT BONDS

to DECREASE the MS and RAISE the fed funds rate…

Fed SELLS govt bonds

to INCREASE the MS and LOWER the fed funds rate…

Fed BUYS govt bonds

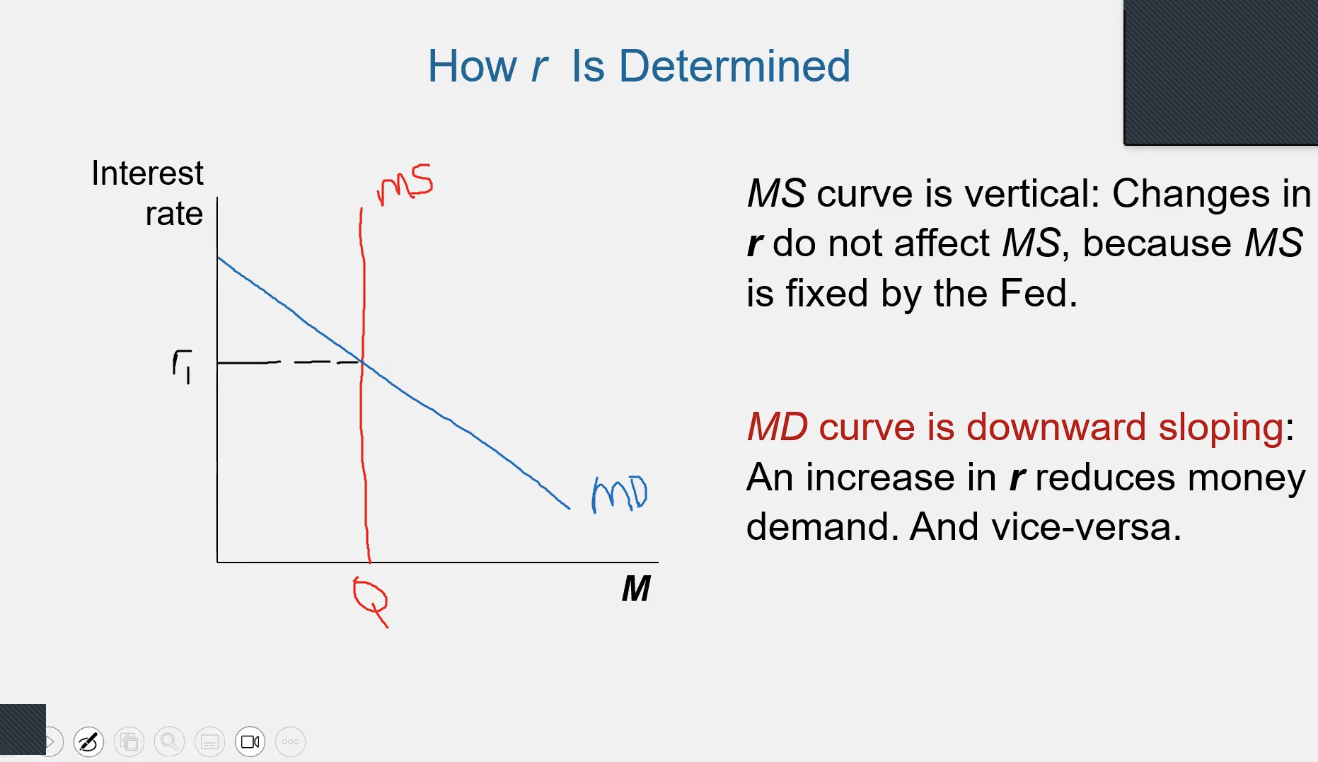

the theory of liquidity preference

interest rate (denoted r) adjusts to bring MS and MD into balance

MS

fixed by the central bank, does not depend on IR

MD

reflects how much wealth people want to hold in liquid form

a household’s money demand reflects its preference for liquidity

an increase in r (interest rate) _____ money demand (MD)

reduces

variables that influence money demand

Y (real income), r, and P

an increase in Y (real income) causes…

an increase in Money Demand

liquidity trap

if interest rates have fallen to around zero, monetary policy is no longer effective

forward guidance

raise inflation expectations by committing to keep interest rates low

quantitative easing

buy a larger variety of financial instruments

expansionary fiscal policy

an increase in G and/or decrease in T shifts AD right

contractionary fiscal policy

a decrease in G and/or increase in T shifts AD left

multiplier effect

additional shifts in AD result when fiscal policy increases income and increases consumer spending

AD = national income

GDP = C + I + G + NX

marginal propensity to consume (MPC) equation

delta C/delta Y

C= consumption, Y= income

fraction of extra income households consume vs save

I and NX are

fixed

spending multipler

1/1-MPC

Aggregate demand focuses on…

spending in the economy as a whole.

Money demand focuses on

preferences for holding money rather than spending it.

automatic stabilizers

changes in fiscal policy that stimulate aggregate demand (spending) when economy goes into recession

ex: tax falling, public assistance (welfare, unemployment insurance)