CHAPTER 6: Marginal Costing and Absorption Costing

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

Marginal Costing only includes

variable production costs (material and labour) in the valuation of cost units

Fixed Costs are treated as

period costs and are charged in full to the income statement

Contribution Costs

Sales price - Variable costs

Revenue is calculated by

Actual units sold x sales price/unit

Production cost is calculated by

actual units produced x variable production cost/unit

Opening Inventory is calculated by

opening inventory units x variable production cost/unit

Closing inventory is calculated by

closing inventory units x variable vost unit

COS =

Opening Inventory + Production Costs - Closing Inventory

Inventory should be valued at the

Variable Production cost - no selling/distribution to be included or any fixed costs

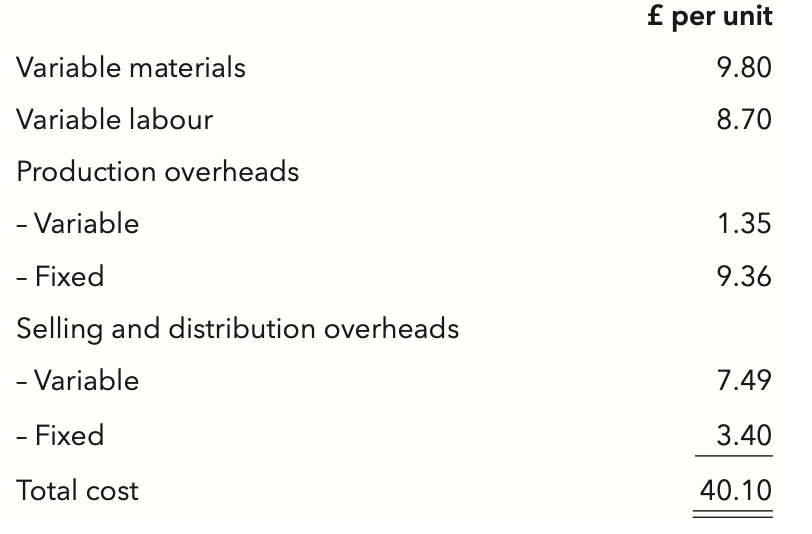

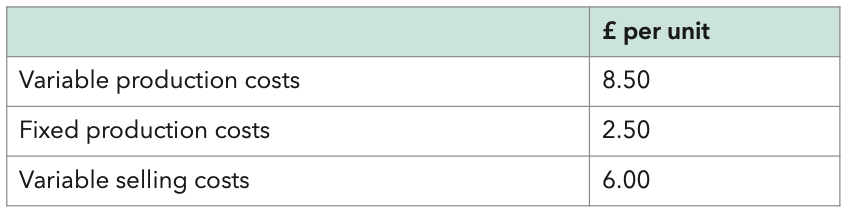

The following cost details relate to one unit of product MC:

In a marginal costing system, the value of a closing inventory of 4,300 units of product MC will be:

£85,355

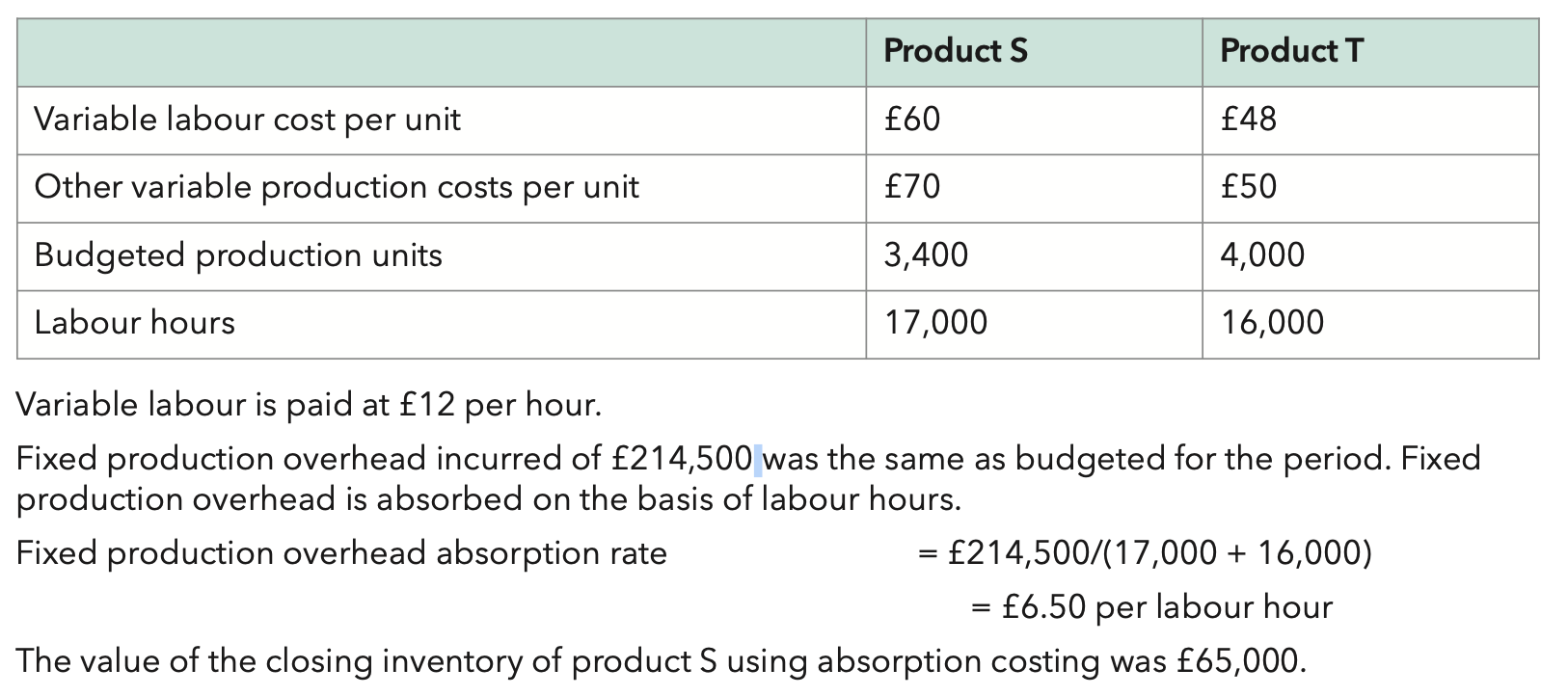

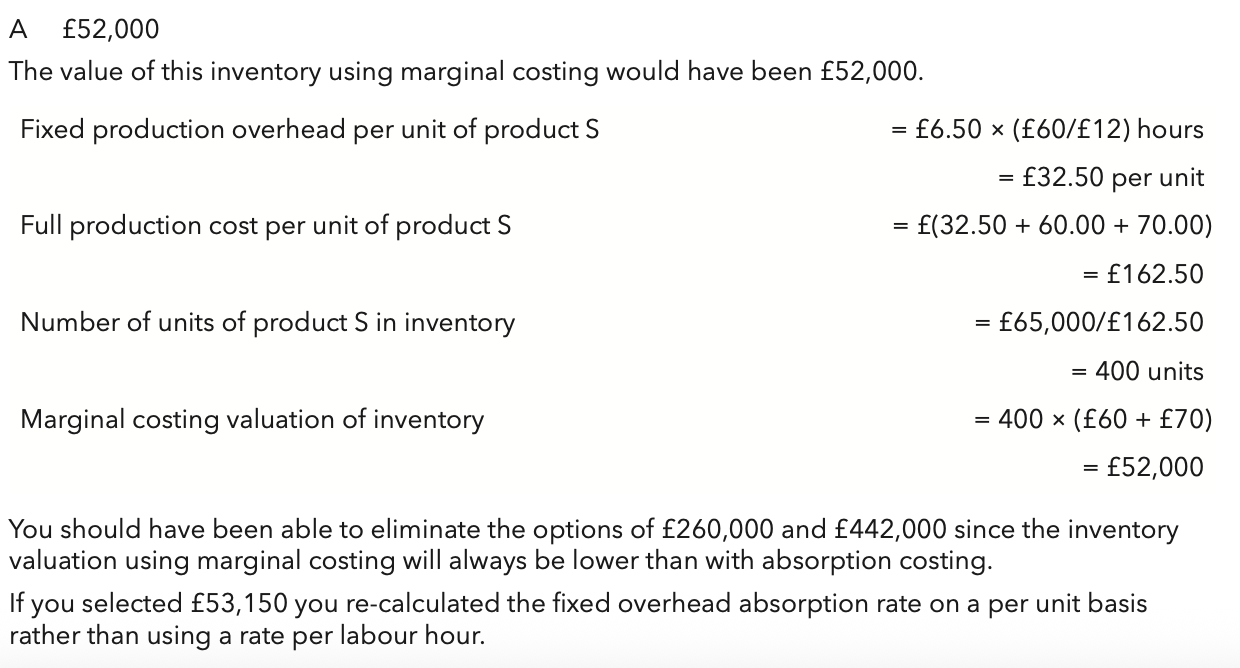

A company manufactures product S and product T.

The following information relates to the latest period.

Variable labour is paid at £12 per hour.

Fixed production overhead incurred of £214,500 was the same as budgeted for the period. Fixed production overhead is absorbed on the basis of labour hours.

Fixed production overhead absorption rate is £6.50/hour

The value of the closing inventory of product S using absorption costing was £65,000.

If Marginal Costing had been used, the value of this inventory would be:

£52,000

First, work out the Production overhead /unit

Full Production cost per unit of specific product

Number of units of that product in inventory

MC costing of the inventory

T/F: Inventory using AC is always going to be lower than MC

False - MC is always Lower

Ticktock Ltd makes clocks with a selling price of £50 per clock. Budgeted production and sales volume is 1,000 clocks per month. During September 1,000 clocks were made and 800 clocks were sold. There was no opening inventory.

The variable cost per clock is £25. Fixed costs in September were, as budgeted, £5,000.

Using marginal costing the contribution and profit for September would be calculated as:

A Contribution: £25,000, Profit: £20,000

B Contribution: £20,000, Profit: £15,000

C Contribution: £20,000, Profit: £16,000

D Contribution: £25,000, Profit: £16,000

B Contribution: £20,000, Profit: £15,000

Which three of the following statements concerning marginal costing are true?

A Marginal costing is an alternative method of costing to absorption costing.

B Contribution is calculated as sales revenue minus fixed cost of sales.

C Closing inventories are valued at full production cost.

D Fixed costs are treated as a period cost and are charged in full to the income statement of the accounting period in which they are incurred.

E Marginal cost is the cost of a unit which would not be incurred if that unit were not produced.

A Marginal costing is an alternative method of costing to absorption costing.

D Fixed costs are treated as a period cost and are charged in full to the income statement of the accounting period in which they are incurred.

E Marginal cost is the cost of a unit which would not be incurred if that unit were not produced.

Which two of the following statements concerning marginal costing systems are true?

A Such systems value finished goods at the variable cost of production.

B Such systems incorporate fixed overheads into the value of closing inventory.

C Such systems necessitate the calculation of under- and over-absorbed overheads.

D Such systems write off fixed overheads to the income statement in the period in which they were incurred.

A Such systems value finished goods at the variable cost of production.

D Such systems write off fixed overheads to the income statement in the period in which they were incurred.

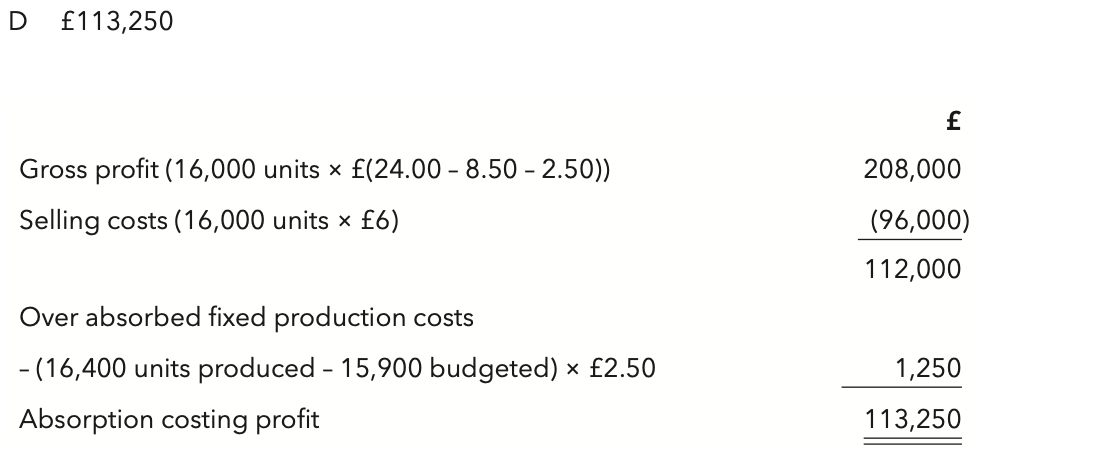

A company budgets during its first year of operations to produce and sell 15,900 units per quarter of its product at a selling price of £24 per unit.

Budgeted costs are as follows:

In the first quarter the unit selling price, variable unit cost and expenditure on fixed production costs were as budgeted. The sales volume was 16,000 units and closing inventory was 400 units.

The absorption costing profit for the quarter was:

£113,250

Which of the following statements about profit measurement under absorption and marginal costing is true (assuming unit variable and fixed costs are constant)

A Profits measured using absorption costing will be higher than profits measured using marginal costing.

B Profits measured using absorption costing will be lower than profits measured using marginal costing.

C Profits measured using absorption costing will be either lower or higher than profits measured using marginal costing.

D Profits measured using absorption costing may be the same as, or lower than, or higher than profits measured using marginal costing.

D Profits measured using absorption costing may be the same as, or lower than, or higher than profits measured using marginal costing.

If the number of units of finished goods inventory at the end of a period is greater than that at the beginning, marginal costing inventory will result in (assuming unit variable and fixed costs are constant)

A less operating profit than the absorption costing method

B the same operating profit as the absorption costing method

C more operating profit than the absorption costing method

D more or less operating profit than the absorption costing method depending on the ratio of fixed to variable costs

A less operating profit than the absorption costing method

Adams Ltd's budget for its first month of trading, during which 1,000 units are expected to be produced and 800 units sold, is as follows:

The profit calculated on the absorption cost basis compared with the profit calculated on the marginal cost basis is:

A

£24,260 lower

B

£5,160 higher

C

£5,160 lower

D

£24,260 higher

B

£5,160 higher

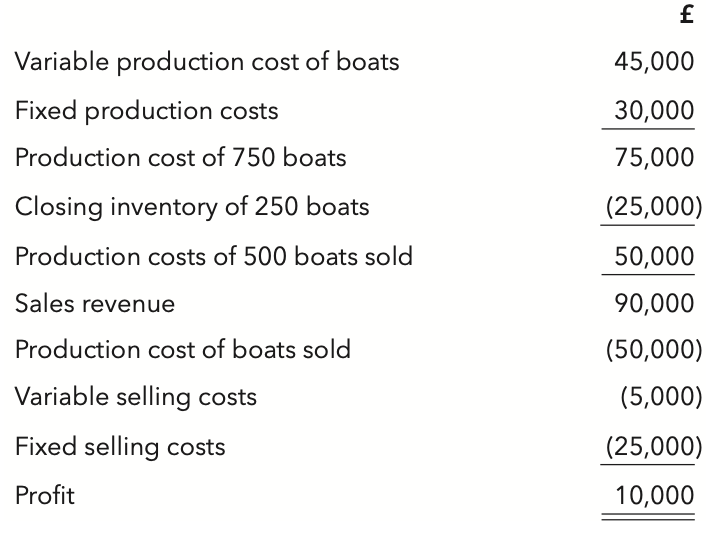

Bright makes and sells boats. The budget for Bright's first month of trading showed the following:

The budget has been produced using an absorption costing system.

If a marginal costing system were used, the budgeted profit would be:

A

£22,500 lower

B

£10,000 lower

C

£10,000 higher

D

£22,500 higher

B

£10,000 lower

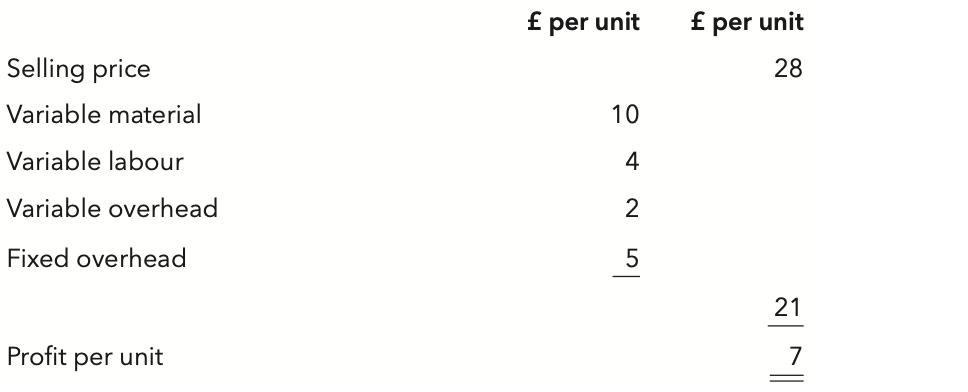

A company produces a single product for which cost and selling price details are as follows:

Last period, 8,000 units were produced and 8,500 units were sold. The opening inventory was 3,000 units and profits reported using marginal costing were £60,000.

The profits reported using an absorption costing system would be:

£57,500

profit difference =

inventory reduction in units x fixed overhead per unit

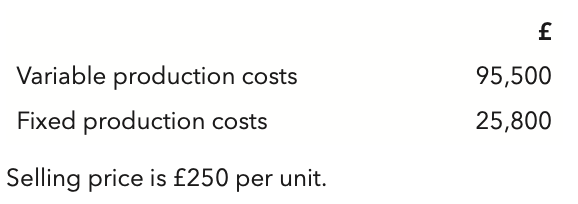

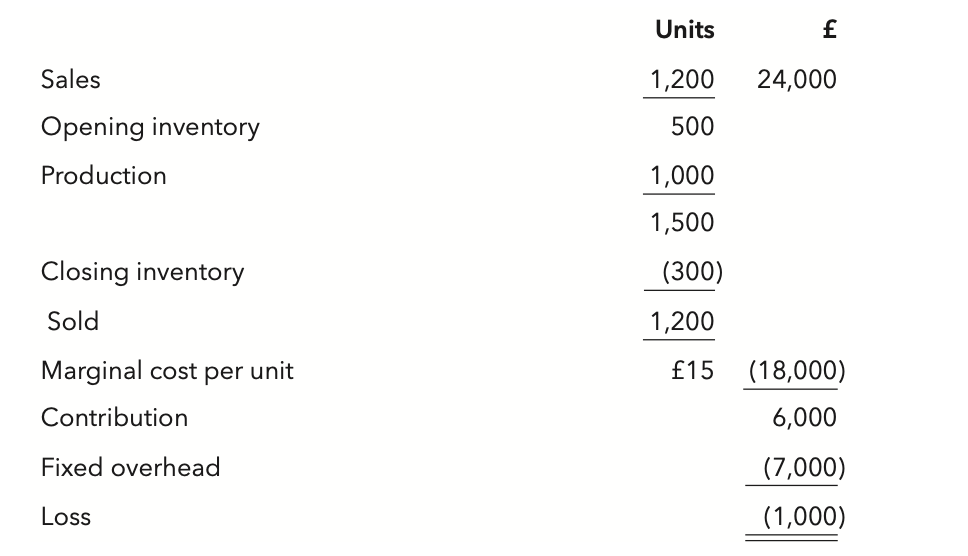

Typo Ltd's budget for the year ended 31 December 20X8 is as follows:

For absorption costing purposes, the fixed overhead absorption rate is set at £7 per unit for 20X8.

If absorption costing were to be used in inventory valuation throughout 20X8, what would the profit (or loss) be for 20X8?

£2,400 loss

Absorption profit =

marginal profit + change in inv x OAR

marginal profit

absorption rate - change in inv x OAR

A company had opening inventory of 48,500 units and closing inventory of 45,500 units. Profits based on marginal costing were £315,250 and on absorption costing were £288,250.

What is the fixed overhead absorption rate per unit?

£9.00

In March, a company had a marginal costing profit of £78,000. Opening inventories were 760 units and closing inventories were 320 units. The company is considering changing to an absorption costing system.

What profit would be reported for March, assuming that the fixed overhead absorption rate is £5 per unit?

£75,800

When comparing the profits reported under marginal and absorption costing when the levels of inventories increased (assuming unit variable and fixed costs are constant):

A Absorption costing profits will be lower and closing inventory valuations higher than those under marginal costing

B Absorption costing profits will be lower and closing inventory valuations lower than those under marginal costing

C Absorption costing profits will be higher and closing inventory valuations lower than those under marginal costing

D Absorption costing profits will be higher and closing inventory valuations higher than those under marginal costing

D Absorption costing profits will be higher and closing inventory valuations higher than those under marginal costing

Which two of the following statements are advantages of marginal costing as compared with absorption costing?

A It complies with accounting standards.

B It ensures the company makes a profit.

C It is more appropriate for short-term decision-making.

D Fixed costs are treated in accordance with their nature (ie, as period costs).

E It is more appropriate when there are strong seasonal variations in sales demand.

C It is more appropriate for short-term decision-making.

D Fixed costs are treated in accordance with their nature (ie, as period costs).

T/F: Marginal Costing complies with accounting standards

False, not with external reporting standards

When comparing the profits reported under marginal and absorption costing when the levels of inventories decreased (assuming unit variable and fixed costs are constant):

A Absorption costing profits will be lower and closing inventory valuations higher than those under marginal costing

B Absorption costing profits will be lower and closing inventory valuations lower than those under marginal costing

C Absorption costing profits will be higher and closing inventory valuations lower than those under marginal costing

D Absorption costing profits will be higher and closing inventory valuations higher than those under marginal costing

A Absorption costing profits will be lower and closing inventory valuations higher than those under marginal costing

Which two of the following statements are correct?

A Absorption unit cost information is the most reliable as a basis for pricing decisions.

B A product showing a loss under absorption costing will also make a negative contribution under marginal costing.

C When closing inventory levels are higher than opening inventory levels and overheads are constant, absorption costing gives a higher profit than marginal costing.

D In a multi-product company, smaller volume products may cause a disproportionate amount of set up overhead cost.

E Marginal unit cost information is normally the most useful for external reporting purposes.

C When closing inventory levels are higher than opening inventory levels and overheads are constant, absorption costing gives a higher profit than marginal costing.

D In a multi-product company, smaller volume products may cause a disproportionate amount of set up overhead cost.

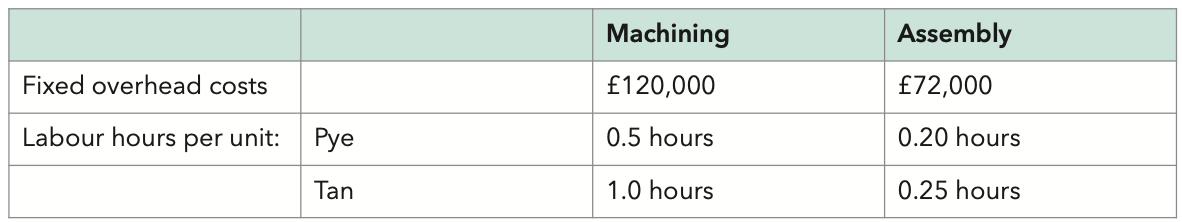

Iddon Ltd makes two products, Pye and Tan, in a factory divided into two production departments, Machining and Assembly. Both Pye and Tan need to pass through the Machining and Assembly departments. In order to find a fixed overhead cost per unit, the following budgeted data are relevant:

Budgeted production is 4,000 units of Pye and 4,000 units of Tan (8,000 units in all) and fixed overheads are to be absorbed by reference to labour hours.

What is the budgeted fixed overhead cost of a unit of Pye?

£18

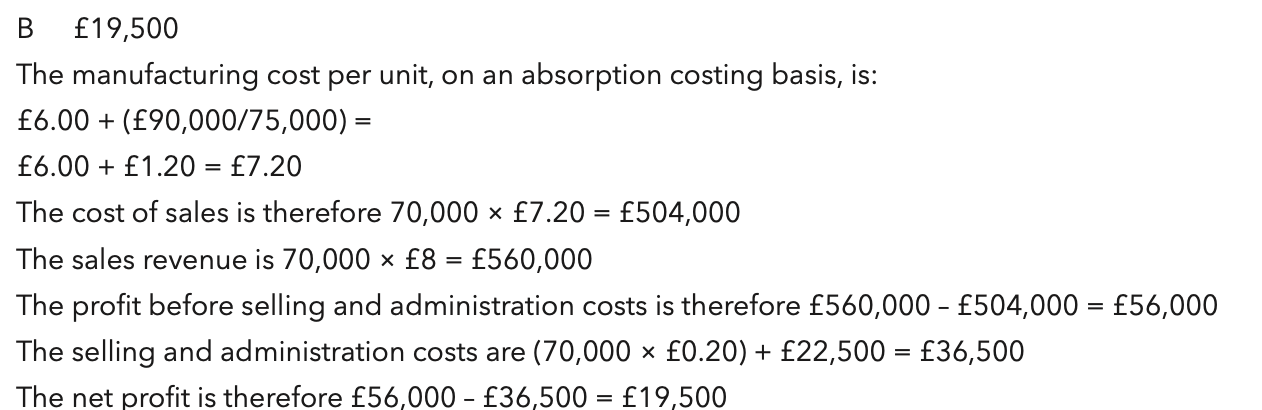

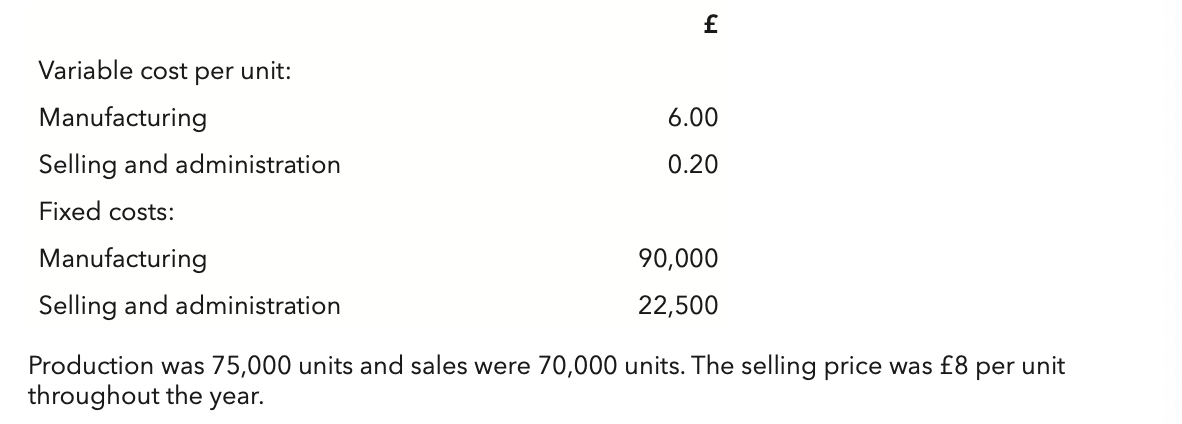

Norbury plc has just completed its first year of trading. The following information has been collected from the accounting records:

Production was 75,000 units and sales were 70,000 units. The selling price was £8 per unit throughout the year.

Calculate the net profit for the year using absorption costing.

£19,500