Economics and Government Intervention

1/103

Earn XP

Description and Tags

Exam on Wednesday 08/20

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

104 Terms

Adam Smith Wealth of Nations

Argued for free trade. Argued against mercantilism

Mercantilism

The idea that having more currency makes a country better off.

If you pay $10 for a sandwich, the person who sold you the sandwich is better off because he now has more currency. But, you may argue you’re better off because you have a sandwich and you can’t eat currency.

Trade Deficit

A country has a trade deficit with another country if it imports more from that country than it exports to that country.

Mercantilists dislike this because it involves shipping currency abroad.

GNE

Gross National Expenditure

amount of money spent by nationals of a given country

GDP

Gross Domestic Product

amount of goods and services produced within a given country

GNI

Gross National Income

total income earned by nationals of a given country

Closed Economy

GNE=GDP=GNI

Imports (M)

Goods and services consumed by nationals of the given country but produced elsewhere

Exports (X)

Goods and services produced in the given country but purchased by nationals elsewhere

How do we calculate GDP

GDP= GNE+ X- M

Imports of Factor Services (Mf)

Good and services produced in a given country by nationals of another country

Exports of Factor Services (Xf)

Goods and services produced in another country by nationals of the given country

How do we calculate GNI

GNI= GDP+Xf- Mf

How do we calculate how much more other countries invest in you, than you invest in them

GNE- GNI

GNE- GNI

M- X+ Mf - Xf

How can we change being in a trade deficit?

Get other countries to invest less in you

Get your citizens to invest more in other countries

Tariffs can do this.

Tariffs

A tax on imports

Autark

when a country has no imports or exports

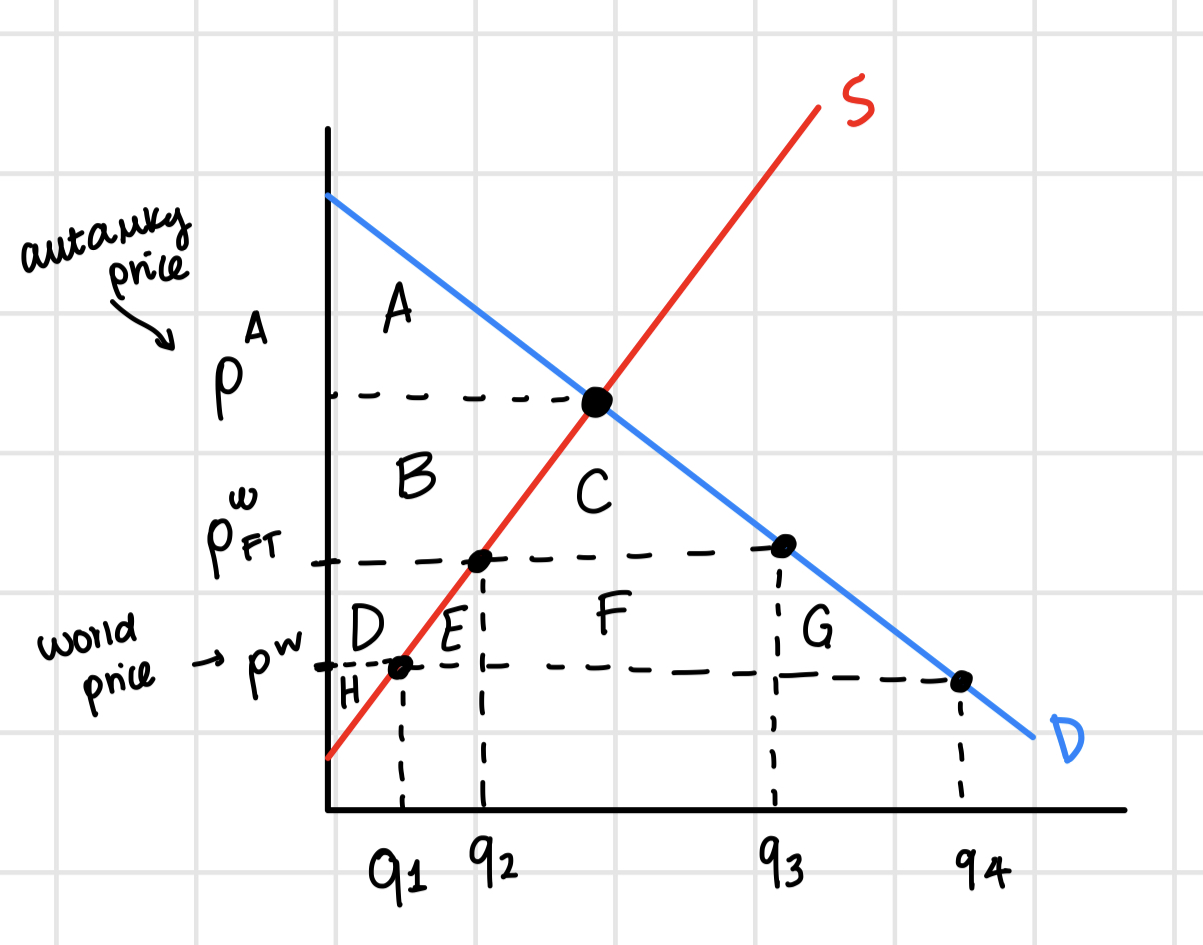

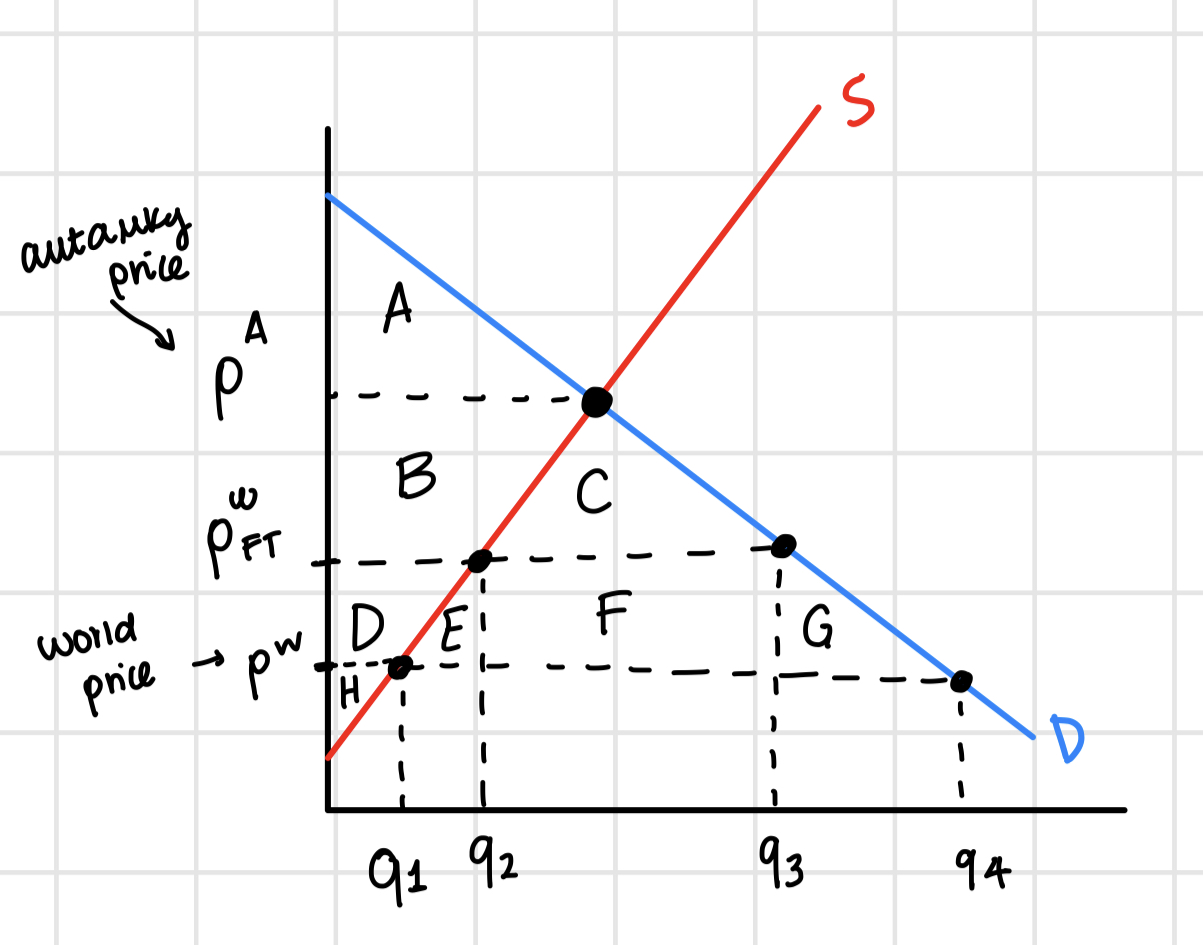

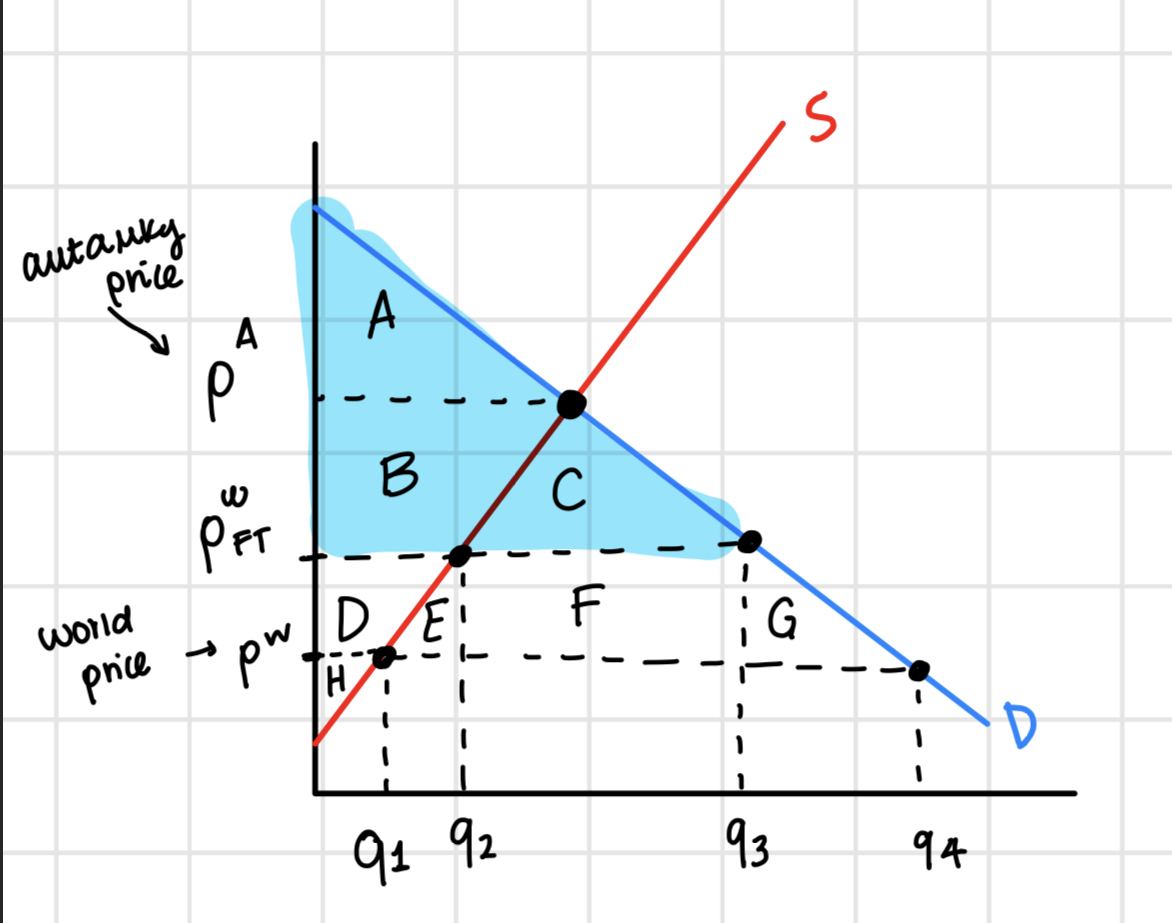

How do we find the number of imports under free trade? Small Cuntry

q4-q1

Can a small country affect world price?

No, only large countries can affect world price

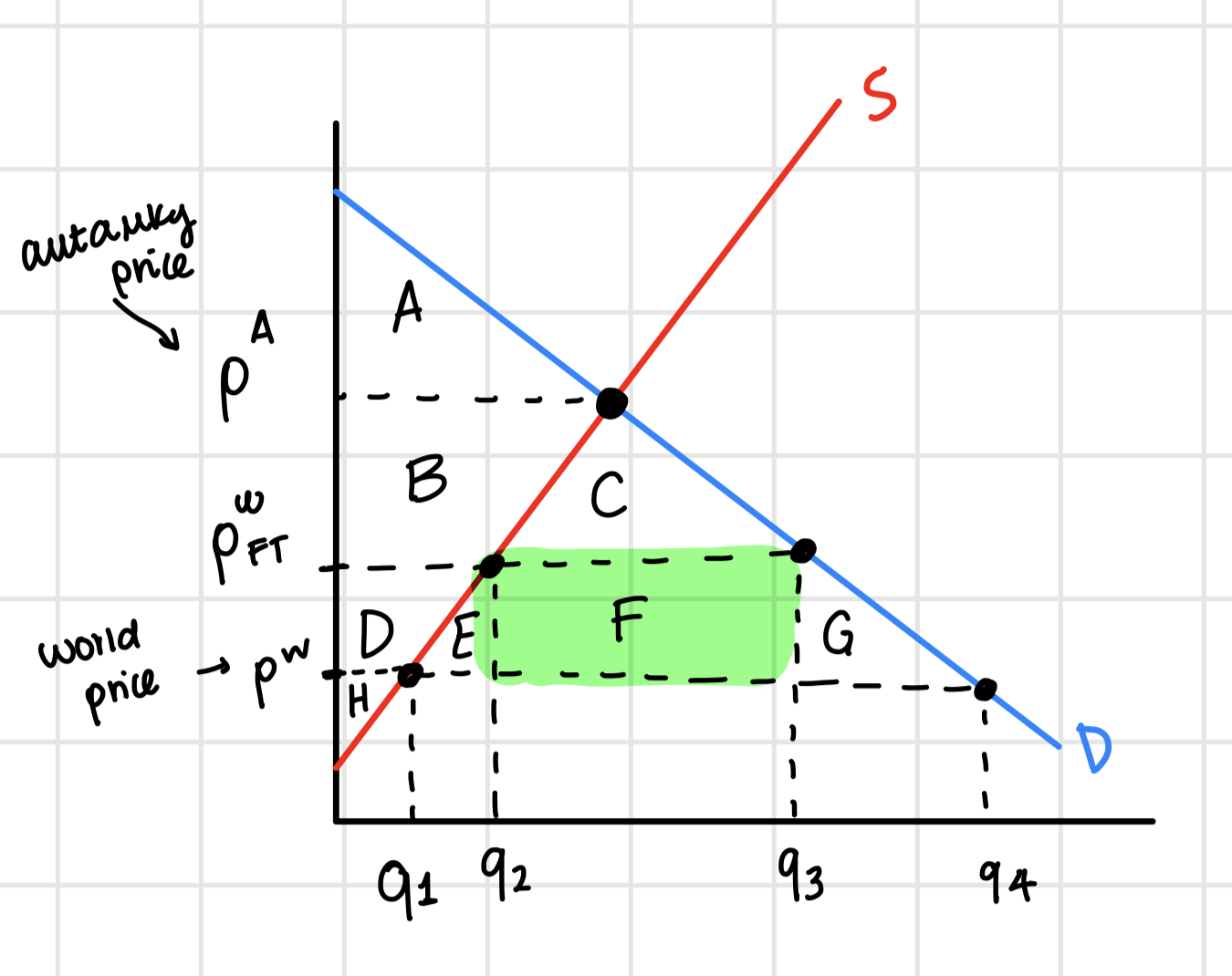

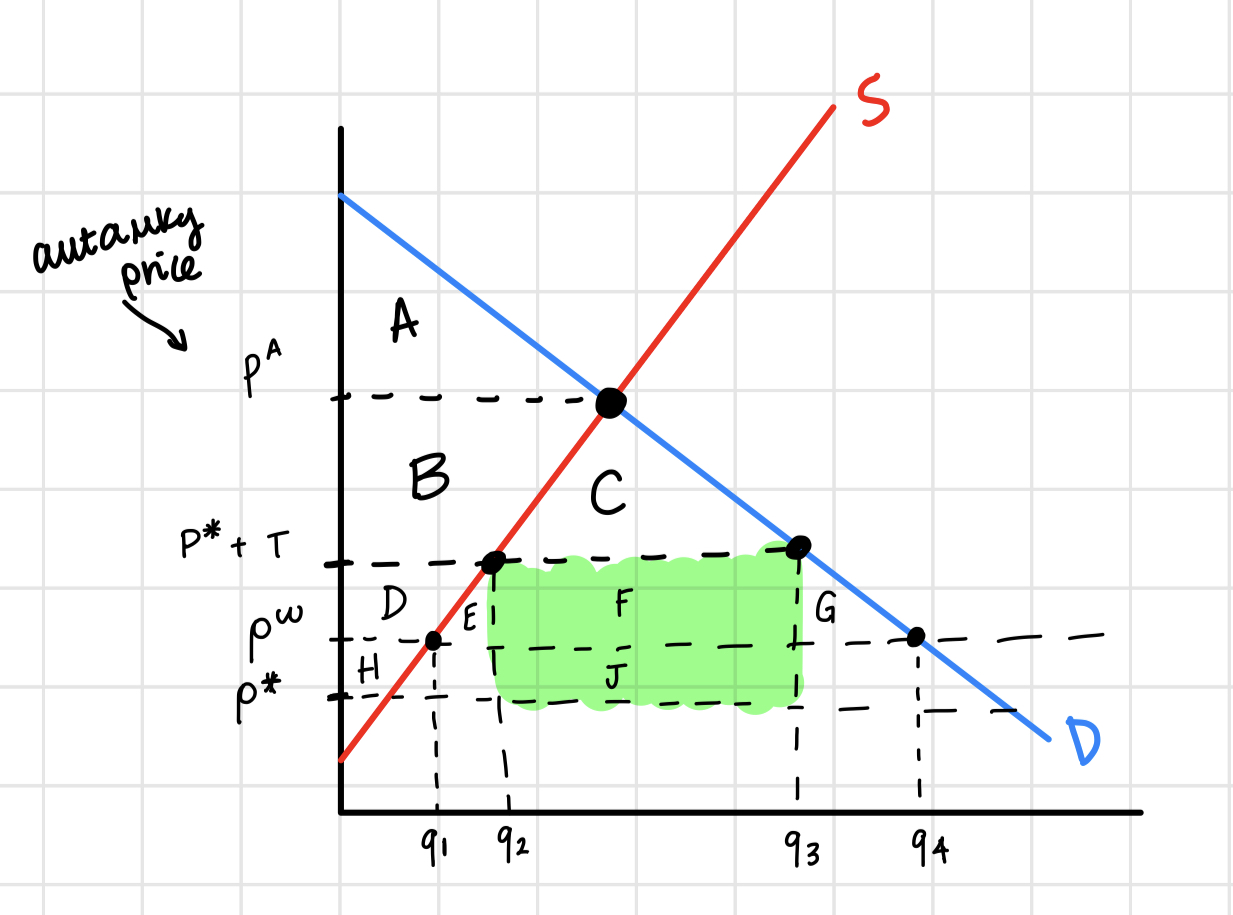

How can we find the number of imports with tariffs?

q3-q2

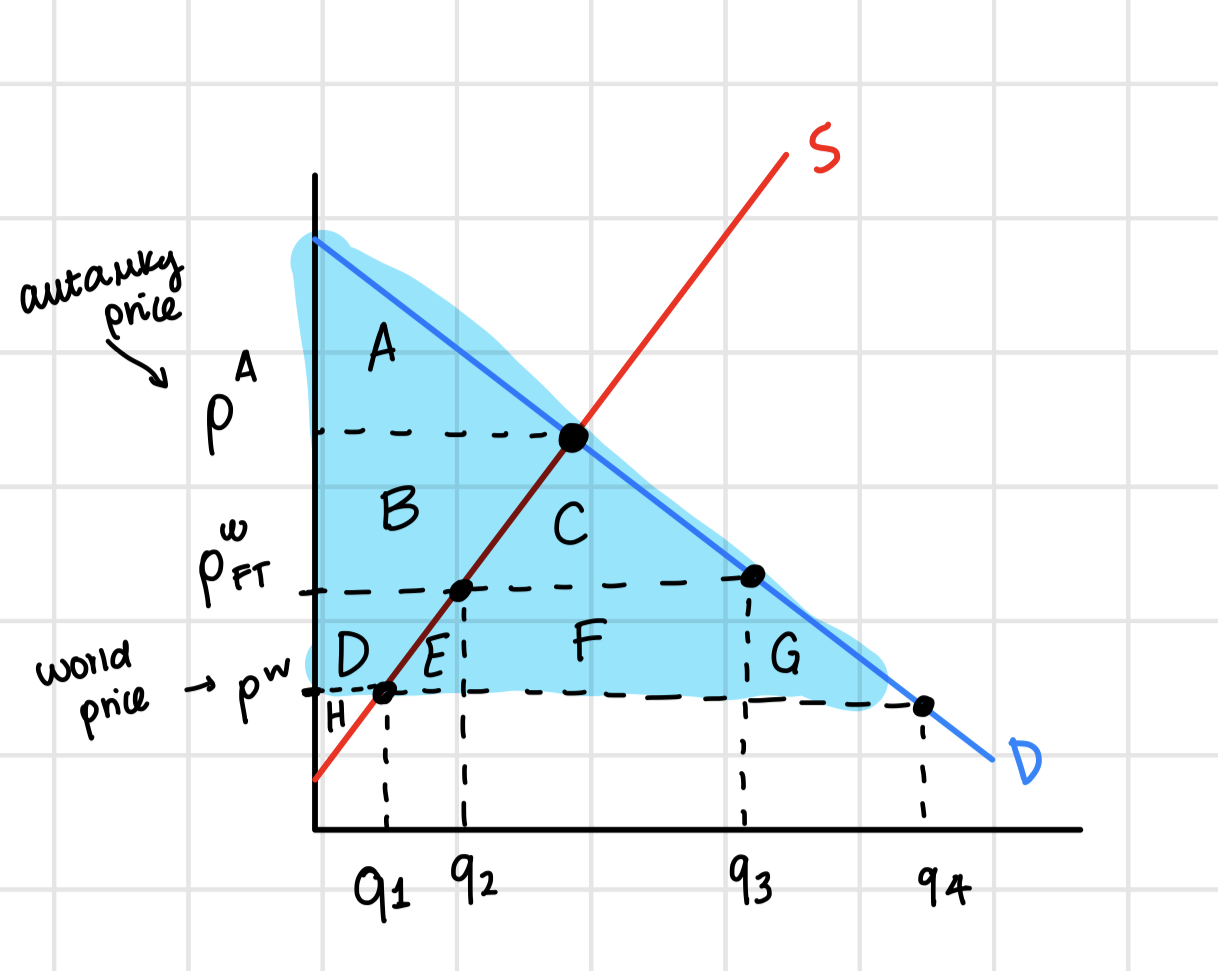

Consumer Surplus Without Tariff

A+B+C+D+E+F+G

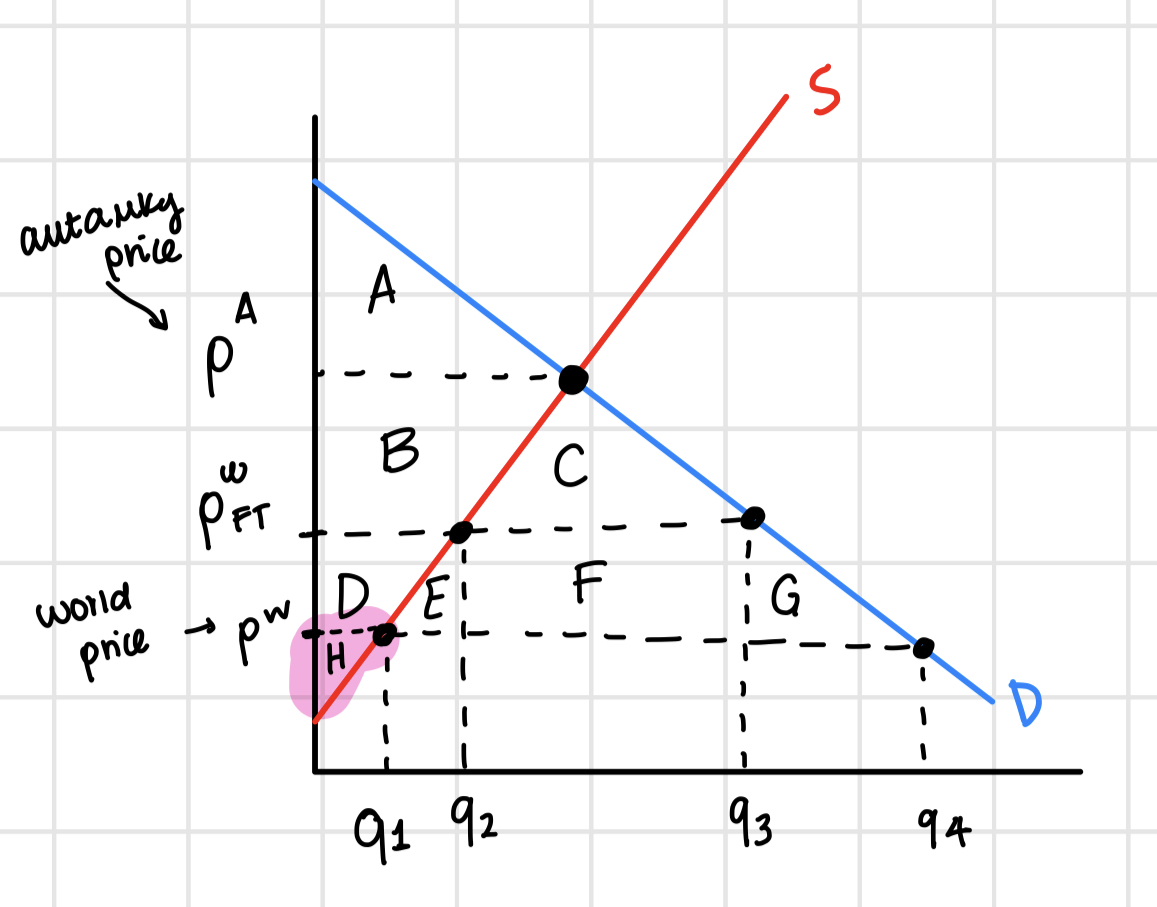

Producer Surplus Without Tariff

H

Consumer Surplus With Tariff

A+B+C

Producer Surplus With Tariff

D+H

Small Country Gov Revenue With Tariff

F

Large Country Gov Revenue With Tariff

F+J

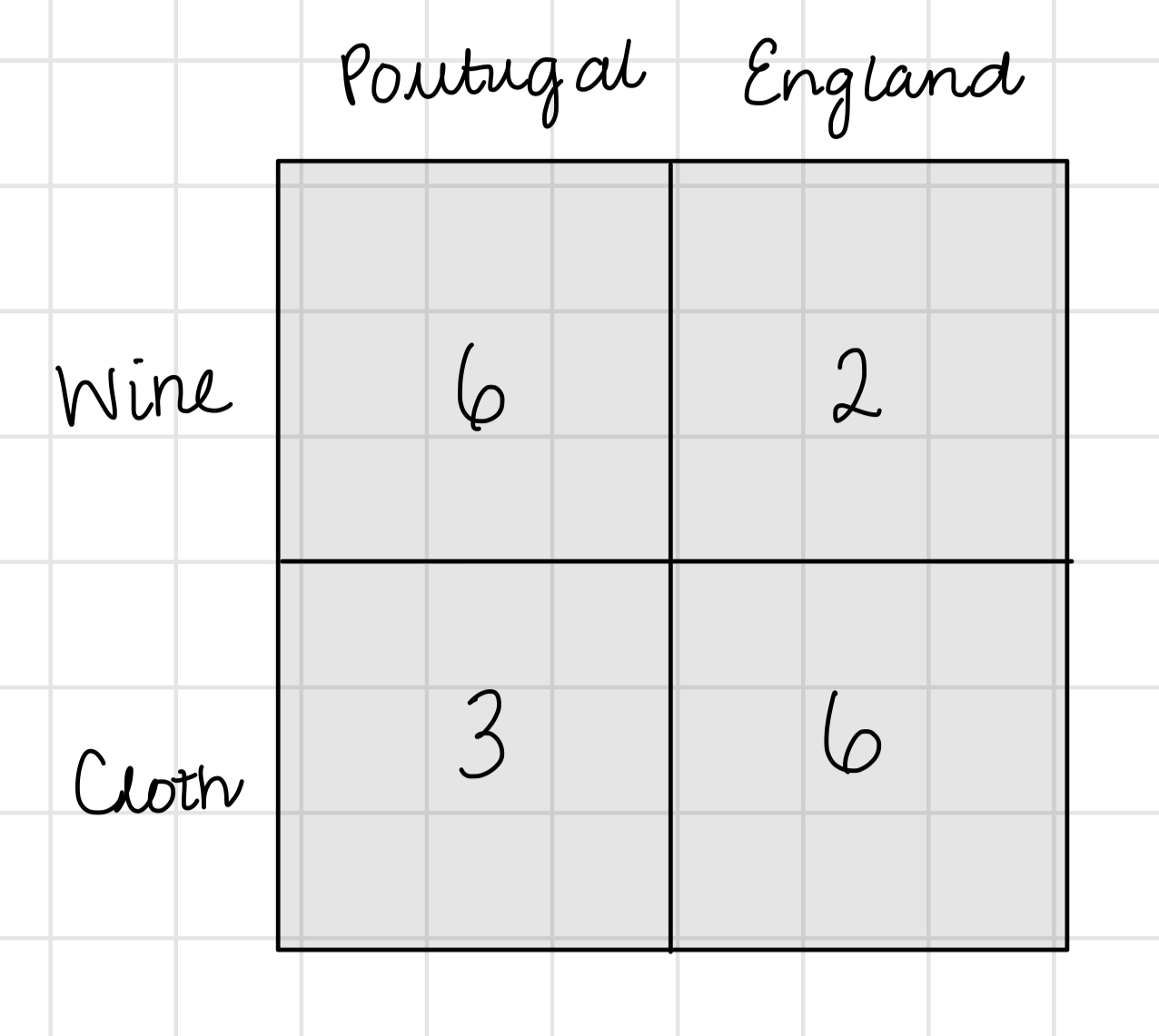

Ricardian Trade

countries gain by specializing in goods where they have comparative advantage

Comparative Advantage

Produce the good with the lower opportunity cost. (Smaller cost for the good)

Absolute Advantage

If one country can make more in the same time, or make the same amount with less time/work, it has absolute advantage.

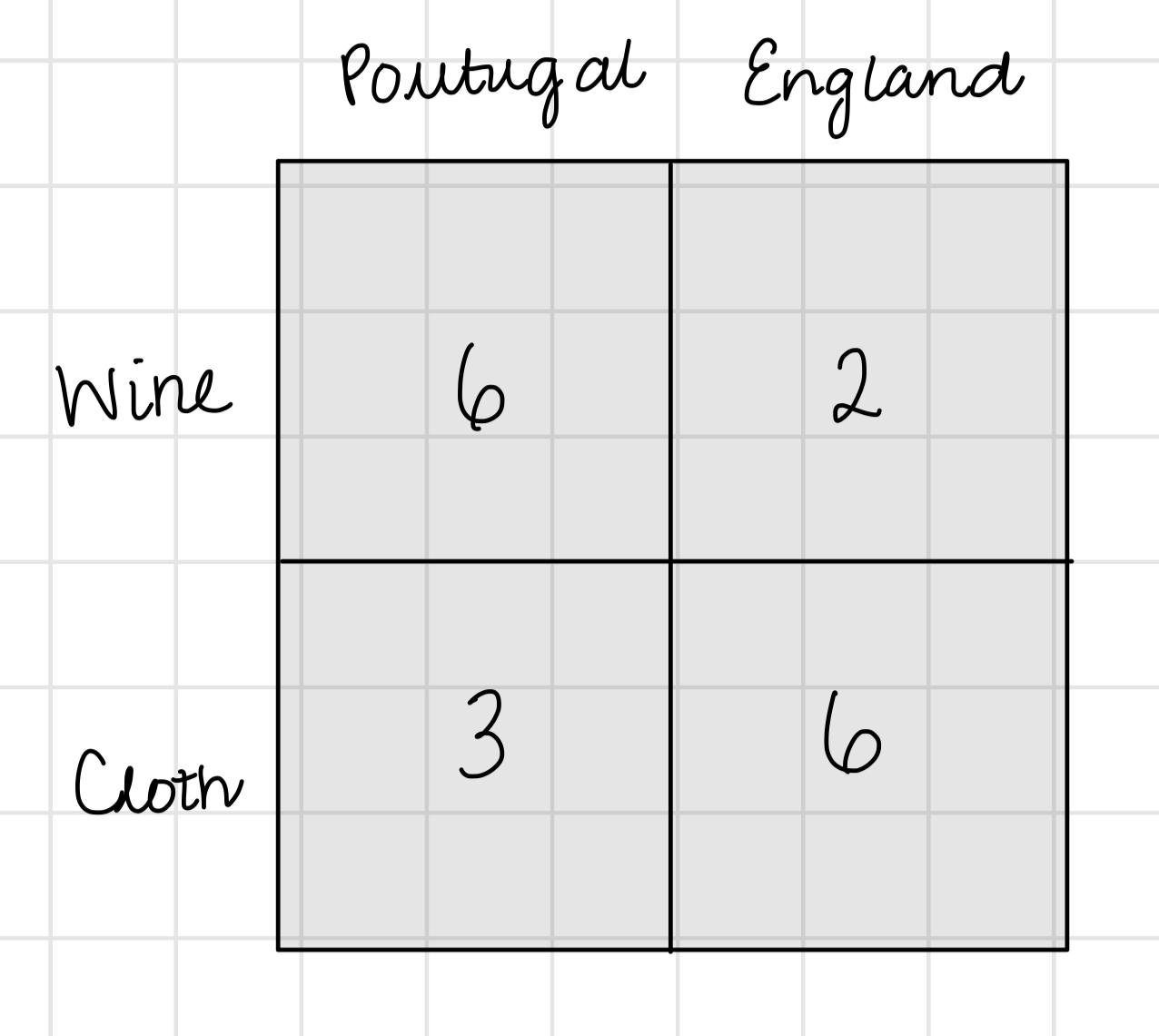

Who has an absolute advantage in Wine?

Portugal

Who has an absolute advantage in Cloth?

England

How do we calculate a country’s opportunity cost of making a product

Opportunity Cost of A: B/A (in units of B)

Opportunity Cost of B: A/B (in units of A)

If a country has a lower opportunity cost on A…

They have a comparative advantage of A.

And Vice versa for B.

In equilibrium, opportunity cost must equal..

Relative Price Pa/Pb

(price of good A over price of good B)

Therefore, we can also think of opportunity cost as the lower relative price.

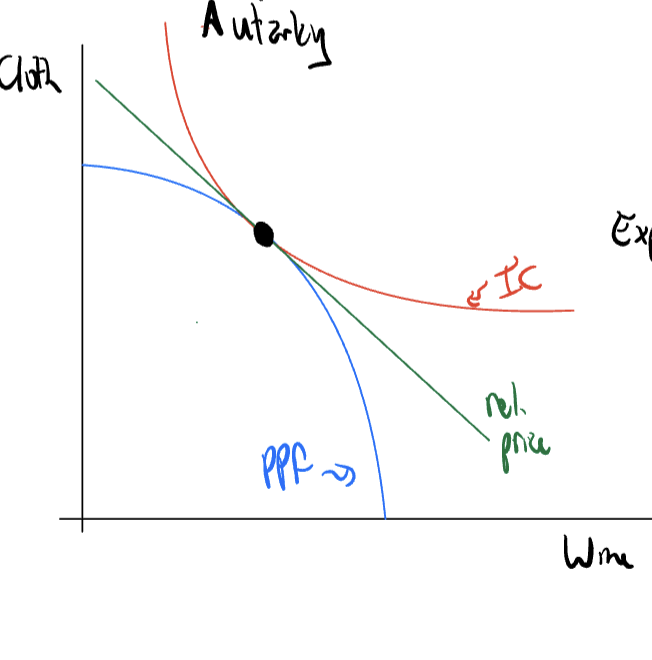

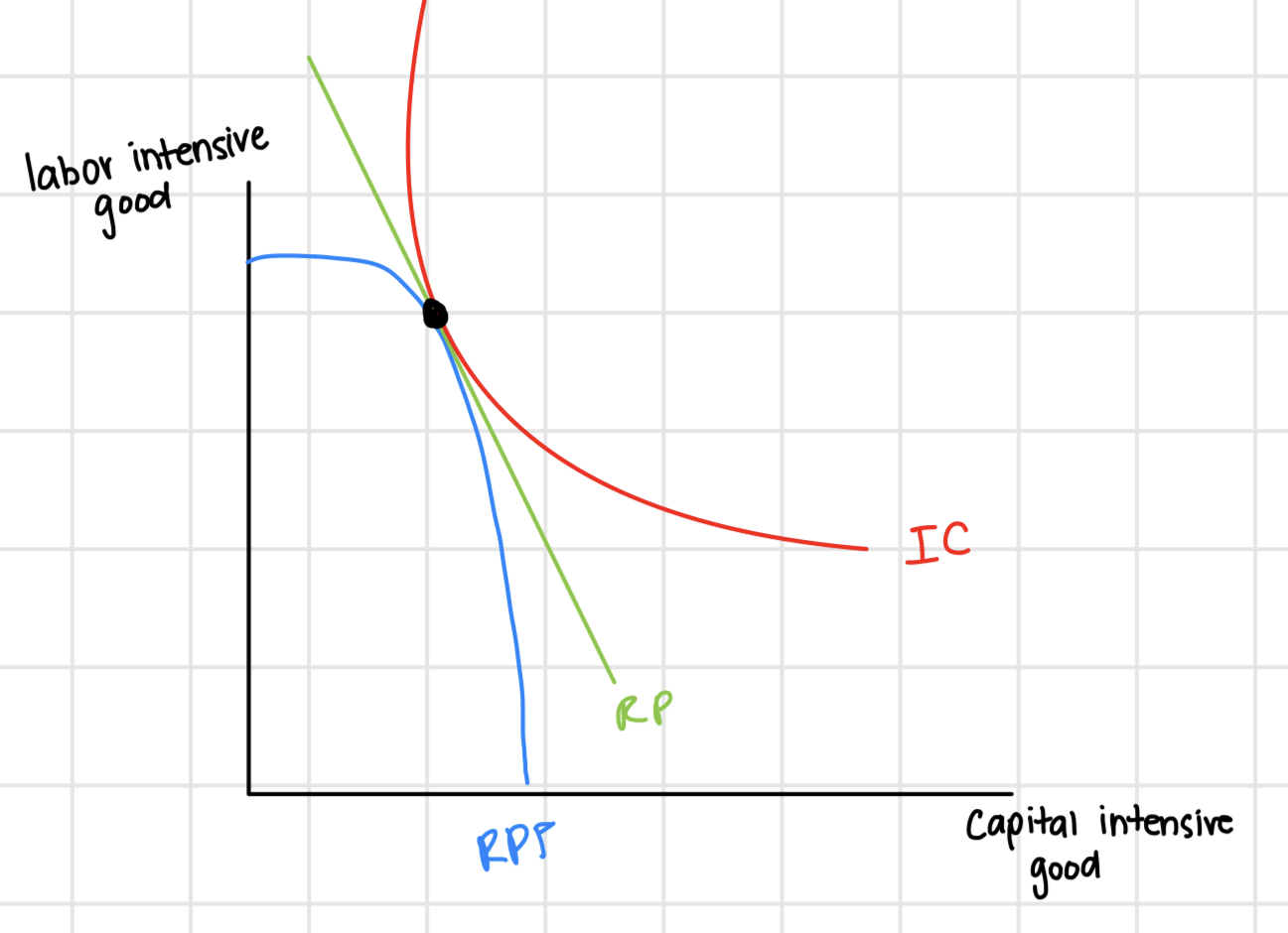

When do we produce under autarky?

When do we consumer under autarky?

Produce: When Relative Price is tangent to PPF (Production Possibilities frontier)

When indifference curve and relative price are tangent.

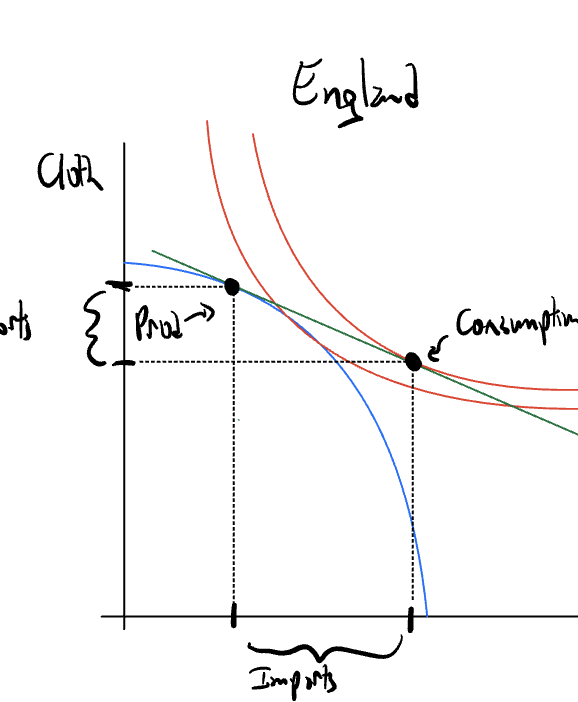

What do countries export and import?

Countries export the goods they have a comparative advantage and import the other goods.

Ex: England has a comparative advantage on cloth → exports cloth, imports wine

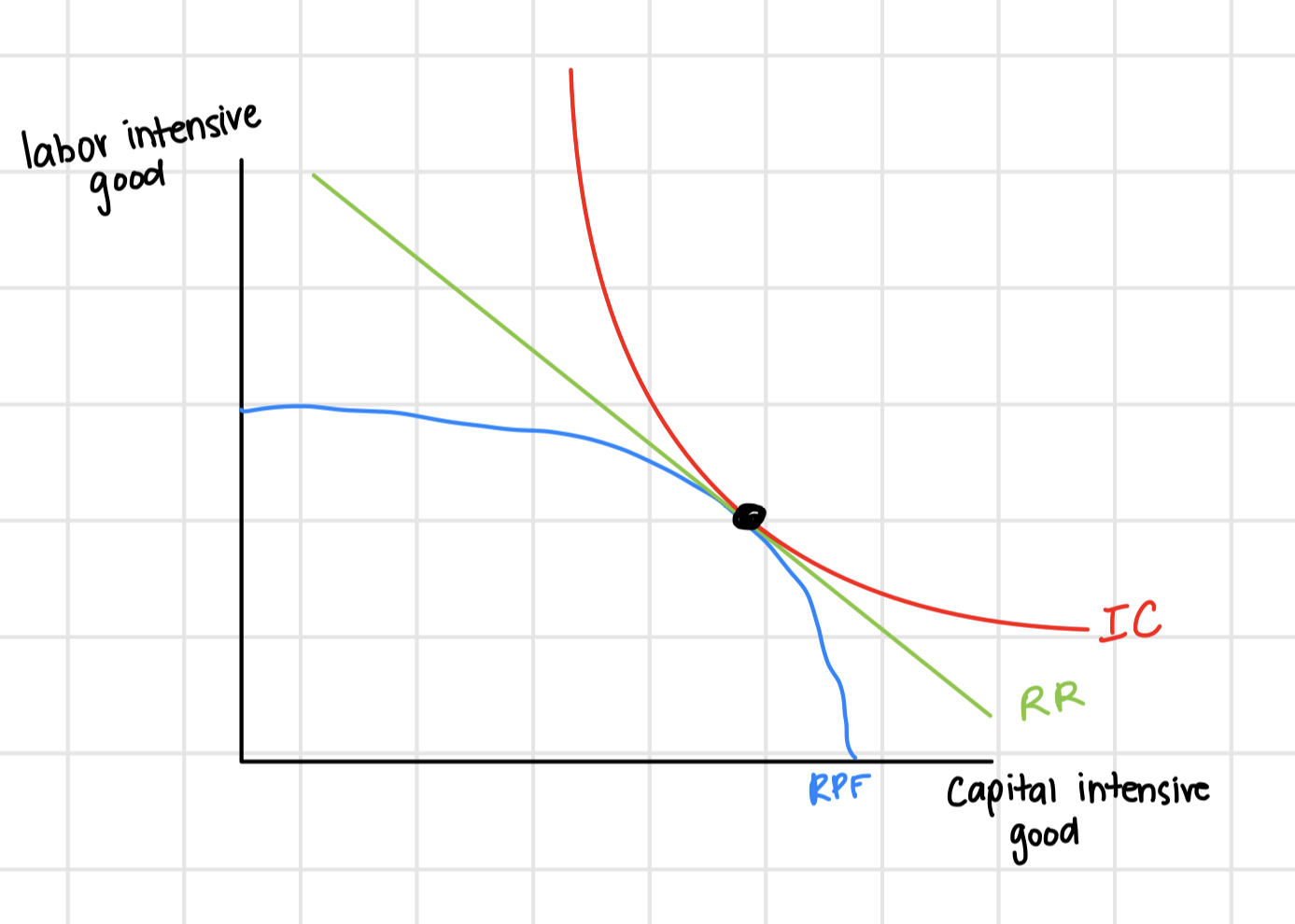

Heckscher Ohlinn Model

Two countries, two goods; one good is capital-intensive, the other labor-intensive. Countries differ in factor abundance (more K vs. more L).

Country A is capital abundant relative to Country B if:

KA/LA > KB/LB

(A’s machines-per-worker ratio is bigger) Capital is bigger

Country B is labor abundant relative to A if:

LA/KA < LB/KB

(B has more workers per machine) Labor is bigger

H-O Theorem

Labor abundant countries have a comparative advantage in labor intensive industries and vice versa

Capital Abundant Country

Labor Abundant Country

Stolper Samuelson Theorem

When a country shifts production more towards one good the factor of production i.e labor or capital used intensively in that good benefits and the other is harmed

What happens to labor abundant countries when they open trade

raises real wages and lower returns to capital

Rybczynski Theorem

raising a factor (e.g., L) raises output of the good that uses it intensively and reduces output of the other.

If L rises →

↑ output of labor-intensive good, ↓ output of the other.

If K rises →

↑ output of capital-intensive good, ↓ output of the other.

How do markets work?

By packaging costs and benefits

MB

Marginal Benefit

Contains all benefits

MC

Marginal Cost

Contains all costs

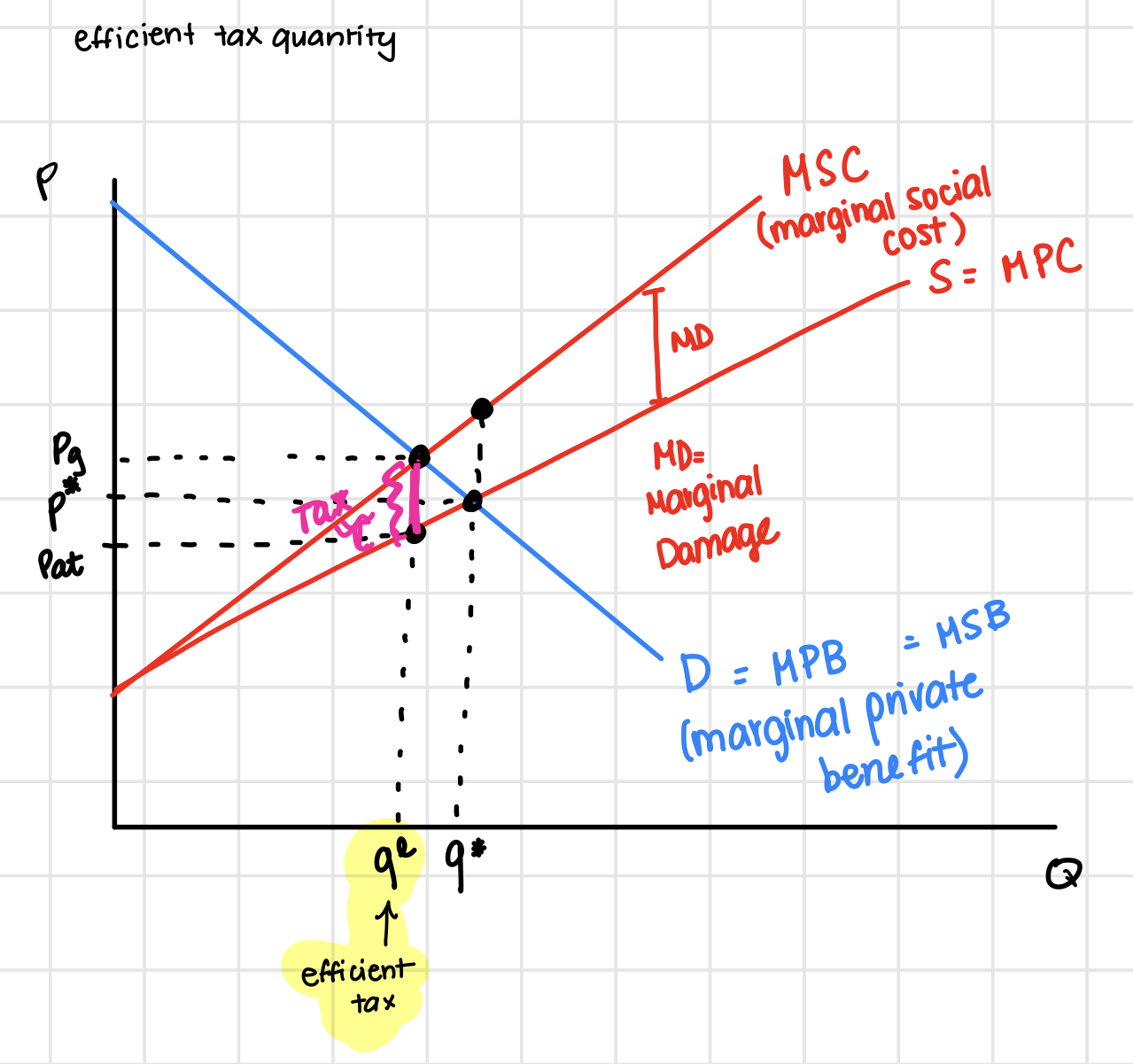

MSC

Marginal Social Cost

MPB

Marginal Private Benefit

When do we have efficient tax quantity?

When MC=MB

Marginal Cost is equal to Marginal Benefit

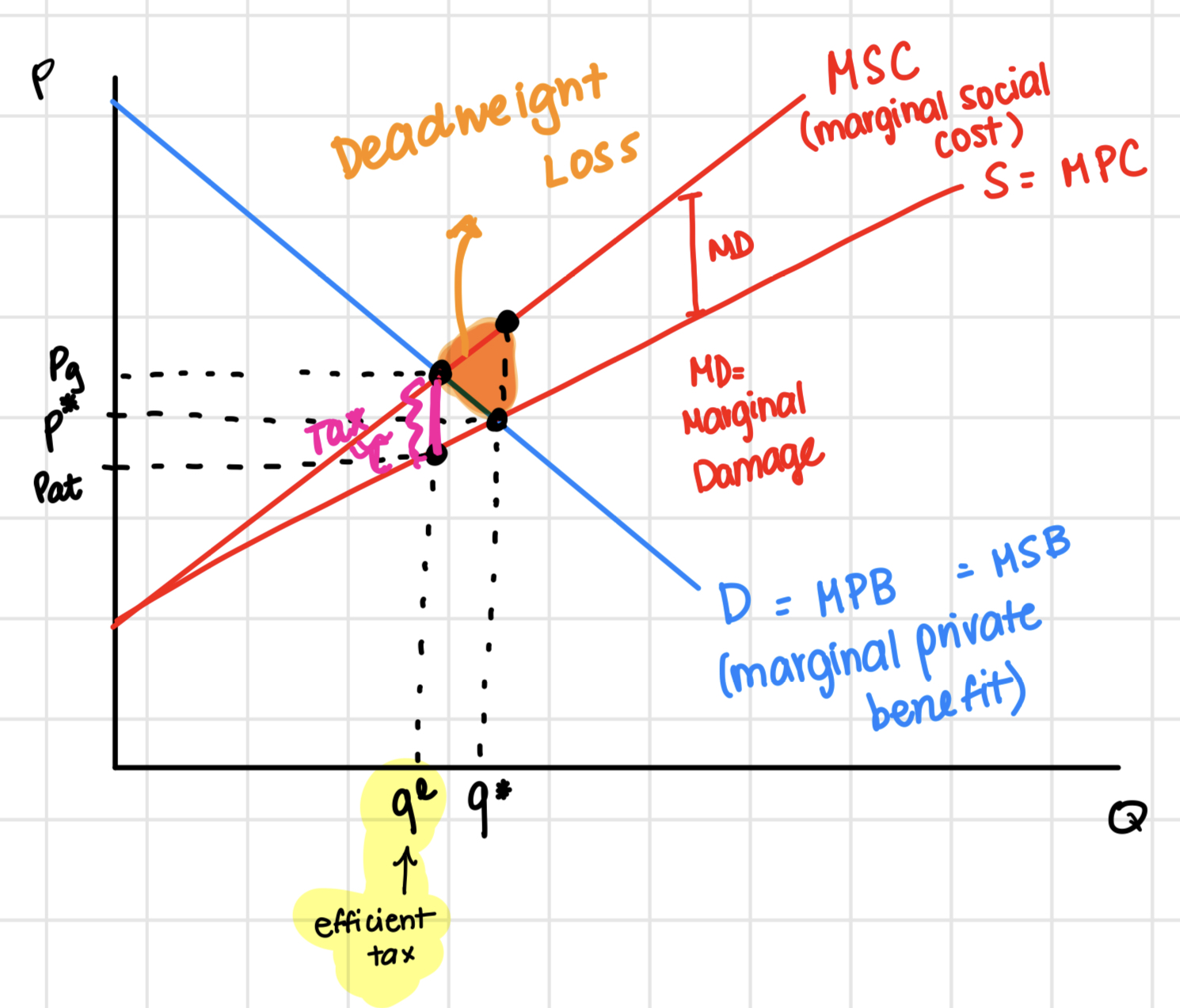

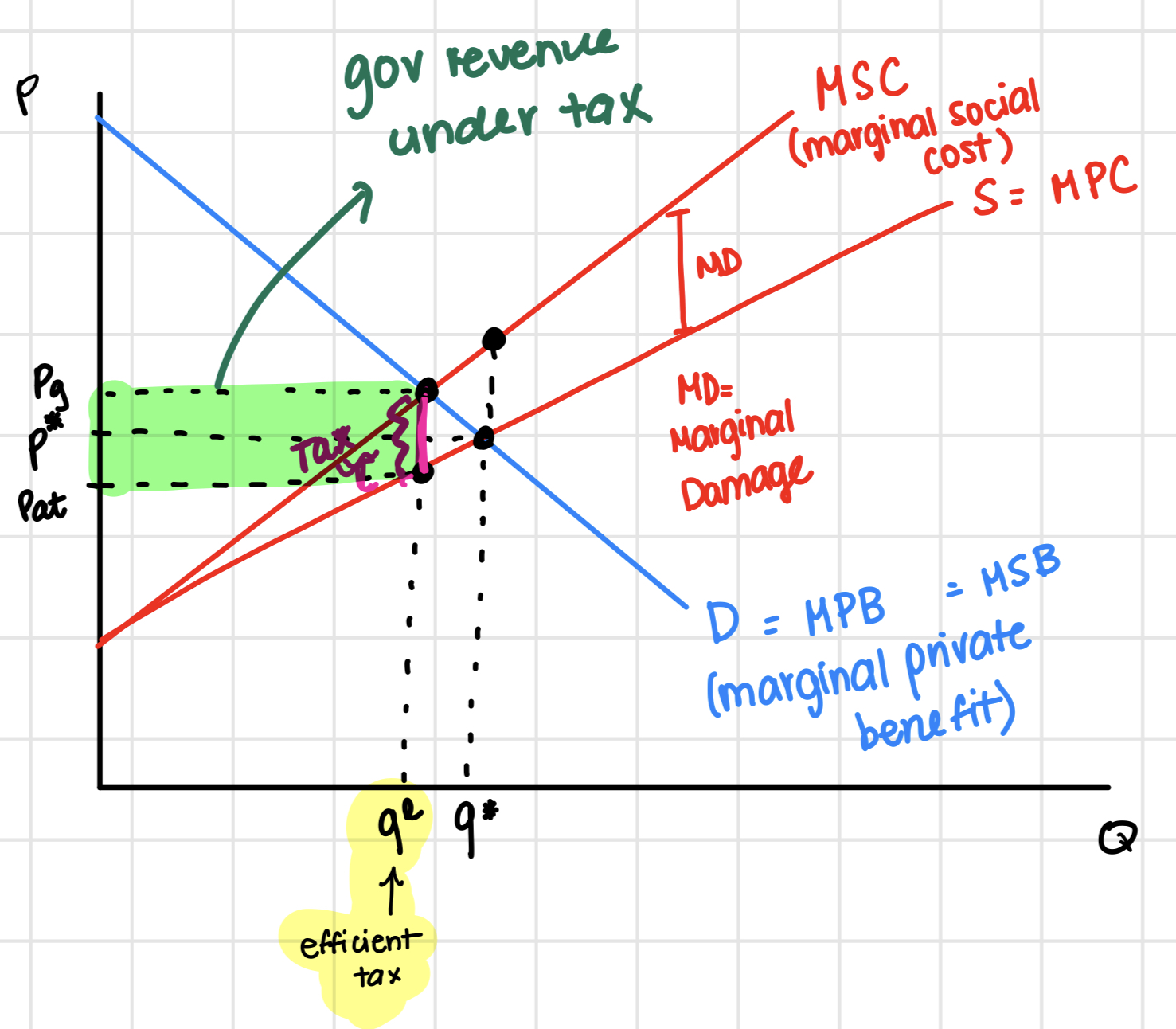

Pigouvian Tax

Corrects the negative externality caused by market failure

When MSC= MSB

Marginal Social Benefit = Marginal Social Cost

Pegouvian Tax Deadweight Loss

Pegouvian Tax Gov Revenue

Cap-and-Trade

Government sets a cap on total emissions and issues permits (auction or free).

Abatement

how much a firm cuts its pollution.

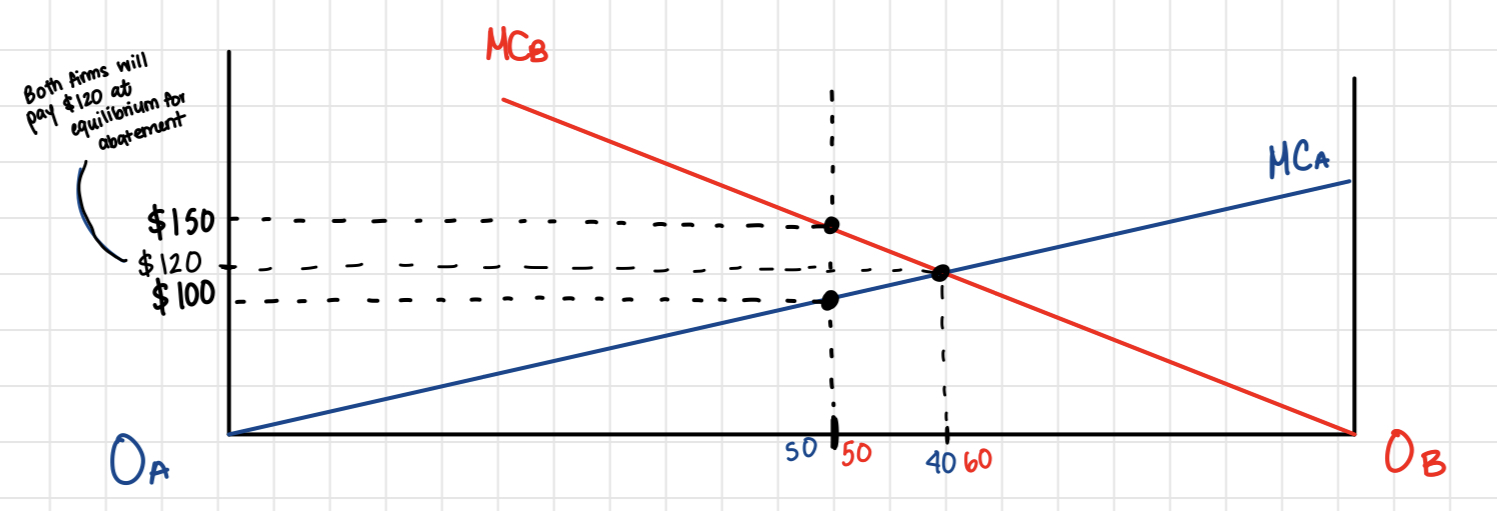

Abatement Equilibrium

Where Marginal Costs of both firms intersect

MC_A=MC_B

Gives you permit quantities and how much firms pay.

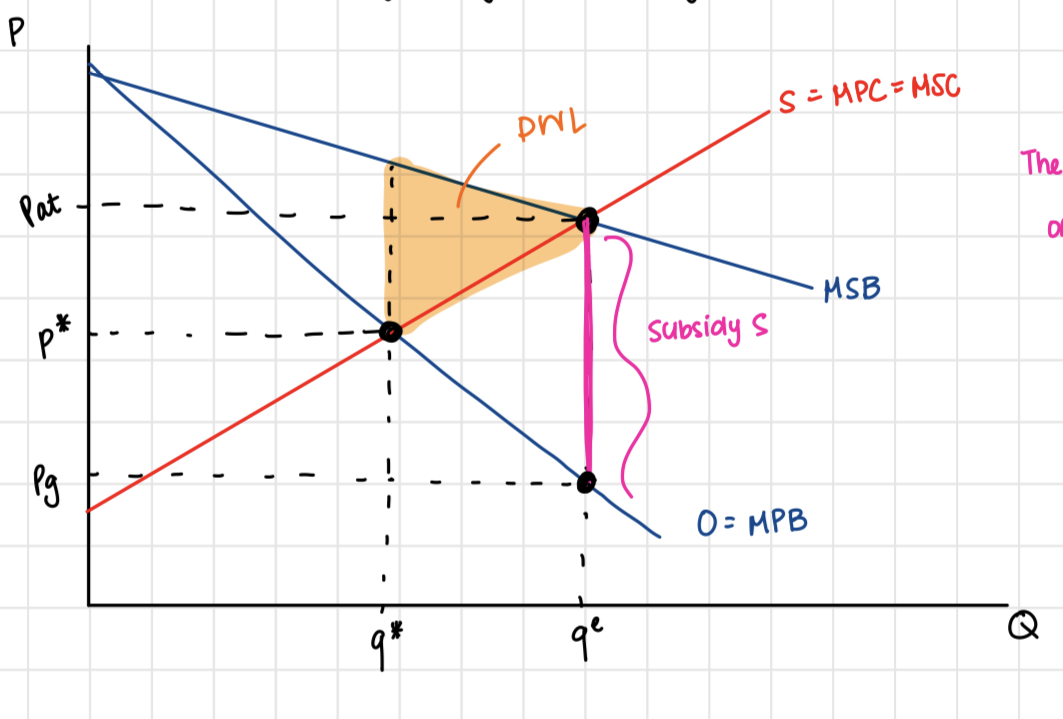

Pegouvian Subsidy

A payment per unit to reward activities with positive externalities

Where MSB= MSC

Marginal Social Benefit equals Marginal Social Cost

HDI

Human Development Index

Solow Model

A simple growth model where saving builds capital but diminishing returns push the economy to a steady state; only productivity (TFP) growth raises long-run living standards.

How do we increase GDP per capita

grow capital and/or TFP

Poverty Trap

a self-reinforcing loop that keeps people or countries poor—low income → low saving/investment (in health, schooling, tools) → low productivity → low income again.

In a graph, how do we know if a country is in the poverty trap?

if their savings line is under the (n+d)k line

Characteristics of Rapid Growth

Macroeconomic and Political Stability Investment in Health and Education Effective Governance and Institutions Favorable Environment for Private Enterprise Trade, Openness, and Growth Favorable Geography

Some Measures of Health

Mortality

Morbidity

Life Expectancy

Health Adjusted Life Expectancy (HALE)

HALE

Average number of years that a person can expect to live in “full health” by taking into account years lived in less than full health due to disease and/or injury.

What is the correlation between income and health?

Positive

What region experiences HIV/AIDS epidemic?

South Africa

Drug treatment tradeoff

Very effective, but there is little incentive to keep funding studies for cheaper generic drugs in poorer countries.

Benefit and Con of Schooling (education)

Investment for future increase in earnings

But there are direct and indirect costs of education

Benefits and Costs of Children (Population/Birth Rate)

Benefits:

Psychic benefits (happiness, etc.)

Can supplement family earnings

Provide a form of social security (care in old age)

Cons:

Food, shelter, education

Psychic costs

Opportunity cost Development

Possible explanation for relationship between income and fertility

Suppose families get utility from quantity and quality of children. Increase in income may encourage investment in higher quality children, rather than more children. Additionally, higher income means higher opportunity cost. Development.

Norman Borlau

father of Green Revolution estimated to have saved one billion lives

Access to Credit in developing countries

Loans from formal institutions are rare; generally comes from friends, relatives, or money lenders, and is attached with high interest rates.

Why are banks unwilling to lend to the poor?

Poor people tend to not have collateral so the interest rates are incredibly high

Microfinance

Small loans, short, fixed repayments.

Group lending with joint liability (one default can cut off the whole group).

Progressive lending: start small; larger loans after successful repayment.

Flexible collateral: everyday assets (livestock, tools).

Focus on women borrowers.

Equity Efficiency Tradeoff

Equity: fairness/redistribution (e.g., transfers to the poor).

Efficiency: size of the pie—how much value the economy produces.

Veil of Ignorance

you choose society’s rules without knowing who you’ll be (class, talent, gender, race, wealth).

Purpose: forces impartial, fair principles—equal basic rights and inequalities only if they benefit the worst-off.

Who does the tax fall on if the demand is perfectly elastic?

All taxes fall on producers

Where does the tax fall on if supply is perfectly elastic?

all taxes fall on capital