Week 5 - Risk & Uncertainty

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

Risk is

uncertainty that can be quantified

Risk lovers

Someone willing to take a fair bet

Risk Lovers will avoid

a very unfair bet

Risk Averse

Someone who isn’t willing to take a fair bet

Risk averse people avoid

Any risk/seek to reduce it

Risk Neutral

Someone who is indifferent to taking a fair bet

Risk neutral people avoid

Unfair bets

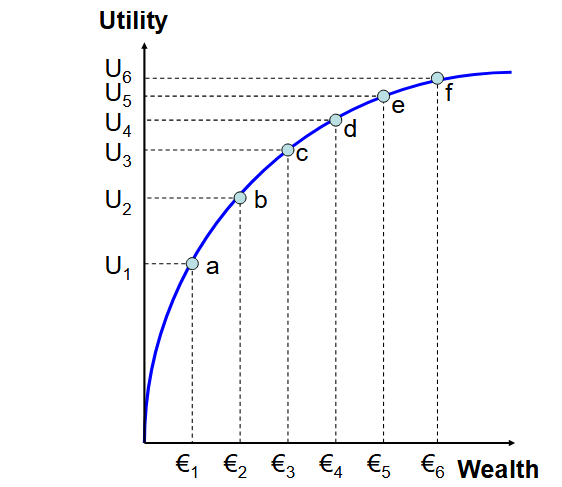

Explain - marginal utility and what it is

Risk Averse

Diminishing marginal utility of wealth

Concave to wealth axis

Diminishing marginal utility of wealth

Each € provides less utility than the € before it

What kind of risk is it

Utility curve is

What’s the marginal utility

What does this show us in terms of risk

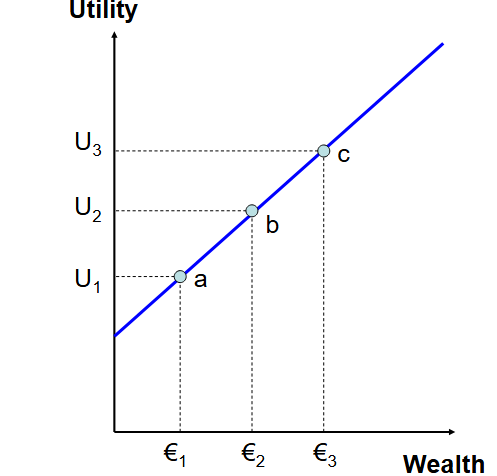

Risk Neutrality

Straight line

Constant marginal utility of wealth

Risk neutral person will choose highest EV even if its riskier

Constant Marginal utility of wealth

Each € provides same amount of utility as previous €

What kind of risk is it

Utility curve is

What’s the marginal utility

What does this show us in terms of risk

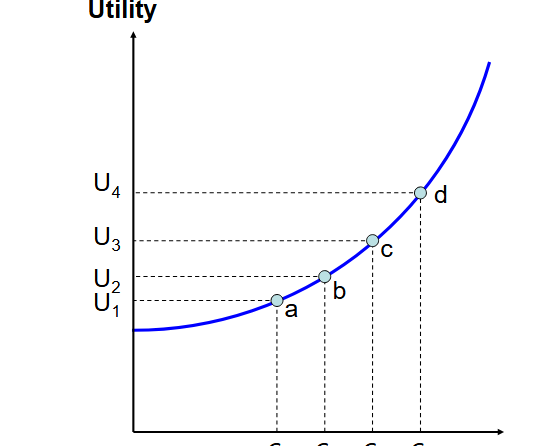

Risk preferring

Convex to wealth axis

Increasing marginal utility of wealth

They prefer uncertain/risky options that give higher rewards

Increasing marginal utility of wealth

Extra utility from each extra € is more utility than each previous €

Risk pooling

Combining several risks to make overall outcome more predictable

Why do insurance companies risk pool?

Ensures they receive more than they pay out

Insurance companies would provide insurance for risks they can’t

Diversify

E.g. War and natural disaster

Diversifying works depending on

Extent to which it works depends on degree to which outcomes are related

Outcomes can be

Positively correlated

Negatively correlated

Uncorrelated

Can elimainate risk if 2 outcomes are

Perfectly negatively correlated

Variance

How far figures are spread from the mean

Variance formula

probability of outcome X payout

Standard Deviation

Shows how close to the mean outcomes are

Low Deviation

High deviation

Close to mean

Far from mean

Expected Value formula

Value of each possible outcome X probability of outcome

Dispersion

The greater the level of dispersion, the greater the lvl of risk associated w/ choosing an alternative decision

Range

Difference between the 2 most extreme outcomes

Expected Utility

Rational person will maximise Expected utility