Banking

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

9 Terms

Which of the following are potential causes of liquidity risk for a DI?

Requests to fund large amounts of loan commitments.

Requests by depositors to withdraw large amounts of deposits.

A disadvantage of using liability management to manage a FI's liquidity risk is

the high cost of purchased liabilities.

A disadvantage of using asset management to manage a FI's liquidity risk is

the resulting shrinkage of the FI's balance sheet.

Which of the following statements is NOT true?

Bank sustains no cost under stored liquidity risk management.

Why have purchased liquidity management techniques become very popular in spite of its limitations?

Because it insulates the assets of an FI from normal drains on liability liquidity.

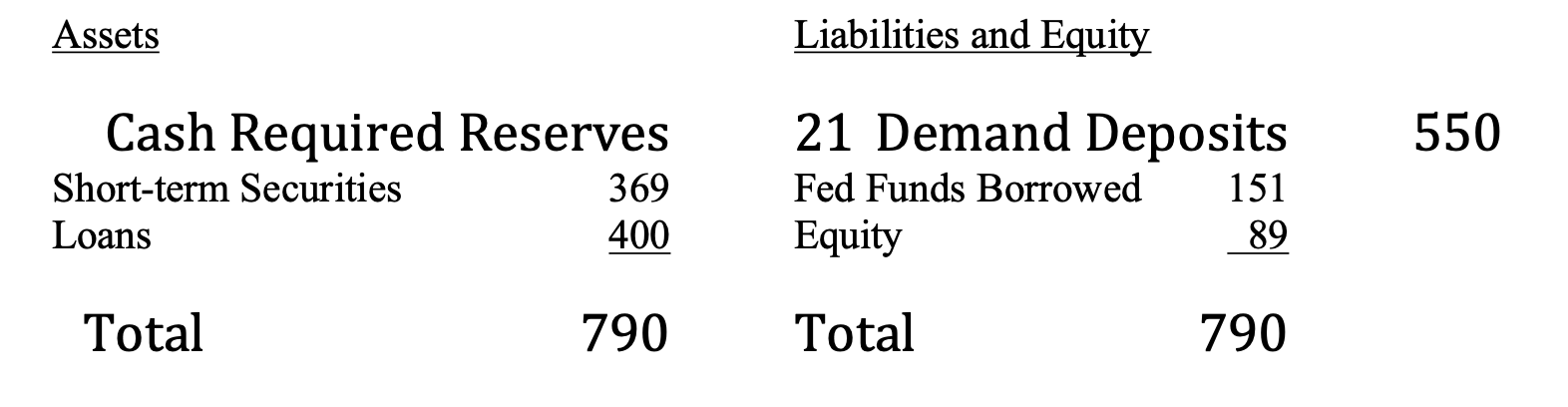

If the bank experiences a $50,000 sudden liquidity drain caused by a loan commitment draw down, what will be the impact on the balance sheet if stored liquidity management

A reduction in securities and/or current loans totaling $50,000.

Which of the following can be classified as off-balance-sheet asset?

Loan commitments

I. Loan commitments

II. Standby letter of credit

III. Commercial letter of credit

IV. Equity capital

Which of the above can be classified as off-balance-sheet liabilities?

II and III

I. Settlement risk

II. Takedown risk

III. Aggregate funding risk

IV. Affiliation risk

Which of the above are non–schedule L off-balance-sheet risk?

I and IV