Econ 206 - Chapter 16

1/54

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

55 Terms

Canadian Payments System - Large Value Transfer System (LVTS)

Electronic, real time net settlement network operated by Payments Canada, designed for time critical transactions, allowing for people to know real time large value transactions

Account for less than 1% of total number of transactions, but account for 87% of value of transactions

How can a financial institution participate directly in LVTS?

Member of Payments Canada

Uses SWIFT

Maintains settlement account at BoC

Has agreements regarding borrowing from BoC and can pledge eligible collateral

Systemic risk and LVTS

the risk to the entire payments system due to the inability of one financial institution to fulfill its payment obligations in a timely fashion

How LVTS helps eliminate Systemic risk

LVTS participants can only make payments if they have real time

positive settlement balances in their accounts with BoC

posted collateral, OR explicit lines of credit with other LVTS participants

Multilateral Netting

when only the net credit or debit position of each participant vis-a-vis all other participants is calculated for settlement at the end of the payment cycle

Overnight Interest rate

At end of day, some LVTS members are short on settlement balances, and others have balances left over, they will borrow and lend to each other on the overnight money market

The interest rate on these overnight loans is the overnight interest rate

Canadian Payment Systems - Automated Clearing Settlement System (ACSS)

Electronic payment system also operated by Payments Canada

Provides settlement to paper-based payment items (cheques, money orders) and small value electronic payments (e.g debit card transactions)

ACSS aggregates payments and calculates net amounts to be sent to from settlement accounts with BoC

BoC Policy Rate

The target for the overnight interest rate that is announced by the BoC, also main target BoC adopts when conducting monetary policy

How BoC implements monetary policy with Policy Rate

by changing the policy rate in order to influence other short-term interest rates and the exchange rate

BoC’s overnight rate objective

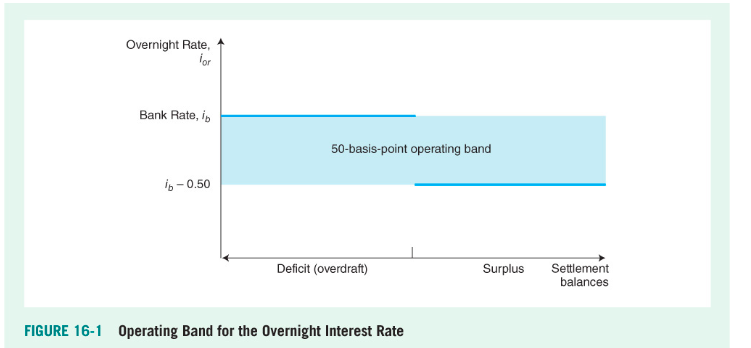

Keep overnight rate within operating band of 50 basis points (half of 1%) or midpoint of operating band

The Bank Rate

The upper limit of the operating band

The interest rate the BoC charges LVTS participants that require an overdraft loan (advance) to cover negative settlement balances with BoC at end of banking day

Lower limit of operating band is?

the rate the BoC pays to LVTS participants with positive settlement balances at the end of the day

BoC Standing Liquidity facilities - Lending Facility

LVTS participants can obtain overnight liquidity in case of shortage in order to bring settlement balance with BoC close to zero

BoC Standing Liquidity facilities - Deposit Facility

LTVS participants can make deposits in the case of excess liquidity in order to bring settlement balance with BoC close to zero

How BoC puts Ceiling and Floor on overnight rate

If overnight rate increases towards upper limit of operating band, the BoC will lend at the bank rate (ceiling)

If the overnight rate falls towards lower limit of operating band, the BoC will accept deposits from LVTS participants at the lower limit rate (bank rate - 50 basis points) (floor)

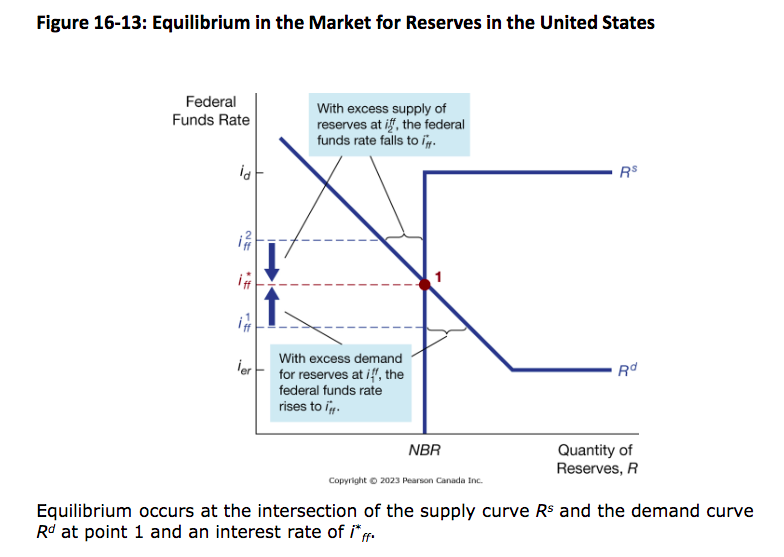

Market for Settlement Balances/Reserves

Where the overnight interest rate is determined, chosen through the market equilibrium where quantity of reserves demanded equals quantity supplied)

Demand Curve for Reserves

Inverse relationship between overnight interest rate and quantity demanded, but demand curve becomes flat at certain point since banks become indifferent to holding reserves beyond this point

Supply Curve Two components - Non-borrowed reserves

the amount of reserves that are supplied by BoC’s open market operations

Supply Curve Two components - Borrowed Reserves

the amount of reserves borrowed from the BoC

Supply Curve of Reserves - when Ior is less than Ib

Banks will not borrow from BoC since it is not worth it to borrow at a higher rate, hence supply of reserves = amount of NBR’s since no one is borrowing

Why is supply curve vertical at whatever the amount of NBR’s?

Since BR’s are zero, reserves only depend on NBR’s, which is fixed

Why is supply curve horizontal at Ior = Ib

happens at bank rate (ceiling), the interest rate has one above Ib, so banks borrow unlimited reserves from BoC at point Ib and lends them at a higher rate, and BoC supplies as many reserves as needed at Ib

How BoC Operating Procedure Limit Fluctuations in Overnight interest rate

By establishing a limit for the fluctuations to between the deposit rate (lower band) and the bank rate (upper band)

Leftward shift in demand curve lowers overnight rate to the minimum deposit rate

A rightward shift in demand curve raises overnight rate to the maximum bank rate

BoC approach to Monetary Policy - Inflation target

Keep inflation rate between target range of 1%-3%, with 2% being most desirable outcome

Inflation rates/targets in Canada trend

rate of inflation has significantly reduced over time and has achieved inflation targets

What determines monetary conditions in which the economy operates?

The level of short-term interest rates and the exchange rate of the CAD (all affected by changes in overnight interest rate)

*slide 19 come back to because prof is lazy and can’t finish slide explanations properly

Exchange rate

the units of foreign currency per one Canadian dollar

If amount of units of foreign currency decreases, implies CAD depreciates

How BoC keeps Inflation rate from falling below limit of target range

Decrease in target rate for overnight interest rate

causes dollar and interest rate to decrease

which causes Increase in aggregate demand, as prices/cost increases and so does inflation

How BoC keeps Inflation rate from moving above limit of target range

Increase in target for overnight interest rate

causes dollar and interest rates to increase

which causes decrease in aggregate demand, as prices/costs decrease, so does inflation

How is it that changes in short-term nominal interest rates affect real interest rates?

Assumption of ‘sticky prices’ meaning nominal prices don’t adjust immediately to changes in money supply, allowing the BoC some control over interest rates

4 Conventional Monetary Policy Tools

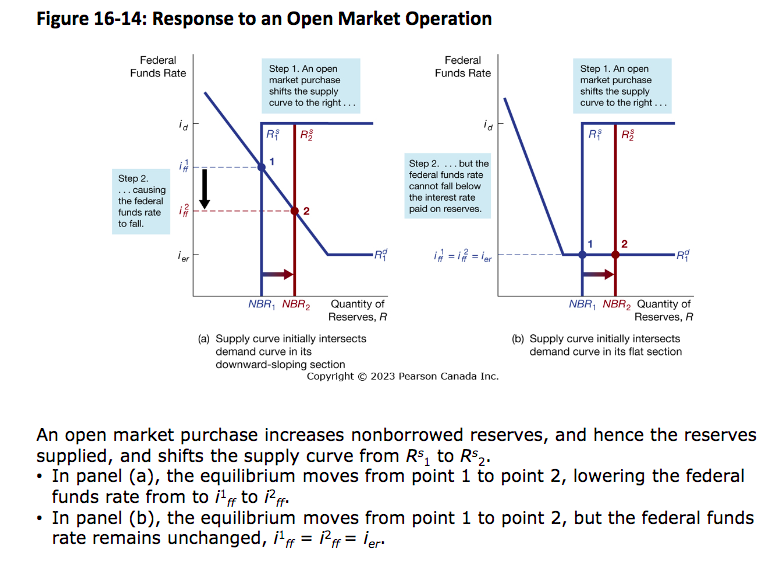

Open market purchases

Open market sales

Settlement balances management

BoC lending

Open market purchase effects

expands bank reserves and monetary base

Lowers short-term interest rates

Raises money supply

Open market sales effects

Shrinks bank reserves and monetary base

Raises short-term interest rates

Lowers money supply

BoC Special Purchase and Resale agreement

BoC purchases securities that are repurchased by the seller the next day

if overnight funds are traded above target overnight interest rate, BoC enters into special purchase at the target price, and relives undesired upward pressure on the overnight interest rate

BoC Sales and Repurchase Agreement

BoC sells securities and then purchases it back the next day

If overnight funds are traded at a rate below the target overnight interest rate, BoC sells securities and removes cash from the market, which means banks need to borrow from each other more and undesired downward pressure on overnight interest rate is removed

Settlement Balances Management - Drawdowns

BoC moves deposits from commercial banks to its account

This removes money from the banking system (bank loses reserves) and settlement balances fall

Settlement Balances Management - Redeposits

BoC moves money from their account to commercial banks

This adds money to the banking system (banks gain reserves) and the settlement balances rise

How do standing lending facilities place a ceiling on the overnight interest rate?

Since banks can always borrow reserves from BoC as the bank rate, they will never pay more than that in the overnight market

BoC as lender of last resort

provides emergency lending assistance (against eligible collateral) preventing bank failures and financial panics

Zero-lower-bound problem

Banks typically lower interest rates to stimulate economic growth, but when the interest rate hits zero, interest rate changes become ineffective as people hoard cash since they will not get a good return with lower interest rates

Thus efforts to stimulate economy with lower interest rates is blocked which can hinder recovery from recessions/economic slowdown

Nonconventional monetary policy tools - Liquidity provision

Standing lending facility expansion

Standing term liquidity facility

New lending programs

Nonconventional monetary policy tools - Large-Scale Asset (bond) Purchase/Quantitative Easing

The large-scale purchase of Government of Canada bonds, leading to an increase in the monetary base

Non-conventional monetary policy tools - Forward Guidance/Management of Expectations

In order to lower long-term interest rates and provide more stimulus to the economy, the BoC commits to keeping the policy rate at zero for an extended period of time

This lowers market’s expectations of future short-term interest rates, also causing long-term interest rates to fall

Non-conventional monetary policy tools - Negative Interest rates on reserves

BoC can charge banks for depositing their funds, banks will look for better uses of their money and thus will lend it out more rather than losing money at the central bank

Monetary Policy Tools of the Federal Reserve (US)

Federal funds rate

Open market operations

Discount lending

Required reserves

Interest on reserves

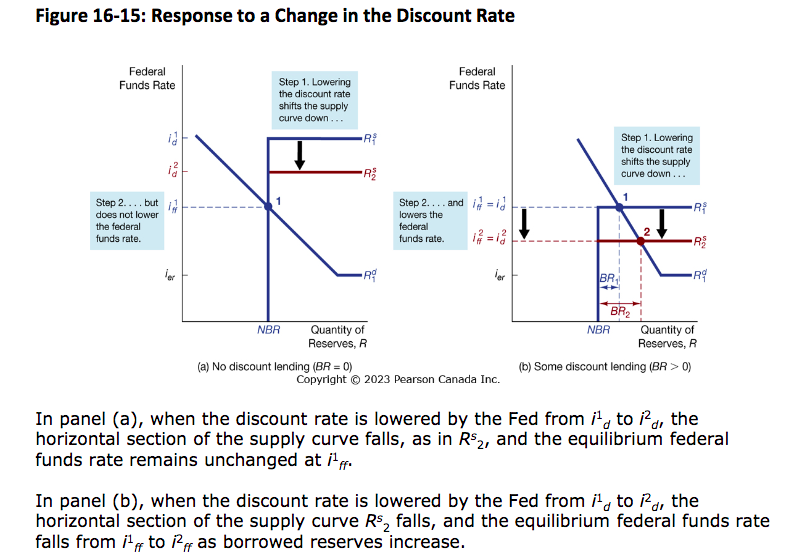

Discount window (US)

the facility at which US banks borrow reserves from the Federal Reserve

Discount rate (US)

the interest rate charged for loans from Discount window

Primary indicator of Monetary policy stance in US

the federal funds rate (interest rate on overnight loans of reserves that banks trade amongst themselves)

Equilibrium for market for reserves in US

Response to open market operation (US)

Response to change in discount rate (US)

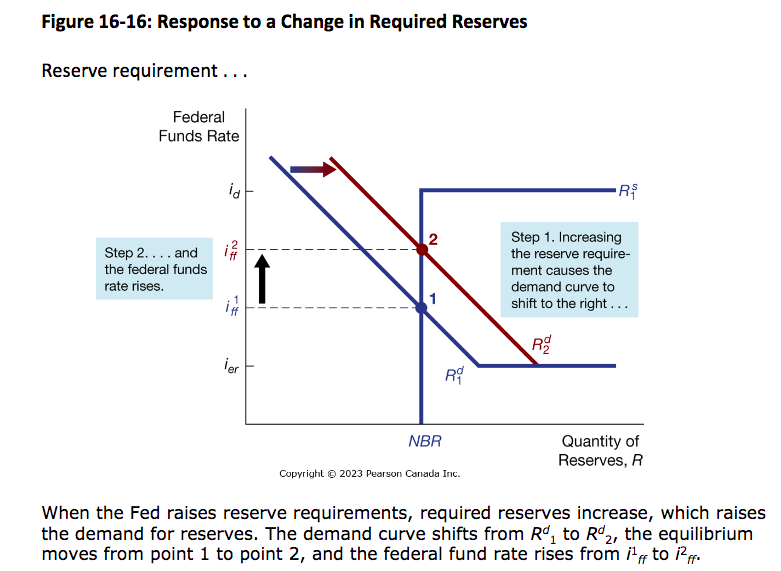

Response to a change in required reserves (US)

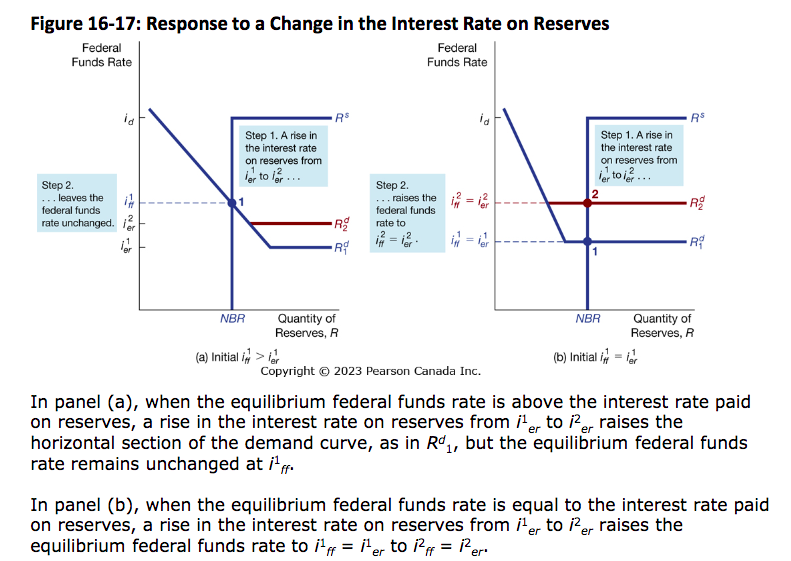

Response to a change in the interest rate on reserves (US)

How European Central Bank (ECB) signals stance of monetary policy

setting target financing rate which in turn sets a target for the overnight cash rate (interest-rate for very short term interbank loans)