3.8 Investment appraisal

What is investment appraisal?

Investment appraisal: evaluating the profitability or desirability of an investment project.

Quantitative investment appraisal requires:

- Initial capital cost of the investment

- Estimated life expectancy

- Residual value of the investment

- Forecasted net returns or net cash flows from the project

Methods of quantitative investment appraisal:

- Payback period

- Average rate of return

- Net present value using discounted cash flows

Quantitative techniques of investment appraisal

- Payback method

- Payback period: length of time it takes for the net cash inflows to pay back the original capital cost of the investment

- Average rate of return (ARR) measures the annual profitability of an investment as a percentage of the initial investment.

Higher level (discounting and net present value)

Discounting future cash flows

- Present value of a future sum of money depends on two factors:

- The higher the interest rate, the less value future cash has in today’s money.

- The longer into the future cash is received, the less value it has today.

Net present value (NPV): today’s value of the estimated cash flows resulting from an investment.

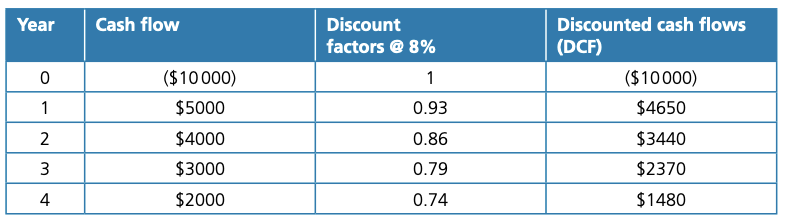

- Calculating NPV:

- Multiply discount factors by the cash flows. Cash flows in year 0 are never discounted as they are today’s values already.

- Add the discounted cash flows.

- Subtract the capital cost to give the NPV.

Example:

NPV = Total discounted cash flows - Original investment

→ $11,940 - $10,000 = $1,940

→ The project earns $1,940 in today’s money values. So, if the finance needed can be borrowed at an interest rate of 8% or less, the investment will be profitable.