TAXATION CAP 2

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

What is VAT?

Value Added Tax (VAT) is a consumption tax imposed on the value added to goods and services at each stage of production or distribution. It is typically collected by businesses on behalf of the government, which uses the revenue to fund public services. The burden of VAT lies on the final consumer.

What is an accountable person and a taxable person

An accountable person is someone who is responsible for collecting and remitting VAT to the tax authorities, while a taxable person is an individual or entity that is registered for VAT purposes and liable to pay VAT on taxable supplies of goods and services.

Why would a business voluntarily register for VAT?

A business might voluntarily register for VAT to reclaim VAT on their purchases, enhance credibility with clients, and comply with regulations if they exceed a certain turnover threshold.

What are the VAT rates in Ireland?

Ireland has three VAT rates: a standard rate of 23%, a reduced rate of 13.5%, and a zero rate of 0%. These rates apply to different categories of goods and services.

What is the rate for CAT

33%

What is Business Relief

When the taxable value of relevant business property can be reduced by 90% in computing the taxable value of the gift/inheritance taken (Section 90-101 CATCA)

How does business relief apply in the case of sole traders and partnerships

Relief applies to the value of the net assets of the business that are used for qualifying business activities. Assets not used for the purpose of qualifying business activity are excluded

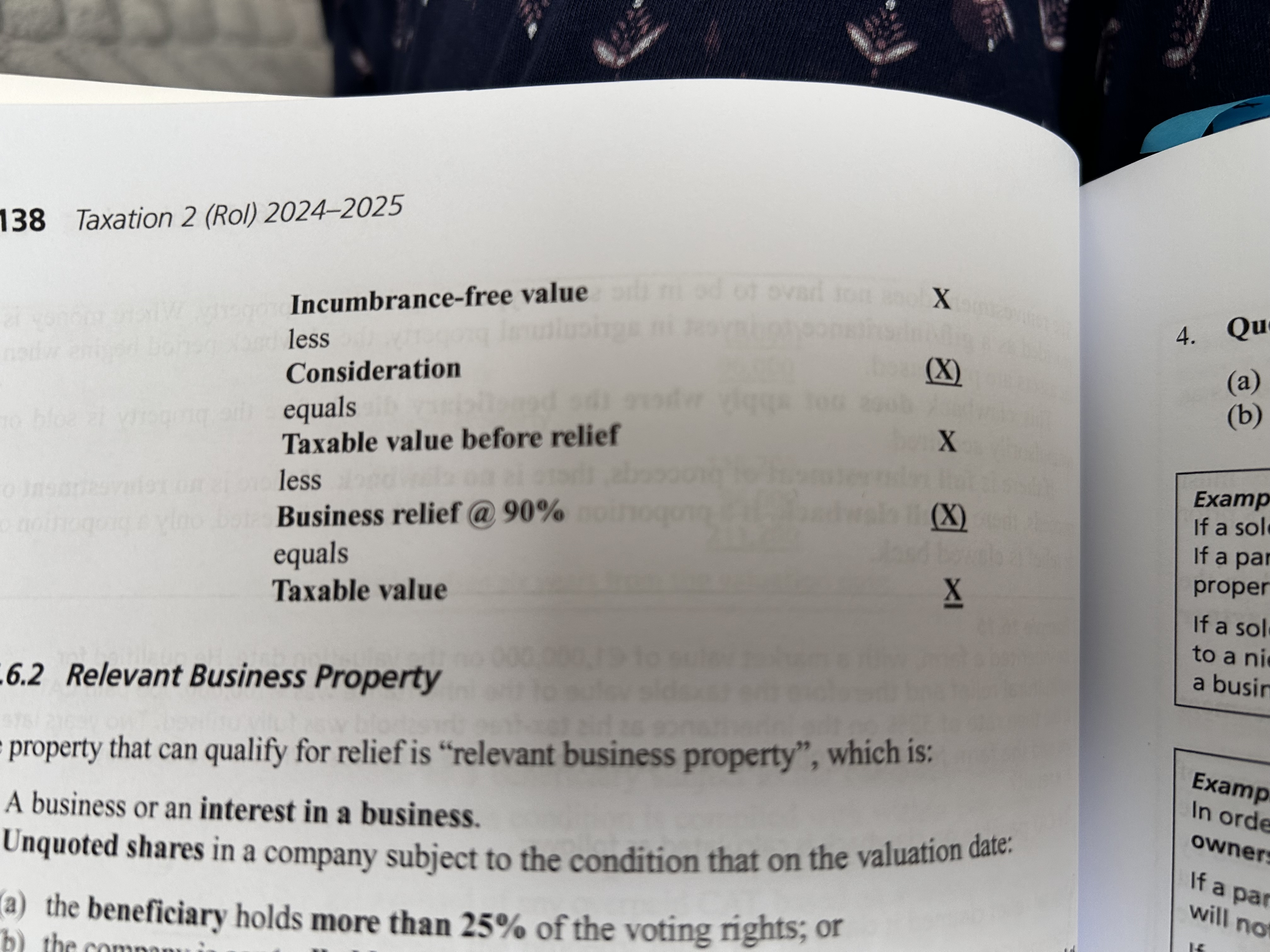

Draw up a CAT computational for then business relief applies

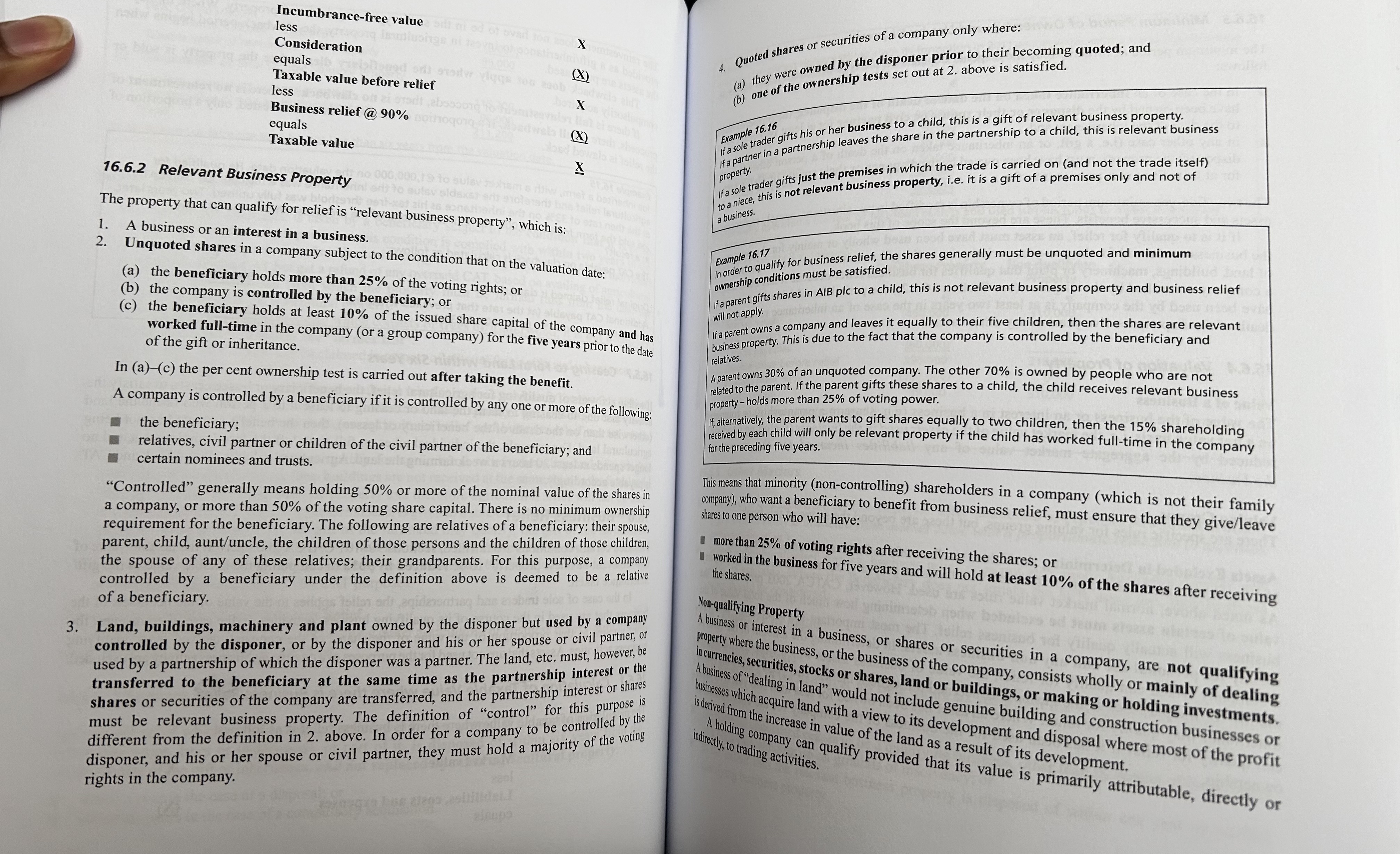

What is relevant business property for CAT business relief

What are non qualifying assets for business relief

Where the business or the business of the company consists wholly or mainly of dealing in currencies, securities, stocks or shares, land and buildings or making or holding investments (A business of ‘dealing in land’ would not include genuine building and construction businesses or businesses which acquire land with a view to its development and disposal where most of the profit is derived from the increase in value of the land as a result of its development)

What is the relief deducted from in the case of 1. Agricultural relief 2. Business relief

Agricultural relief is deducted from the market value with a proportionate reduction in expenses and consideration.

Business relief is deducted from taxable value i.e. after deduction of expenses and consideration

What is small gift exemption

An annual exemption of €3000 that applies in respect of any gift by any donee from any one disponer in a calendar year

What’s one difference between groups thresholds and small gift exemption

GT:It is a lifetime limit

SGE: applies yearly