MKT CH 17

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

84 Terms

These Objectives drive decisions about key pricing policies:

How flexible prices will be

The level of prices over the product life cycle

To whom and when discounts and allowances will be give

How temporary price reductions, financing, and transportation costs influence customer behavior

Price

The amount of money that is charged for “something” of value

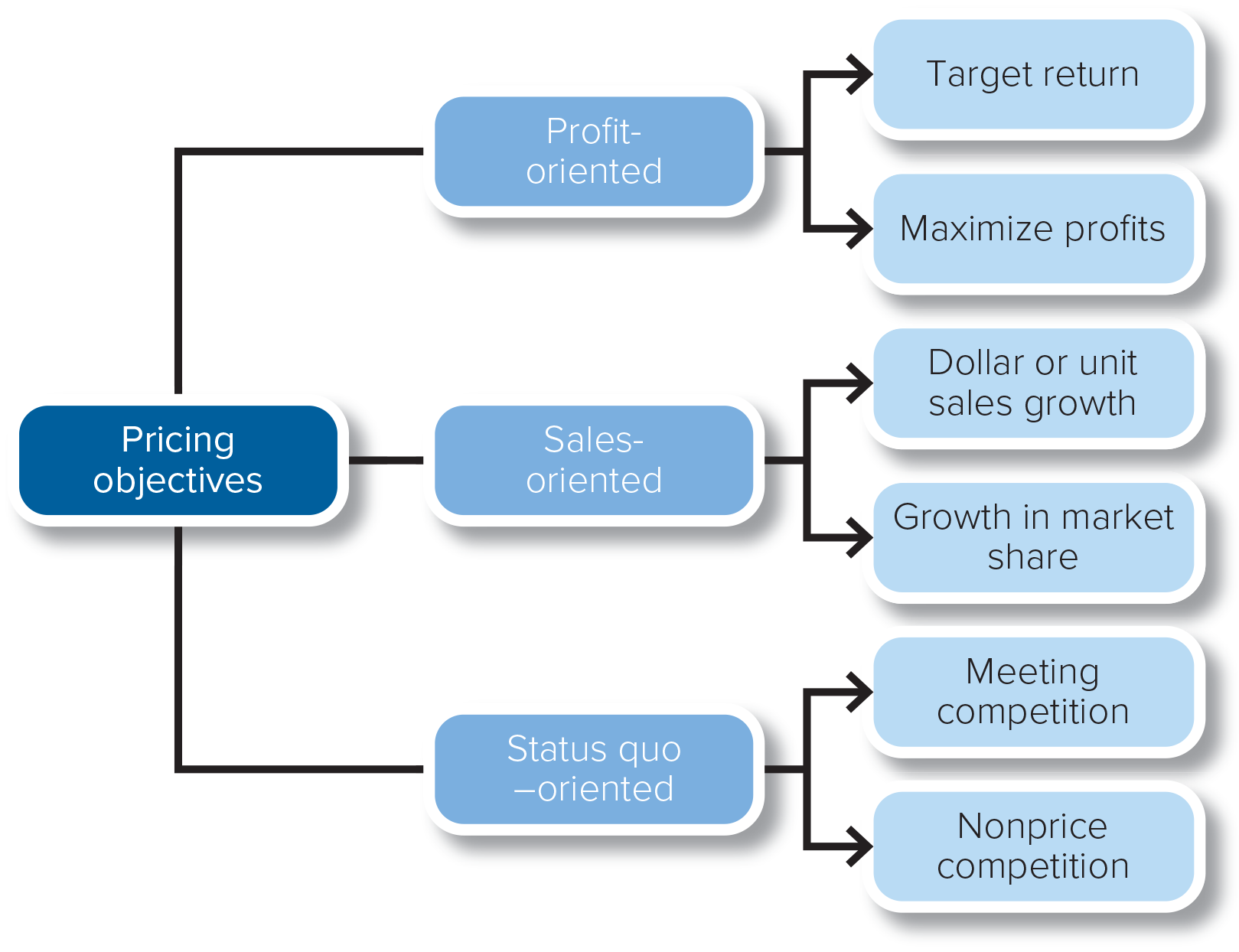

Pricing Objectives

Profit Oriented

Target Return

Maximize Profits

Sales Oriented

Dollar or Unit Sales Growth

Growth in Market Share

Status Quo Oriented

Meeting Competition

Nonprice Competition

Target Return Objective

A specific level of profit as an objective

Profit Maximization Objective

An objective to get as much profit as possible

Benefit Corporation

A legal corporate structure that allows for goals that may include positive impacts on society, employees, the community, and the environment

B Corporation Certification

A private certification that a corporation meets a high standard for social and environmental performance

Sales-Oriented Objective

An objective to get some level of unit sales, dollar sales, or share of market - without referring to profit

Sales-Oriented Objective works

over the short term

when products are in the introductory or early growth stages of the product life cycle

A company with a longer-run view may aim for

increased market share when the market is growing

A larger market share, if gained at too

low a price, may lead to profitless “success”

Status Quo Objectives

“Don’t-rock-the-pricing-boat” objectives

Managers with Status Quo Objectives may

want to stabilize prices

meet competition

avoid competition

A Status Quo Objective may be part of an aggressive overall marketing strategy focusing on Nonprice Competition

Aggressive action on one or more of the Ps other than Price

Price policies usually lead to Administered Prices

Consciously set prices aimed at reaching the firm’s objectives

If a firm doesn’t sell directly to final customers, it usually wants to

administer both the price it receives from intermediaries and the price final customers pay.

One-Price Policy

Offering the same price to all customers who purchase products under essentially the same conditions and in the same quanitites

The majority of U.S. firms use a One-Price Policy -

mainly for administrative convenience and to maintain goodwill among customers.

Flexible-Price Policy

Offering the same product and quantities to different customers at different prices

Dynamic Pricing

Pricing products at a particular customer’s perceived ability to pay

The idea of dynamic pricing is to optimize revenue and profit by

charging higher prices to customers willing to pay more & lower prices to those who don’t see value at the high price but will buy at lower prices

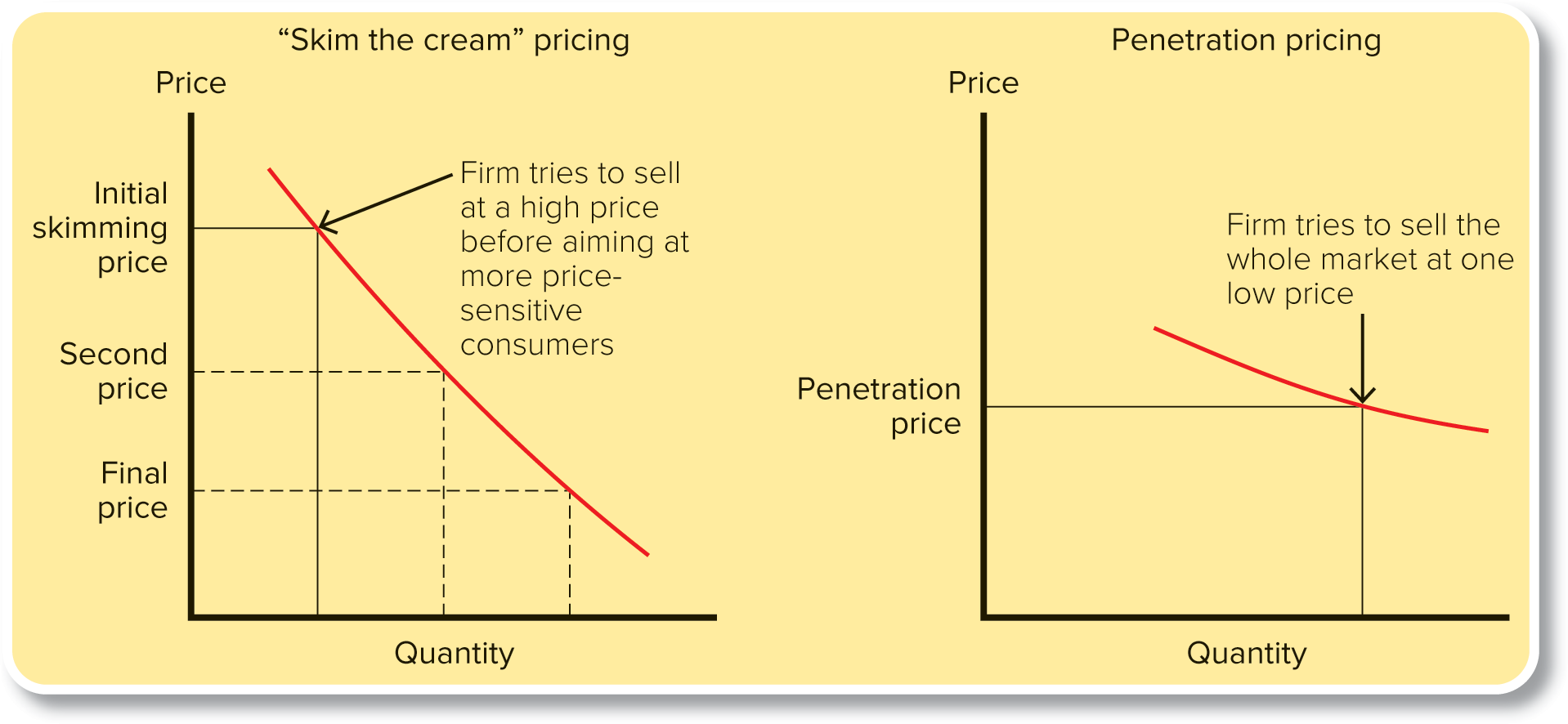

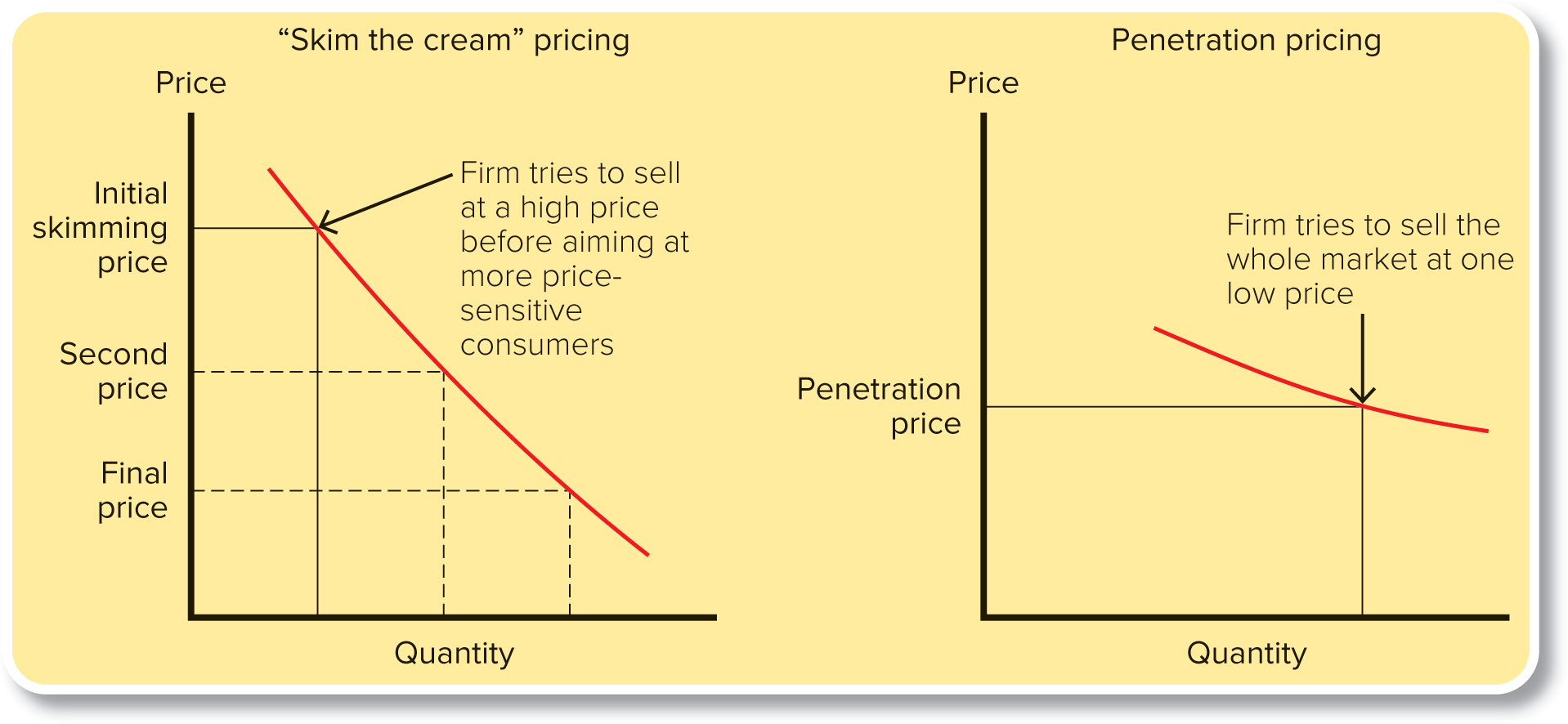

Skimming Price Policy

Trying to sell the top of the market - the top of the demand curve - at a high price before aiming at more price-sensitive customers

Skimming Price Policies may maximize profits in the

market introduction stage for an innovation, especially if there are few substitutes or if some customers aren’t price sensitive

Skimming Price Policies are useful when

you don’t know very much about the shape of the demand curve

A Skimming Policy often involves a

slow reduction in price over time

Penetration Pricing Policy

Trying to sell the whole market at one low price

A Penetration Pricing Policy might be wise when the

elite market -those willing to pay a high price - is small. This is the case when the whole demand curve is fairly elastic

Penetration Pricing may be wise if the firm expects

strong competition very soon after introduction

Introductory Price Dealing

Temporary price cuts to speed new products into a market and get customers to try them

Competition begins to impact pricing more in the

market growth and market maturity stages

In the sales decline stage,

new products come in to replace the old. Prices will likely decline in the shrinking market.

(Basic) List Prices

The prices that final customers or users are normally asked to pay for products

Discounts

Reductions from list price given by a seller to buyers who either give up some marketing function or provide the function themselves

Quantity Discounts

Discounts offered to encourage customers to buy in larger amounts

2 Kinds of Quantity Discounts

Cumulative

Noncumulative

Cumulative Quantity Discounts

Reductions in price for larger purchases over a given period, such as a year

Cumulative Discounts encourage

repeat buying by reducing the customer’s cost for additional purchases

A Cumulative Quantity Discount is often attractive to

business customers who don’t want to run up their inventory costs.

Noncumulative Quantity Discount

Reductions in price when a customer purchases a larger quantity on an individual order

Noncumulative Discounts encourage

larger orders but do not tie a buyer to the seller after that one purchase

Seasonal Discounts

Discounts offered to encourage buyers to buy earlier than present demand requires

If Seasonal Discounts are used by a manufacturer,

it tends to shift the storing function along in the channel and even out sales over the year

Service firms that face irregular demand or excess capacity often use

seasonal discounts

Net

An invoice term meaning that payment for the face value of the invoice is due immediately.

Cash Discounts

Reductions in the price to encourage buyers to pay their bills quickly

2/10, net 30

Allows a 2 percent discount off the face value of the invoice if the invoice is paid within 10 days

Trade (Functional) Discount

A list price reduction given to channel members for the job they are going to do

Allowances

Reductions in price give to final consumers, customers, or channel members for doing something or accepting less of something

Advertising Allowances

Price reductions to firms in the channel to encourage them to advertise or otherwise promote the firm’s products locally

Stocking Allowances aka Slotting Allowances

Allowances given to wholesalers or retailers to get shelf space for a product

Stocking Allowances are commonly used

to get supermarket chains to handle new products. Supermarkets are more willing to give space to a new product if the supplier will offset their handling costs and risks.

Push Money (or Prize Money) Allowances

Allowances(aka PMs or spiffs) given to retailers by manufacturers or wholesalers to pass on to the retailers’ salesclerks for aggressively selling certain items.

Push Money Allowances are used for

new items, slower-moving items, or higher-margin items. They are often used for pushing furniture, clothing, consumer electronics, and cosmetics.

Trade-in Allowance

A price reduction given for used products when similar new products are bought

Trade-ins give the marketing manager an easy way to

lower the effective price without reducing list price

Marketing managers often use different Price tactics to motivate customers to action

Temporary price reductions

Adding convenient ways to finance or pay

How transportation costs are handled

Sale Price

A temporary discount from the list price

Sale Price discounts encourage

immediate buying

In other words, to get the sale price, customers give up

the convenience of buying when they want to buy and instead buy when the seller wants to sell

Special sales provide a marketing manager with

a quick way to respond to changing market conditions without changing the basic marketing strategy

Everyday Low Pricing

Setting a low list price rather than relying on frequent sales, discounts, or allowances

A variation of targeted price reductions are Rebates -

Refunds to consumers after a purchase

Coupon and Rebates give a producer a way to certain that final consumers

actually get the price reduction

A firm might use coupons or rebates to

segment the market

Installment involves making

small payments over time - usually with interest payments built in

Mobile Payments

Payments made at the point of purchase using a mobile device

Lease

An agreement that gives a customer the right to use something for a specified period of time in exchange for regular payments

Value Pricing

Setting a fair price level for a marketing mix that really gives the target market superior customer value

In making price decisions and using value pricing, it is important to clearly define the

relevant target market and competitors when making price comparisons

The value customers perceive can be measured as price premium

that is, the percentage by which a price exceeds (or falls short of)a benchmark price

Unfair Trade Practice Acts

Legislation that puts a lower limit on prices, especially at the wholesale and retail levels

Dumping

Pricing a product sold in a foreign market below the cost of producing it or at a price lower than in its domestic market

Phony List Prices

Misleading prices that customers are shown to suggest that the price they are to pay has been discounted from list

Wheeler-Lea Act

Law that bans unfair or deceptive acts in commerce

Price Fixing

Competitors illegally getting together to raise, lower, or stabilize prices.

Robinson-Patman Act

A 1936 law that makes illegal any price discrimination if it injures competition

Price Discrimination

Injuring competition by selling the same products to different buyers at different prices

The law does permit some price differences - but they must be based on

cost differences

the need to meet competition

The Robinson-Patman Act allows a marketing manager to charge different prices for similar products if

they are not of “like grade and quality”

The FTC says that if the physical products characteristics of a product are similar,

then they are of like grade and quality

The Robinson-Patman Act allows price differences if there are

cost differences - say, for larger-quantity shipments or because intermediaries take over some of the physical distribution functions

Under the Robinson-Patman Act, meeting a competitor’s price is permitted as

a defense in price discrimination cases

Some firms violate the Robinson-Patman Act by

providing push money, advertising allowances, and other promotion aids to some customers and not others.

The Robinson Patman Act prohibits such special allowances, unless

they are made available to all customers on “proportionately equal” terms