12 Economics - Unit 3.1

1/54

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

55 Terms

Closed Economy

If the economy does not engage with the foreign sector

Open Economy

When an economy opens itself up to international trade through engaging with the foreign sector

Factor Endowment

The supply of the factors of production that exist within a country.

Exchange Rate

The value of the currency of a nation expressed in terms of the currency of another nation.

Standard of Living

A measure of lifestyle standards based on material and quantitative indicators.

Absolute Advantage

The ability of a nation to produce commodities more efficiently than another nation. A term coined by Adam Smith in his book, the Wealth of Nations.

Assumptions of PPC’s representing Absolute Advantage

Resources are perfectly mobile

There are only two countires and two commodities

Both countires ahve equal quantities of resources, but not the same quality

If trade takes place there are no transfer costs

Comparative Advantage

The ability of a nation to produce a product at a lower opportunity cost of production than another nation. - Coined by David Ricardo

Competitive Advantage

Trade advantage obtained through the capacity of a nations industries to innovate and upgrade. - Coined by Michael Porter in 1990

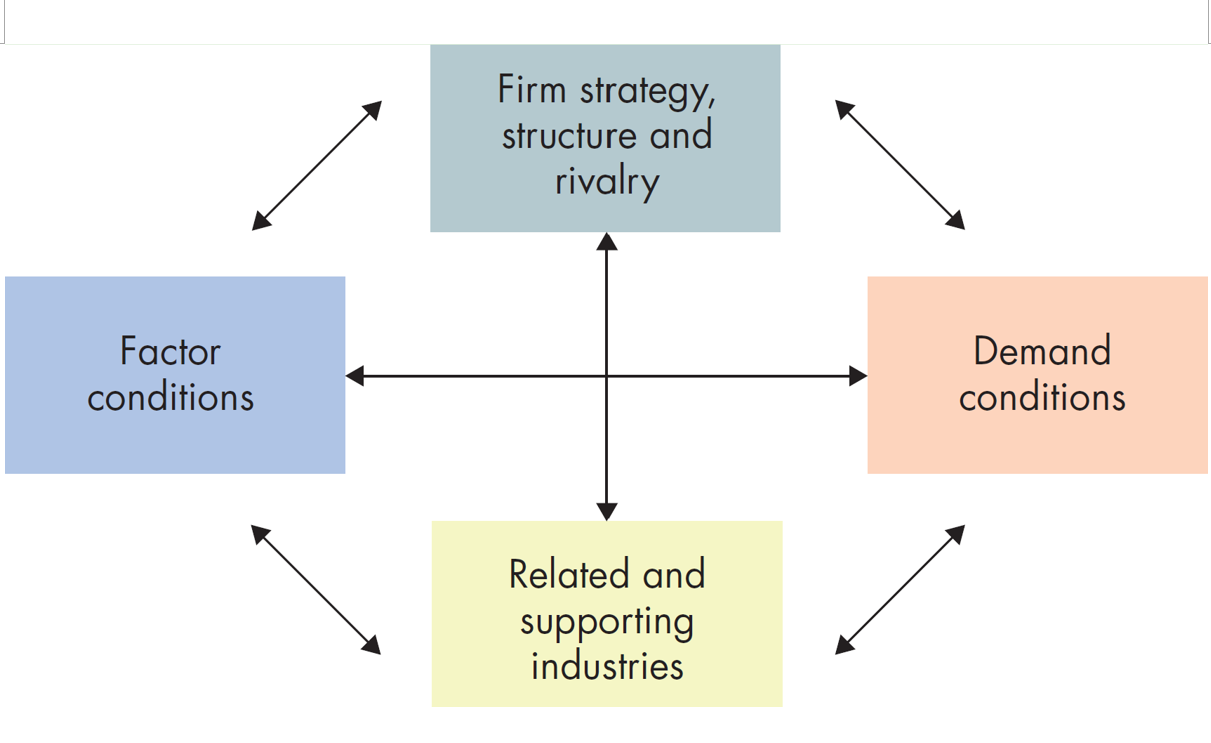

Factor Conditions of Competitive Advantage

The nation must have an advantage in factors of production. They can be created through investment for infrastructure and highly specialised training of the workforce

Demand Conditions

The nation can benefit from having a clear view of consumer demand by first developing a domestic market to help anticipate international market needs.

Related and Supporting Industries

A nation can gain an advantage by having efficient and internationally competitive supplier industries.

Firm Structure, Strategy, and Rivalry

Conditions governing company creation, organisation and management, and domestic rivalry need to be disciplined, flexible and supportive of innovation.

Self-Sufficiency

Refers to the ability of a nation to produce sufficient products to meet its own needs for domestic sources.

Exchange Rate

The value of the currency of a nation expressed in terms of the currency of another nation.

Law of one price

Identical goods should have the same price in different markets when adjusted for currency exchange rates and transport costs.

Purchasing Power Parity

Exchange rates should eventually adjust so that an identical basket of goods and services costs the same in any two countries.

Currency Appreciation

An increase in the value of a currency relative to other currencies under a floating exchange regime.

Currency Depreciation

A decrease in the value of a currency relative to other currencies under a floating exchange regime.

Fixed Exchange Rate

The value of a currency that is determined by the government fixing it to the value of another currency at a certain level, and guaranteeing to maintain it at that level.

Floating Exchange Rate

The value of a currency determined by the forces of supply and demand in the foreign market.

Managed Exchange Rate

A floating rate with some government intervention in currency value to keep it in a certain range.

Currency Revaluation

A deliberate upward adjustment to the value of country’s currency relative to the value of a country’s currency.

Currency Devaluation

A deliberate downward adjustment to the value of country’s currency relative to the value of a country’s currency.

Money Supply

Represents the amount of money in circulation at a given time.

Determinants of Demand - Exchange Rates

Exports of goods and services

Incomes received

Capital inflow - referring to Foreign Direct Investment (FDI)

Speculation - People who purchase currency as an investment

Determinants of Suppy

Speculation - People who purchase currency as an investment

Capital outflow

Incomes payable

Imports of goods and services

When representing supply on an exchange rate demand and supply graph…

It is not a representation of how much money exists, but rather how willing the different people who own the currency are to sell it.

Porter’s diamond

The Balance of Payments

The summary of a nation’s payments to, and receipts from, the rest of the world over a year.

The Current Account

The record of day-to-day financial transactions involving the trade of goods and services between a nation and the rest of the world

Balance of Trade

Is the difference between the value of imports and the value of exports. Formula = Total Value of Exports - Total value of Imports

Terms of Trade

The ratio of export prices to import prices. Formula = (Index of Export Prices / Index of Import Prices) x 100.

Sub Accounts within the Current Account

The balance of trade.

Net primary income - earnings derived from our foreign investments or paid to foreigners for their investment in Australia.

Net current transfers - movement of funds in which there is no reciprocal activity, e.g. migration, foreign aid, insurance payments.

The Capital Account

A record that includes capital transfers and the acquisition / disposal of non-produced, non-financial assets between residents and non-residents.

The Financial Account

Tracks transactions and financial assets and liabilities between economic entities.

Direct Investment

Transaction s related to long-term capital investment in a business where the investor has significant voting power in the business.

Portfolio Investment

The purchase of equity or debt in a business. In contrast to direct investment, portfolio investment occurs when the investor does not have an influence in the operation of the business.

Financial Derivatives

The purchase or sale of financial derivatives. These transactions involve the exchange of risk between parties, rather than funds.

Reserve Assets

The purchases or sale of reserve assets held by the Reserve Bank. These reserves are assets controlled by the Reserve Bank to meet policy objectives such as intervention in the foreign exchange market and to assist the Australian Government in Meeting its commitments to the IMF.

Other investments

Transactions that do not fit into any one of the Financial Account categories.

Double Entry Accounting

The current account minus the capital and financial accounts should equal 0.

Credits

Payments received by a nation from the rest of the world.

Debits

Payments by a nation to the rest of the world.

Intra-Industry Trade

When countries trade similar / the same good.

Intra-Company Trade

Trade between affiliates of the one organisation; for example, between a home-based subsidiary and a foreign-based subsidiary of the same company.

Transfer Price

The price charged for goods by one subsidiary of a multinational corporation to another subsidiary of the same company in another company.

Value of FDI

Economic Growth and Employment

Productive Capacity

Technological Advancement

Foreign Exchange Access

Market Access.

Problems of FDI

Loss of Ownership and Control

Increased External Debt and Servicing Costs

Profit Repatriation

Foreign Investment Review Board (FIRB)

Established in 1976. Acts as an advisory body to the Treasurer and the government on Australia’s foreign investment policy.

The FIRB has three main functions:

To examine investment proposals

To provide advice regarding policy on foreign investment

To foster awareness and understanding of foreign investment

Foreign Debt

A debt owned by a nation to the rest of the world

Gross Foreign Debt

The total of Australia’s overseas borrowings (what we owe)

Net Foreign Debts

Gross foreign debt less Australian lending to overseas residents (what we owe minus what we are owed).

Private Foreign Debt

The part of debt owed by private residence

Public Foreign Debt

The part of debt owed by the government.