Market failure & government intervention 1.3&1.4

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

Market failure

when the market fails to allocate scarce resources effectively

causing a loss in social welfare loss

Externalities

the cost or benefit a third party receives from an economic transaction outside of the market mechanism

cigarettes

education

Under provision of public goods

public goods are non rivalry and non excludable

meaning they are underprovided by the private sector due to the freerider problem

street lights

Information gaps

when a buyer or seller doesnt have the full information they need to make a fully informed decision

private costs/benefits

the cost/benefits to the individual participating in the economic activity

private benefits= demand

private costs= supply

social costs/benefits

the costs/benefits of the activity to society as a whole

external costs/ benefit

costs/benefits to a third party not involved in the economic activity

what is a merit good

A good with external benefits

underprovided in he free market

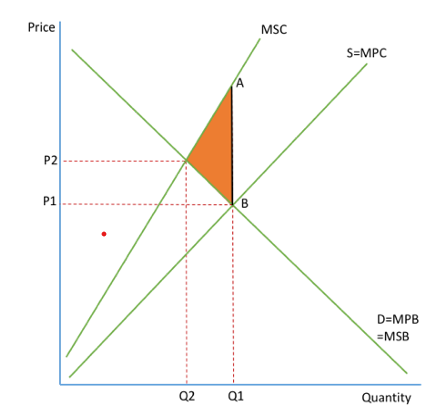

Negative production externalities

occurs when social costs are greater then private costs

market left to operate freely will ignore the external costs involved in producing a good

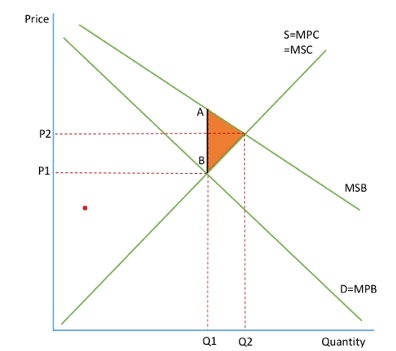

Positive consumption externalities

social benefits are greater then social costs

market is left to its own devices, will produce where MPB=MPC

wont consider the benefits to society so will produce Q1P2

misallocation of resources so there is an under production

healthcare and education

Many externalities are involved with information gaps as people are aware of full implications of their decisions

Government intervention

Governments can intervene to ensure the market considers the external costs and benefits

indirect taxes and subsidies

tradeable pollution permits

provision of the good

provision of information

regualation

Public goods

missing from the free market but offer benefits to society

non rivalry

non excludable

free rider problem

you cannot charge an individual a price for the provision of a non excludable good

a free rider is someone who receives the benefits without paying for it

Private sector producers will not provide public goods to people because they cannot be sure of making a profit

the market would fail and so they are provided by the government and financed through taxation

Symmetrical information

occurs when buyers and sellers have potential ccess to the same information

perfect information

Asymmetric information

when one party has superior knowledge compare to another

usually the seller has more information than the buyer and this means they can take advantage of the other party’s lack of knowledge

what information gaps lead to

market failure

there is a misallocation of resources because people do not buy things that maximise their welfare

consumer demand for a good or producer supply of a good may be too high or too low

economic agents are unable to make rational decisions

eg drugs

government use of indirect taxation

to prevent market failure

fall in supply and increase the costs to individuals

advantages of indirect tax

It internalises the externality- market now produces at the social equilibrium position and social welfare is maximised

raises government revenue- could be used to solve the externality in other ways eg education, may help goods become more elastic

disadvantages of indirect tax

difficult to know the size of the extenality so difficult to target the tax- depends on where the tax is set- government suffers from imperfect information where setting the tax

conflict between gov goal of raising revenue and solving the externality

creation of black market

government use of subsidies

in order to fix information gaps

shift supply curve right- lower cost of production

social welfare is maximised

advantages of subsidies

society reaches the social optimum output and welfare is maximised

encourage small businesses, bring abt equality

disadvantages of subsidies

high opportunity costs

difficult to target

producers can become inefficient

subsidies are difficult to remove

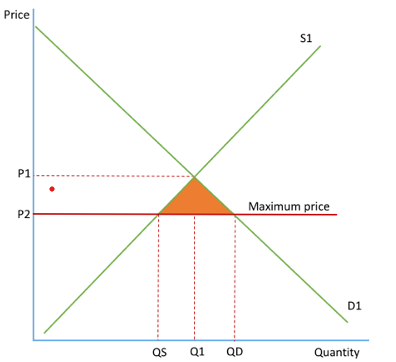

Maximum prices

must be set below current price equilibrium

a legally imposed price for a good that the suppliers cannot charge above

set on good with positive externalities

prevent monopolies from exploiting customers

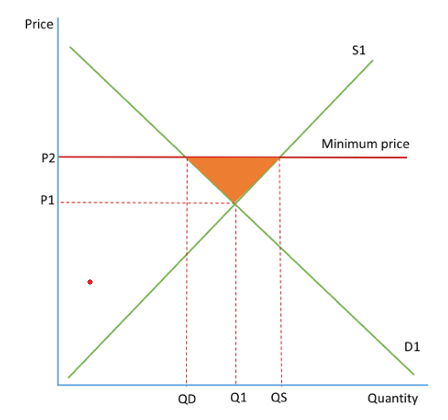

Minimum prices

must be set above current price equilibrium

a legally imposed price at which the price of the good cannot go below

set on goods with negative externalities, the price is raised to the social optimum point and consumption is discouraged

encourage producers to produce goods so can be set on goods with social benefits that are underprovided by the market

advantages of minimum and maximum prices

they can be set where MSB=MSC so allow for soe consideration of externalities and so help to increase social welfare

maximum price- will ensure that goods are affordable

minimum price will ensure that poducers get a fair price

both reduce poverty and increase quality

disadvantages of minimum and maximum prices

is a distortion of price signals and this causes excess supply/demand

excess demand will lead to questions about how to allocate goods and excess supply will lead to questions about what to do with the surplus goods

difficult for the government to know where to set the price

can lead to the creation of the black market

tradable pollution permits

allows the owner to pollute up to a specific amount of pollution and the gov controls how many permits there are so limits the maximum amount of pollution

companies have to buy permits in order to pollute- companies may use greener technology

incentive to cut emissions so maximise profits

advantages of tradeable permits

guaranteed that pollution will fall- maximise social welfare

government raise revenue

encourage efficiency

Disadvantages of tradeable pollution permits

can be expensive to monitor and police

will raise costs for business- higher costs will be past onto consumers

difficult to know how many permits the government should allow

advantages of public goods

corrects market failure by providing important goods with otherwise would not be provided

helps bring abt equality- ensuring everyone has access to basic goods

benefits for the goods them self

disadvantages of public goods

expensive and represents a high opportunity cost for the government

the government may produce combination of goods as consumers can not indicate their prefernece

government may be inefficient as they have no incentive to cut costs

government officials may suffer from corruption and conflicting objectives

eg NHS suffer from severe underfunding

Provision of information

government provides information to allow people to make informed decision

advantages of provision of information

helps consumers act rationally

can make demand more elastic in the long run and so help indirect taxes to become more effective at reducing output

disadvantages of provision of information

can be expensive for the government to do, incurring an opportunity cost

consumers may not listen to the information provided due to irrational behaviour

regulation

governments are able to to impose laws and caps to ensure that levels are set where MSB=MSC or to ensure that companies provide full information on products

ensures firms follow regulation and do not exploit their costumers or take advantage of market position

advantages of regulation

can ensure consideration of externalities, prevent exploitation of consumers and keep consumers fully informed

help to overcome market failure and maximise social welfare

disadvantages of regulation

laws may be expensive for government to monitor- incurring to opportunity cost

dont take into account the different costs of following the laws for different companies

firms may pass on costs to consumers in the form of higher prices

government failure

is when government intervention in the market leads to net welfare loss and a misallocation of resources

the total social costs arising from the intervention are greater than the social benefit

distortion of price signals

some types of gov intervention change price signals in the market and distort the free market mechanism

as a result they keep some companies n business when they are inefficient so the resources should be switched to somewhere else or make consumers pay too much for a good (taxes)

by intervening the gov distorts the mechanism and so resources may be allocated inefficiently

unintended consequences

cause effects which the government did not intend to happen

consumers and producers may react to new policies in unexpected ways and so the policy doesnt have the effect it should

eg the buffer stock scheme in the EU- lead to overproduction and fall in agricultural prices

excessive administration costs

a lot of money that is allocated by the government is actually used up on basic administration costs

the social costs may be higher than social benefits once administration costs are taken into account

governments causing information gaps

it is impractical and impossible for the government to get every piece of information they need