mmw finals

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

Lender

person or institution who invests the money or makes the funds available

or creditor

Borrower

person or institution who owes the money or avails of the funds from the lender.

or debtor

Origin

Date on which money is received by the borrower.

or loan date

Repayment

Date on which the money borrowed, or leaned is to be completely repaid.

or maturity date

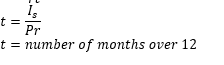

Time (T)

amount of time in years the money is borrowed or invested; length of time between the origin and maturity dates.

or term

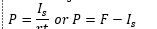

Principal (P)

Amount of money borrowed or invested on the origin date.

Rate (r)

Annual rate, usually in percent, charged by the lender, or rate of increase of the investment.

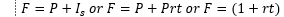

Interest (I)

Amount paid or earned for the use of money.

Simple Interest (SI)

Interest that is computed on the principal and added to it

Compound Interest (CI)

Interest is computed on the principal and also on the accumulated past interests.

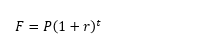

Maturity Value or Future Value (F)

Amount after t years that the lender receives from the borrower on the maturity date.

Simple Interest

the interest charged on the principal alone for the entire duration or period t of the loan or investment, at a particular rate r. After the term of the loan or investment, the maturity value or future value F is computed by getting the sum of the principal and the interest due.

Time Formula

Principal Formula

Maturity Value

Interest Formula

Maturity Value