The Meaning of Interest Rates (Chapter 4)

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

11 Terms

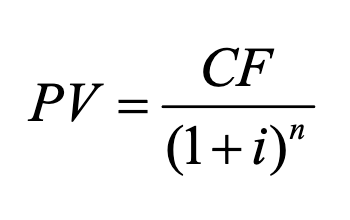

Present value of a simple loan

The current value of a future sum of money or stream of cash flow given a specified rate of return

Net present value

The difference between the present value of cash inflows and the present value of cash outflows over a period of time

Yield to Maturity

The interest rate that equates the present value of all cash flow payments received from a debt instrument with its value today (price)

Relationship between price of a coupon bond and ytm

When P = FV, YTM = coupon rate

P and YTM are negatively related

YTM > coupon rate when P < FV

YTM on a consol/perpetuity

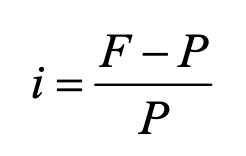

YTM on a discount bond

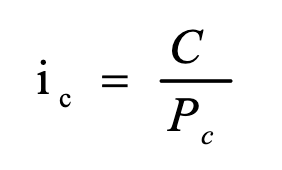

Coupon rate

coupon payment / FV

Current yield

annual coupons / current bond price

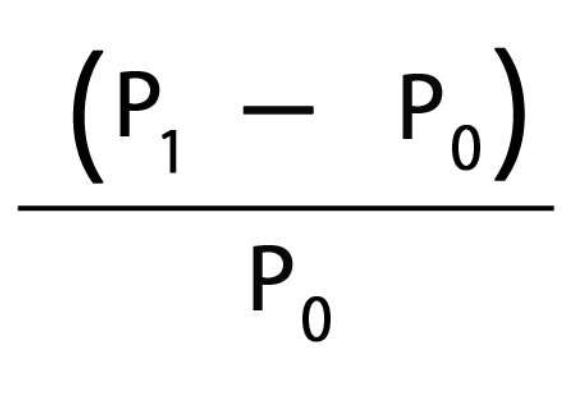

Capital Gains Yield

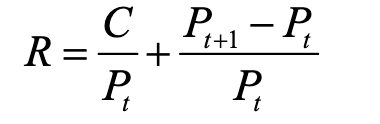

Rate of Return

current yield + rate of capital gain

Relationship between interest rates and returns

Return = YTM only if the holding period = time to maturity

Rise in interest rates → fall in bond prices → capital loss IF time to maturity > holding period

The more distant a bond’s maturity, the greater the size of the % price change associated with % interest change

The more distant a bond’s maturity, the lower the rate of return that occurs as a result of an increase in the interest rate

Even if a bond has a substantial initial interest rate, its return can be negative if interest rates rise