Profitability ratio

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

Profitability ratio

Ratio analysis involves extracting information from financial accounts to assess business performance and answer key questions including

Why is one business more profitable than another in the same industry?

Is a business growing?

How effectively is a business using assets and capital invested?

What returns on investment are expected?

How risky is the financial structure of the business?

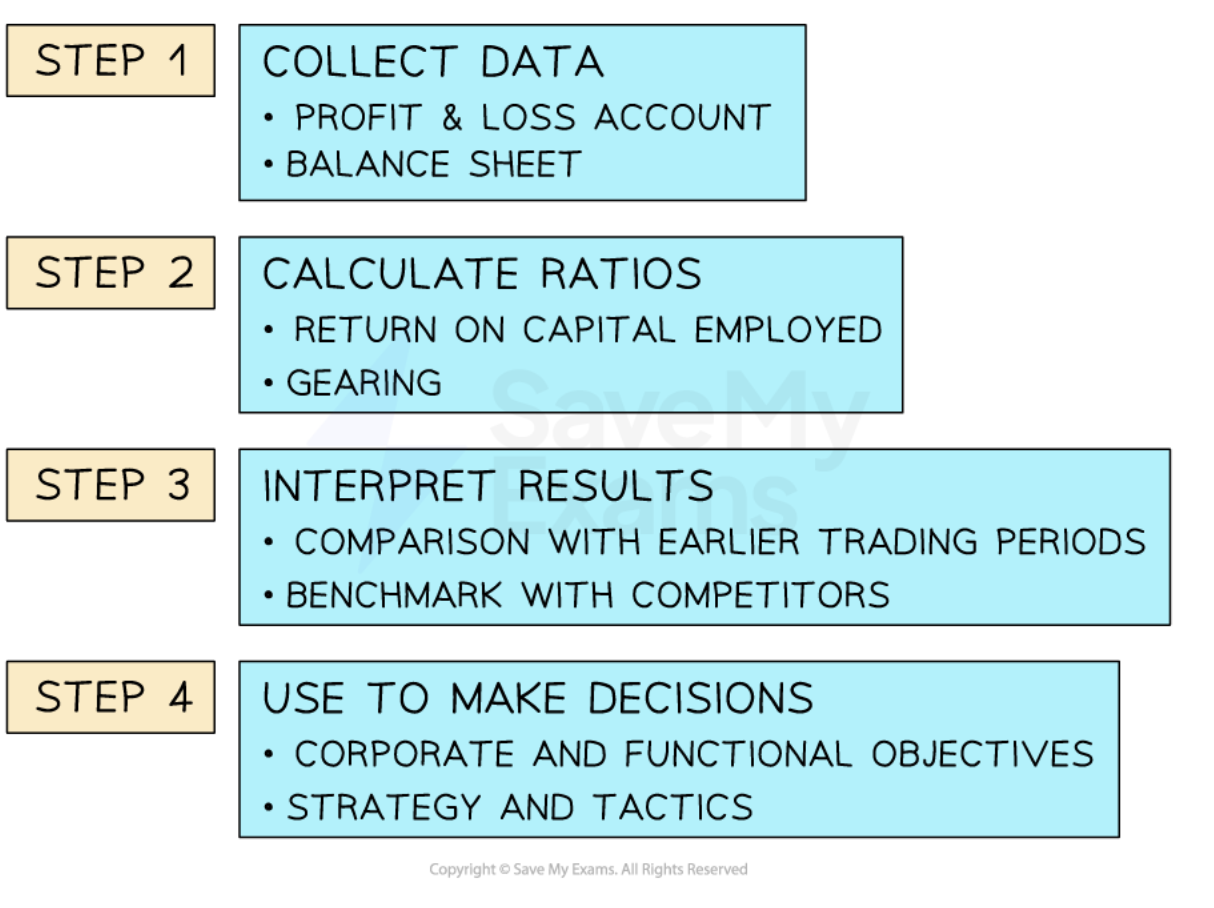

ratio analysis process

three main profitability ratios are

The Gross Profit Margin

The Profit Margin

Return on Capital Employed (RoCE)

Profit Margins

A profit margin measures the proportion of revenue that is converted into profit

Profit margins can be compared to previous years to better understand business performance

Higher and increasing profit margins are preferable, as it means that more revenue is being converted to profit

Gross profit margin

This shows the proportion of revenue that is turned into gross profit and is expressed as a percentage

(Gross profit / sales revenue) x 100

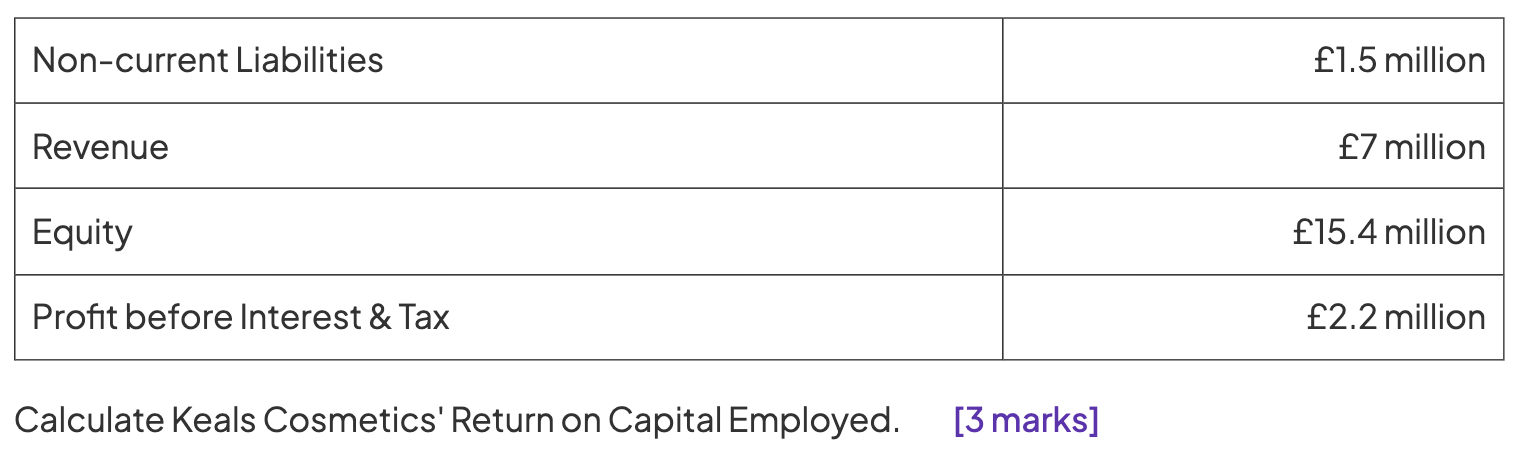

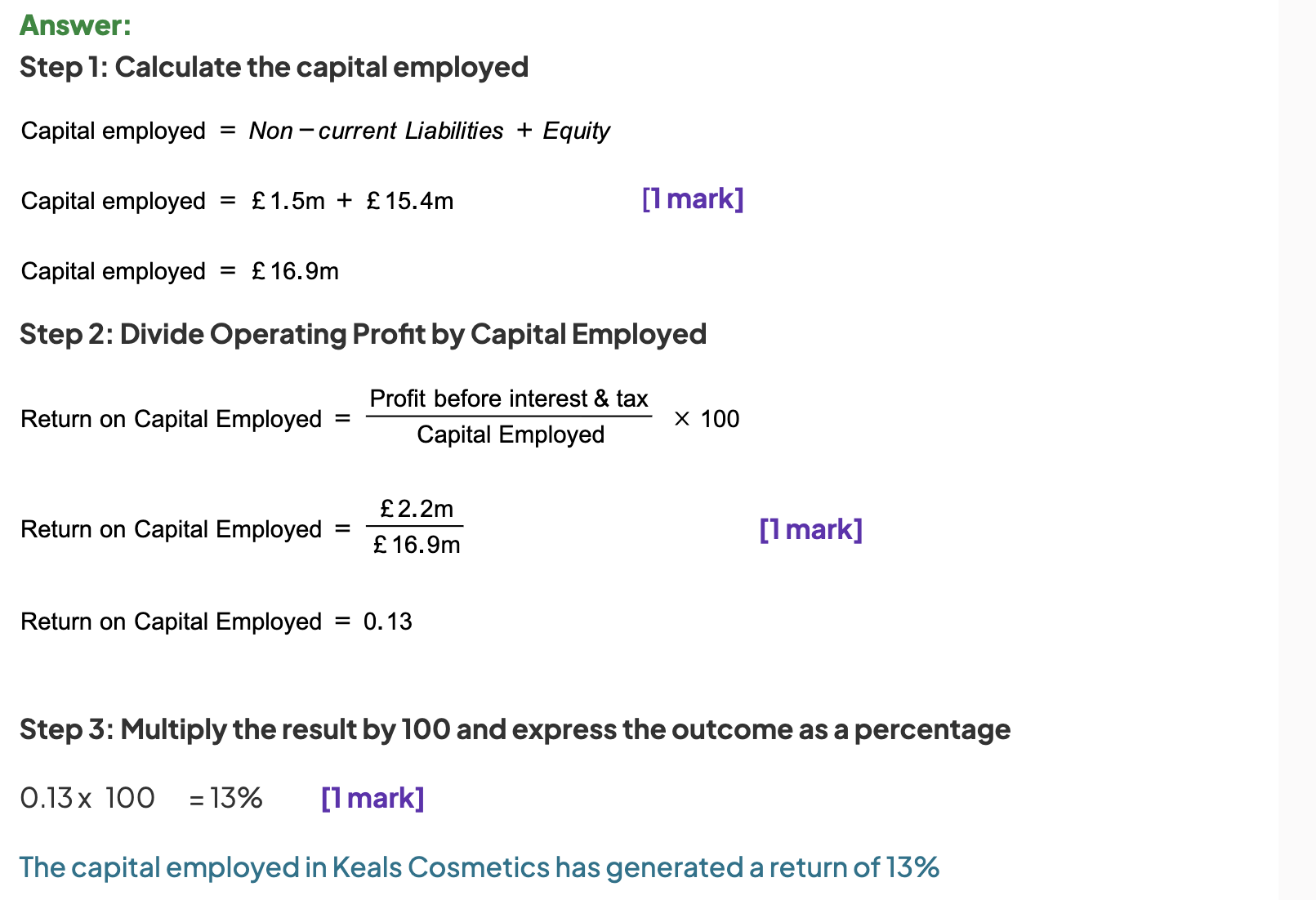

Return on Capital Employed

It compares the profit made by a business to the amount of capital invested in the business

It is a measure how effectively a business uses the capital invested in the business to generate profit

Return on Capital Employed is a key performance indicator that can be compared over time and also with competitors and other potential capital investments

Return on Capital Employed is expressed as a percentage and can be calculated using the formula (profit before interest and tax) / capital employed x 100

capital employed

non-current liabilities + equity

Improving Profitability Ratios

Businesses aim to improve their profit margins over time

Whilst profit margins may fall as a result of external factors (for example, the cost of raw materials may rise as a result of poor weather damaging raw materials) there are a number of internal steps a business can take to improve its profit margins

Improving the gross profit margin

They can increase their sales revenue

They can reduce their direct costs