Business management unit 3

1/96

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

97 Terms

The role of finance

finance is needed for starting up a new business, for day to day operations, growth, and to expand the business

Why do firms need capital

To start a business

Day-to-day operations

Growth and expansion

Capital expenditure

Spending on items lasting more than a year

Fixed assests- machinery, land, equipment

Long-term investments

used collateral

Examples- Machinery, technology, vehicles

Revenue expenditure

Revenue expenditure is spending on goods and services that a business uses in the short-term

Money on day to day activities

Examples- Rent, wages, raw materials, insurance, fuel

Otherwise, in the long run a business would be unable to grow and continue operating

internal sources of finance

personal funds- personal savings of owners and risk for owners

Retained profits- Value of profit kept by the business after paying off the tax, interest, and dividends (to the shareholders) to use within the business

Often used for purchasing and/or upgrading fixed assets which will increase returns

advantages- cheap, permanent source, flexible, controlled by owners

Disadvantages- start ups are rarely profitable at first, might be insufficient for expansion, might be used up

Sale of assests- Businesses can sell their unused assets, such as selling old machinery and computer equipments that have been replaced

advantages- no interest or borrowing costs

disadvantage- available to established businesses only

External sources of finance

share capital- money raised from selling shares in a company

Loan

Overdrafts

Grants

Debt factoring

Trade credit- payment made a later stage agreed upon between seller and buyer

Leasing- the lessee pays rental income to hire assets from the lessor, who is the legal owner of the assets.

venture capital- a form of high-risk capital, usually in the form of loans or shares, invested by venture capital firms, usually at the start of a business idea

overdrafts

When a lending institution allows a firm to withdraw more money than it currently has in its account

grants

Funds usually provided by a government, foundation, trust, or other agency to businesses which does not need to be repaid.

subsidies

Financial Assistance granted by a government, NGO, or an individual to support businesses that are in the public interest

loan

Money sourced from financial institutions such as banks, with interest charged on the loan to be repaid

debt factoring

a business sells its invoice to a third party

short-term finance

Day to day running of business

one year or less

examples- overdrafts, trade crediting, debt factoring

medium- term finance

1-5 years

equipment, machinery, vehicles

examples - leasing, grants, loans

long-term finance

expansion of business

5-30 years

examples - loans, share capital

fixed cost

costs of production which have to be paid regardless of output level

Examples- rent, interests, lease payments

independent of output level

semi-variable cost

An element of both fixed and variable costs

Changes when production exceeds a certain level of output

variable cost

cost of production which change in proportion to output level

Examples- raw materials, packaging

direct cost

related to an individual product or to the output of a specific product

Indirect costs

cannot be traced directly to the output of a product

sales volume

the number of products sold

sales revenue = price * quantity

revenue stream

Revenue streams are the sources of revenues or incomes for a company or a business

Firms utilising different sources/methods to generate income

revenue streams examples

Advertising revenue: this is when an organisation is offering advertising space and charges other organisations for posting ads in this space

Royalties/franchisor: royalty payments are made to artists for the use of their artworks or to franchisors for the use of franchise

Sponsorship deals: the way it usually works is sponsor gives you financial support in exchange for an extra advertising space and publicity.

Subscriptions: use or access goods or services

Merchandise: in addition to the main trading activity, some organisations sell their souvenirs or clothes to get extra revenues

Dividends: companies that own stock/shares within another business can also get dividends

Donations: charities and non-profit

Interest earnings: on cash deposits in banks

Subversions: Government subsidies- aimed at benefiting society

wholesale market

a market where a trader buys goods from a manufacturer in bulk and re-sells the goods to business houses or retailers to further sell the goods to end consumers

Venture Capital

Financial capital proved by investors to high-risk, high potential start ups or small businesses.

Business Angels

Highly affluent individuals who provide financial capital to small startups in return for ownership in their business.

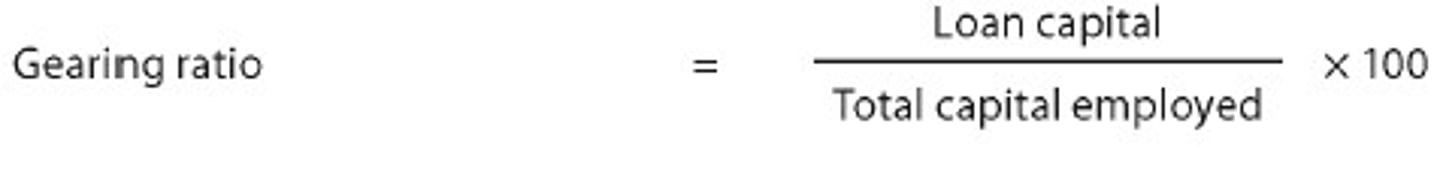

High Geared

Large proportion of loan capital to share capital

Low Geared

Small proportion of loan capital to share capital

Cost

The total expenditure incurred by a business in order to run its operations

Revenue

Measure of the money generated from the sale of goods/services

Contribution

sum of money that remains after all direct and variable costs have been taken away from sales revenue

Contribution Per Unit

Refers to the difference between the selling price per unit and the variable costs

Margin of Safety

The difference between the firm’s sales and the break-even quantity

Target Profit Output (TPO)

The level of output that is needed to earn a specified amount of profit

Trading Account

Shows the difference between the sales revenue and the cost of goods sold

Profit and Loss Account

Second part of the income statement that shows the net profit before interest and tax, net profit before tax, and net profit after interest

Appropriation Account

final part of the profit/loss account that shows how the company's net profit after interest and tax is distributed

Gross Profit

profit made by a company (sales revenue - cost of goods sold)

how to improve gross profit

lower costs

increase sales

net profit

the profit after all expenses are subtracted from the total revenue

Dividends

A sum of the money paid to shareholders which is decided by the board of directors

Stock

unsold goods, raw materials or work-in-progress that the company has in hand at the end of the trading period

Opening Stock

the quantity of goods produced/owned by the business that are unsold in the previous accounting period

Closing Stock

the quantity of goods produced/owned by the business after sales at the close of the accounting period such as a year

Balance Sheet

a statement of the financial position of a business in terms of assets, liabilities and owner's equity at a particular point in time

Assets

all items of value that are owned by the firm, such as cash or buildings

Fixed Assets

Long-term assets that last in a business for more than 12 months (Ex. vehicles, buildings, and machinery)

Current Assets

Short-term assets that last in a business for up to 12 months (Ex. Cash, debtors, stock)

Liabilities

all funds owed by the company to financial and other institutions, such as banks and suppliers

Long-term liabilities

Long-term debts payable after 12 months by the business (Ex. Mortgages)

Current Liabilities

Short-term debts that are payable within 12 months (Ex. creditors, tax, overdraft)

Working Capital

(Net current assets) Helps establish whether a firm can pay its day-to-day running costs

Equity

shows the value of the business attributable to its owners

intangible assets

Non-physical fixed assets that have the ability to earn revenue for a business

Debtors

people who owe money

Creditors

People who lend money

Patents

exclusive rights to make or sell inventions

Goodwill

the value of all favorable attributes that relate to a company

Copyright Laws

laws that provide creators with the exclusive right to protect the production and sale of their artistic or literary work

Trademarks

Recognizable symbol, word, phrase, or design that is officially registered and identifies a product or business

Depreciation

the decline in the value of fixed assets over time mainly due to usage and newer models or better technologies being available

Obsolescence

state of being no longer useful or in fashion

Straight-line method

Spreads out the cost of an asset equally over its lifetime by deducting a given constant amount of depreciation

Reducing Balance Method

the value of the asset depreciates by a predetermined percentage for the duration of its life

more realistic

Residual Value

the estimated value of a fixed asset at the end of its useful life

Ratio Analysis

Financial management tool for analysing and judging the performance of a business

Profitability Ratios

show a company's overall efficiency, performance and financial position

liquidity ratio

ability of firm to pay its short-term liabilities

current ratio

looks at whether a company can pay/cover its short-term debts

current assets/current liabilities

acid test (quick) ratio

similar to current ratio but ignores stocks

cash

cash-

held by hand

deposited in bank account

role of cash-

business need cash to sustain itself

inability to pay suppliers, employees or creditors would a successful business into bankruptcy

profit

profit-

difference between total sales revenue and costs

any sales beyond- lead to a profit

purchases made can be through a cheque, cash, on credit (Buy now pay later)

credit option-

enables customers to buy right away

might result in cashflow problems for the business

short-term liquidity problems

occur due to-

poor credit control

expanding too quickly

hence cashflow management is key

working capital cycle

the delay between cash receipts from customers and cash payments to supplier

working capital cycle cont’d

working capital- The cash or liquid assets available for the daily running of a business

used to pay suppliers, employees, creditors

liquidity- how easily an asset available could be turned into cash

insolvency- working capital insufficient to meet current liabilities

liquidation- selling off of a business

creditors take legal action against the business to recover their money

working capital=current asset-current liabilities

current asset

the liquid resources, which could be converted into cash within a year

cash

Debtors

stock

current liabilities

money owed which needs to be repaid within a year

overdrafts

creditors

tax

cash flow

Financial document that shows expected movement of cash inside and outside of a business per time period

Cash inflows – usually from sales revenues when cash payment is received

Cash outflows – payment of bills, usually itemised expenses

Net cash flow – the differences between cash inflow and outflow

reasons for cashflow

business planning

is the business financially healthy

plan for and alleviate liquidity crisis

causes of cashflow problems

overtrading

over borrowing

overstocking

poor credit control

unforeseen changes

strategies to deal with cash flow problems

reducing cash outflows

improving cash inflows

seeking alternative sources of finance

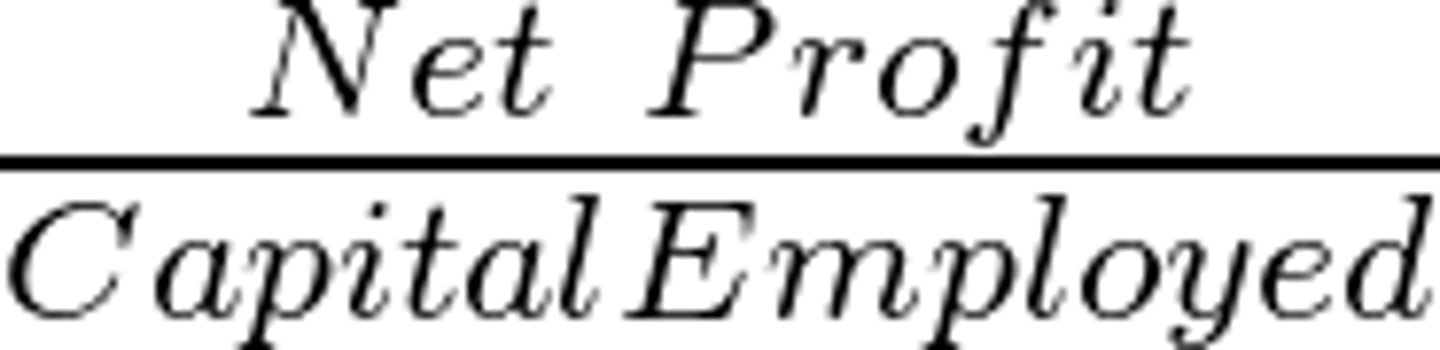

Return on Capital Employed (ROCE)

Measures the financial performance of a firm compared with the amount of capital invested

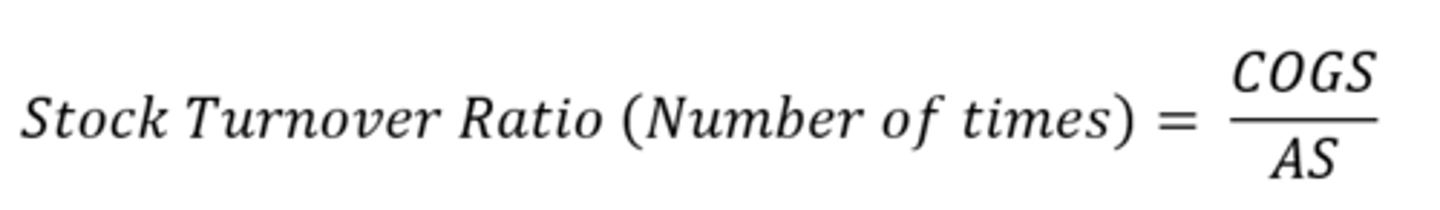

Stock Turnover Ratio

Measures how quickly a firm's stock is sold and replaced over a given period

Debtor Days

Measures the number of days it takes on average for a firm to collect its debts from customers if it has sold goods to on credit.

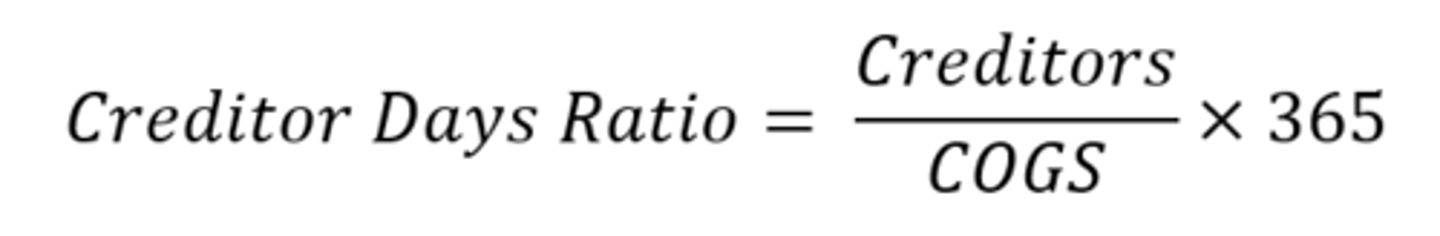

Creditor Days

measures the average number of days a firm takes to pay its creditors

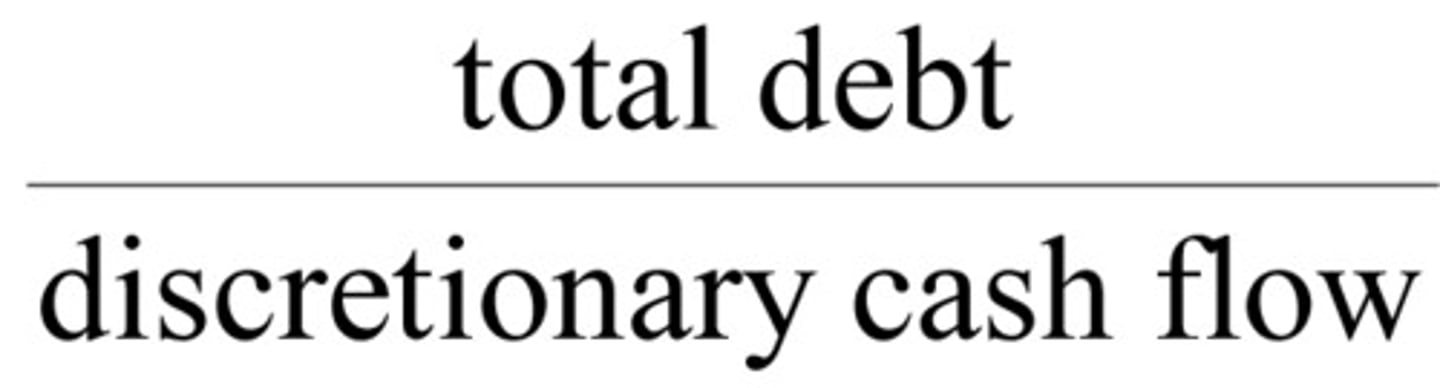

Gearing Ratio

Measures the extent to which capital employed by a firm is financed from loan capital

Opening Balance

The amount of money in a business at the start of the month

Closing Balance

The amount of money in a business at the end of the month

Investment

Purchase of asset with potential to yield a financial benefit in the future

Investment Appraisal

Quantitative techniques used to calculate the financial costs and benefits of an investment

Payback Period

Estimates the length of time required for an investment project to pay back its initial cost outlay

Average Rate of Return

Measures the annual net return on an investment as a percentage of its capital cost

Net Present Value

considers time value of money

Budget

A financial plan for expected revenue and expenditure for an organisation for a given time period

reasons-

planning and guidance

coordination

control

motivation

Cost Center

Department or unit of business that incurs costs

Doesn’t contribute to profit directly.

e.g. Marketing and HR departments

Departments must be made aware of their costs to help managers operate within the allocated budget

Profit Center

Branch of a company that is accounted for on a standalone basis for the purposes of profit calculation

Used to know which aspects of a business are the most and least profitable

Managers have to be responsible for costs and earnings of their profit center, and they should know how to best use resources to maximise profitability

variance analysis

variance- difference between budgets and actuals

favorable variance-

adverse variance- overspending and/or underselling

Benchmarking

a process by which a company compares its performance with that of high-performing organizations