Perfect Competition

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

11 Terms

Assumptions for Perfect Competition

The market has many buyers and many sellers

Homogeneity of output – firms produce identical products

The multiplicity of sellers of identical goods means that no one firm has power to determine the price – so firms are price takers

No barriers to entry or exit

Perfect information and low transaction cost

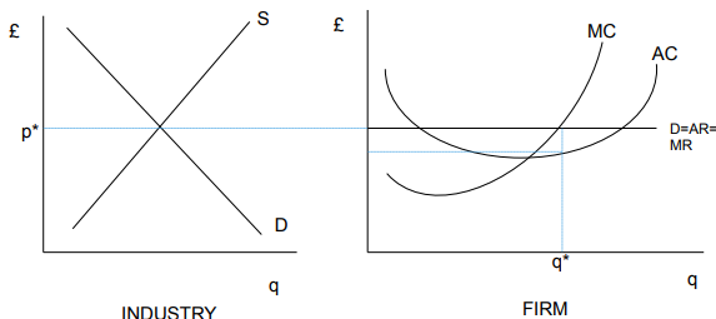

Perfect Competition: Short Run

The amount of capital employed (and so also the number of firms) is fixed

Profit Maximisation Equations

Total revenue = price x quantity sold

TR = pq

Average revenue = total revenue / quantity sold = price

AR = TR/q = p

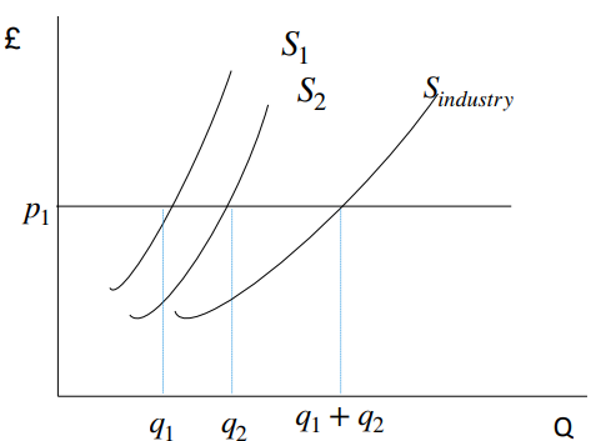

A firm’s marginal revenue is the additional revenue from selling one additional unit of output

Marginal revenue = the rate of change (derivative) of total revenue with respect to quantity sold

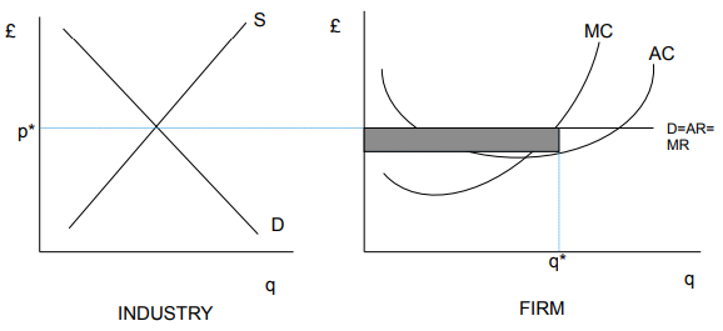

Profit Maximisation

In a perfectly competitive market, the profit maximising output level occurs where p=MC

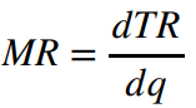

Profit is maximised where marginal cost cuts marginal revenue from below. Below q*, adding units of output adds more to revenue than to cost. Above q* more is added to cost than to revenue

The shaded area is supernormal profit: total revenue (AR x q*) minus total costs (AC x q*) (p = TR – TC)

Short Run Shut Down Condition

If operate: profit=TR-TC=TR-FC-VC

If shutdown: profit=0-FC-0

As long as TR covers the VC (that is p ≥ AVC), the firm should keep operating

Shutdown if p < AVC

In the short run, a firm may continue production even if it is making a loss – so long as it is covering its variable costs. This has the effect of minimising the losses

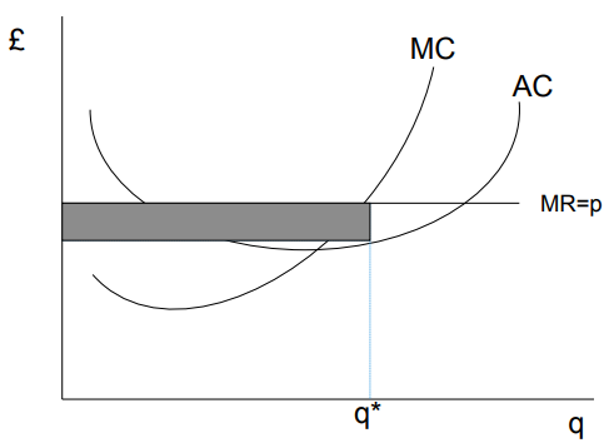

Industry Supply Curve

The industry supply curve is the horizontal sum of individual firms supply curves

Must just sell same product - don't need same equations

Short Run Market Equilibrium

Profit is maximised where marginal cost cuts marginal revenue from below. Below q*, adding units of output adds more to revenue than to cost. Above q* more is added to cost than to revenue

Free Entry

the ability of a firm to enter an industry without encountering legal or technical barrier

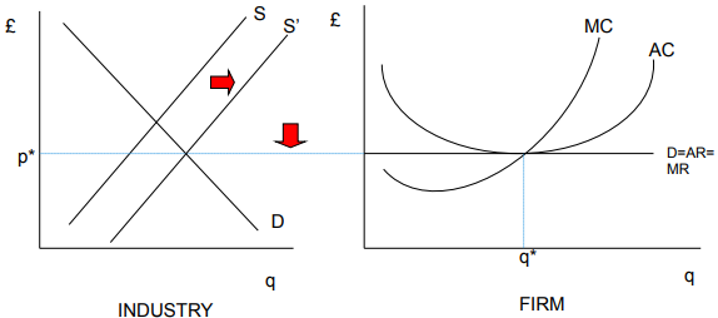

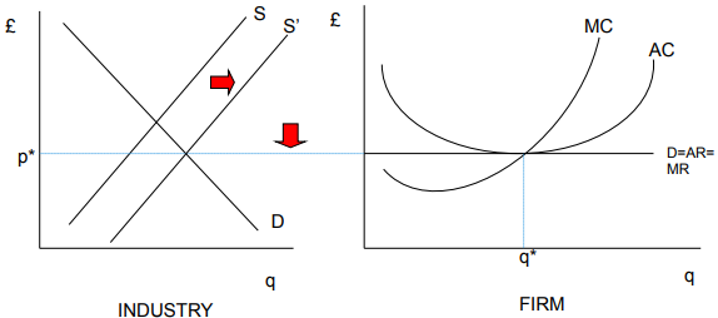

Long Run Competitive Equilibrium

occurs at the point where the market price is equal to the minimum average total cost

the firms earn zero economic profit (considering opportunity cost)

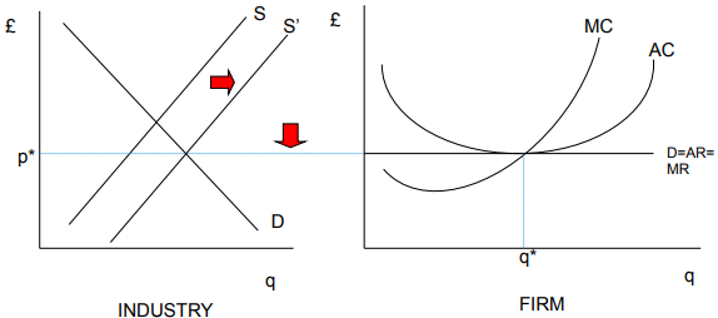

Supernormal Profit

attracts new entrants into the industry

supply (at industry level) increases, pushing the price down – thus shifting the demand curve faced by individual firms down

results in a decrease in price, profit decreases for the firm

What is happening in this Graph?

no further supernormal profits are made. At this point there is no incentive for further new entry, and so the industry is in long run equilibrium. Note that in this equilibrium each firm produces output at minimum average cost – and so we have allocative efficiency. This makes perfect competition a good benchmark.

Firms make 0 profit