ACCT 4040 - Tax Law Exam 1 Study Materials

1/109

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

110 Terms

Tax

compulsory payment to support the cost of government

Taxpayer

any person or organization required by law to pay tax

- Includes individuals and corporations

Incidence

ultimate economic burden of a tax

- May not fall on the person or organization who pays tax; could pass on to customers

Jurisdiction

the right of a government to tax

The government can tax based on what three things?

1. Citizenship

2. Physical/home location

3. Work location

Taxes are levied by

federal, state, and local governments

Tax Formula

Tax = Tax Base * Tax Rate

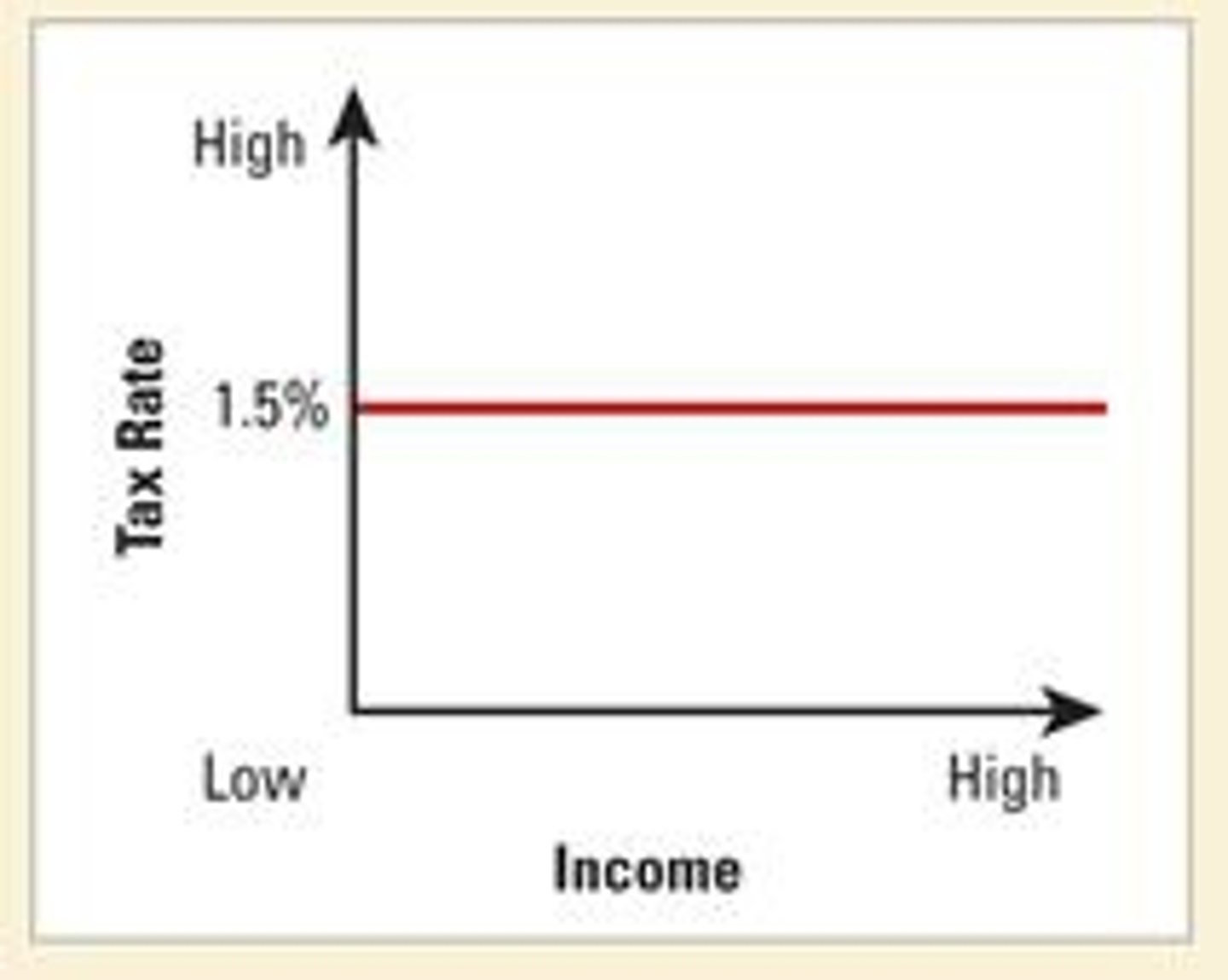

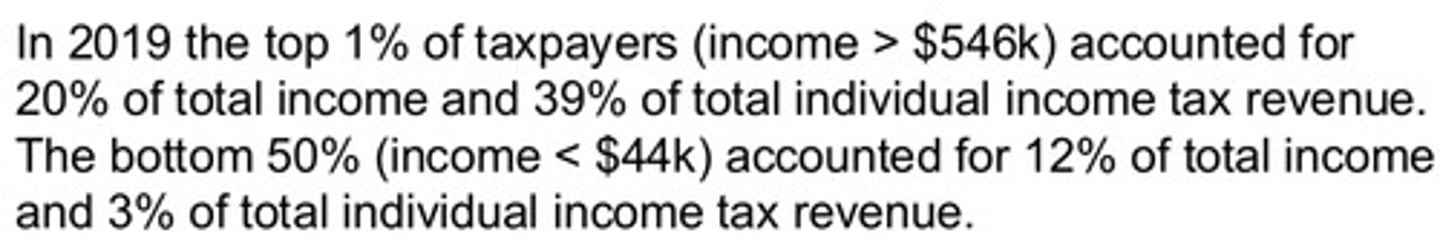

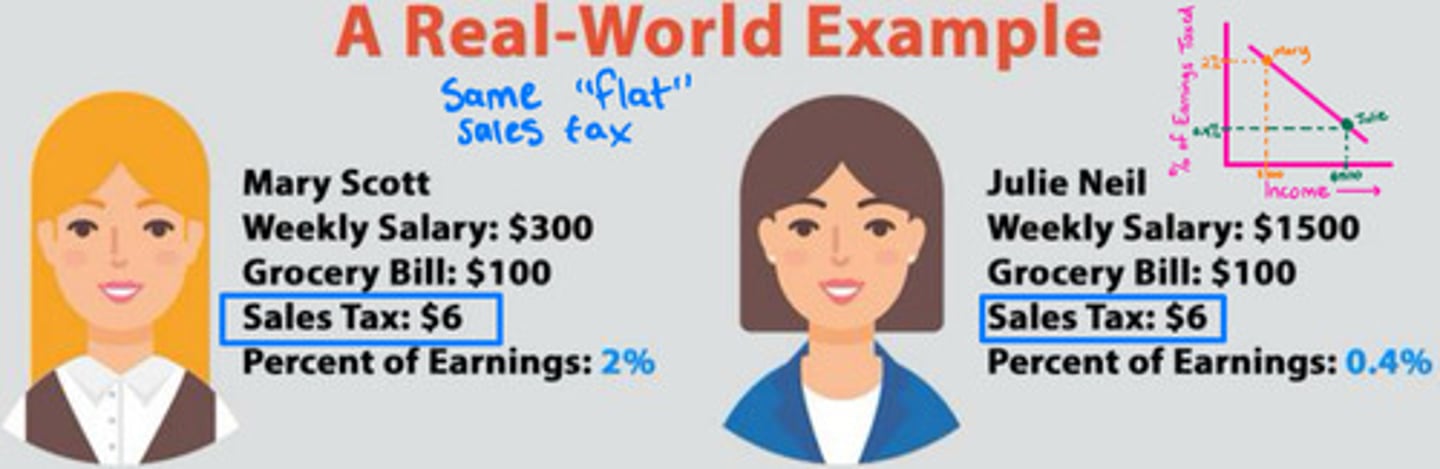

Flat (proportionate) tax rate

everyone pays the same tax rate regardless of income (e.g., sales tax)

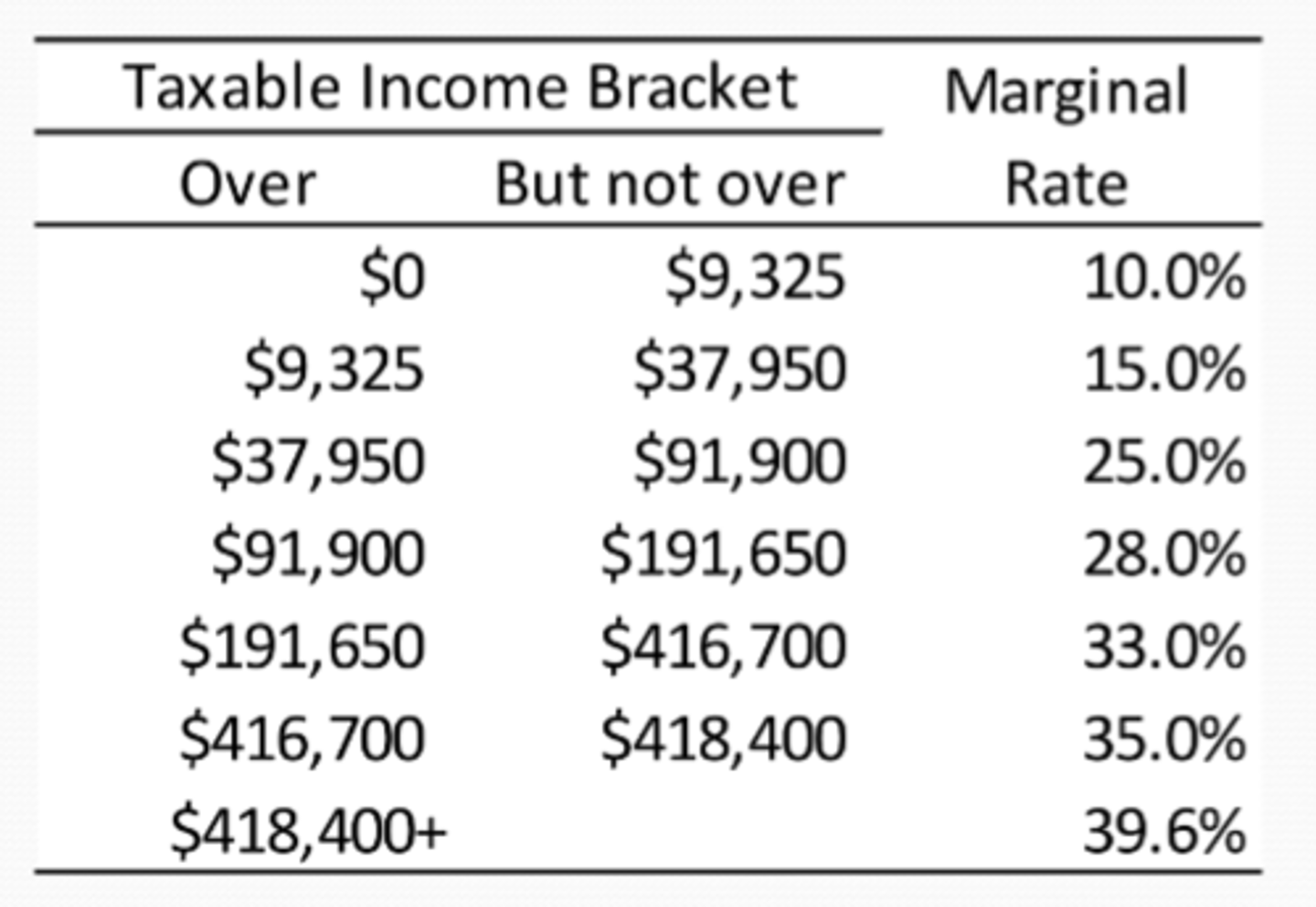

Graduated tax rate

multiple rates apply to portions (brackets) of tax base

Tax base

an item, occurrence, transaction, or activity on which a tax is levied (expressed in monetary terms)

How taxes are characterized

1. Frequency with which the tax occurs

- Transaction/event based taxes: sales tax

- Activity based taxes: income tax

2. Linked to specific government expenditures

- Earmarked to finance designated projects: medicare

Sales and Use tax

the amount charged extra for a product or a service that gets added to the price

- Often excludes necessities (e.g., food, medications) and personal services (e.g., haircuts)

Excise tax

taxes imposed on retail sale of specific goods or services (e.g., cigarettes, gasoline, hotel/motel accommodations)

- Usually per unit, not as a % of sales price

Income tax

a tax on the earnings of individuals and businesses

History of the Federal Income Tax

Pre-1861: tariffs, excise and property taxes.

First income tax enacted to pay for Civil War in 1861, expired in 1872.

First permanent income tax passed in 1894, but struck down by Supreme Court as unconstitutional.

Sixteenth Amendment, ratified in 1913, made the income tax constitutional.

Internal Revenue Code was enacted in 1939 and subsequently revised in 1954 and 1986.

Tax Cuts and Jobs Act enacted in 2017.

Tax Cuts and Jobs Act (2017)

An act to provide budget resolution that represented changes to individual and business tax rates.

- Reduced the corporate tax rate from 35% to 21%

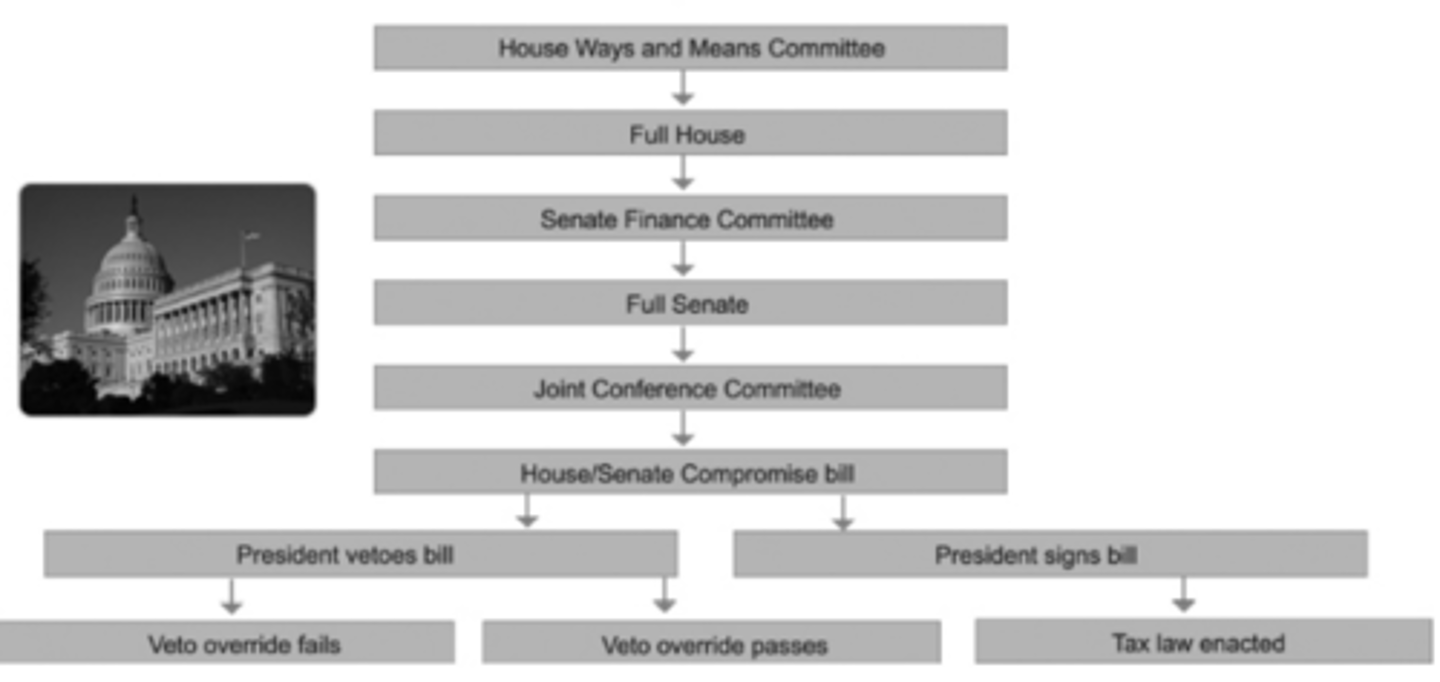

Tax Legislation Process

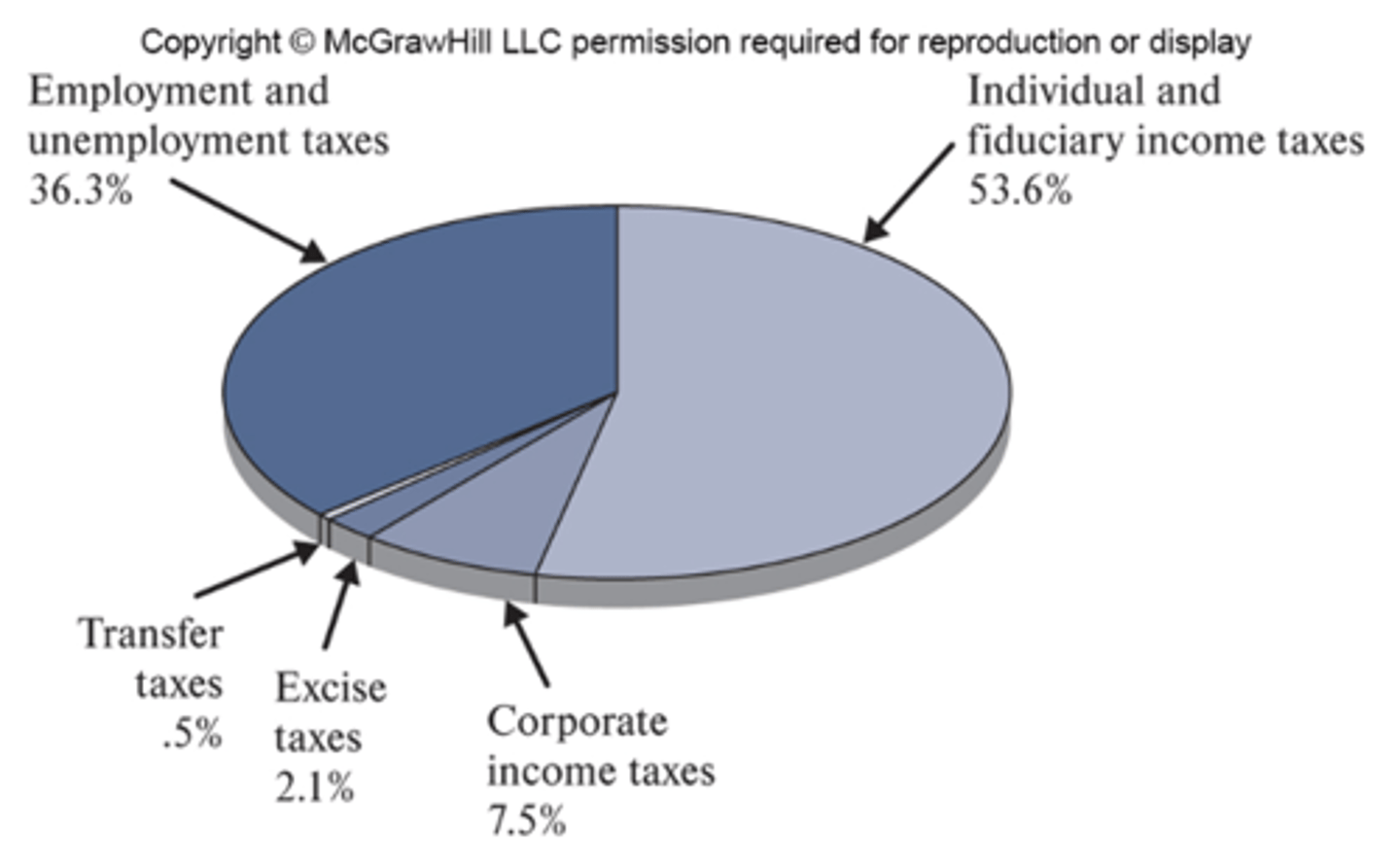

Federal taxes

Income taxes

- Individuals

- Corporations

Employment taxes

- Social Security

- Medicare

Other

- Unemployment taxes

- Excise taxes

- Transfer taxes

Value-added tax (VAT)

Similar to a sales tax on the incremental value added by a business at each stage of the production process

Jurisdictional competition

T = B * R

Increasing the tax rate or expanding the definition of the tax base can cause taxpayers to flee the tax jurisdiction

- Must instead increase tax base

Increasing Tax Base

- Sales tax expansion (including services)

- Sports gambling

- Marijuana

Sales Tax Expansion

In 1992, Supreme Court held that online sellers need not collect sales tax from customers located in states where the company did not have physical presence.

In 2018, Supreme Court overturned the "physical presence test." This means that customers are charged sales tax based on their location.

States now may require online sellers to collect sales tax based on the residence of the purchaser (e.g., pay SC sales tax if bought online from a shop in California)

Primary Sources of Tax Law Authority

1. Internal Revenue Code (IRC) (e.g., §61)

2. Administrative authority

- Treasury Regulations (e.g., §1.61-1)

- IRS revenue ruling/revenue procedures

3. Federal judicial authority (court rulings)

- Trial courts (tax court, district court, court of federal claims)

- Appellate courts

- Supreme Court

Tax compliance

the extent to which an individual or business meets tax obligations

- Backwards looking

- Ex: preparing and filing tax returns

Tax planning

seeking legal ways to reduce, eliminate, or defer income taxes

- Forward looking

- Ex: entity structuring and asset acquisition

Standards for a good tax

1. Sufficient to raise necessary government revenues

2. Convenient to administer, pay, and enforce

3. Efficient in economic terms

4. Fair to taxpayers required to pay

A tax is sufficient if:

it generates enough funds to pay for the public goods and services provided by the government

- If not, new tax laws will need to be enacted

- Allows a government to balance its budget

- Our federal tax system is NOT sufficient

Government can increase tax revenues by:

1. Exploiting a new tax base: most radical and politically sensitive (e.g., Wealth Tax, Book Minimum Tax 2023)

2. Increase the rate of an existing tax: most obvious and likely to anger the greatest number of voters

3. Enlarge an existing tax base: most subtle and less likely to attract public attention (e.g., Social Security tax of 6.2% applied to first $51,300 of wages in 1990. Now that same rate is applied to the first $160,200 in 2023. Not a new tax, did not increase rate, but increased tax base)

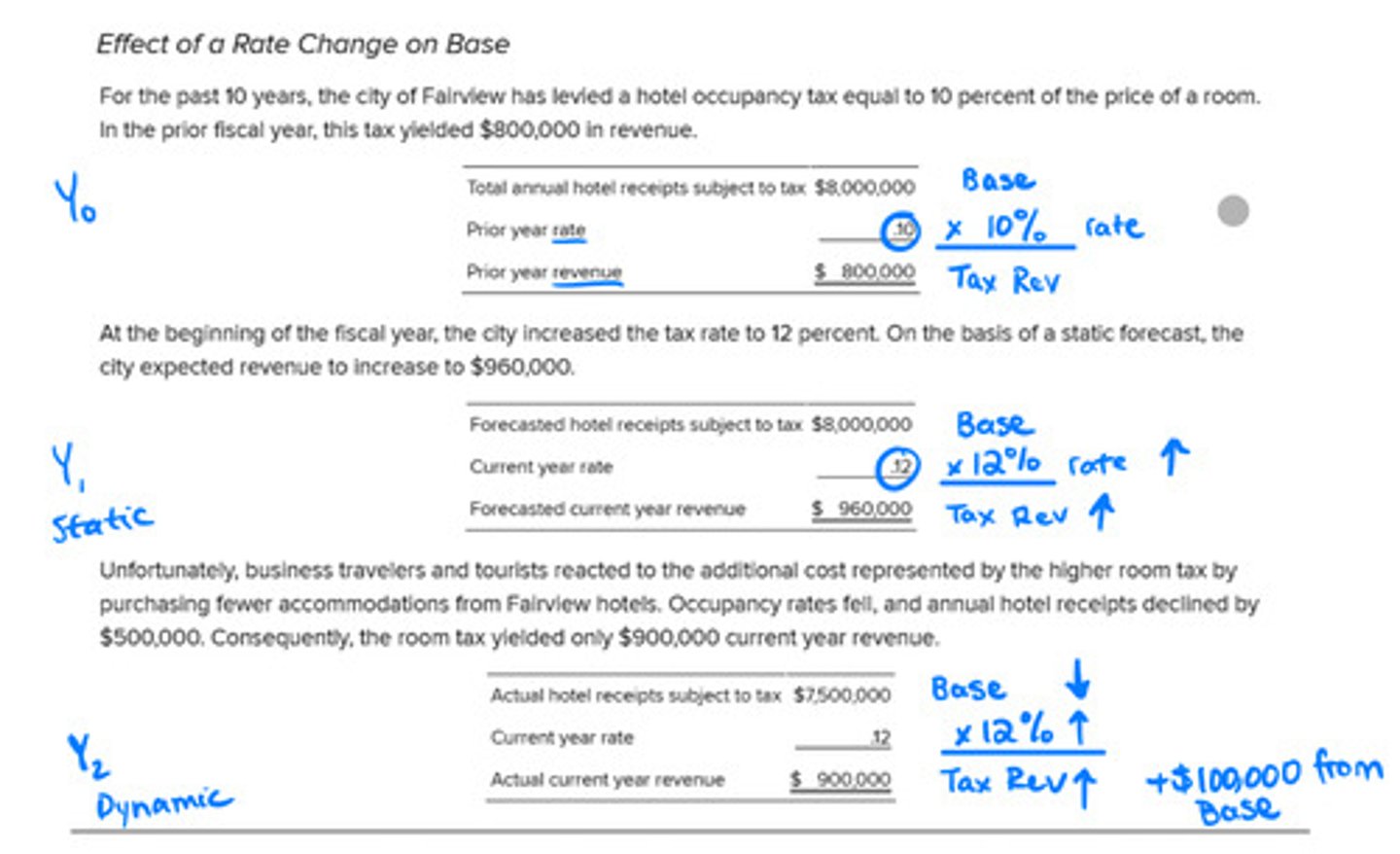

Two ways to forecast the increase in tax revenue

1. Static forecast: assumes base stays the same

2. Dynamic forecast: estimate change in base due to change in rate

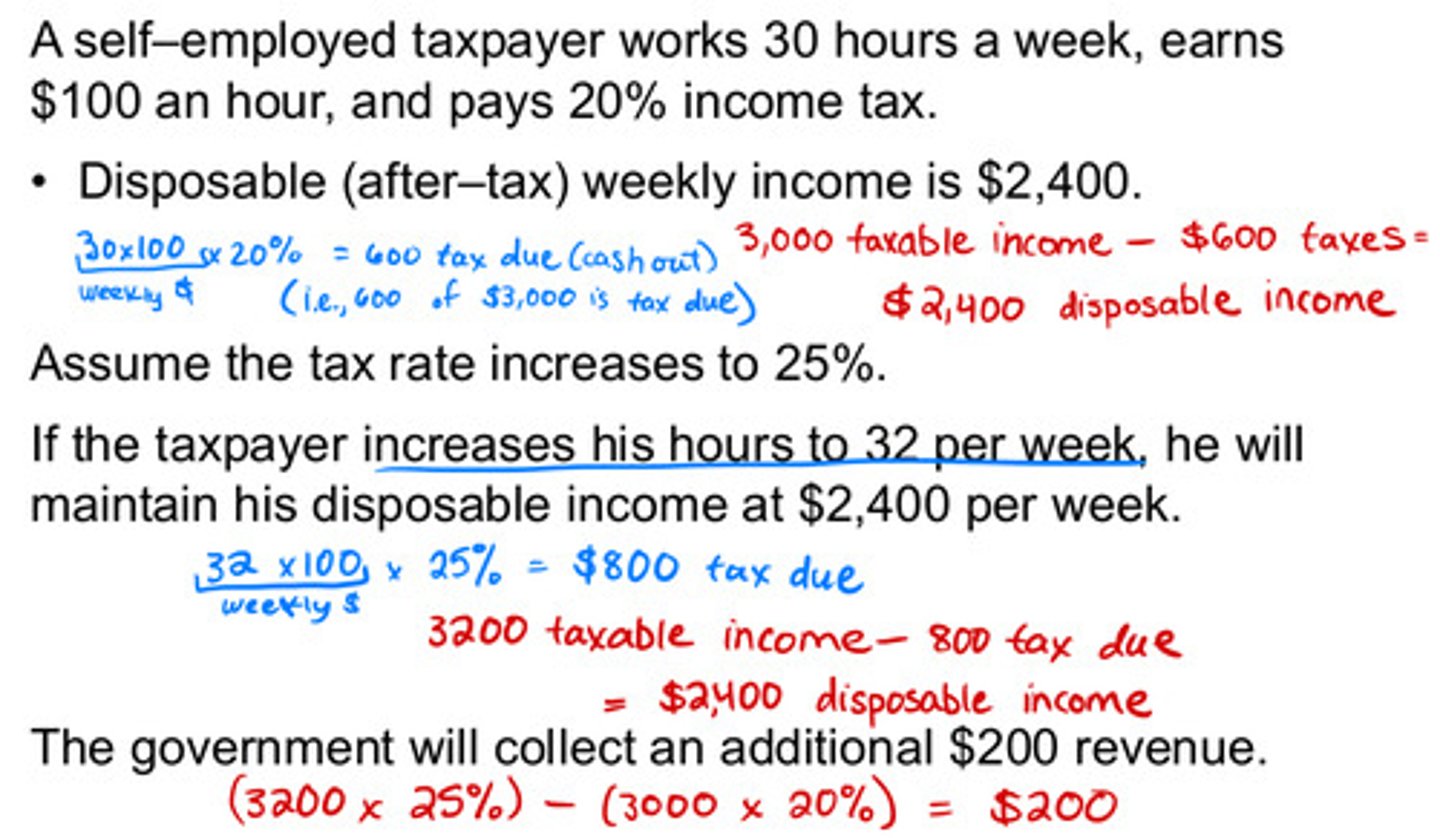

Income Effect

How a consumer's demand for a good or service changes due to changes in their income or purchasing power; can be positive or negative, depending on whether the good is normal or inferior

Tax rate increase → income (tax base) increase

Tax rate decrease → income (tax base) decrease

Taxpayers work more (or less) to maintain their after-tax income

More powerful for lower-income taxpayers

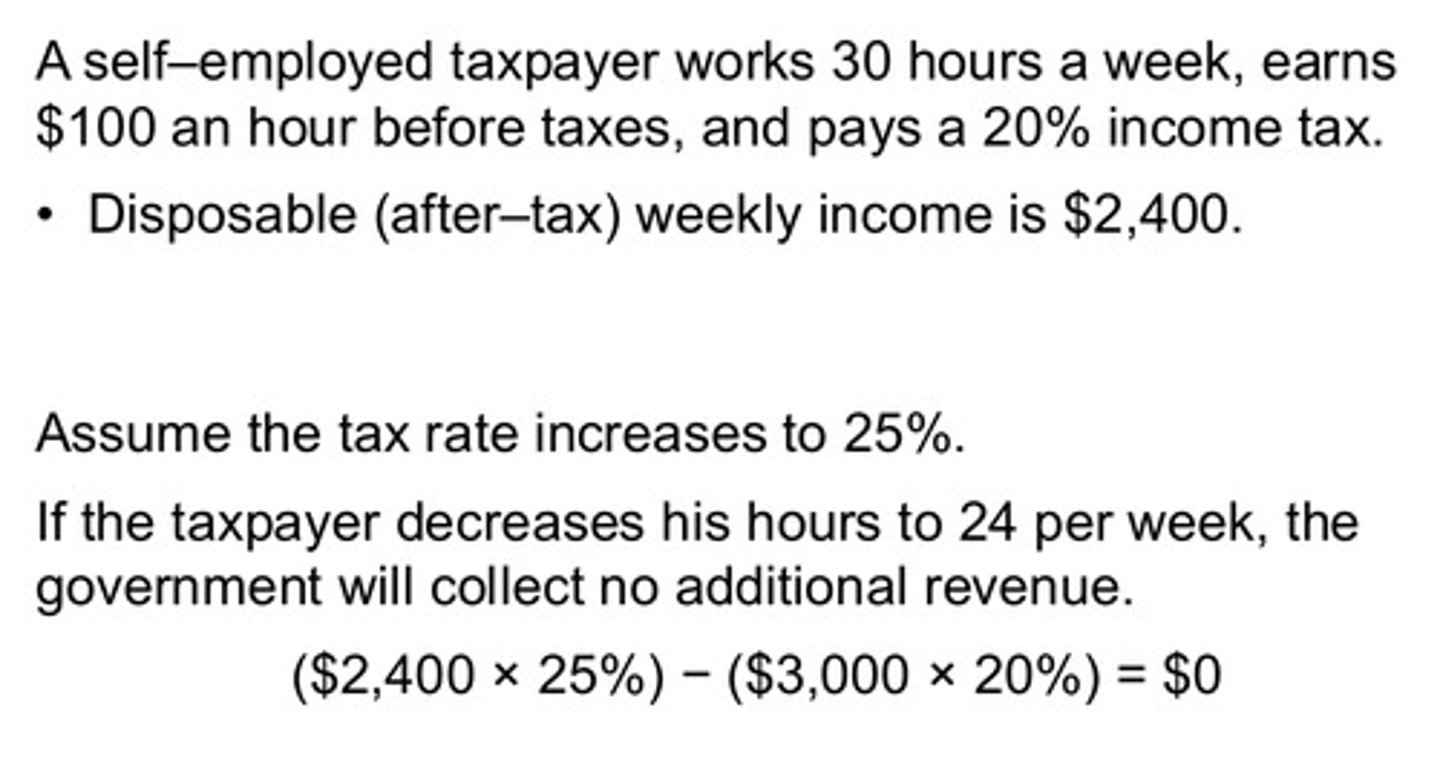

Substitution Effect

How a consumer's demand for a good or service changes when they switch to a cheaper alternative product or service; occurs when the price of a product increases or the price of a related product decreases

Tax rate increase → income (tax base) decrease

Tax rate decrease → income (tax base) increase

Substitute between labor and leisure (e.g., retirement)

More powerful for higher-income taxpayers

A tax is convenient if:

Government's view: Tax is easy to administer, easy to understand, and offers few opportunities for noncompliance

Taxpayer's view: Tax is easy to pay, easy to compute, and requires minimal time to comply

- Our federal tax system is NOT convenient for the taxpayer (difficult to understand)

A tax is efficient if:

Judged by the classical standard of efficiency: it is neutral in effect on the market so that it doesn't distort the market, create suboptimal allocation of goods and services, or modify taxpayer behavior

Judged by Keynesian (modern) standards: it is an effective policy tool for regulating the economy (governments should use taxes to move the economy in the desired direction)

What standard of efficiency does the U.S. government advocate?

The Keynesian (modern) standard

- The Employment Act of 1946 charged the Executive Branch with promoting full employment and a stable dollar

- The US tax system is designed to address not only fiscal problems, but also social ones

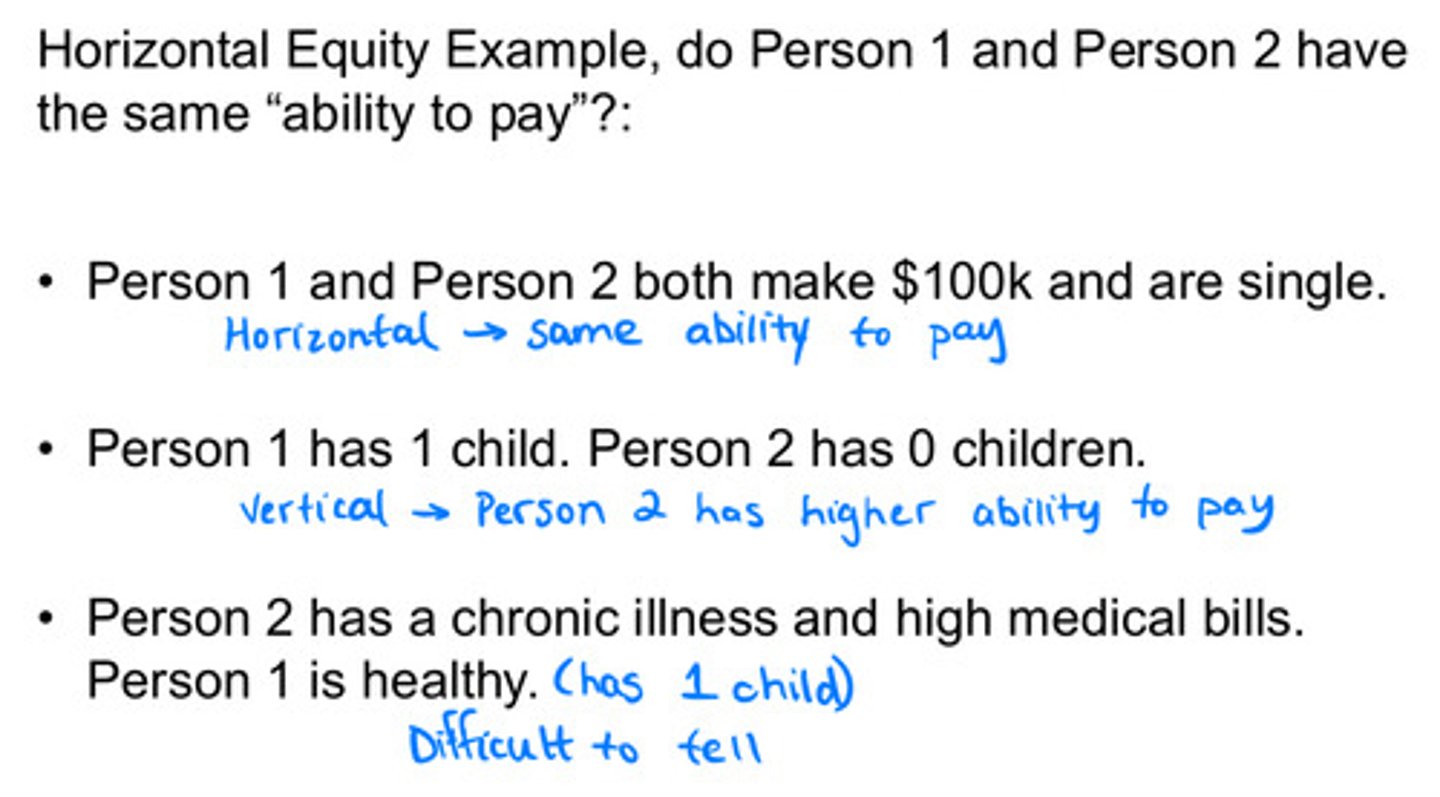

A tax is fair if:

- The taxpayer has the ability to pay the tax

- The tax enhances horizontal equity

- The tax enhances vertical equity

Horizontal equity

persons with the same ability to pay owe the same tax

- Ability to pay varies with marital status, number of dependents, disability status, etc

- Enhanced by refining the calculation of taxable income to include significant variables affecting economic circumstances

Vertical equity

persons with greater ability to pay owe more tax than persons with lesser ability to pay

- Concerned with a fair rate structure

Regressive tax rate structure

the tax rate decreases as tax base increases

- Rates are rarely explicity regressive, but can be implicitly regressive (e.g., different salary and different % of income spent)

- Average tax rate > marginal tax rate

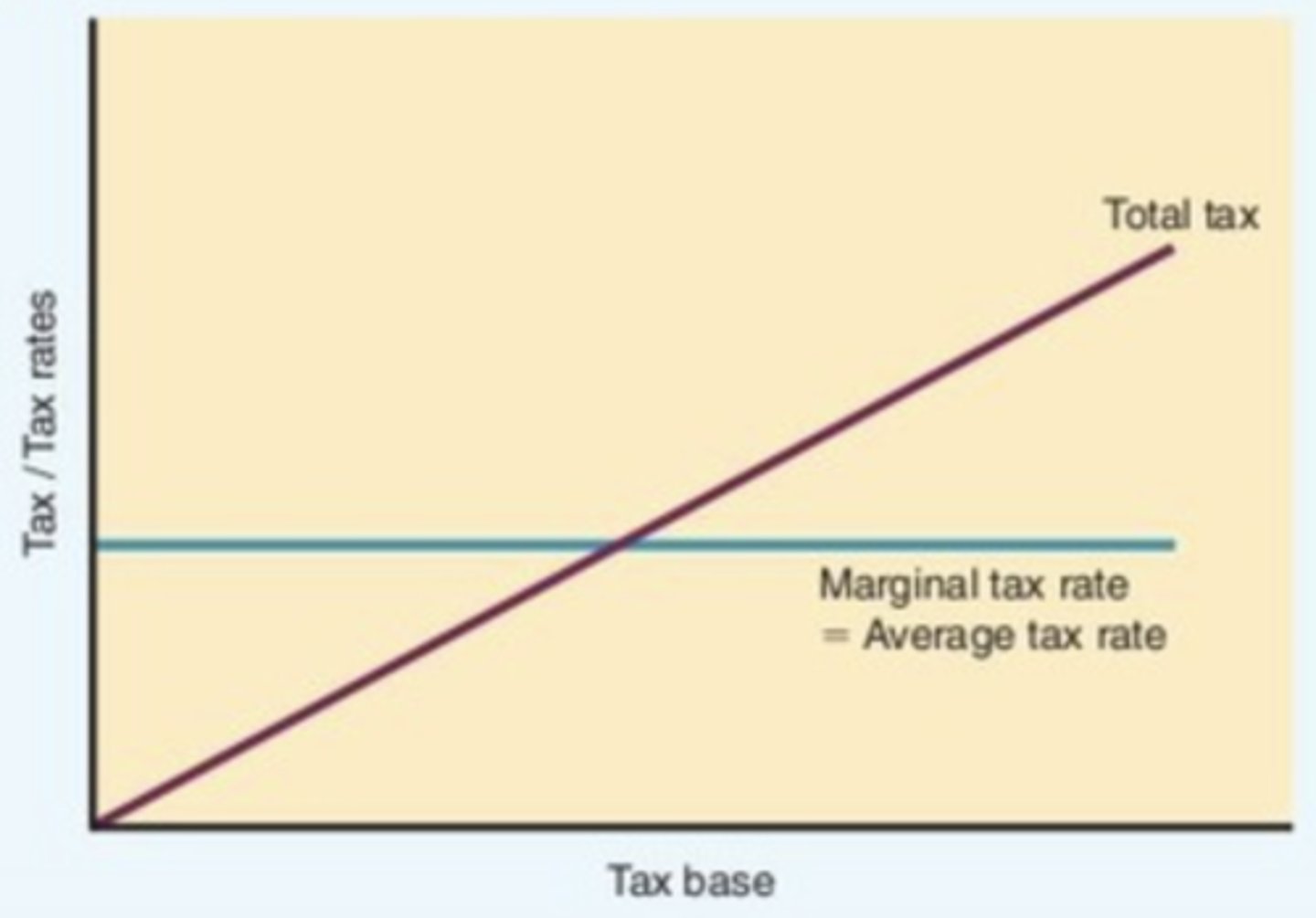

Proportionate (Flat) tax rate structure

one single tax rate applied to taxable income (e.g., corporate tax rate = 21%, sales tax)

- Average tax rate = marginal tax rate

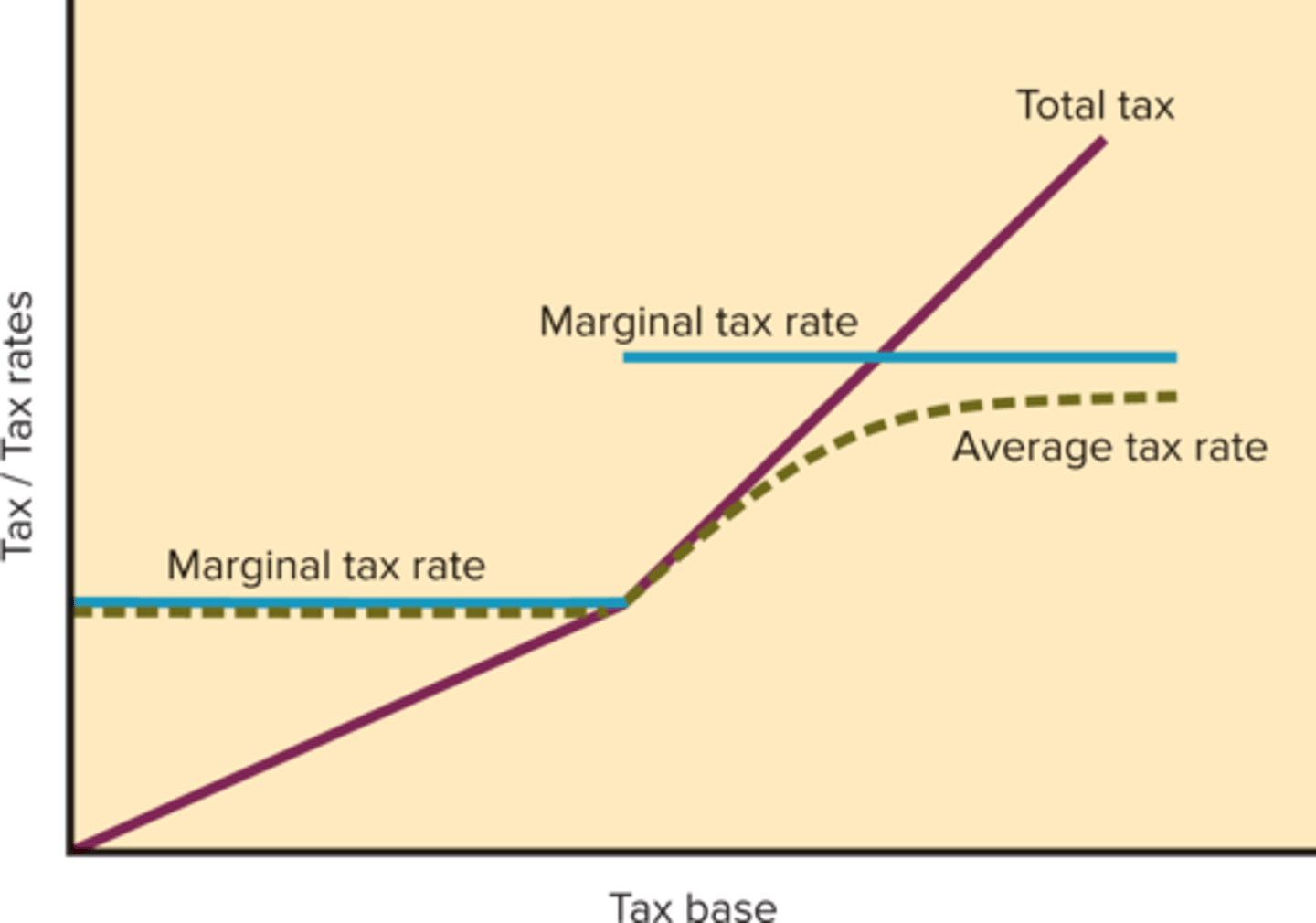

Progressive tax rate structure

the tax rate increases as tax base increases (e.g., individual income tax)

- Marginal rate increases as taxable income increases

- Marginal tax rate > average rate

Average tax rate

total tax paid / taxable income

Marginal tax rate

the rate applied to the next dollar of taxable income

What is the objective of business decisions?

maximize the value of the firm

Tax costs as cash flows

If a transaction results in an increase (↑) in any tax for any period, the increase (tax cost) is a cash outflow (→)

If a transaction results in a decrease (↓) in any tax for any period, the decrease (tax savings) is a cash inflow (←)

After Tax Cash Flow (ATCF)

= BTCF*(1 - T)

*if cash flow is non-taxable/non-deductible: ATCF = BTCF*

Examples of taxable cash inflows

wages and salaries, business income, interest income, dividends, capital gains, etc.

Examples of non-taxable cash inflows

state bonds (not taxed federally), gifts, inheritance, child support payments, etc

Examples of non-deductible cash outflows

fines, penalties, personal living expenses, political contributions, etc

Examples of deductible cash outflows

mortgage interest, SALT, medical expenses, charitable contributions, etc.

Audit risk

In tax, the risk of finding an error if audited; the chance of an audit causing you to pay more taxes

Statute of limitations for IRS to assess taxes: 3 years

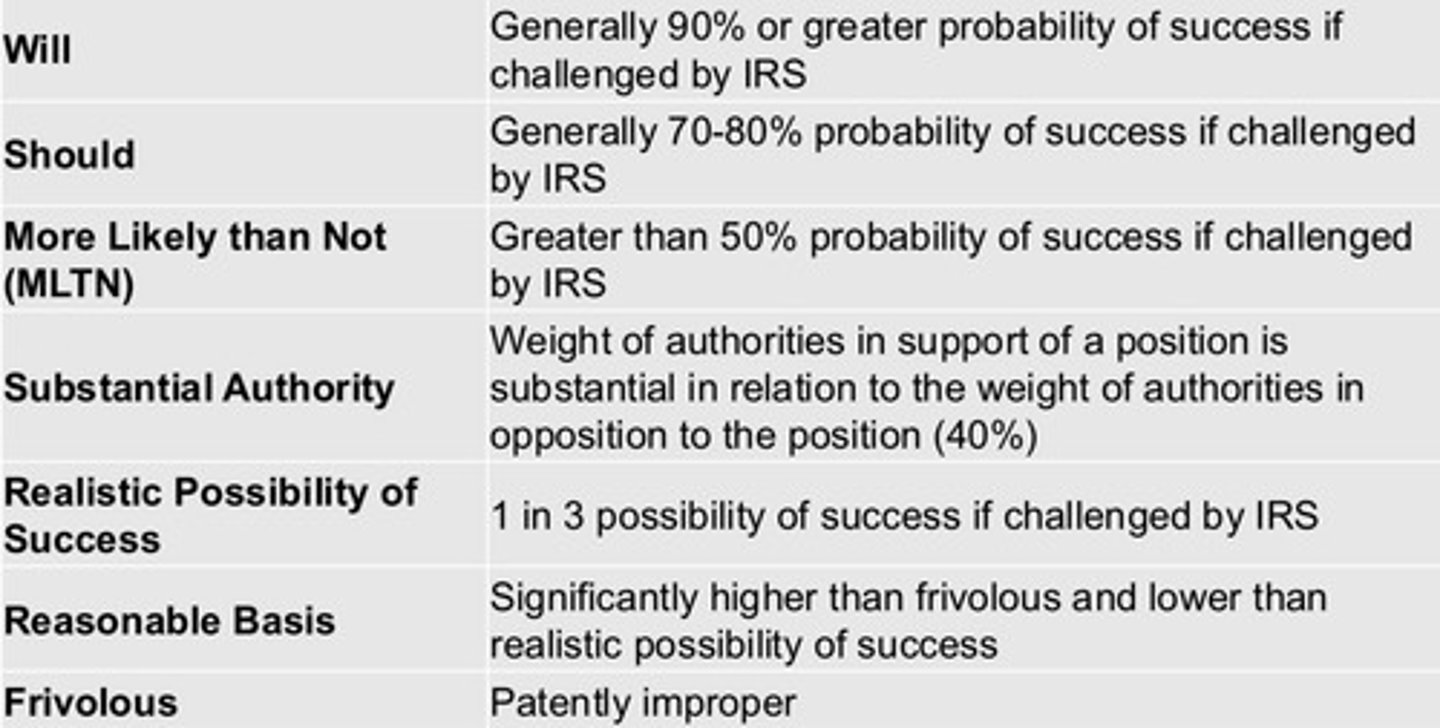

"Will"

Generally 90% or greater probability of success if challenged by the IRS; highest level of confidence

"Should"

Generally 70-80% probability of success if challenged by the IRS

"More likely than not" (MLTN)

Greater than 50% probability of success if challenged by the IRS

"Substantial authority"

The weight of authorities supporting taxpayer's position is substantially greater than the weight of authorities opposing it (40%)

"Realistic possibility of success"

1 in 3 (33%) probability of success if challenged by the IRS

"Reasonable basis"

Significantly higher than frivolous and lower than realistic probability of success (20%)

"Frivolous"

Patiently improper; lowest level of confidence (10%)

Reducing taxes: private market

both parties can customize the transaction to minimize the aggregate tax cost; tax savings can be shared between the parties

- Most opportunity for tax planning

- Ex: executive and employer

Reducing taxes: public market

Parties do not engage in direct negotiation; tax planning is one-sided

- Least opportunity for tax planning

- Ex: investing by purchasing shares of a publicly traded company

Reducing taxes: fictional market

If related parties are not dealing at arm's length, no true market exists and any transaction between them may not reflect economic reality

- Ex: transaction between parent and child, or between siblings, or a corporation and its subsidiary

Some cash inflows are _____, but not all. Some cash outflows are ______, but not all.

taxable; deductible

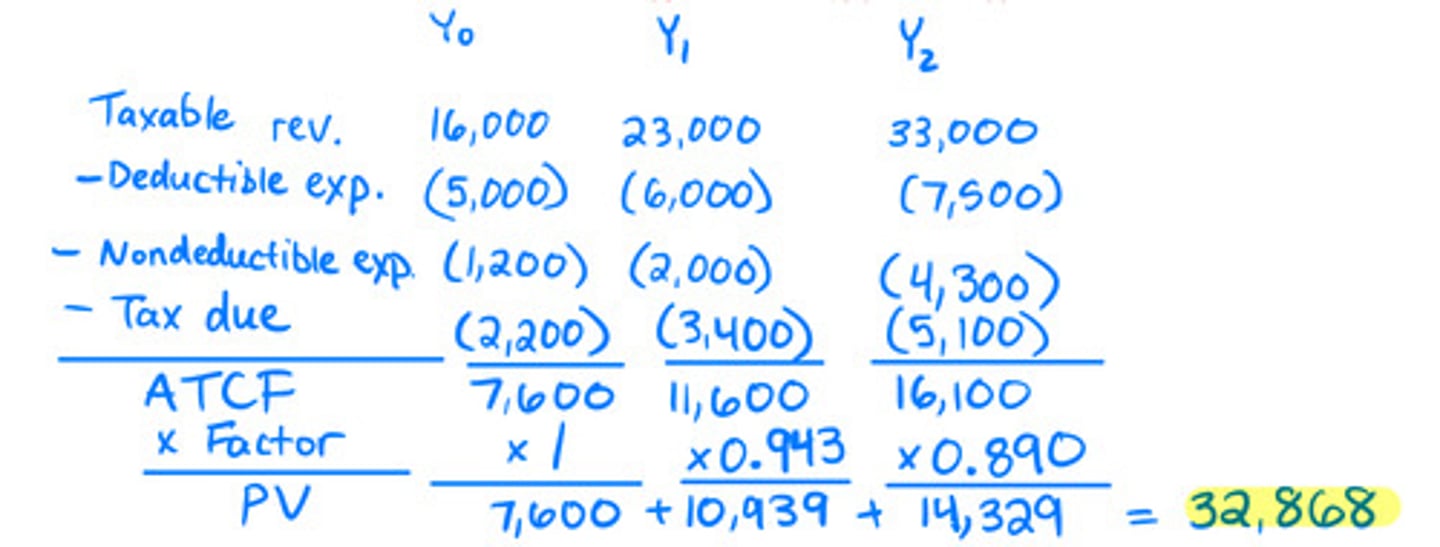

Computing NPV of ATCF (5 steps)

1. Determine BTCF

2. Determine taxable income and deductions

3. Compute tax cost of income and tax savings from deductions

4. Compute ATCF

5. Compute PV of individual cash flows and NPV of total net cash flows using discount rate

Long-term tax planning involves uncertainties relating to (3):

1. Audit risk

2. Tax law uncertainty

3. Marginal rate uncertainty

Tax avoidance

the use of legitimate (legal) methods to reduce one's taxes

Tax evasion

the use of illegal actions to reduce one's taxes

- Felony offense punishable by severe monetary fines and imprisonment

Tax consequences of a transaction depend on the interaction of four variables (maxims):

1. Entity variable: which entity undertakes the transaction?

2. Time period variable: during which tax year does the transaction occur?

3. Jurisdiction variable: in which tax jurisdiction does the transaction occur?

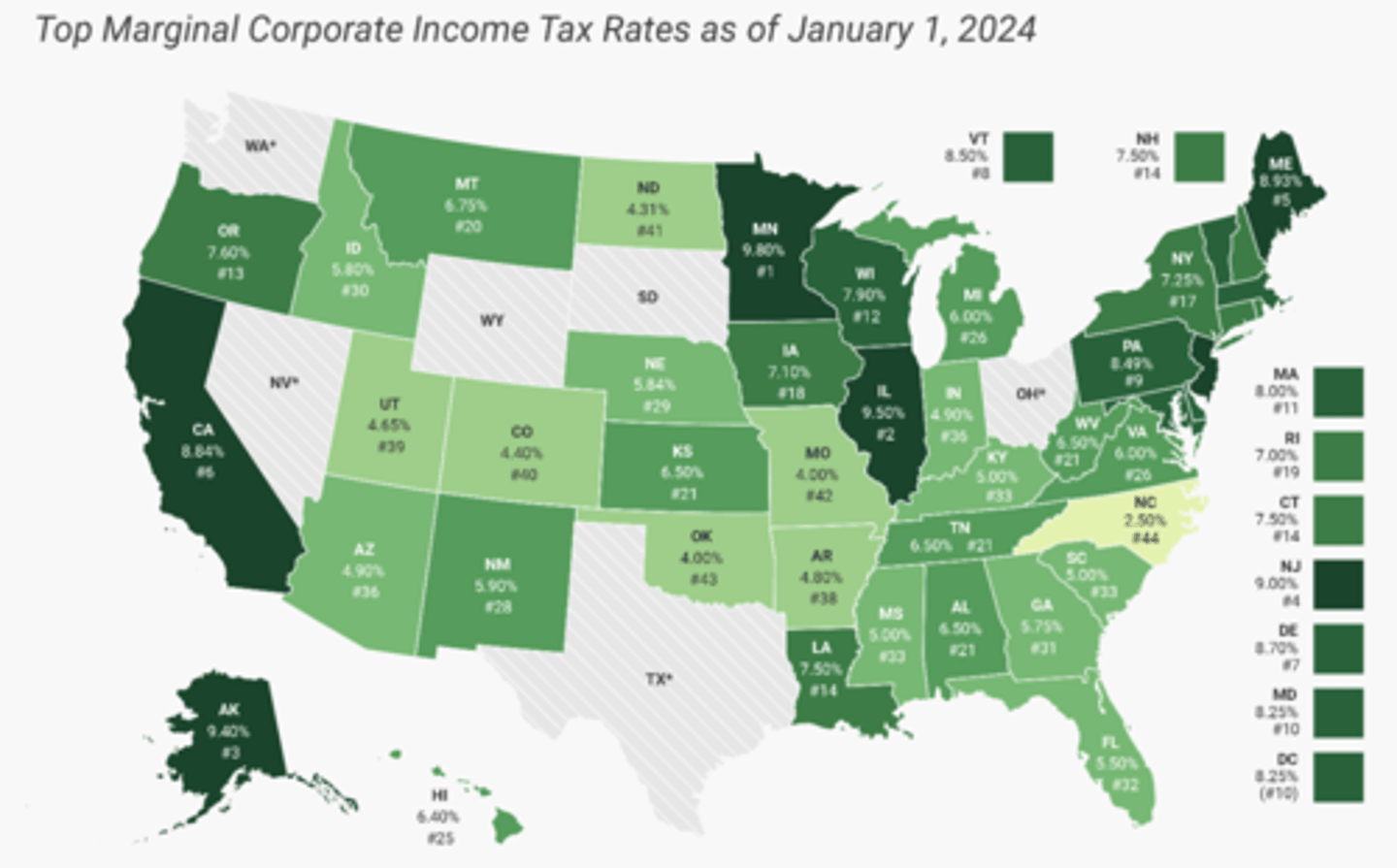

4. Character variable: what is the tax character of the income, gain, loss, or deduction from the transaction?

Two taxpaying entities

individuals and corporations

Corporate taxpayers

Proportionate (flat) tax rate of 21%

Individual taxpayers

Progressive tax rate structure ranging from 10% to 37%

- Rate depends on filing status (e.g., married, single)

Tax Planning Maxim 1

Entity Variable

Tax costs decrease (and cash flows increase) when income is generated by an entity subject to a lower tax rate

Income shifting

Arranging transactions to transfer income from a high tax rate entity to a low tax rate entity (e.g., an entity with NOLs)

Deduction shifting

Arranging transactions to transfer deductions from a low tax rate entity to a high tax rate entity

Assignment of Income Doctrine

Income must be taxed to the entity that earns it from the sale of goods or performance of services

- Ex: if Corporation A sells goods, customer must pay Corporation A, not Corporation B, a subsidiary to A

Income generated by capital must be taxed to the entity that owns the capital

- Ex: if Corporation A owns stock, cannot have dividend paid to Corporation B

Tax Planning Maxim 2

Time Period Variable

In present value terms, tax costs decrease (and cash flows increase) when a tax cost is deferred until a later taxable year

Constraints to Tax Planning Maxim 2

1. Opportunity costs: shifting tax costs to a later period may involve postponing a cash inflow; the OC of postponing the cash inflow may exceed the savings from tax deferral

2. Tax rate increases: if taxpayers defer the recognition of income to a future year and Congress increases future tax rates, the cost of the rate increase offsets the benefit of the deferral

Tax deferral

a postponement of taxes to be paid (e.g., get cash next year, pay taxes next year)

Tax Planning Maxim 3

Jurisdiction Variable

Tax costs decrease (and cash flows increase) when income is generated in a low tax rate jurisdiction

Tax Planning Maxim 4

Character Variable

Tax costs decrease (and cash flows increase) when income is taxed at a preferential rate because of its character

- Tax character of income is determined by law

- Every income item is characterized as either ordinary income (i.e., general salary) or capital gain

Ordinary income

income generated from sale of goods or performance of services in regular course of business

- Ex: income generated by investments (interest, dividends, royalties, rents), interest income, wages and salaries, etc

Capital gains

profits generated by the sale or exchange of capital assets

- Taxed at preferential rates for individuals (0%, 10%, 15%); individuals try to arrange transactions to convert ordinary income to capital gains

- Taxed at regular rates for corporations (21%)

- Ex: real estate, stocks, bonds, mutual funds, ETFs, etc

Implicit taxes

reduced before-tax rate of return on a tax-favored investment

Managers' goal

NPV (ATCF) maximization; NOT tax minimization

Economic substance/business purpose doctrine

A transaction must have a business purpose other than tax avoidance

Taxpayer responsibility

Many taxpayers engage a tax practitioner to prepare their returns; taxpayers who rely on professional help are still responsible for complying with the law and must bear the consequences of failure to comply

Filing dates

For calendar year taxpayers: April 15

- If filing date falls on a weekend or holiday, the filing date is postponed to the next business day

- Exception: corporations with a FYE of June 30 must file by September 15

Filing extensions

Taxpayers can apply for an automatic 6-month extension of time to file their return (still must pay taxes on 4/15)

- Form 4868 for individuals or 7004 for corporations

- Extension until October 15

- IRS can give automatic extensions to those impacted by natural disasters

- Govt charges interest on late payments regardless of reason for late payment

Tax payment requirements

Individuals: pay in the form of withholding (from their salary/wages) or through quarterly estimated payments

Corporations: pay through quarterly estimated payments

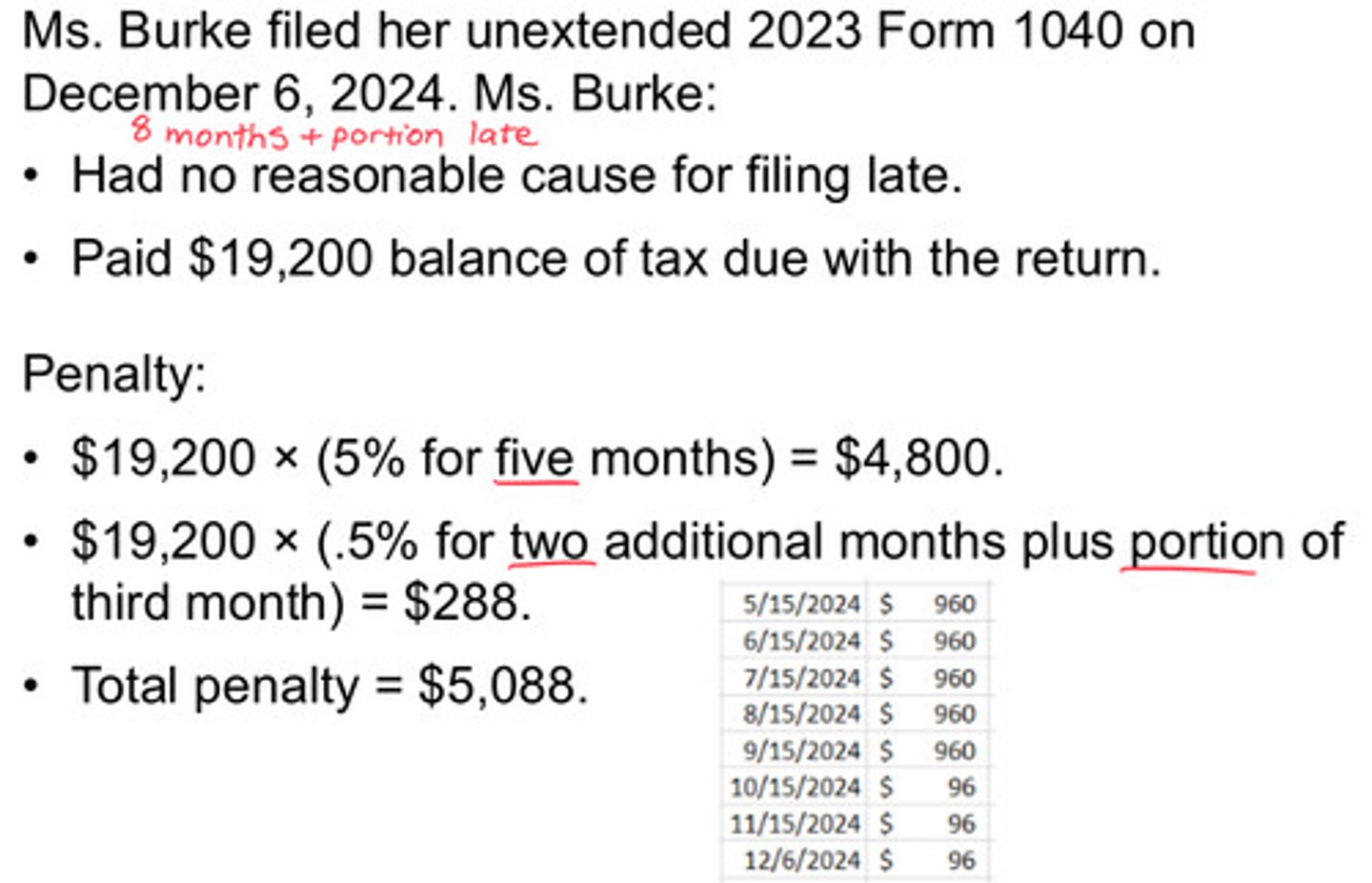

Late Filings/Payment Penalty

5% of unpaid tax per month or portion thereof that the return is late (5 months maximum)

0.5% of unpaid balance for the following months up to 45 additional months plus portion thereof

- If taxpayer is due a refund that same year, NO late filing penalty

Return processing

Income tax returns are processed by 10 IRS service centers

- Returns are checked for mathematical accuracy and cross-checked against information returns (e.g., W-2s, K-1s, 1099s)

Statute of limitations

IRS may audit a return and assess additional tax 3 years from the later of the 1) unextended filing date (4/15) or 2) date actually filed

- If taxpayer omits > 25% of gross income, statute of limitations extends to 6 years

- If a return is found to be fraudulent, there is no statute of limitations (open INDEFINITELY)

The Audit Process

Corporate returns: selected for audit based on taxable income and net assets

Individuals: scored under the discriminate inventory function (DIF) system

- Higher DIF = greater chance that return has error causing an understatement of tax

Three Types of Audits

1. Correspondence exams are conducted by mail

2. Office exams take place at IRS office

3. Field exams take place at the taxpayer's place of business

Tax deficiency

additional tax assessed as a result of an audit (e.g., owe additional $1,000 plus interest and penalties)

- Interest charged is deductible for corporations and non-deductible for individual taxpayers

Taxpayer Bill of Rights

part of the federal law requiring the IRS to deal with every citizen and resident in a fair, professional, prompt, and courteous manner

Accuracy-Related Penalty

a penalty of 20% of any underpayment of tax attributable to one of eight reasons; most commonly negligence and substantial understatement of income tax

Negligence

applies when the IRS concludes that the taxpayer failed to make a reasonable attempt to compute the correct tax

- Penalty = 20% of any underpayment attributable to negligence

- IRS must show a preponderance of evidence

Negligence vs Mistake

Based on the complexity of issues, taxpayer's education and experience, cooperation with IRS, and advice from professionals

Substantial understatement

Excess of correct tax over tax reported on return

Penalty = 20% of any substantial understatement of income tax

- Substantial if exceeds the greater of: 10% of correct tax or $5000

Civil Fraud

The willful intent to cheat the government by deliberately understating the tax liability (e.g., systematically omitting income, deducting nonexistent expenses, keeping two sets of books, etc.)

Penalty = 75% of any underpayment attributable to fraud

- IRS must show clear and convincing evidence

Criminal Fraud

Felony offense (e.g., tax evasion); prison time may result

Penalty = up to $100,000 for individuals and $500,000 for corporations

- Government must demonstrate guilt beyond a reasonable doubt