Unit 3: Macroeconomic Objectives (3.3)

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

DEFINITION: Unemployment rate

People of working age who are without work, available for work, and actively seeking employment.

Unemployment rate = (Unemployed * 100)/Total labour force

The labour force is the 'economically active population'.

Anyone outside of specified ages is not part of the labour force.

Students attending school are not part of the labour force.

Parents who stay at home to look after children are not part of the labour force.

Measuring unemployment

There are many ways of measuring unemployment. Countries like Britain or Belgium count people who claim unemployment benefits, while countries like Austria or Switzerland count people who are registered as unemployed.

Difficulties in measuring unemployment

Hidden unemployment:

- Consists of people who have been unemployed for long periods of time and have given up the search for work

- Those who have part-time work but would prefer to work full time

- Those who are working in jobs for which they are greatly over-qualified.

Costs of unemployment to the unemployed

Unemployed people receive less income than they would if they were employed, if they even have benefits. A reduction in income implies lower standards of living for those that are unemployed and their families. Mental health costs.

Costs of unemployment to society

High levels of unemployment means high levels of poverty, homelessness, crime and vandalism.

Costs of unemployment to the economy

If actual output is less than potential output due to unemployment of labour, then the economy is foregoing possible output and would be operating within the PPC curve. Leads to opportunity cost of government spending, less direct tax, less consumption.

EXAM TECHNIQUE: Labour market

Y-axis: Real average wage rate.

X-axis: Number of workers.

Supply: Aggregate supply of labour.

Demand: Aggregate demand of labour.

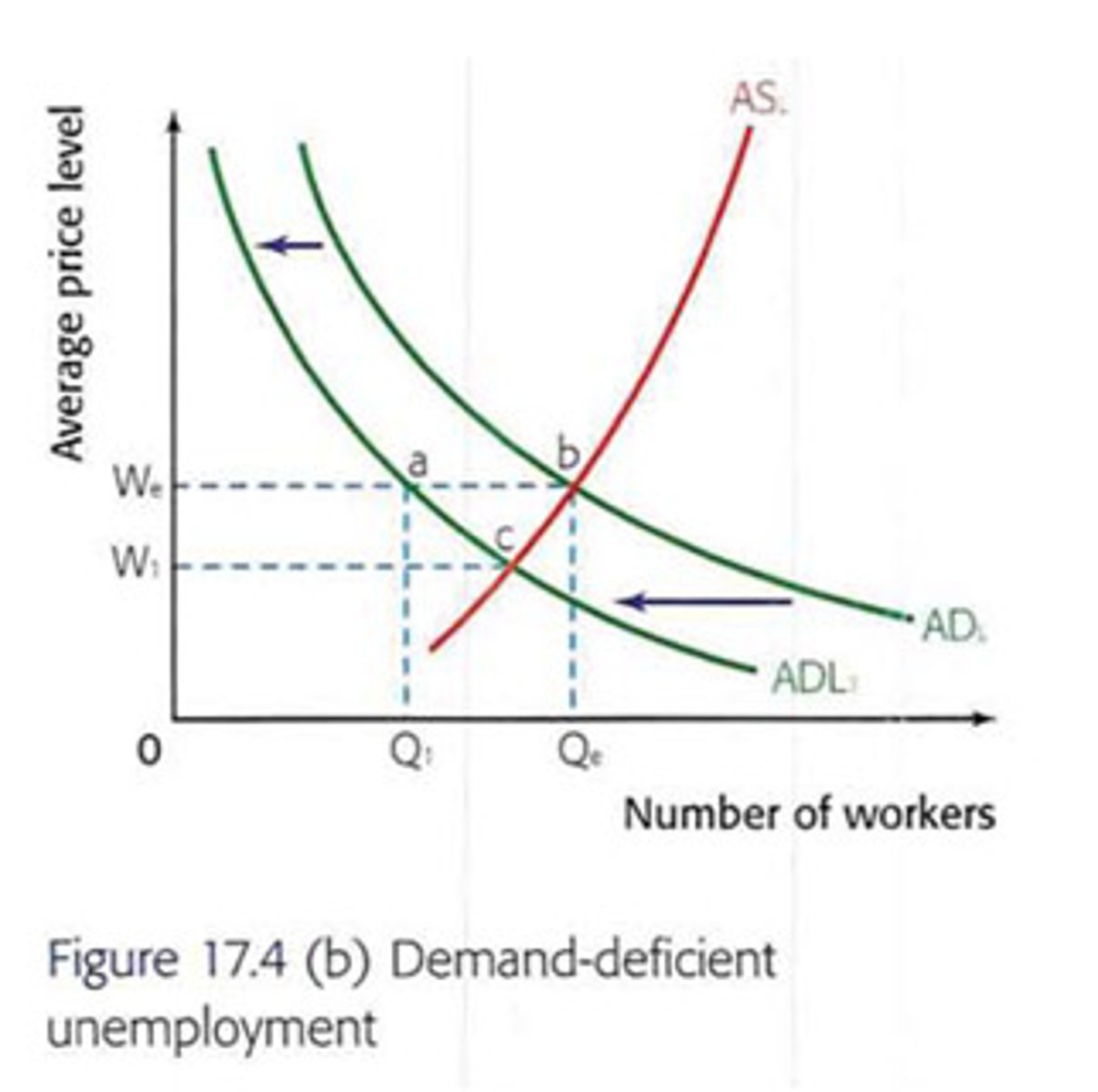

Causes of unemployment: Demand-deficit

This type of unemployment is associated with cyclical downturns in the economy. As the economy moves into a period of slower growth, or negative growth, AD falls as consumers spend less on goods and services. Fall in consumer spending leads to a fall in demand for labour, as firms need to cut back on production. If labour markets functioned perfectly, then we would see the drop in wages shown in the diagram.

However, labour markets do not work perfectly due to 'sticky wages'. Since wages remain at the high level, there is a lot of unemployment a - b.

EXAM TECHNIQUE: Must draw deflationary gap to show downturn in economy and link to the diagram shown.

Solution:

Increasing aggregate demand using demand management policies.

Causes of sticky wages

- Firms realise that paying lower real wages is likely to lead to discontent and reduced motivation among workers, leading to lower productivity.

- Firms may not be able to reduce wages due to labour contracts and trade union power.

Structural unemployment

unemployment that results because the number of jobs available in some labor markets is insufficient to provide a job for everyone who wants one

Structural unemployment, change in framework of economy

- Laws governing labour market.

Consider case of law making firing of workers illegal without documentation and proof of inefficiency. Such law may make it difficult for firms to hire workers as they fear costs of dismissing them should they be inefficient, reducing demand for labour.

- Minimum wage legislation.

Since the minimum wage is higher than the equilibrium wage, there is an excess supply of workers. Since unemployment is people who want to work but cant, this counts as unemployment.

You must be able to draw this for the exam.

- Laws governing trade unions.

Key responsibility of trade unions is to protect union members. Firms may not be allowed to hire certain workers who are willing and able to work as they are non-union, contributing to unemployment.

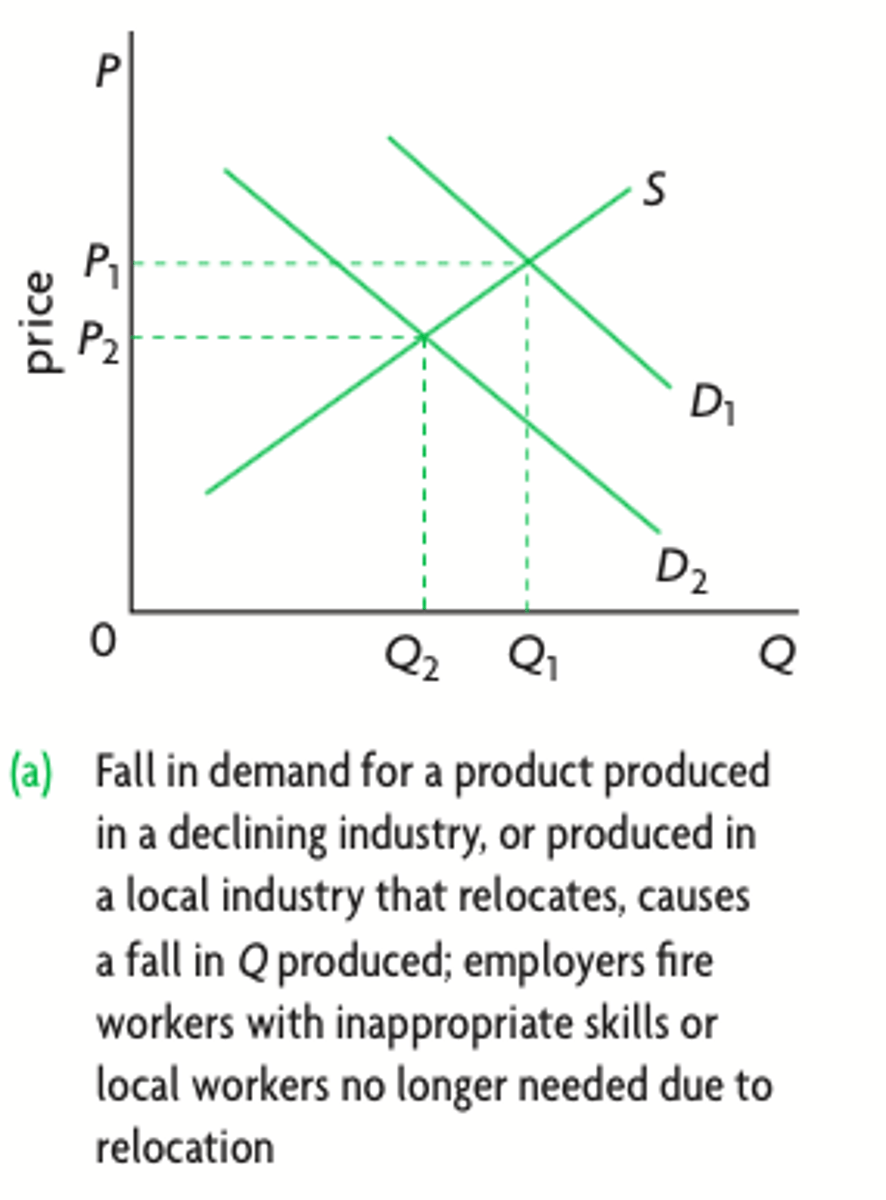

Structural unemployment, permanent fall in demand

Causes:

- Technological change making workers redundant. Example: Self driving trucks.

- Globalisation allowing for labour in countries where labour costs are lower leading to unemployment in the home country. Example: USA and China.

- Changes in consumer taste may lead to a permanent fall in demand for a good. Example: Coal

Curing structural unemployment, interventionist

- Education system that trains people to be more occupationally flexible. Evidence suggests that people in more developed economies will have to change jobs several times in career. Education system therefore must make people learn to adapt.

- Improving occupational mobility through adult upskilling.

- Subsidising training firms.

- Subsidise or tax break to encourage people to move to areas with many jobs.

- Supporting apprenticeship programmes.

Job centres providing information about job vacancies, trading opportunities and interview-training.

Curing structural unemployment, market-based

- Reduction of unemployment benefits to encourage workers to seek jobs.

- Deregulating firing and hiring workers.

Frictional unemployment

Short-term unemployment that arises from the process of matching workers with jobs.

To reduce frictional unemployment governments may want to reduce unemployment benefits, increasing incentives to find work.

Governments may also improve the flow of information so people know about vacancies when they happen.

Seasonal unemployment

Unemployment that occurs as a result of harvest schedules or vacations, or when industries slow or shut down for a season

May be reduced by encouraging people to seek different jobs in the 'off-season'.

Natural rate of unemployment

When the labour market is in equilibrium, the number of job vacancies matches the number of people looking for work. Even so, there are some workers who are unwilling or unable to take them.

Natural unemployment = Structural + Frictional + Seasonal.

DEFINITION: Inflation

(Measuring inflation)

Inflation is defined as the persistent increase in the average price level in the economy, usually measured through a basket of goods or the CPI.

The main drawback to measuring inflation this way is that while the basket of goods represents a good amount of households, it does not represent all of them.

Other ways of measuring inflation use the PPI or producer price index, which tracks the prices of good as they leave the factories of producers.

Costs of high inflation, loss of purchasing power

If the rate of inflation is 2%, and your income increases by less than 2%, then you will not be able to buy the same things you would have been able to before. This is a loss in purchasing power.

Costs of high inflation, effect on savings

If you save $1,000 in the bank at 4% annual interest, but the inflation rate is 6%, then your real rate of interest will be negative. Therefore, inflation discourages saving.

Costs of high inflation, effect on economic growth

If people do want to save money, rather than spend on consumption, they may choose to buy fixed assets such as houses or art. This means that there are fewer savings available in the economy for investment purposes, which is bad for growth.

Costs of high inflation, effect on interest rates

If there is a high inflation banks will have to raise their nominal interest rates to keep the real rate positive.

Costs of high inflation, effect on international competition

High inflation rate will make exports less competitive and imports from countries with lower inflation more desirable, decreasing AD.

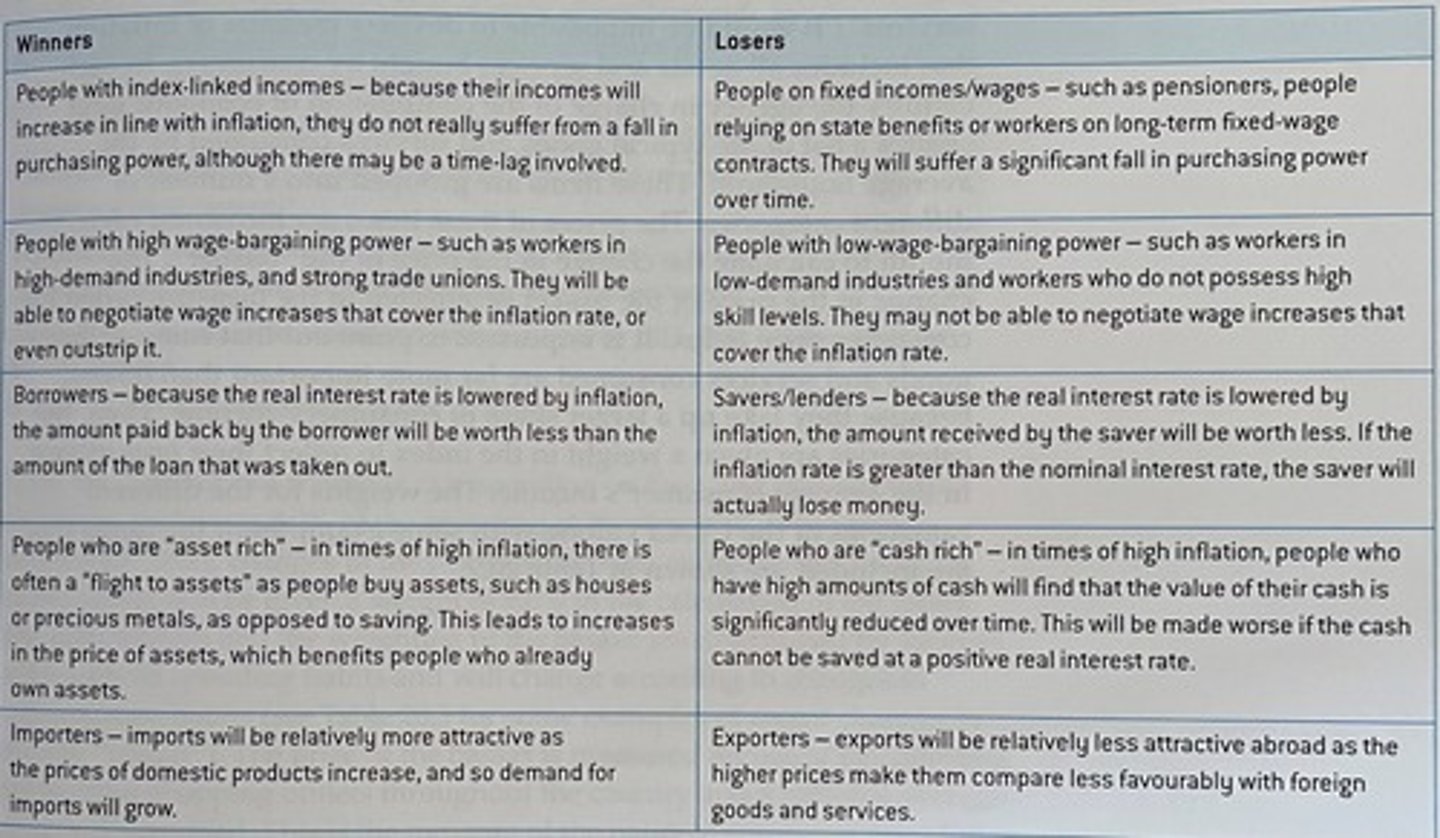

Winners and losers in inflation

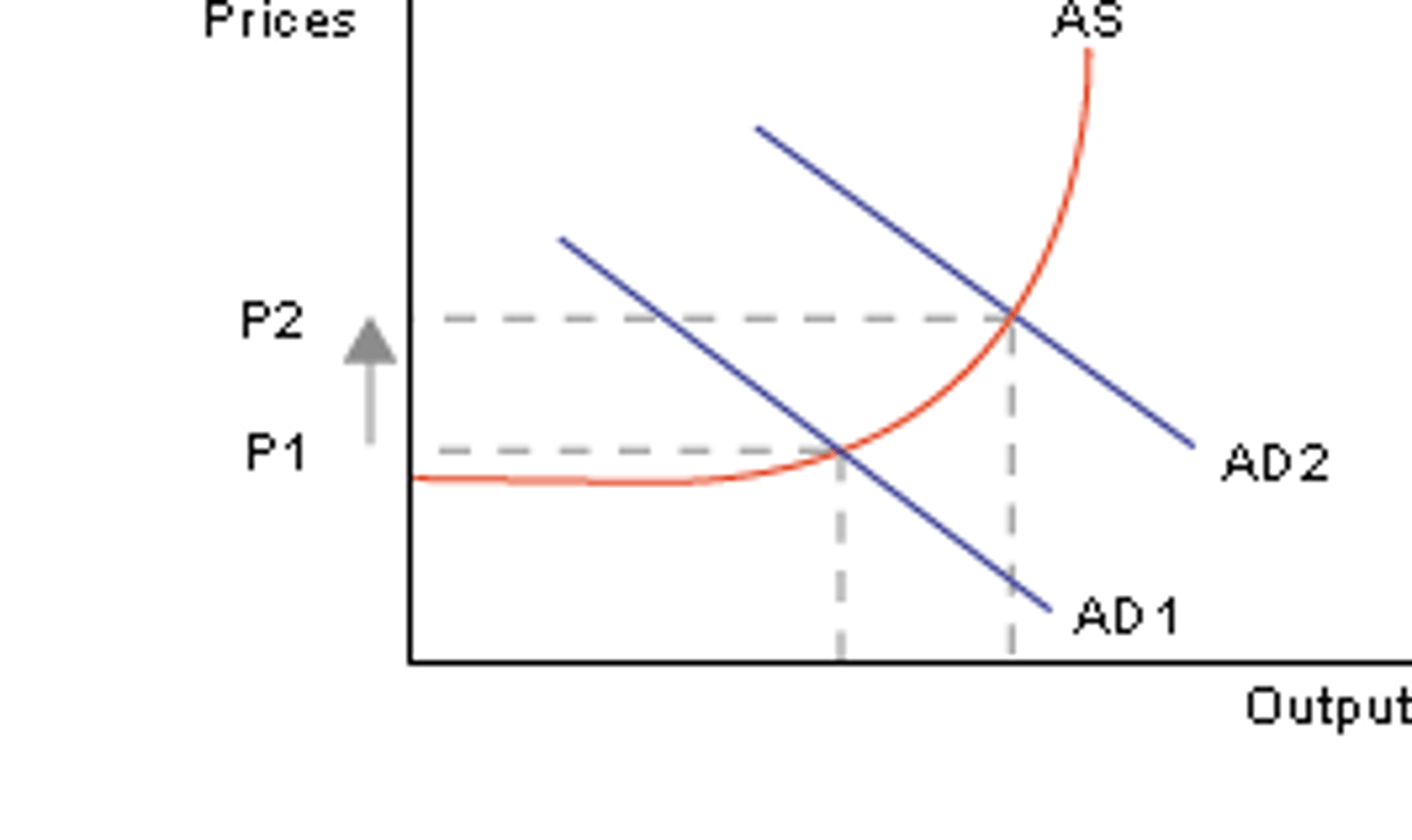

Demand-pull inflation

Demand pull inflation, unsurprisingly, comes from a rightward shift in AD. The increase in AD could come from any change in the components of AD.

Cost-push inflation

Cost push inflation comes from an increase in the costs of the factors of production. Increases in the costs of labour may be referred to as wage-push inflation.

Examples of cost-push inflation:

UK inflation in November 2021 was 4.2%, a 10 year high. This was because of the increase in the price of oil, of 12.2%.

Reducing inflation

In the case of demand-pull inflation, it is clear that governments should use demand side management to try and increase consumption.

Rather counterintuitively, demand side management is also effective against cost-push inflation. This is because while the inflation comes from SRAS, policy makers have very little control on the costs of the FoP.

However, contractionary demand side management is generally very unpopular with the public. Fiscal policy, due to the requirement of increasing taxes, is especially so. Hence, most developed economies adopted a policy of (almost) complete independence between the central bank and government, so that the bank can continue making unpopular decisions, which ultimately benefit the population, rather than being influenced by whatever political party is in power. This is also because monetary policy is significantly better at reducing and controlling inflation than fiscal policy, as it is difficult for governments to reduce their spending or to increase taxes.

Deflation

A persistent fall in the average price level in the economy. It has two types, "good deflation", and "bad deflation".

Good deflation

Good deflation comes from improvements in the supply side of the economy (LRAS shifting out), causing decreased price levels and higher output.

Benefits:

Increased employment, output and growth.

Bad deflation

Bad deflation comes from the demand side of the economy. A fall in AD results in a decrease in price level, and a decrease in output.

EXAM TECHNIQUE: Deflation vs. Disinflation

Deflation is the decrease in price levels.

Disinflation is the decrease in the rate of inflation.

Costs of "bad" deflation

- Unemployment

If AD is low then businesses may lay off workers, further reducing AD. May cause deflationary spiral.

- Deferred consumption

If prices are falling, the purchase of durable goods will be put of, as consumers wait for prices to drop even further. This can lead to further drops in AD, and may cause a deflationary spiral.

- Falling consumer confidence

Causes decreased AD and deflationary spiral.

- Effect on investment

Deflation means businesses make less profit, or losses. This leads to laying off workers. Business confidence may also be low, bad for growth.

- Cost to debtors

Costs of paying back loans increases with deflation.

- Policy ineffectiveness

Deflation makes monetary policy ineffective. The low or negative real interest rates makes it impossible to reduce interest rates substantially.

DEFINITION: Economic growth

An increase in real GDP over time.

Short-term growth

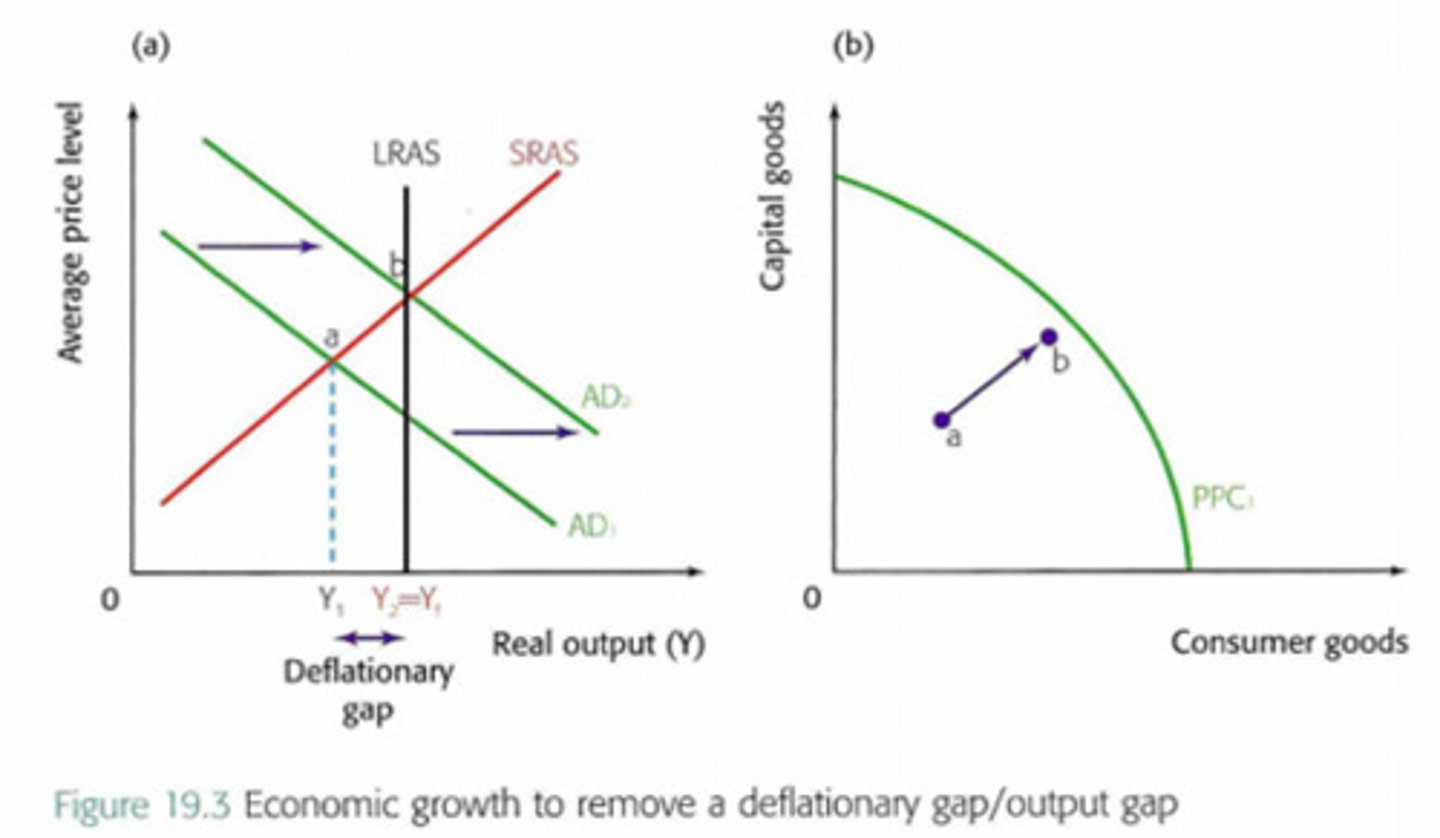

Short-term (actual) growth is shown as a movement within a PPC curve. It is also shown by a movement in SRAS or AD which either closes a deflationary gap or opens an inflationary gap.

Note that a return to LRAS on an AD/AS diagram is never shown as a dot on the edge of the PPC curve since the economy can never function at its full level of output, due to natural unemployment.

Long-term growth

Long-term growth is shown as an increase in LRAS or a shift outwards of the PPC curve. It can be achieved with supply-side policies.

EXAM TECHNIQUE: How to measure economic growth

Growth rate = 100* (rGDP year 2 - rGDP year 1) : rGDP year 1

Positive consequences of economic growth

If we assume that aggregate demand will increase at an appropriate rate (such that there is no inflation), which is natural as population sizes and incomes grow, we may gather the following benefits:

- Higher incomes means higher living standards.

- Economic growth is achieved through leaps in technology, but also contributes to further technological advancement, such as health care and transportation.

- Higher income leads to greater tax revenue, which can be spent on merit and public goods, increasing living standards. May also help redistribute wealth.

- Higher productivity makes exports more competitive. May also make imports more attractive.

- Levels of education and human capital may rise as well.

Negative consequences of economic growth

- Move from primary to secondary production may lead to structural and frictional unemployment.

- Less leisure time in general may reduce well being.

- The benefits of growth may not be shared equitably.

- Impact on the environment (also known as uneconomical growth)