AP Macroeconomics Ultimate Guide

1/73

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

74 Terms

Labor Participation Rate

number of people in labor force/working age population x 100

Unemployment rate

number of people unemployed/number of people in labor force x 100

% Change in GDP

(New GDP - Old GDP)/Old GDP x 100

Consumer Price Index

Value of market basket/Value in base year x 100

GDP deflator

Nominal GDP/Real GDP x 100

GDP (Expenditure Approach)

C + I + G + (X - M)

GDP (Income Approach)

Wages + Rent + Interest + Profit

MPS =

1 - MPC

Spending Multiplier

1/MPS

Tax Multiplier

MPC/MPS or (1/MPS) - 1

Money Multiplier

1/Reserve Requirement

Real Interest Rate

Nominal Interest Rate - Expected Inflation

Quantity Theory of Money

M x V = P x Y

Increase in Human Capital

Increase in Economic Growth

Increase in Demand

Equilibrium Price Up

Increase in Supply

Decrease in Equilibrium Price

Increase in Consumer Spending

Increase in Real GDP

Increase Interest Rates

Decrease in Investment

Increase in Inflation

Decrease in Real Wages

Increase in Discouraged workers

Decrease in Unemployment rate

Increase in Aggregate Demand

Increase in Price Level

Increase in SR Aggregate Supply

Decrease in Pirice Level

Increase in Government

Increase in Real GDP

Increase in Taxes

Decrease in Disposable Income

Increase in MPC

Increase in Spending Multiplier

Increase Interest Rates

Decrease in Bond Prices

Increase in Money Supply

Decrease in Nominal Interest Rates

Increase in Reserve Requirement

Decrease in Money Supply

Increase in Discount Rate

Decrease in Money Supply

Increase in Central Bank buys bonds

Increase in Money Supply

Increase in Interest on Reserves

Decrease in Aggregate Demand

Increase in Inflation

Decrease in Real Interest Rate

Increase in Deficit Spending

Increase in Real Interest Rates

Increase in Capital Stock

Increase in Economic Growth

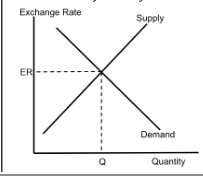

Increase in Appreciation

Decrease in Net exports

Increase in Interest Rates

Increase in Net Capital inflow

Comparative Advantage

A country makes a good at a lower opportunity cost than another country

Investment

Business spending on physical capital, never personal investing

Full Employment

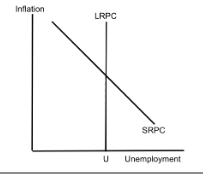

When there is only frictional and structural unemployment

Long-run self-adjustment

When there’s a positive or negative output gap, SRAS will eventually shift.

Fiscal policy

Government changes spending and/or taxes. This shifts AD.

Monetary policy

When there are limited reserves, Central banks can influence interest rates by changing the reserve requirement, discount rate, or by doing open market operations. This shifts AD.

Open Market Operations

When Central banks buys or sell bonds.

Crowding Out

Deficit spending leads to higher real interest rate and less investment

Capital Inflow

High interest rates decrease investment but attract more foreign financial capital.

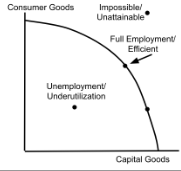

Production Possibilites Curve

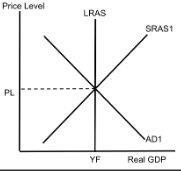

AD/AS (Full Employment)

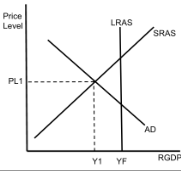

AD/AS (Negative Output Gap)

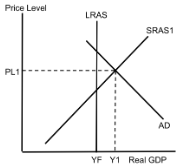

AD/AS (Positive Output Gap)

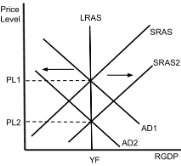

AD/AS (Recession Self-Adjust)

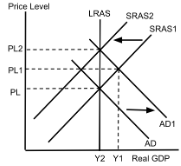

AD/AS (Inflation Self-Adjust)

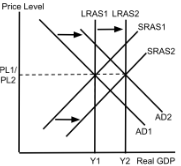

AD/AS (Economic Growth)

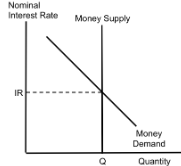

Money Market

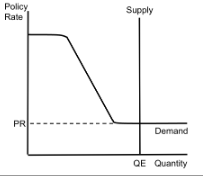

Reserve Market

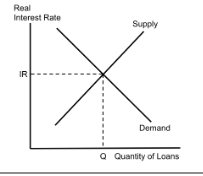

Loanable Funds

Phillips Curve

Foreign Exchange

Discount Rate

The interest rate the Federal Reserve charges banks to borrow money. Lowering it encourages banks to lend more, stimulating the economy.

Policy Rate

A general term for key interest rates set by central banks (like the discount rate or federal funds rate) to influence economic activity.

Ample Reserves

When banks hold more reserves than required, giving them flexibility to lend more, which can support economic growth.

Limited Reserves

When banks less reserves than required, giving them less flexibility to lend more.

Cyclical Unemployment

Job loss due to economic downturns; occurs when demand for goods and services decreases.

Frictional Unemployment

Short-term unemployment during transitions between jobs or entering the workforce.

Structural Unemployment

Long-term unemployment from a mismatch between workers' skills and job requirements, often due to technological changes.

Seasonal Unemployment

Job loss related to seasonal work patterns, such as holiday retail or agricultural harvesting.

Human Capital

The skills, knowledge, and experience possessed by individuals, enhancing their productivity.

Capital Investment

Spending on physical assets like machinery or buildings to increase production capacity.

Capital Outflow

When money leaves a country to invest in foreign assets, often due to better returns or economic instability at home.

Marginal Propensity to Consume (MPC)

The fraction of additional income that a household spends on consumption.

Marginal Propensity to Save (MPS)

The fraction of additional income that a household saves rather than spends.

Remittance

Money sent by individuals working abroad to family or others in their home country.

Tax Credit

A direct reduction in the amount of taxes owed, often used to encourage specific behaviors like education or investment.

M1 Money

The most liquid forms of money—immediately available for spending.

M2 Money

A broader measure of money that includes M1 plus assets that are slightly less liquid.