1. Goals and Governance of the Corporation

1/125

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

126 Terms

Plant and machinery, office buildings, and vehicles are (BLANK) assets

tangible

Brand names and patents are (BLANK) assets

intangible

Corporations finance assets by

1. borrowing

2. reinvesting profits back into the firm

3. selling additional shares

Investment decisions do what?

spend money

Financing decisions do what?

raise money for investment

The financial goal of the corporation is

maximizing value

Financial managers add value whenever the (BLANK) can (BLANK) to earn a (BLANK) return than its (BLANK) can earn for themselves

corporation, invest, higher, shareholders

corporate governance helps to align the interests of

managers and shareholders

investment forms that provide funds and advice to young companies in return for a partial ownership share

venture capitalists

Decision to invest in tangible or intangible assets

capital budgeting or capital expenditure (CAPEX) decision

decision on the sources and amounts of financing

financing decision

assets used to produce goods and services

real assets

financial claims to the income generated by the firm’s real assets

financial assets

When a company needs to raise money it can either invite (BLANK) to put up cash in exchange for a share of (BLANK), or it can promise to pay back the (BLANK)

investors, ownership, investors’ cash plus a fixed rate of interest

Investors that receive shares of stock and become shareholders, part-owners of the corporation

equity investors

equity investors contribute

equity financing

investors that lend cash and get repaid cash plus a fixed rate of interest later

debt investors

debt investors are

lendors

the choice between debt and equity financing is often called the

capital structure decision

the firm’s sources of long-term financing

capital

A firm that is seeking to raise long-term financing is said to be

raising capital

When a firm invests in something to produce the firm’s goods and services, it acquires

real assets

The firm finances its investment in real assets by issuing (BLANK) to investors

financial assets

Shares of stock and bank loans are (BLANK) assets

financial

Financial assets that can be purchased and traded by investors in public markets are called

securities

Financial managers say that “value comes mainly from the (BLANK) side of the balance sheet”

investment

If Microsoft shares traded for $230 each and there were 7.56 billion shares outstanding then Microsoft’s market value, market capitalization, or market cap is

$1,739 billion

Financing decisions add (BLANK) value compared to good investment decisions

less

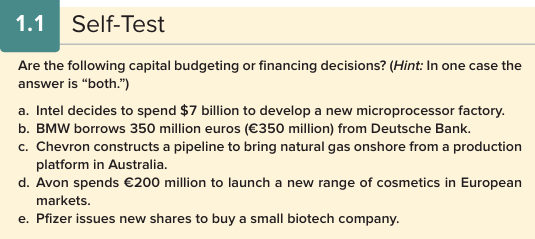

a. Capital budgeting

b. financing

c. Capital budgeting

d. Capital budgeting

e. Both

The investment decision =

purchase of real assets

The financing decision =

sale of financial assets

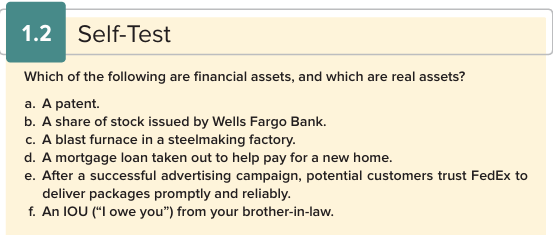

a. r

b. f

c. r

d. f

e. r

f. f

A business organized as a separate legal entity owned by stockholders

corporation

the owners of a corporation are not personally liable for its obligations

limited liability

set out the purpose of the business and how it is to be financed, managed, and governed

articles of incorporation

A corporation’s owners are called

shareholders or stockholders

A corporation is legally distinct from the shareholders. Therefore, the shareholders have (BLANK) and cannot be held personally responsible for the corporation’s debts

limited liability

Shareholders can lose their entire investment in a corporation, but

no more

Incorporation means that the bank will be more cautious in lending to you because it will have no recourse to your

other assets

When a corporation is first established and the shares are not publicly traded the company is said to be

closely held

When new shares are issued to raise additional capital, corporations are called

public companies

Public shareholders elect a (BLANK) who appoint the top managers and monitor their performance

board of directors

Makes corporations able to, in principle, live forever as even if managers quit or are dismissed, the corporation survives

separation of ownership and control

The separation of corporate ownership and control can also have a downside as it can open the door for managers and directors to act in their

own interests

Income generated by businesses that are not incorporated is taxed just once as

personal income

An important tax drawback to corporations is that they are a separate legal entity and are taxed

separately

supervises all financial functions and sets overall financial strategy

chief financial officer (CFO)

is the most important financial voice of the corporation and explains earnings results and forecasts to investors and the media

chief financial officer (CFO)

Responsible for financing, cash management, and relationships with banks and other financial institutions.

treasurer

Responsible for budgeting, accounting, and taxes.

controller

Below the CFO are usually a (BLANK) and a (BLANK)

treasurer, controller

main function is to obtain and manage the firm’s capital

treasurer

ensures that the money is used efficiently

controller

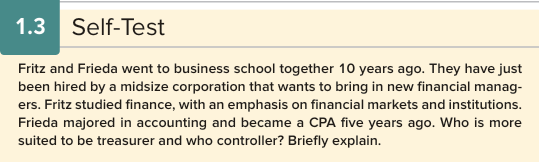

Treasurer: Fritz

Controller: Frieda

anyone responsible for an investment or financing decision

financial manager

A corporation’s roster of shareholders will usually include both (BLANK) and (BLANK) investors

risk-averse, risk-tolerant

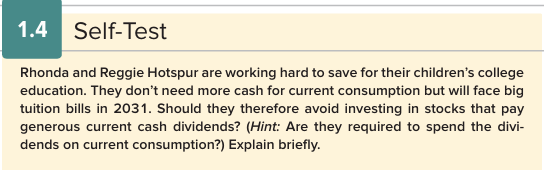

No

As long as a corporation's proposed investments offer (BLANK) rates of return than its shareholders can earn for themselves in the stock market (or in other financial markets, its shareholders will applaud the investments and the market value of the firm will increase

higher

Managers look to the (BLANK) to measure the opportunity cost of capital for the firm's investment projects

financial markets

Opportunity cost of capital: 15%

No, 12% < 15%

In most large corporations the owners are usually outside investors, and so the managers may be tempted to act in their

own interests

Agency problems arise when (BLANK) have (BLANK)

Managers may empire-build with (BLANK)

managers and shareholders, different objectives, excessive growth, risk-aversive, or take excessive salaries

1. Internal controls and decision-making procedures

2. Compensation schemes that align managers' and shareholders' interest

3. Corporate governance systems

requires that more board of directors be independent, not affiliated with management

Sarbanes-Oxley Act of 2002 (SOX)

The further the stock price falls, the easier it is for another company to buy up the majority of shares and

take over