econ unit 11 ppt

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

Externalities

1. Fundamental Welfare Theorems — Background for Externalities

__ Welfare Theorem

In perfectly competitive markets, with ideal conditions, the market outcome is ___.

“Efficient” = maximizes total surplus.

first, efficient

___ Welfare Theorem

Any efficient allocation can be achieved by:

___ wealth first

Then letting markets operate ___

Meaning: equality concerns ≠ efficiency concerns.

second, redistributing, freely

BUT these theorems depend on unrealistic assumptions:

All markets must be perfectly ____

– No market power, monopolies, or strategic behavior.All agents have ____ information and beliefs

– No misinformation, uncertainty, or asymmetric information.No externalities

– People only affect __

When any of these fail → markets can be inefficient.

competitive, perfect, themselves

2. What Are Externalities?

Externalities are the ___ of an economic choice that affect others who did not make the decision.

Positive externalities → third-party benefits

Negative externalities → third-party costs

Externalities occur in both production and consumption

Production: ____, bee pollination, R&D spillovers

Consumption: ___, congestion, Christmas lights

Externality = external effect.

consequences, pollution, noise

3. Examples from Daily Life (Slides 7–14)

“No man is an island” (John Donne, 1624)

Used to illustrate that: Individuals’ actions ____ affect others.

Negative Externalities

Congestion

Conflicting lawn maintenance

Household ___(Neve’s nasty nicotine addiction)

CO₂ emissions & climate change

Noise pollution

inevitably, trash

Positive Externalities

Christmas lights → neighborhood enjoyment

Education → societal productivity

____ → herd immunity

Employment → reduced crime

Flowers & bees → pollination

Network spillovers → social media value increases with more users

Graph example: CO₂ emissions vs. temperature (Slide 12)

CO₂ emissions rising from 1900–2025

Global temperature increases with emissions

→ Clear visual of negative externality: harm falls on everyone

vaccines

4. Externalities and Market Failure

Moral behavior vs. economic incentives

Ideally: people consider how their actions affect others

In reality: decisions are made based on ___ costs and benefits

→ Externalities are usually ___.

When externalities are ignored:

Private decision rule (selfish choice):

MC = MB

Social efficiency rule: MSC = MSB

MSC = MC + __

(Marginal Social Cost = Private cost + Marginal External Cost)

MSB = MB + MEB

(Marginal Social Benefit = Private benefit + Marginal External Benefit)

private, ignored, MEC

5. Negative Externalities (Slides 18–22)

Pollution

___ emissions

Traffic congestion

factory

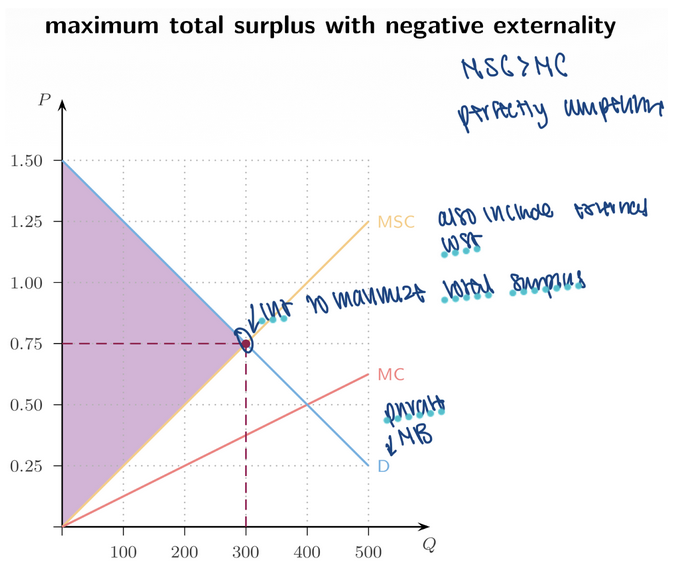

Graph: Negative Externality (Slide 18)

Graph with Q (quantity) on x-axis and P (price) on y-axis.

Curves:

____ (private cost) = ___ curve ignoring external costs

MSC (social cost) = MC + external cost

→ lies ___*** MCVertical distance between MSC and MC = ____*** (external cost)

Producers do not bear the full cost → they overproduce

MC, supply, above, MEC

Socially Efficient Outcome (Slide 19)

Add the demand curve (D).

Efficient Q = intersection of ___ and D

Free-market Q = intersection of ___ ****and D

The efficient quantity is ____.

→ Society prefers ___ production than the market produces.

MSC, MC, lower, less

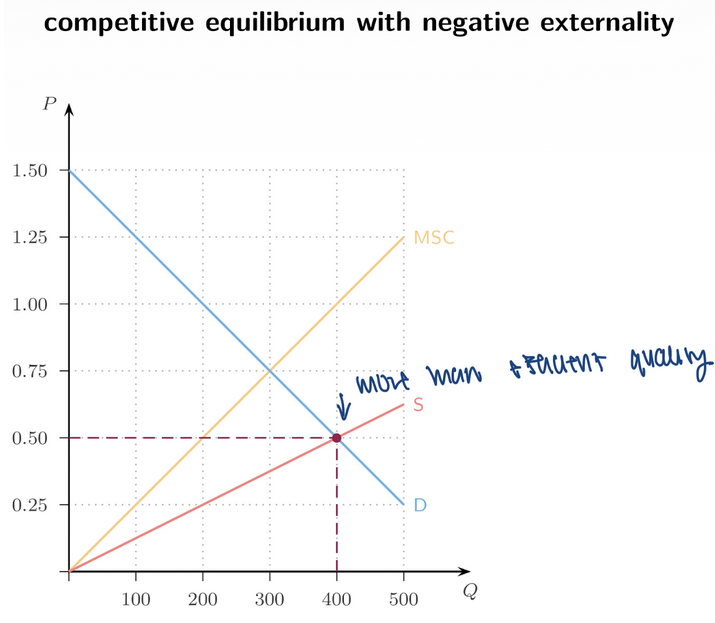

Competitive Equilibrium (Slide 20)

The market produces where: D intersects ___ (private supply)

→ Overproduction

MC

Negative Externality Summary

Free market results in:

___

Too ___ a price

___

overproduction, low, DWL

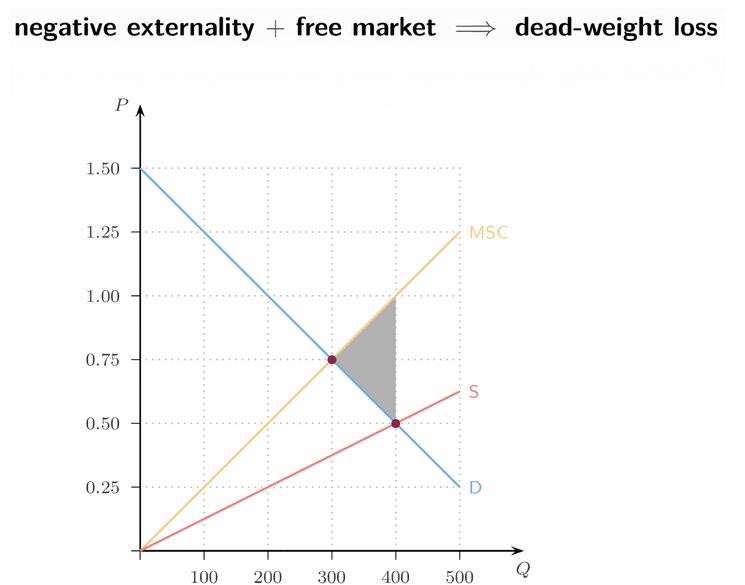

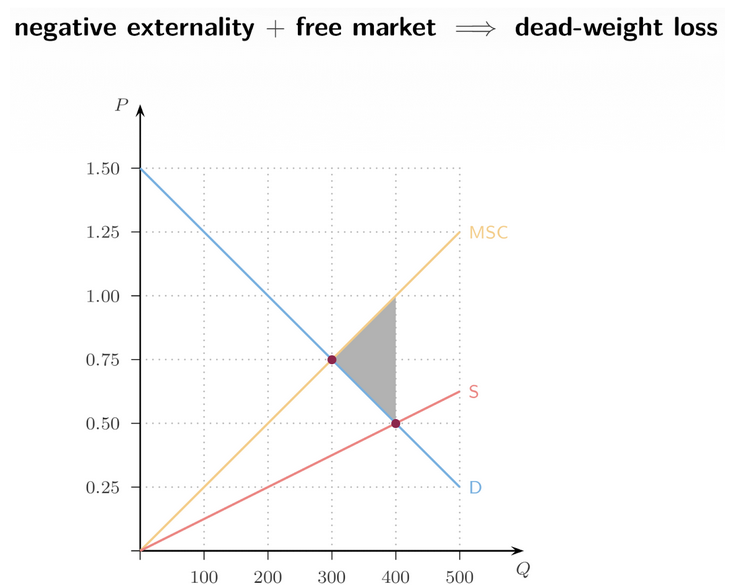

Graph: Deadweight Loss (Slide 22)

DWL = triangular area between:

__

__

__

between the efficient Q and the market Q.

MSC, MC, Demand

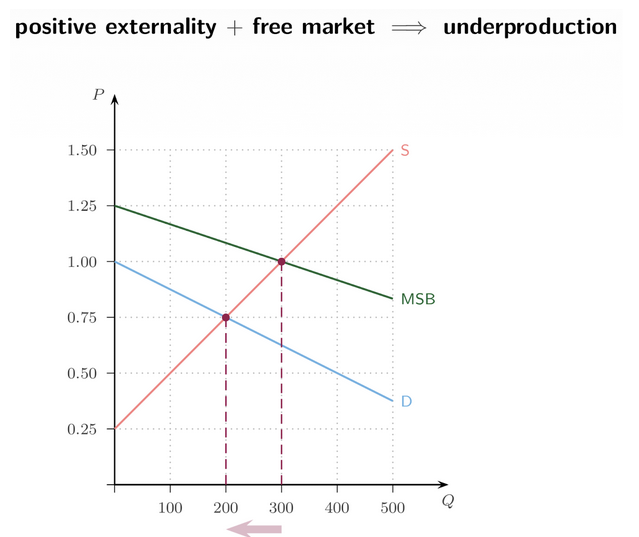

6. Positive Externalities (Slides 23–27)

Education

Vaccinations

R&D

Public __

Well-maintained lawns

art

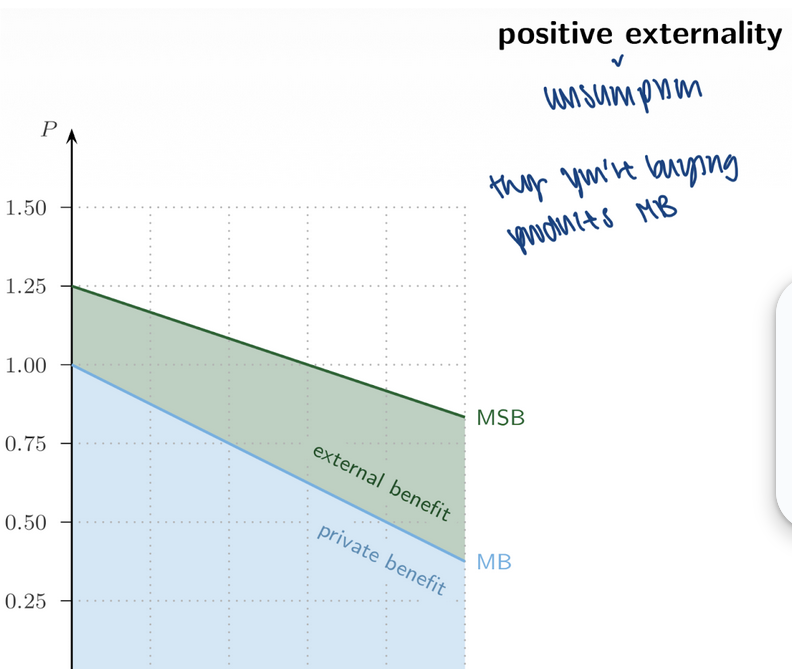

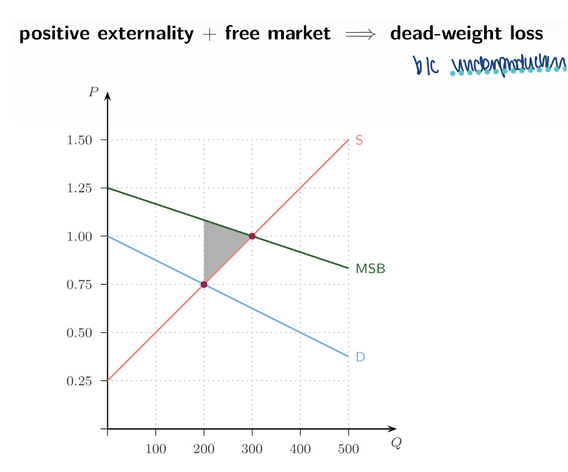

Graph: Positive Externality (Slide 23)

Curves:

MB (private benefit) = demand curve

MSB (social benefit) = MB + external benefit

→ lies above MB

Distance between MSB & ___ = MEB (external benefit)

MB

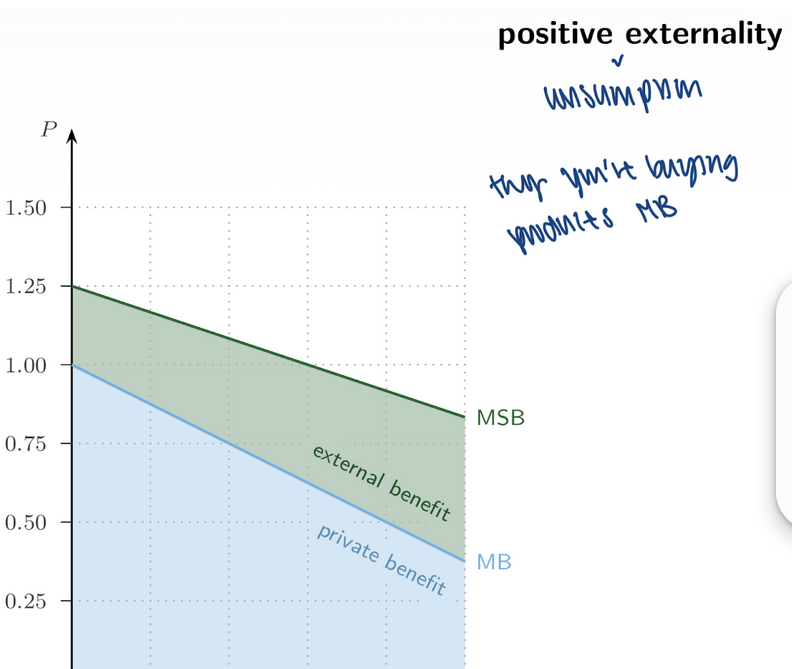

Efficient Outcome (Slide 24)

Efficient Q = intersection of: ____and ___

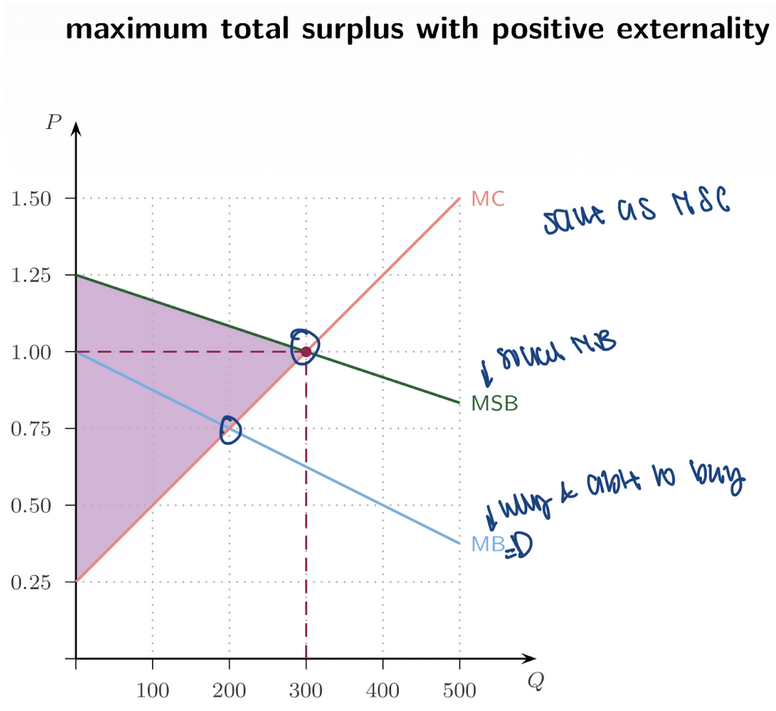

Market Outcome (Slide 25)

Market chooses: ___ intersects ___

→ __

MSB, MC, MB, MC underproduction

Market Outcome (Slide 25)

Market chooses: __ intersects __

→ __

MB, MC, underproduction

Positive __ Summary

Free market results in:

Underproduction

Too low a quantity

Deadweight loss

(DWL between MSB & MB between the two quantities)

externality

7. Why Markets Fail with Externalities

Competitive markets are efficient only if:

Every person is an ___ decisionmaker

No unintended ___ exist

But: In almost all real-world activities, externalities exist

→ Therefore, policy interventions can improve efficiency.

isolated, spillovers

8. Controlling Pollution (Slides 29–30)

Three major policy approaches:

1. Price Controls (bag fees)

Toronto considering $2 fee on plastic bags

Federal ban on single-use plastics (ongoing legal battle)

Effect: Raising price reduces __ = lower pollution.

QD

8. Controlling Pollution (Slides 29–30)

Three major policy approaches:

2. Quantity Controls (Quotas / Cap-and-Trade)

Canada drafting national cap-and-trade

Systems in: Quebec, California, EU, China

Mechanism:

Government sets a cap on total emissions

Firms receive or buy ___

They can trade permits → ensures ___ reduction.

permits, least-cost

8. Controlling Pollution (Slides 29–30)

Three major policy approaches:

3. Pigouvian Taxes (___ Taxes)

Canada:

Federal carbon tax + ___ since 2019

BC + Quebec have provincial systems

Canada reached peak emissions in 2023

Purpose: Make firms/consumers pay the full ___ cost.

carbon, rebates, social

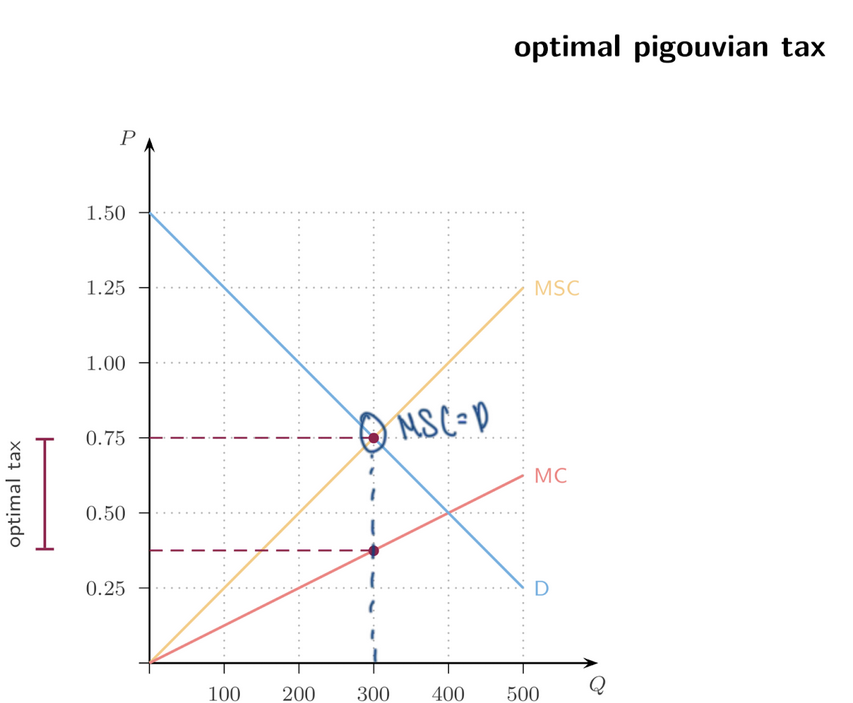

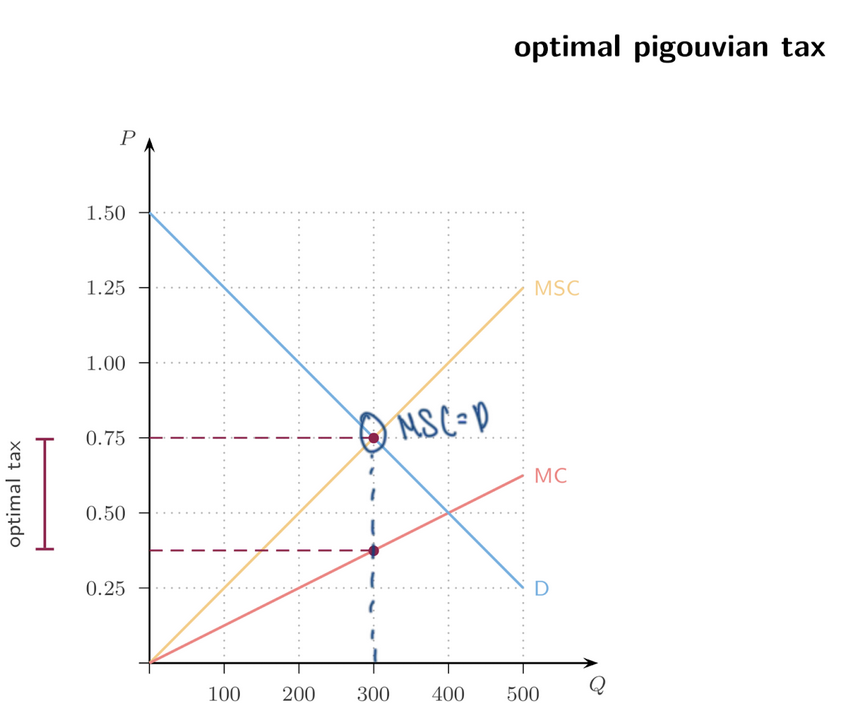

9. Pigouvian Taxes (Slides 33–35)

A Pigouvian tax is a tax set equal to the marginal external cost (MEC).

T = ____

Effect on price:

Price consumers pay becomes: ___ + ___ = ____ + MEC = MSC

The tax internalizes the external cost

Market outcome becomes efficient again.

Assumptions (important for exams):

Government must be able to:

Accurately measure __

Have correct incentives (not use tax as cash grab)

MEC, P + T, MC, MEC

Graph: Optimal Pigouvian Tax (Slide 34)

Curves:

MC = private supply

MSC = MC + __

Demand

The tax vertically shifts supply upward until: New supply intersects demand at the efficient quantity

tax

Graph: Efficiency Restored (Slide 35)

New supply = supply + tax

Intersection with __ = efficient Q

No deadweight loss → maximized total surplus

demand

10. Are Carbon Taxes Good? (Slide 36)

Benefits

Increase ___

Increase efficiency

Reduce pollution

Political skepticism

People perceive it as a “cash grab”

Public concern: ___

Despite rebates where 70–90% of households get back more than they pay.

Economist consensus

Large majority support carbon pricing:

Canadian open letter

American open letter

Global expert surveys

revenue, inflation

11. Producing Knowledge (Slides 37–39)

Knowledge production has positive externalities, so markets underproduce it.

Policies to promote knowledge:

1. Public __

Public universities (including Western University)

Western’s revenue:

54% tuition

33% government

13% other sources

provision

11. Producing Knowledge (Slides 37–39)

Knowledge production has positive externalities, so markets underproduce it.

Policies to promote knowledge:

2. Subsidies / Vouchers

Work like negative Pigouvian taxes

Reduce the price to consumers

Vouchers = more consumer ___

Provinces offering vouchers: AB, QC, MB, SK (some extent)

choice

11. Producing Knowledge (Slides 37–39)

Knowledge production has positive externalities, so markets underproduce it.

Policies to promote knowledge:

3. Intellectual Property Rights

Patents

Copyrights

___

These give creators temporary ___ profits → incentive to __.

trademark, monopoly, innovate

12. Coase and Transaction Costs (Slides 40–42)

Coase (1988) Quote - Markets exist to reduce ___ costs.

Coase’s Theory of the Firm

Why do some transactions occur ___ firms instead of in markets?

Because of:

Search __

__ frictions

Incomplete contracts

Contract enforcement problems

Misaligned ___

Firms exist to reduce these costs.

transaction, inside, frictions, information, incentives

Property Rights & Externalities

Assigning property rights can ___ externalities.

Patent owners can license ___

River owner can sell pollution ___

Knowledge creators earn ___ profits

Effectiveness depends on:

__ costs

___ costs

Sometimes:

Private regulators work best

Sometimes government is needed

internalize, innovations, rights, monopoly, enforcement, transaction

13. Public Goods (Slides 44–46)

Rival vs Nonrival

Excludable vs Nonexcludable

Rival good - Consumption by one person reduces ___ for others.

Food

Fish in a river

Underground __

Nonrival good - One person’s consumption ___ reduce availability.

__

Streaming services

Pathways

availability, water, doesn’t, knowledge

Excludable good - ___ to prevent someone from using it (through ___ or access).

___

Concert ticket (ERA’s tour)

Nonexcludable good - Cannot prevent ___ from using it.

Public ___

Clean air

__

Law enforcement

Carbon capture

possible, price, house, nonpayers, parks, firefighters

Public Goods Grid (Slide 46)

Rival | Nonrival | |

Excludable | House, food | ERA’s Tour (___) |

Nonexcludable | Fish in rivers, water | Firefighters, law, carbon capture, pathway, social media |

Key idea: Public goods → nonrival + nonexcludable → free rider problem → underprovided by market.

concert

Externalities

MEC, MEB

MSC = MC + MEC

MSB = MB + MEB

Negative Externalities

___

price too low

DWL on __ side

overproduction, right

Positive Externalities

Underproduction

Price too low

DWL on ___ side

Pigouvian Tax

T = ___

Makes MC → MSC

Eliminates __

Cap-and-Trade

Fixed quantity

___ permits

Achieves efficient allocation

left, MEC, DWL, tradable

Public Goods

Nonrival + nonexcludable

Free rider problem

Underprovided by markets

__ Theory

Property rights internalize externalities

Works best when transaction costs low

coase