Finance and Accounting Exam 1

1/132

Earn XP

Description and Tags

Chapters 1-3

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

133 Terms

Each page within Excel is called which of the following?

A worksheet

To properly format a table in Excel, you can use the functions in which ribbon?

home

You have three tables in a worksheet in Excel. You need to sort one of the tables numerically, from smallest to largest values. How can you do this?

Highlight the table, then click on the Data ribbon and find the Sort & Filter button. Use the Custom Sort option to sort from smallest to largest.

Using a formula written as “=B3 + B4 − B5” that points to specific cells versus typing in the numbers listed in those cells is termed which of the following?

Cell referencing

Which Excel cell entry will calculate the square root of 165?

=SQRT(165)

Which fields are required to calculate net present value (NPV) in Excel?

Rate of return and cash flows for each year

Which statements about Excel's FV function are correct?

The FV function has five arguments, and their abbreviations are rate, nper, pmt, pv, and type.

If the number for the pmt argument is entered as a positive value and the pv value is zero, the FV value is negative.

If the interest rate is 10%, the rate argument can be entered as .1 or 10%.

All of the options are correct.

Which Excel function is used to calculate the amount of each annuity payment?

PMT

Which fields are required to calculate the rate of return (RATE) for a present value calculation in Excel?

Nper, PMT, and PV

Nper

Number of periods

Returns the number of periods for an investment based on periodic, constant payments and a constant interest rate

PMT

payment

calculates the payment for a loan based on constant payments and a constant interest rate

PV

present value

calculates the present value of a loan or an investment, based on a constant interest rate

Which Excel ribbon contains the Charts menu?

Insert

You have a list of European stocks that are priced in euros. Where can you go to format the prices in euros in Excel?

The Number menu under the Home ribbon

You need to use the Goal Seek feature in Excel. Where is this located?

Under What-If Analysis in the Data ribbon

You have a table of stocks and their corresponding stock prices. You would like a quick summary of statistics such as median stock price, mean stock price, and standard deviation. What is the best tool to help you find this data?

The Descriptive Statistics feature under Data Analysis in the Data ribbon

Suppose that you have a list of stocks, and for each stock you have its beta and P/E ratio. You want to calculate the correlation between the stocks' betas and P/E ratios. Where can you find the correlation feature in Excel?

Under Data Analysis in the Data ribbon

3 key types of forms of organizations

sole proprietorships, corporations, partnerships

Who is responsible for the financial management of a corporation?

company management

Goal of financial managers

maximize market value of the company

some ways companies incentivize managers to maximize shareholder value

deferred compensation

clawback clauses

compensation tied to financial performances

stock options

Recently, the emphasis of financial management has been on the relationship between risk and return. (T/F)

True

Sole proprietorship means single-person ownership and offers the advantages of simplicity of decision making and low organizational and operating costs. True or False

True

Sole Proprietorships, partnerships and limited liability partnerships are considered pass through forms of organizations because the income passes through to the owners and is taxed at the owner's individual tax rate. True or False

True

There is unlimited liability in a general partnership. True or False

True

Dividends paid to corporate stockholders have already been taxed once as corporate income. True or False

True

Institutional investors have had increasing influence over corporations with their ability to vote with large blocks of stock and replace poorly performing boards of directors. True or False

True

A major focus of the Sarbanes-Oxley Act is to make sure that publicly traded companies accurately present their assets, liabilities, and income in their financial statements. T/F

True

The ultimate measure of performance is not what the firm profits, but how the profits are valued by the investor. T/F

True

Insider trading involves the use of information not available to the general public to make profits from trading in a company's stock. T/F

True

If an investor hears of a large change that a company is going to make through a news article and reacts quicker than any other investor, it is considered insider trading. T/F

False

Money markets refer to those markets dealing with short-term securities having a life of one year or less. T/F

True

Capital markets refer to those markets dealing with short-term securities that have a life of one year or less. T/F

False

The primary market includes the sale of securities by way of initial public offerings. T/F

True

New issues are sold in the secondary market. T/F

False

Existing securities are traded in the secondary market. T/F

True

Time value of money is the idea that a dollar received today is worth less than a dollar that we expect to receive at some date in the future. T/F

False

What should be the primary goal of financial management?

Maximizing shareholder wealth

Proper risk-return management means that

the firm must determine an appropriate trade-off between risk and return.

Corporate governance is the

relationship and exercise of oversight by the board of directors of the company.

Agency theory examines the relationship between the

owners of the firm and the managers of the firm.

The Sarbanes-Oxley Act was passed in an effort to

control corrupt corporate financial behavior.

Maximization of shareholder wealth is a concept in which

optimally increasing the long-term value of the firm is emphasized.

Insider trading occurs when

someone has information not available to the public which they use to profit from trading in stocks.

What is the future value of $2,000 deposited for one year earning 6 percent interest rate annually?

$2,120

The difference between investments and corporate finance is that investors use investment principles to value the stock and bonds of many companies whereas corporate finance principles are used to determine which assets the firm should develop or buy, which securities to issue, how management compensation should be structured and other inside of the company issue. T/F

True

Profits of sole proprietorships are taxed at corporate tax rates. T/F

False

Dividends paid to corporate stockholders have already been taxed once as corporate income. T/F

True

Agency theory examines the relationship between companies and their customers. T/F

False

Institutional investors have had increasing influence over corporations with their ability to vote with large blocks of stock and replace poorly performing boards of directors. T/F

True

Maximizing the earnings of the firm is the main goal of financial management. T/F

False

Insider trading involves the use of information not available to the general public to make profits from trading in a company's stock. T/F

True

If an investor hears of a large change that a company is going to make through a news article and reacts quicker than any other investor, it is considered insider trading. T/F

False

Existing securities are traded in the secondary market.

True

Time value of money is the idea that a dollar received today is worth less than a dollar that we expect to receive at some date in the future.

False

What is the major difference between money markets and capital markets?

The timing of how long the security will be held onto.

The higher the profit of a firm, the higher the value the firm is in the market.

False

An S corporation

has all the organizational benefits of a corporation and its income is only taxed once

Recently, the emphasis of financial management has been on the relationship between risk and return.

True

Sole proprietorship means single-person ownership and offers the advantages of simplicity of decision making and low organizational and operating costs.

True

Profits of sole proprietorships are taxed at corporate tax rates.

False

Sole Proprietorships, partnerships and limited liability partnerships are considered pass through forms of organizations because the income passes through to the owners and is taxed at the owner's individual tax rate.

True

There are some serious problems with the financial goal of maximizing the earnings of the firm.

True

The ultimate measure of performance is not what the firm profits, but how the profits are valued by the investor.

True

Money markets refer to those markets dealing with short-term securities having a life of one year or less.

True

When a company is looking to raise money through issuing more shares of stock, that is considered in the secondary market.

False

Social responsibility is an expense and thus should be avoided by financial managers because it will lead to loss of income.

False

Corporate governance is the

relationship and exercise of oversight by the board of directors of the company.

Institutional investors are important in today's business world because

as large investors, they have more say in how businesses are managed.

they have a fiduciary responsibility to the workers and investors that they represent to see that the firms they own are managed in an ethical way.

as a group they can vote large blocks of stock for the election of board members.

What is financial capital as defined in the financial industry?

Money

What is the language of business called?

Accounting

What are the two main categories of accounting?

Managerial and Financial

The __________ retains the power and authority to set accounting standards. Currently, this responsibility has been delegated to the __________.

Securities and Exchange Commission; Financial Accounting Standards Board

Under __________ accounting, revenues are recorded when earned and expenses are recorded with related revenues. Under __________ accounting, revenues are recorded when cash is received and expenses are recorded when cash is paid out. Financial statements are prepared using __________ accounting

accrual-basis; cash-basis; accrual-basis

__________ are items owed to a creditor. __________ are items owned by a company. __________ represents owners' claims to company resources.

Liabilities; Assets; Stockholders' equity

Which of the following is a snapshot of a company’s financial position at a particular date?

balance sheet

In what order are the four primary financial statements prepared?

Income statement > Statement of stockholders' equity > Balance sheet > Statement of cash flows

Which of the following is the amount of cash owed to a company from the sale of goods or services?

Accounts receivable

Order of income statement

Common shares |

sales

cost of goods sold

gross profit

selling and administrative expense

depreciation expense

operating profit

interest expense

earnings before taxes

taxes

earnings after taxes

preferred stock dividends

earnings available to common stockholders

common shares outstanding

earnings per share

current assets

cash

inventory

marketable securities

accounts recievable

current liabilities

accounts payable

notes receivable

fixed assets (long-term)

plants and equipment

long-term liabilities

bonds payable

Which section of the statement of cash flows includes cash receipts and cash payment related to revenues and expenses?

Cash flows from operating activities

The purchase or sale of a building falls into which category in the statement of cash flows?

Cash flows from investing activities

The statement of retained earnings analyzes changes in which two accounts?

Common stock and retained earnings

Which of the following is not a type of ratio analysis?

book value

Liquidity

Solvency

Profitability

Which measure is calculated by dividing 365 days by the receivables turnover?

avg collection period

Which of the following measures the value investors assign to a company’s performance and future growth prospects?

market value

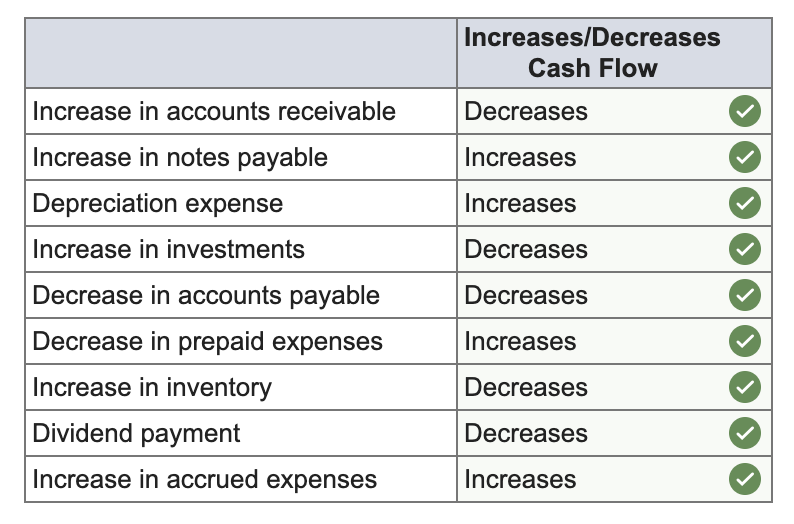

Identify whether each of the following items increases or decreases cash flow.

Allen Lumber Company had earnings after taxes of $750,000 in the year 2024 with 300,000 shares outstanding on December 31, 2024. On January 1, 2025, the firm issued 50,000 new shares. The company took the proceeds from these new shares as well as other operating improvements and earned $937,500 earnings after taxes in 2025. Earnings per share for the year 2025 were

$2.68.

A firm with earnings per share of $3 and a price-earnings (P/E) ratio of 24 will have a stock market price of

72

Which of the following would represent a positive source of funds and, indirectly, an increase in cash balances?

A reduction in accounts receivable

The long-term investments account represents a commitment of funds of at least one year or more.

True

Although depreciation does not provide cash to the firm directly, the fact that it is tax-deductible can provide cash inflow to the company.

True

Assume that two companies both have a net income of $100,000. The firm with the highest depreciation expense will have the highest cash flow, assuming all other adjustments are equal.

True

Preferred stock dividends _________ earnings available to common stockholders.

decrease

The statement of cash flows does not include which of the following sections?

Cash flows from operating activities

Cash flows from sales activities

Cash flows from investing activities

Cash flows from financing activities

An increase of $100,000 in inventory would result in a(n)

decrease of net cash flow.

Accumulated depreciation shows up in the income statement, while depreciation expense shows up on the balance sheet.

False