Economics Unit 1 AOS 1

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

49 Terms

Define economics:

Study of the decision making of individuals, businesses and governments regarding the production, consumption, distribution of goods and services and incomes.

What are the two main branches of economics? Describe each.

Microeconomics: Study of the factors that influence the small parts such as a single firm, industry and market that make up the economy.

Macroeconomics: Study of the whole economy and its conditions. This includes: GDP, inflation, employment/unemployment and national incomes.

What are the two forms of economic analysis? Describe each.

Positive Analysis:

Proved or disproved beyond doubt

Based on verifiable facts + Can be tested

Free of personal values, feelings and opinions.

‘Expected’

Normative Analysis:

Proved nor approved

Based on personal opinions, likes and dislikes

‘Should be’

Compare wants and needs

Wants are desires, but are not things needed in order to survive. Whereas needs are things essential for survival.

What are resources? What are the different types and give examples of each.

Resources are the factors of production.

Natural Resources: Productive inputs derived from nature.

E.g. Minerals, water, climate

Labour Resources: Intellectual skills, knowledge and manual effort people provide to produce goods and services.

E.g. doctors, accountants

Capital Resources: manufactured or producer goods that are past production but are used to aid current and future production.

E.g. tractors, factories, commercial buildings

What is relative scarcity?

Basic economic problem – wants and needs are unlimited, however the resources used to fulfil and produce these wants and needs are limited —> resulting in people having to make decisions as to which wants and needs to satisfy first.

Define opportunity cost:

Value of production or consumption given up when resources are allocated to their next best alternative use.

What are productive possibility diagrams used for?

Illustrate ideas such as scarcity, choice in production, opportunity costs, unemployment and nation’s productive capacity.

What do PPDs show?

Productive capacity or physical limits of a nation’s total production, and the output combinations of goods and/or services.

The size of a nation’s PPF depends on what?

Quantity of resources and level of technical efficiency.

What do points inside the PPF illustrate?

Below the economy’s potential capacity/maximum level of production —> resources are not fully utilised

What do points outside the PPF illustrate?

Beyond the economy’s potential capacity/maximum level of production —> results in scarcity, inflation

What are some factors that can cause the PPF to grow in size and shift outwards?

New resources

Better technology

Improved worker efficiency

Better education

High levels of foreign investment

What are living standards affected by?

Affected by both material well-being (income, quantity of goods and services consumed) and non-material well-being (Quality - happiness, low crime rates, long life expectancy, political freedom)

Define trade-offs:

When individuals, businesses or governments make choices between different ways that scarce resources should be used --> sacrifice certain things for an alternative

What is cost-benefit analysis used for and how is it measured?

Used to make decisions that maximise efficiency, satisfaction and wellbeing.

Expected + indirect costs added up

Expected benefits added up

Benefit to cost ratio: total value of benefits/total value of costs

Ans >1 —> Net benefit. Ans <1 —> Net cost

What are the three basic economic questions?

What and how much to produce

How to produce?

For whom to produce

Define economic system:

Collection of national organisations that coordinate production and distribution of goods, services and incomes amongst the population

Define traditional economy:

Old-fashioned, natural

Hunter-gatherer, traveller

System of barter (trade)

Low living standards → Low productive efficiency

Outline how a traditional economy answers these questions:

What and how much to produce?

How to produce?

For whom to produce?

What and how much to produce? |

|

How to produce? |

|

For whom to produce? |

|

What are some of the cons of a traditional economy?

Low productive efficiency

Low living standards

Define market economy:

Self-interest, competition, private ownership of resources

Includes consumers, sellers/businesses

System of prices

No government interference

Outline how a market economy answers these questions:

What and how much to produce?

How to produce?

For whom to produce?

What and how much to produce? |

|

How to produce? |

|

For whom to produce? |

--> Wages + incomes – Sell scare/wanted resources + require greater skills have higher wages |

What are some qualities of market economies that can lead to market failure?

Cheap production methods → reduce society’s well being

Resources are not allocated efficiently → prevents maximisation of consumer satisfaction + society wellbeing

Define planned economy:

Non-democratic, central government, dictatorial

All businesses are government-owned

Lack of consumer freedom + low allocative efficiency

Outline how a planned economy answers these questions:

What and how much to produce?

How to produce?

For whom to produce?

What and how much to produce? |

|

How to produce? |

|

For whom to produce? |

|

What are some cons of a planned economy?

Low allocative efficiency

Lack of consumer freedom

Lack of innovation + adaptability in production

Removal of incentives to work hard + improve skills → providing products & essentials fairly

Define mixed/contemporary economy:

Most features of market economies (competition, price system, consumer sovereignty, most private sector ownership)

Some features of planned economy (government-owned businesses, provision of goods & services)

Outline how a mixed economy answers these questions:

What and how much to produce?

How to produce?

For whom to produce?

What and how much to produce? |

|

How to produce? |

|

For whom to produce? |

--> Progressive taxes (tax rises with income) --> Welfare payments (payments to those in need) --> Provision of free or cheap services (health, housing and education) --> Minimum wages |

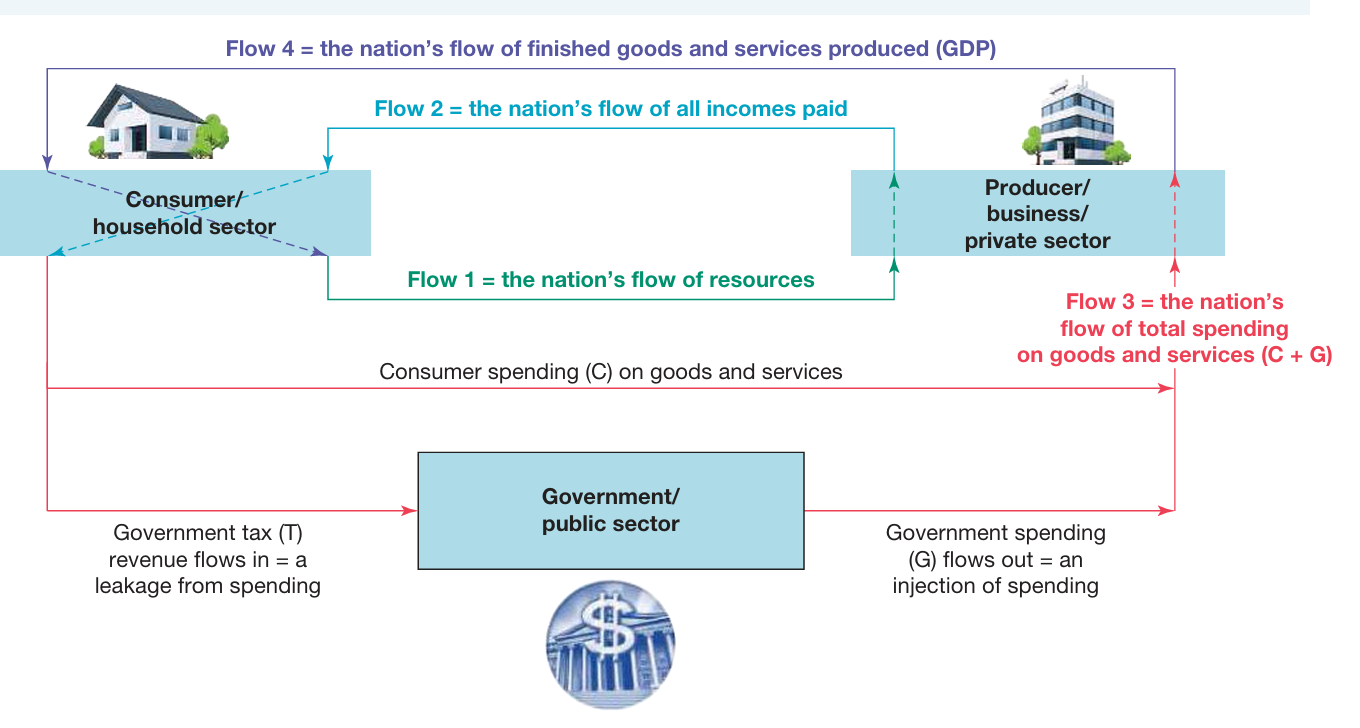

What are the three main sectors of the three-sector circular flow model:

Consumer/household sector

Producer/business sector

Government/public sector

What are the flows in the three-sector circular flow model? Describe each.

Flow 1: (Nation's supply of resources)

Household sector sells wanted resources (labour) to business sector using resource markets

Flow 2: (Demand of resources + payment of national incomes)

Businesses demand resources from household sector --> pay incomes to households

Flow 3: (Nation's spending of incomes or demand for goods and services)/ Aggregate demand

Undertaken by both households and governments

Household pay government taxes + spend leftover income for goods & services

Government uses tax income --> goods & services for the community

Flow 4: (Production of final goods & services/ Nation's GDP)

Production of businesses --> total value of finished goods & services

What are the four stages of the business cycle diagram?

Boom/peak:

Extremely strong spending --> rising prices --> inflation

Slowdown:

Spending starts to fall

Recession:

Economic activity drops

GDP shrinks

Unemployment rises + incomes fall

Recovery:

Spending begins to expand again

Compare material and non-material living standards.

Material:

Affected by incomes, consumption of goods & services

Non-material:

Reflect quality of life (happiness, life expectancy, mental & physical health, freedom, crime rates, education)

Define the term economic agent:

Individual, company or organisation that influences the economy by producing, consuming or selling goods & services.

What are the qualities of a consumer according to the traditional viewpoint?

Rational

Self-interest

Ordered preferences/priorities

Informed and smart decisions based on knowledge

Maximisation of utility → maximise pleasure + minimise pain

Define marginal utility.

Additional satisfaction/benefit consumers derive when consuming an additional unit of a good or service

What is the law of marginal utility?

Number of units consumed increases → utility decreases

Explain these terms:

Incentives

Disincentives

Inducement designed to further encourage behaviour that would otherwise not occur to the same extent

Used to discourage certain behaviour

Provide some examples of government incentives and disincentives.

Cash payments/subsidies

Tax rebates/offsets

Indirect taxes

Enforced laws and regulations

What does business behaviour look at?

Looks at factors influencing the decisions of firms involving the production and sale of goods and services.

What are the qualities of a business according to the traditional viewpoint?

Seek profit maximisation

Give back to the community

Affected by government policies

How would businesses aim to maximise their profit?

--> Maximise sales revenue (advertising, developing new products, consumer sovereignty)

--> Minimise production costs (lower wages, cheaper materials, equipment, transport and utilities)

Define monopoly-type firms:

Sell a particular product/service

Dominant in their field

No competition --> firm has complete control over the price + availability of product/service

Why is government intervention necessary?

Prevent market failure → improve material and non-material living standards

How might the government prevent market failure and improve society’s general wellbeing?

Stabilisation of economic activity

Increase efficiency in resource allocation

Redistributing income fairly

In order for the economy to be stable, how much percent should the GDP rise each year?

3% a year

What are some actions which the government may undertake during booms and recessions?

Booms (GDP is above 3-4%) → Increases taxes + cutting government spending

Recessions (GDP is below 2-3%) → Cutting taxes + raising government spending

What are some ways the government may increase efficiency in resource allocation?

Installing laws to promote competition (Anti-monopoly laws, consumer protection laws)

Provision of beneficial goods and services

Installing laws that discourage harmful production

What are some ways the government may redistribute incomes fairly?

--> Progressive taxes (tax rates rise with income)

--> Welfare benefits to the neediest

--> Provision of services