Econ 13: Ch06 Globalization & Protectionism

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

What is protectionism?

When limitations are placed on a country to prevent imports from abroad

What are the 3 ways to restrict trade?

tariffs

import quotas

non-tariff barriers

What are Tariffs?

Taxes on imports. Restricts trade and increase prices on imported goods

What are Import Quotas

government-imposed trade restrictions that limit the number/value of goods that can be imported

What are Non-tariff Barriers

barriers against trade, that are different from tariffs

eg. quotas, levies, embargoes, sanctions & other restrictions

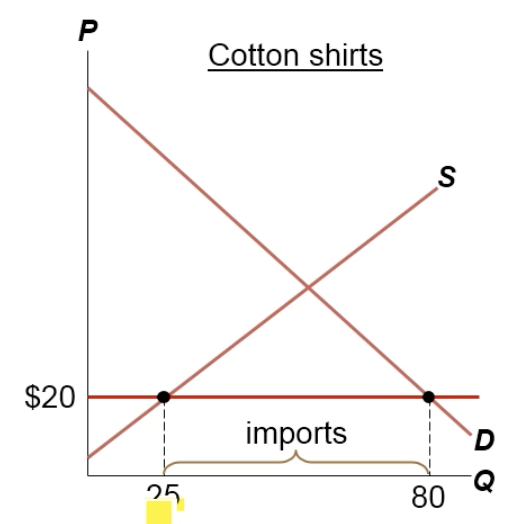

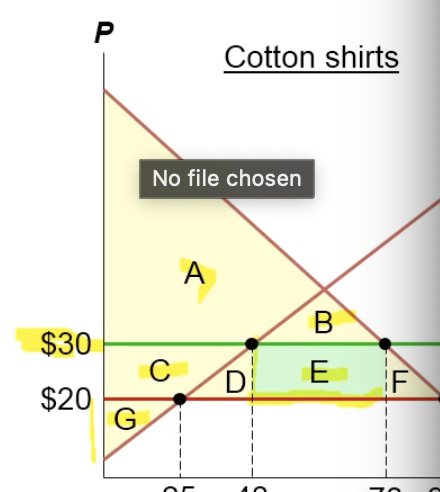

How many imports are there in this cotton-shirt economy?

80 demanded - 25 supplied = 55 imports

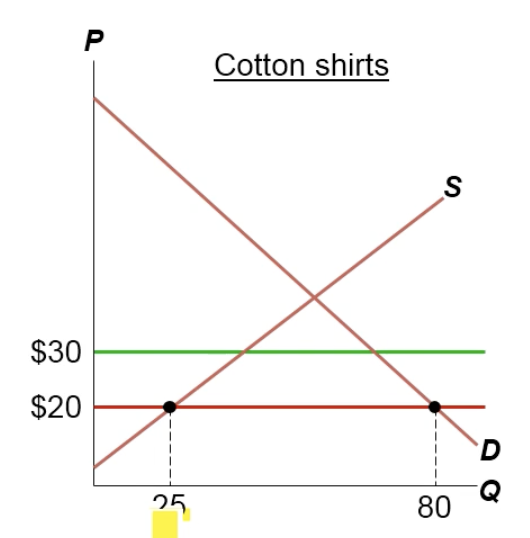

What happens to the imports when taxes are imposed on the cotton-shirt economy?

70 demanded - 40 supplied = 30 imported, taxe lowered imports

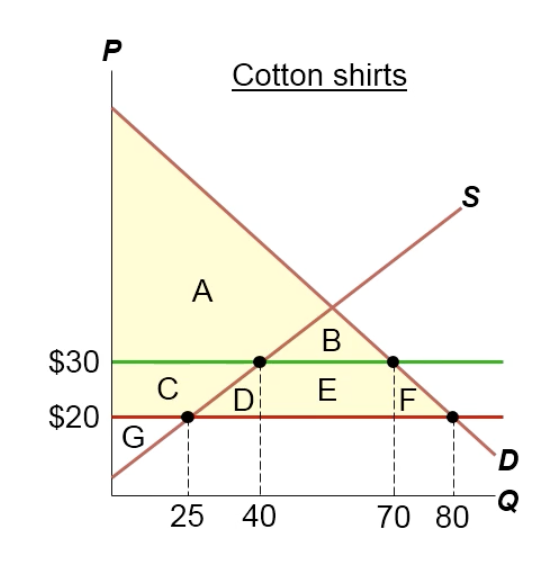

When there’s free trade, what’s CS, PS, & TS?

CS = A, B C D E F

PS = G

TS = A B C D E F G

When taxes are imposed, what’s CS, PS, TS, n dead weight loss?

CS = A B

PS = C. G

TS = A B C E G

Deadweight loss = D & F

Where’s government income?

E

What is an argument against trade?

Loss of jobs

Why do economists disagree with the argument loss of jobs

But economics disagree, as the unemployment rate has not gone up as the US economy became more open to trade

job loss in one industry is compensated by job creation in another

it’s expensive to save jobs through tariffs and quotas

What happens when tariffs are placed?

They increase the price, making number of exports/imports smaller, making another countries exports/imports smaller, making their prices decrease because of lack of demand.

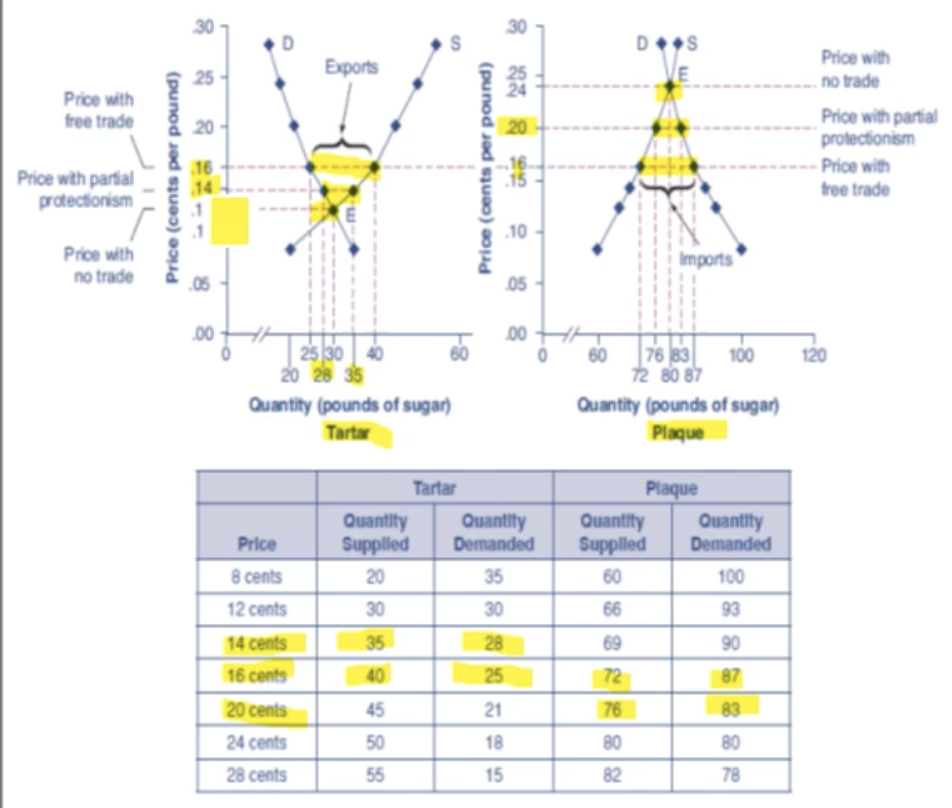

What happens when tariffs are placed on Plaque, the importer?

Plaque is importing goods because the price is below equilibrium, the demand is greater then what is supplied and they want to purchase more for a cheaper price.

When Tariffs are placed, the price increases, supply demanded decreases, supply supplied decreases, overall amount of imports are decreased. Also decreasing Tartar’s exports because they have less demand, making the prices go down

When taxes being placed on Plaque, who wins or losses, conumers and producers, on Plaque and Tartar?

Taxes imposed on Plaque: producers gain, consumers lose

Less demand for Tartar: producers lose, consumers gain

Under free trade: who wins n loses?

Importing countries: producers lose, consumers gain

Exportign countries: producers gain, consumer lose

Under protectionism/tariff: what happens to Importing country, and their consumers

Importing country: sugar farmers of Plaque are able to sell more at a higher price

Consumers who are w/ the tariffed good, they are clearly negative effects. They end p buying a lower quantity of the good and paying a higher price for what they do buy

Under protectionism/tariff: what happens to exporting country, and their consumers?

Exporting country: the Tartar won’t be able to export, and will experience lower prices, producers lose

Consumers wold benefit from these reduced prices

What happens when there is protectionism?

it hurts both countries

the cost to save jobs is high bc of tariffs

there will be a net loss of welfare to both countries (deadweight)

Does trade increase or decrease the number of jobs?

The increase in trade doesn’t have much effect on the number of jobs

there will be a shift in job s away from the industries that don’t have a comparative advantage, and it will be shifted towards those who do

What do economists say about global trade?

global trade will increase the average level of wages bc of increased productivity

but increase in wages may only be in some and losses to others

How is there downward pressure on wages bc of trade?

workers in import competing industries see their wages decrease

it affects low skilled workers

but they still benefit from lower prices because of the imports

What are arguments against labor standards and wages?

labor standards: some workers work in illegal and un-humane conditions

low minimum wage in some countries

child labor

There’s a line in labor practices between what is unpleasent to think about and what is morally wrong

Child labor, morally objectionable

long working hours in poor countries, unpleasent to think abt but good for them to make money

What is the infant industry argument?

Put taxes on small domestic industries so they can be protected from foreign large companies and grow into strong competition, but they normally dont grow

The dumping argument against trade

When prices are set at below the cost of production.

This is to drive out competition and then raise prices

What are anti-dumping laws

to block imports that are sold below the cost of production and impose tariffs that would increase the price

High Environmental Standards

Low-income countries have lower environmental standards.

Shutting off trade won’t make create a cleaner enviorment

What’s the unsafe consumer product?

countries are allowed to set any standards for product safety, but domestic products have to be the same

What’s the national interest argument?

unwise to import certain key products bc the nation could become too dependent and be vulnerable to cutoff

but its better to stockpile reasources

what’s trade conflicts

Countries experience conflict over trade issues

How does the country deal with these conflicts?

The global economy deals w/ trade issues

Global Agreements: World Trade Organization

Regional Agreements: NAFTA/USMCA

What’s the public attitude towards trade?

Pretty high

How is trade policies determined?

administrative agencies w/ government, laws passed

global negotiations thru WTO

The acronym GATT stands for:

General Agreement on Tariffs and Trade.

The infant industry argument for protectionism suggests that an industry must be protected in the early stages of its development so that:

a.

it will not be subjected to a takeover from a foreign competitor.

b.

firms will be protected from subsidized foreign competition.

c.

domestic producers can attain the economies of scale to allow them to compete in world markets.

TYPE: Multiple Choice

d.

there will be adequate supplies of crucial resources in case they are needed for national defense.

c