Accounting Applications DECA

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

Accounting

Language of business. Record, classify, summarize, analyze and communicate a business's financial information and transactions for use in management decision-making.

Bank Reconcilliation

Process performed by a company to ensure that the company's records (Check Register, General Ledger Account, Balance Sheet, etc.) are correct and the bank's record are also correct

1. Compare your ledger and bank statement. Accounts that do not match need to be reconciled

2. Record deposits marked in your ledger but not in your bank statement.

3. Deduct outstanding checks

4. Deduct Bank Fees

5. possibly create new journal entries detailing changes

Special Journals

Designed to facilitate the process of journalizing and posting transactions. Used for most frequent transactions in a business. Three Types:

1. Sales Journal

2. Cash Receipts

3. Purchases

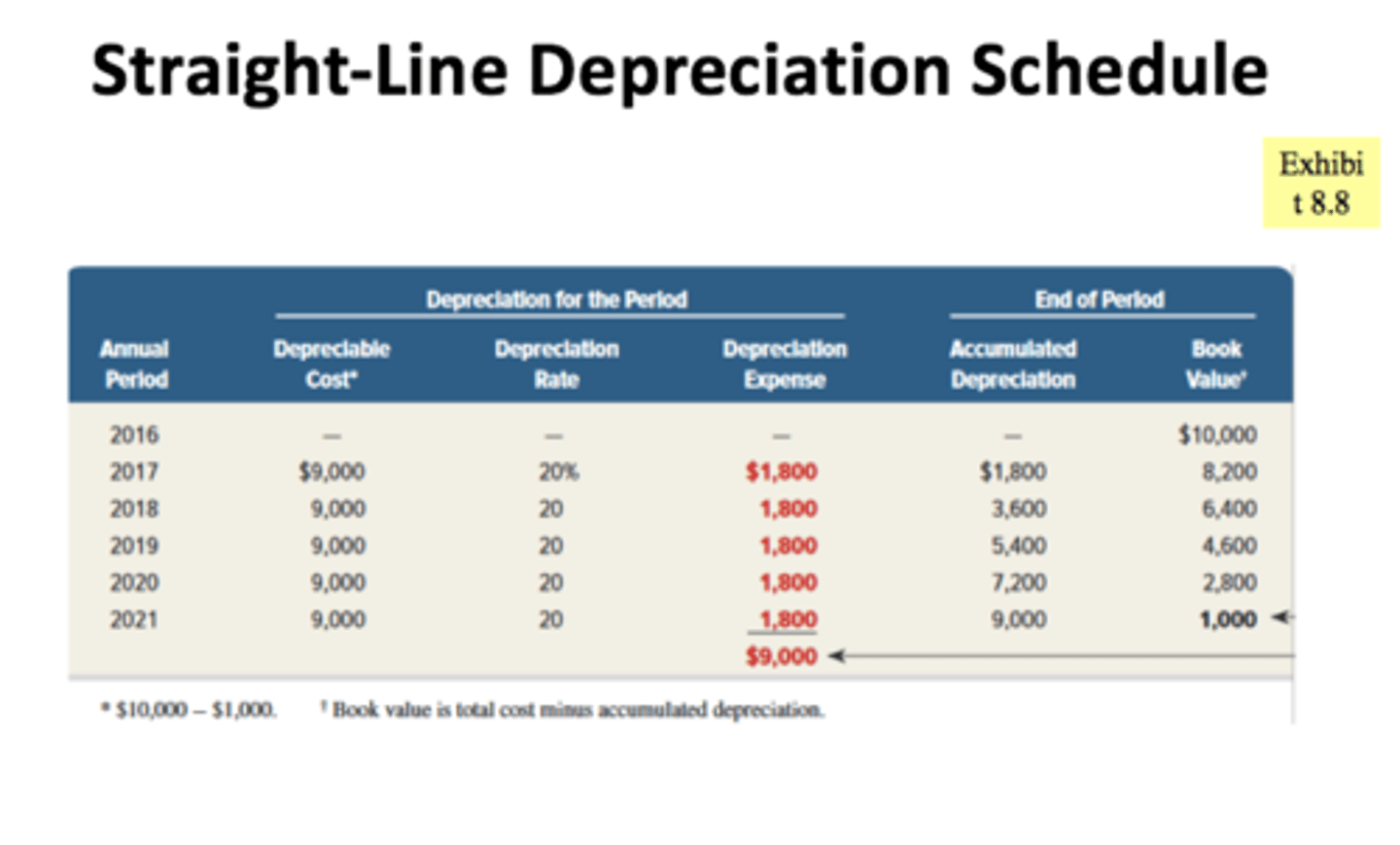

Straight- Line Depreciation

(Cost-Salvage Value)/Useful Life

Salvage Value could also be represent by the phrase "book value." They mean the same thing.

Book Value

AKA Salvage Value

The residual value of plant assets at the end of their useful life

Profit Margin

Net Income/Total Revenue

The profit margin percent indicates how much profit is generated for every dollar in sales. A higher profit margin is more favorable. When evaluating the profit margin, it is best to compare trends over several years, compare it to the industry average or compare it to a competitor. Ex. if X Company's Profit Margin is 8%, it means means that for every dollar in boarding revenue, the company is earning 8 cents in profit.

Generally, what can a company do to increase profit margin?

1. Consider performing a Cost-Volume Profit analysis (or Break-Even Analysis) and target profit analysis

2. Raise the prices of their goods and services (to increase total revenue)

3. Have better advertising or marketing tactics to attract a higher volume of customers

4. Analyze your waste production or other external costs to lower expenses

Trial Balance

a proof of the equality of debits and credits in a general ledger

Annual Report

Comprehensive report on a company's activities throughout the preceding year. Intend to give shareholders information about the company's activities.

Financial Ratios

Useful indicators of a firms performance and financial situation. Most can be calculated from information provided by the financial statements. Can be used to analyze trends and to compare the firm's financials to other firms.

Asset

Balance sheet item representing what a firm owns, tangible or intangible. Cash, Computer Systems, Patents

Equity

The owners value in an asset or group of assets, also called net worth.

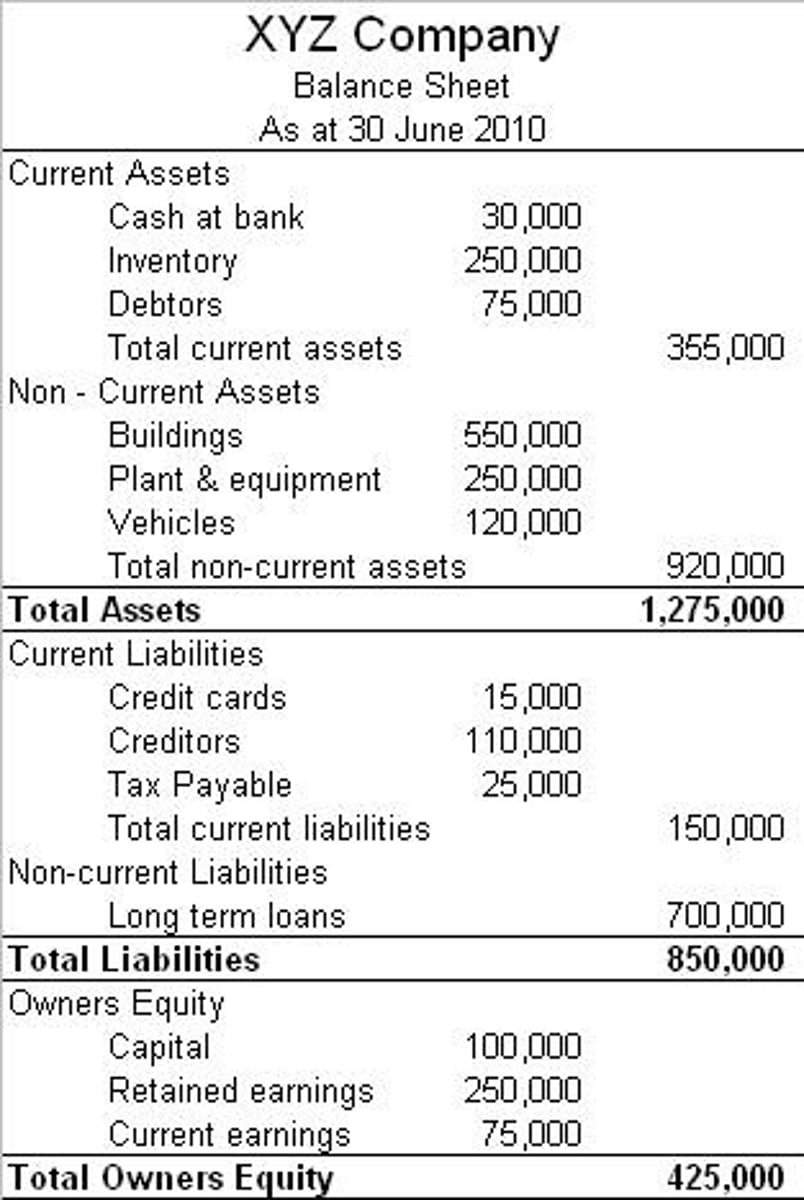

Balance Sheet

Financial statement that summarizes a company's assets, liabilities, and owner's equity at a specific point in time. The three segments give investors an idea as to what the company owns and owes, as well as the amount invested by the shareholders.

Working Capital

Total Current Assets - Total Current Liabilities

(Total Current aka Current)

Tells the business exactly what their net value is in the short run

Current Ratio

Total Current Assets/ Total Current Liabilities

Measures whether or not a firm has enough resources to pay its debt over the next twelve months.

Debt Ratio

Total Liabilities / Total Assets

Equity Ratio

Total Owners Equity / Total Assets

Financial Statements

Objective is to provide information about the financial position, performance and changes in financial position that are useful in making economic positions

Financial Records

Monitor the progress of business and identify source of receipts

Accounts Receivable

The amount of money owed by your customers after goods or services have been delivered and/or used. An asset to a creditor.

Accounts Payable

The amount of money you owe creditors (suppliers) in return for good and/or services they have delivered. A liability resulting from the sale of goods/services on credit or "on account".

Capital

A financial asset and its value, such as cash or goods. Working Capital is calculated by taking your Current Assets subtracted by Current Liabilities

Costs of Goods Sold (COGS)

The direct expense related to producing the goods or services sold by a company. This can include the cost of the raw materials

Present Value

The value of how much a future sum is worth today. Helps understand how receiving $100 now is worth more than receiving $100 a year from now.

LIFO method (last in first out)

LIFO, short for last-in-first-out, means the last items bought are the first ones sold. Cost of sales is determined by the cost of items purchased the most recently. Because this method assumes that the most recently purchased items are sold, the value of the ending inventory is based on the cost of the oldest items.

FIFO method (first in first out)

FIFO, first in-first out, means the items that were bought first are the first items sold. Cost of sales is determined by the cost of the items purchased the earliest. Ending inventory is valued by the cost of items most recently purchased. FIFO is the most commonly used method in the U.S. A primary reason is that this approach appeals to common sense. Good inventory management would dictate that the oldest goods should be sold first, while the most recently purchased items remain in inventory.

Petty Cash

Businesses generally keep small amounts of cash to meet small miscellaneous payments such as entertainment expenses and stationery costs. Usually kept in a cash box. Cashier must be responsible to keep supporting invoices in respect of payments made through.

Surprise cash counts must be conducted time to time to ensure the accuracy of the cash balance

Overages

When there's more money in a check register than there should be. Written as a Revenue+ Cash in Bank

Shortage

When there's more money in a check register than there should be. Written off as an expense when filing taxes

Sole Proprietorship

a business owned and managed by a single individual

Partnership

a business organization owned by two or more persons who agree on a equal division of profits, assets etc.

Example: if a business has 3 owners and their net income was 30000, each owner receives 10000

limited partnership

a business organization owned by two or more persons who agree on a specific division of profits, assets etc.

ex: 3 owners, ratio of 1:2:1

25% of earnings goes to Owner 1

50% goes to Owner 2

25% goes to Owner 3

Depreciation

Method of allocating the cost of a tangible asset over its useful life.

Return on Investment

Measure used to evaluate the financial performance relative to the amount of money that was invested.

Simple Interest

I= PRT

I= Interest

P= Principal

R= Rate

T= Time (in this formula it is usually in years)

Ordinary Interest

I= PRT

TIME is x amount of days/360 days

Exact Interest

I= PRT

Time is x amount of days/365 days

Depreciation Schedule

A depreciation schedule breaks down the depreciation of the firm's long-term assets. It calculates the depreciation expense for each asset and allocates the cost of each asset over the useful life.

How to record Depreciation in a Journal

Debit to Depreciation Expense

Credit Accumulated Depreciation

Income Statement

A formal report which includes revenue and expenses only. This report is used to evaluate the profitability of the company over a period of time. In this case, it is for a period of 4 months. If the net income is positive, the company has an excess of revenue over expenses. If the net income is negative, the company has more expenses than revenues. This report should be generated monthly for management to make important decisions related to prices, boarding volume and costs.