Chapter 17 Inflation, Unemployment, and Federal Reserve Policy

1/15

Earn XP

Description and Tags

Macro Economic

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

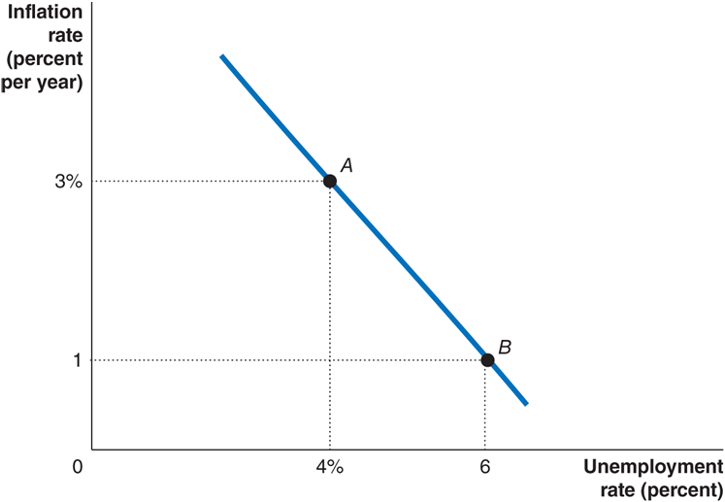

Philips Curve

A graph showing the short-run relationship between the unemployment rate and the inflation rate

structural relationship

a relationship that depends on the basic behavior of consumers and firms and that remains unchanged over long periods

Long-run aggregate supply curve

was vertical in the late 1960s and so the long-run philips curve was also vertical

real wage

= nominal wage/ price level

non-accelerating inflation rate of unemployment

the level of unemployment at which inflation does not accelerate, often referred to as the "natural rate of unemployment."

Demographic changes

Younger and less skilled workers have higher unemployment rates

Changes in labor market institutions

a change in the availability of unemployment insurance, the prevalence of unions, or legal barriers to firing workers

Past high rates of unemployment

During long periods of unemployment, workers’s skills may deteriorate or they may become dependent on the government for support

Low inflation

slow adjustment since workers and firms seem to ignore inflation

Moderate but stable inflation

Quick adjustment stable but noticeable inflation is easily incorporated into expectations

High and unstable inflation:

quick adjustment again, but for a different reason: forming rational expectations about inflation becomes very important, so workers and firms pay a lot of attention to forecasting inflation.

rational expectations

expectations formed by usin all available information about an economic variable

deemphasizing the money supply

During Greenspan’s term, the Fed continued to move away from using the money supply as a target. the relationship between the money supply and inflation appeared to have broken down

Emphasizing Fred Credibility

The Fed learned to follow through on policy actions that it had announced. Markets and market participants must believe the Fed for monetary policy to be effective

too-big-to fial policy

a policy under which the fed gov doesn’t allow large financial firms to fail for fear of damaging the financial system. This policy aims to prevent systemic risk by providing support to major financial institutions during crises to stabilize the economy.