Price Elasticity & Market Efficiency

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

39 Terms

Price Elasticity of Demand

Measures how responsive the quantity demanded is to a change in price.

Elastic Demand

Elasticity greater than 1, indicating high responsiveness.

Inelastic Demand

Elasticity less than 1, indicating low responsiveness.

Availability of Substitutes

More substitutes make demand more elastic.

Necessity vs. Luxury

Necessities tend to have inelastic demand; luxuries are more elastic.

Proportion of Income

Goods that take up a larger portion of income have more elastic demand.

Time Period (demand)

Demand is more elastic in the long run as consumers adjust behavior.

Total Revenue and Elastic Demand

If demand is elastic, lowering prices increases total revenue.

Total Revenue and Inelastic Demand

If demand is inelastic, raising prices increases total revenue.

Price Elasticity of Supply

Measures how responsive the quantity supplied is to a change in price.

Elastic Supply

Elasticity greater than 1, meaning producers can quickly adjust output.

Inelastic Supply

Elasticity less than 1, indicating limited responsiveness.

Determinants of Price Elasticity of Supply

Factors that influence the elasticity of supply.

Production Time (supply)

Goods that require longer production times have less elastic supply.

Availability of Resources (supply)

Easier access to resources leads to more elastic supply.

Storage Capabilities (supply)

Goods that can be stored have more elastic supply.

Flexibility of Production (supply)

Industries with adaptable production processes tend to have higher elasticity.

Application of Price Elasticity to Markets

Helps businesses set optimal pricing strategies based on consumer responsiveness.

Incidence of Taxation

When demand is inelastic, consumers bear most of the tax burden; when supply is inelastic, producers bear most of it.

Price Discrimination

Businesses use elasticity insights to charge different prices to different consumer groups based on their willingness to pay.

Market Efficiency

Occurs when goods and services are produced at the lowest possible cost.

Consumer Surplus

The difference between what consumers are willing to pay (marginal benefit) and what they actually pay.

Producer Surplus

The difference between the price producers receive and their minimum willingness to accept (marginal cost).

Total Surplus

The sum of consumer surplus and producer surplus, representing overall economic welfare.

Deadweight Loss

A reduction in total surplus caused by market inefficiencies like underproduction or overproduction.

Market Equilibrium

Maximizes total surplus by aligning supply and demand at the equilibrium price and quantity.

Price Ceiling

A legislated maximum price that sellers are allowed to charge in the market.

Price Floor

A legislated minimum price that sellers are allowed to charge in the market.

Underproduction

Occurs when fewer goods are produced than the equilibrium quantity, reducing consumer and producer surplus.

Overproduction

Happens when more goods are produced than demanded at equilibrium, leading to wasted resources.

Effects of a Price Ceiling

Benefits consumers, results in shortages as quantity demanded exceeds quantity supplied, creates deadweight loss.

Effects of a Price Floor

Benefits producers, leads to surpluses as quantity supplied exceeds quantity demanded, causes deadweight loss.

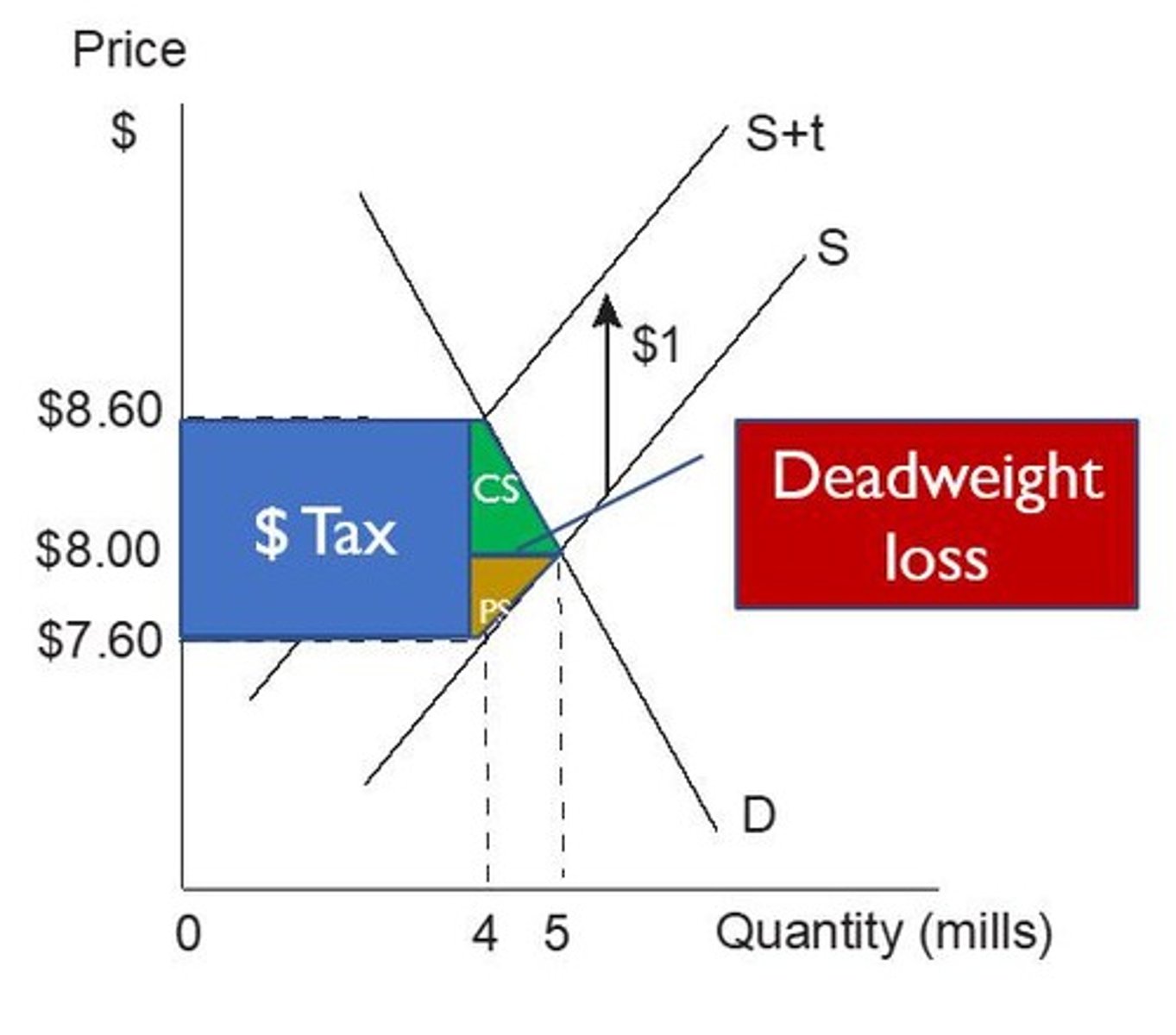

Tax

Increases costs for producers or consumers, reducing equilibrium quantity and creating deadweight loss.

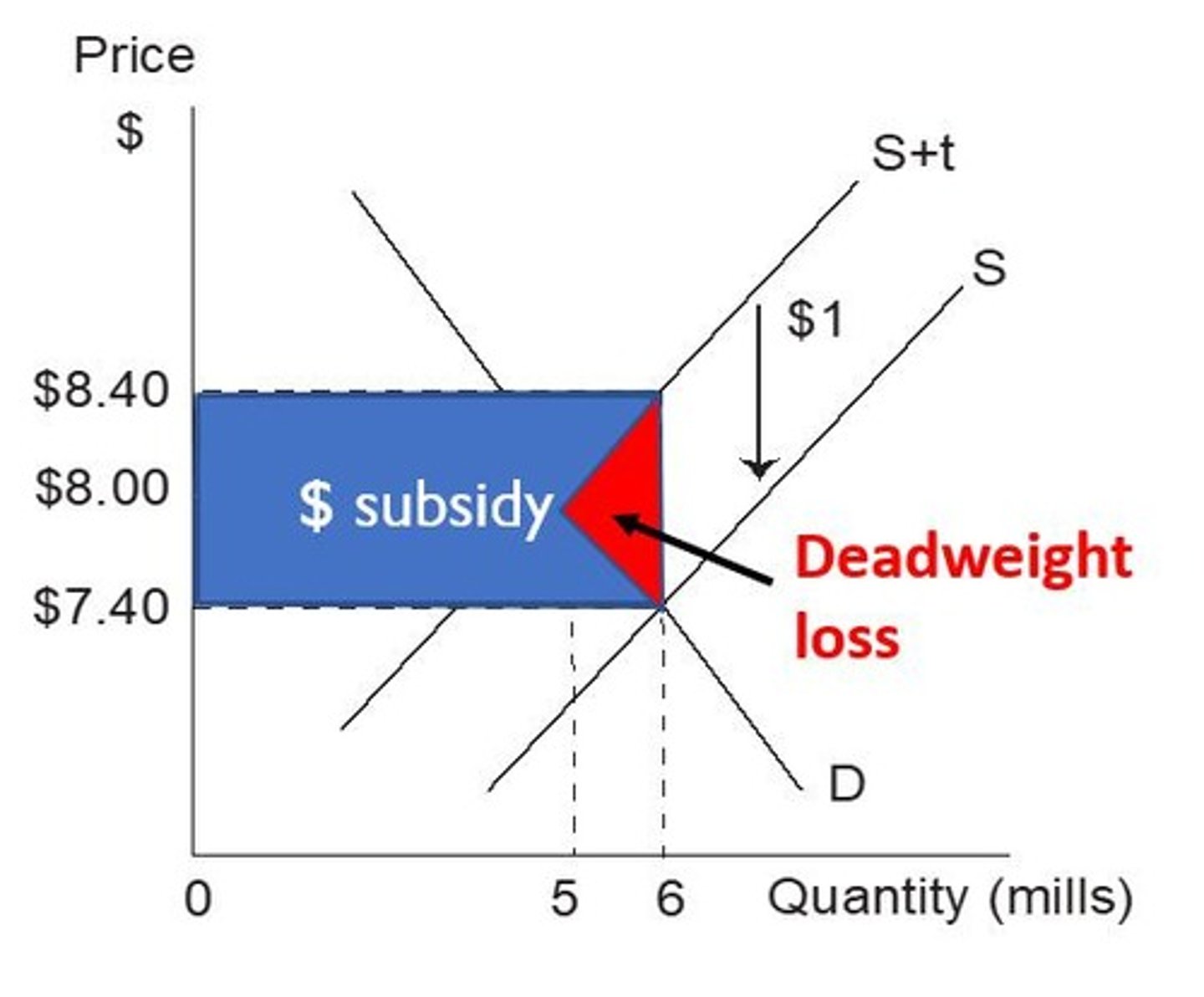

Subsidy

Lowers production costs or prices for consumers, increasing equilibrium quantity and can improve economic welfare.

Deadweight Loss from Tax

Creates deadweight loss by decreasing total surplus as fewer transactions occur.

Deadweight Loss from Subsidy

May lead to overproduction if not carefully managed.

Efficiency of Competitive Markets

Considered ideal because they achieve maximum total surplus without external intervention.

Equilibrium Price

The price at which the quantity supplied equals the quantity demanded.

Equilibrium Quantity

The quantity of goods sold at the equilibrium price.