Monetary and Fiscal policy

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

monetary policy

adjusting interest rates and money supply to influence AD

set by central banks

used to help govs achieve macroeconomic objectives

low + stable rate of inflation

low unemployment

reduce business cycle fluctuations

promote stable economic environment for longterm growth

control level of exports and imports

real vs nominal interest rates

nominal interest rate: headline rate presented by commercial banks, not adjusted for inflation

real interest rate: nominal interest rate - rate of inflation

calculated using CPI

monetary policy instruments

incremental adjustments to interest rate

quantitative easing, increases supply of money in economy

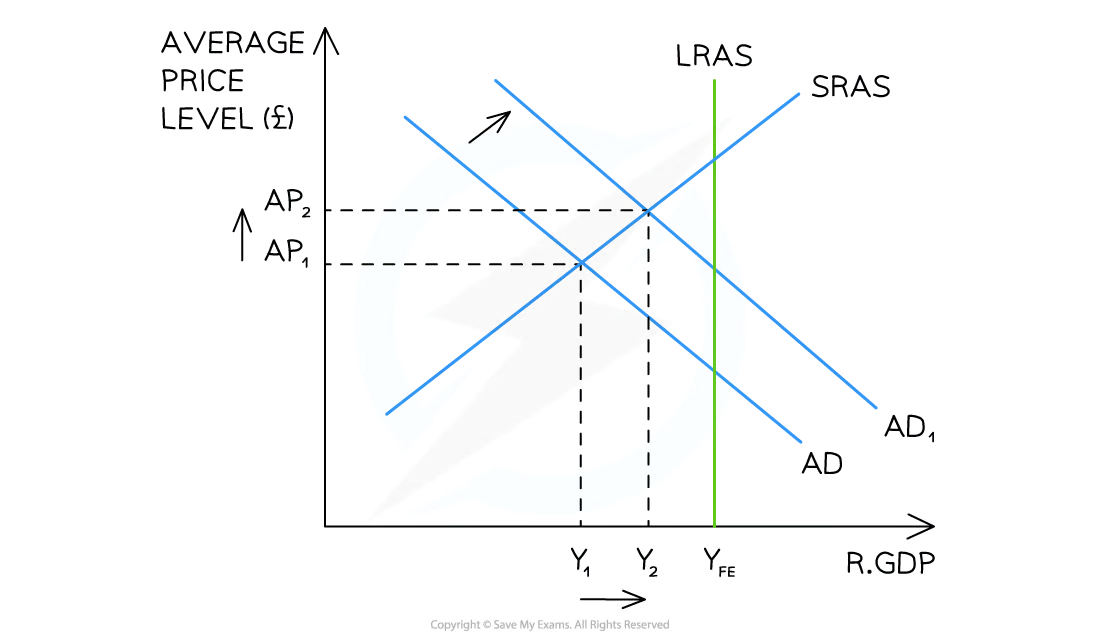

expansionary monetary policy

central bank wants to boost economic growth and lowers interest rates

lower interest rates = investment and consumption increases, these are components of AD

AD shifts right

economy has higher price level and greater national output

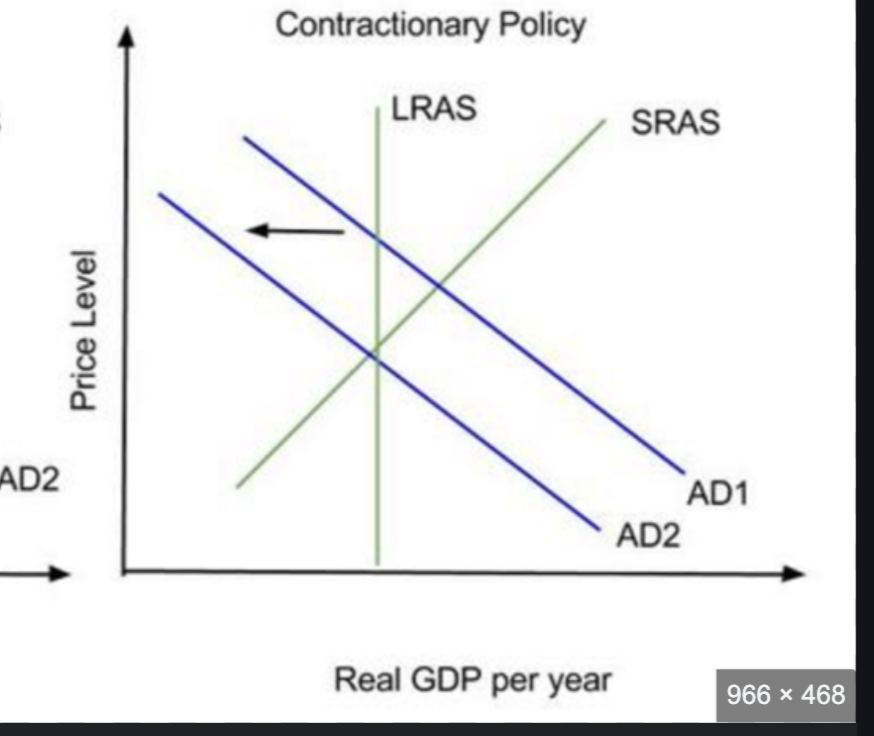

contractionary monetary policy

central bank wants to lower inflation toward its target, so increases interest rates

higher interest = decrease in investment and consumption

AD shifts left

economy has lower average price level and smaller level of national output

strengths of monetary policy

central banks can operate independently from gov

meaning they can consider the long term outlook

contractionary policy useful in reducing inflationary gap

reducing inflation increase exports

incremental and flexible, can be implemented/changed quickly by the central bank, allows for constant adjustments to macroeconomic variables

rate changes can be quickly reverse/amended

weaknesses of monetary policy

conflicting goals

e.g economic growth puts an upward pressure on inflation

expansionary policy less effective during a a recession

consumers/firms may not respond to low interest rates with consumption/investment when confidence is low

time lags between policy and desired impact

interest rate has limitations on downward adjustment

when interests rates are already close to 0, its hard to lower them further

ineffective against cost-push inflation

can reduce demand-pull inflation, but cost-push depends on costs to produce

fiscal policy

use of government spending and taxation to influence AD

sources of gov revenue

taxation

direct taxes imposed on income and profits

indirect taxes imposed on spending

paid by supplier to gov

sale of goods

gov owned firms charge for the goods they provide

sale of gov owned assets

gov expenditure

current expenditures

daily payment required to run gov and public sector

capital expenditures

investments in infrastructure and capital equipment

transfer payments

payment made by gov where no goods are exchanged

doesn’t contribute to AD

goals of fiscal policy

maintain low and stable rate of inlation

maintain low unemployment

reduce business cylce fluctuations

create stable economic environment for long term economic growth

redistribute income to ensure equity

control level of exports and imports

expansionary fiscal policy

reducing taxes/increasing gov spending with aim of increasing AD

gov wants to boost economic growth, lowers rate of income and corporation taxes

lower taxes = increase in consumption and investment

AD shifts right

economy has higher average price level and greater national output

contractionary fiscal policy

increasing taxes/decreasing gov spending with aim of decreasing AD

gov wants to lower inflation, so raises rate of income tax

higher tax = less disposable income = decrease in consumption

AD shifts left

economy has lower average price level, smaller level of national output

strengths of fiscal policy

highly effective in restoring confidence in an economy during recession

spending can be targeted at specific industries

redistributes income through taxation

reduces negative externalities through taxation

weaknesses of fiscal policy

political pressures

policies may fluctuate significantly when new governments are elected

this can mean lack of follow-through for long term projects

unsustainable debt

increased gov spending creates budget deficits

time lags

takes a longer time to implement than monetary policy as it must be debated by government