ECON Paper 1 (Micro)

1/129

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

130 Terms

price controls

setting a min. or max. price by gov. so equilibrium price can’t be adjusted.

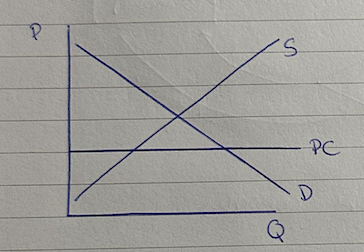

price ceiling

max price set by gov below equilibrium price

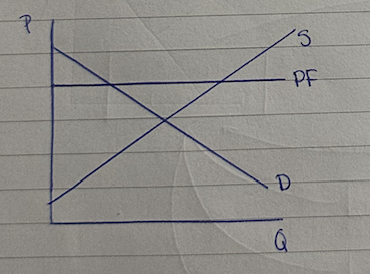

price floor

min price set by gov above equilibrium price

indirect taxes

payments made to gov by producers but partly consumers

excise taxes

placed on demerit goods

sales or value added tax (vat)

placed on almost all goods/services

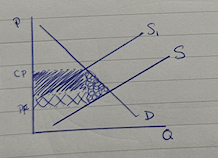

specific tax

per unit amount added to good/service

ad valorem

fixed percentage of the price of a good/service

consumer burden (tax)

what the consumer pays

producer burden (tax)

what the producer pays

consumer + producer burden

= gov. revenue

welfare loss

societies loss during poor resource allocation

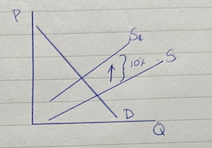

Producers pay more tax when demand is…

elastic

Consumers pay more tax when demand is…

inelastic

producer subsidy

payment by the gov. to producers, generally fixed for a per unit output; producers make more, consumers pay less.

market failure

when a market fails to efficiently allocate resources = allocative inefficiency.

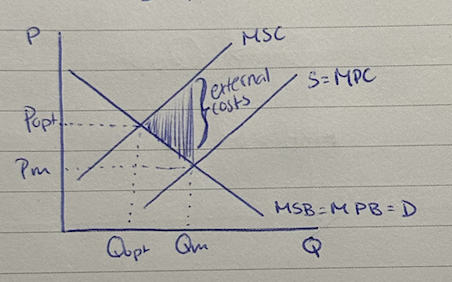

externality

when actions of producers/consumers affect a third party

marginal private cost (MPC)

cost to producers for producing one more unit of a good.

marginal social cost (MSC)

cost to society for producing one more unit of a good

marginal private benefit (MPB)

benefits to consumers for consuming one more unit of a good.

marginal social benefit (MSB)

benefits to society for consuming one more unit of a good

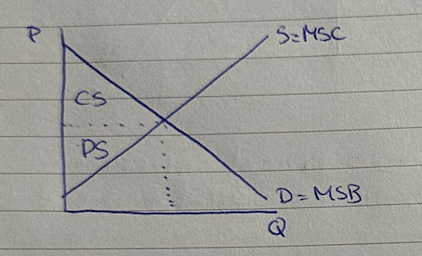

MSB = MSC

allocative efficiency

markets

arrangement where buyers and sellers of goods/services are linked to make an exchange

competitive markets

large quantity of independent buyers and sellers, so no one can control price of product.

demand

the individual consumers willingness and ability to buy goods/services at different prices during a specific period of time (all else being equal)

the law of demand

there is a negative causal relationship between a goods price and its quantity demand in a specific time period (all else being equal)

the law of diminishing marginal marginal utility

consumers want benefit (utility) from purchasing goods/services. but the more they buy, the less additional (marginal) benefit they get (will only buy for a lower price).

scarcity

demand for a good or service is unlimited but the resources to make it are limited.

opportunity cost

the loss of other alternatives when one alternative is chosen.

the substitution effect

consumers will purchase the substitute good if price falls

the income effect

real income is income that adjusts to change in price - as price decreases, consumers will buy more.

non price determinants of demand

changes in income

tastes and pref.

future price expectations

price of related goods

size of market.

supply

the individual firms willingness and ability to produce different quantities of goods/services at different prices during a specific time period (all else being equal)

the law of supply

there is a positive causal relationship between a goods price and its quantity supplied in a particular time period.

short run

at least one FoP is fixed (usually capital)

long run

all FoP can be changed

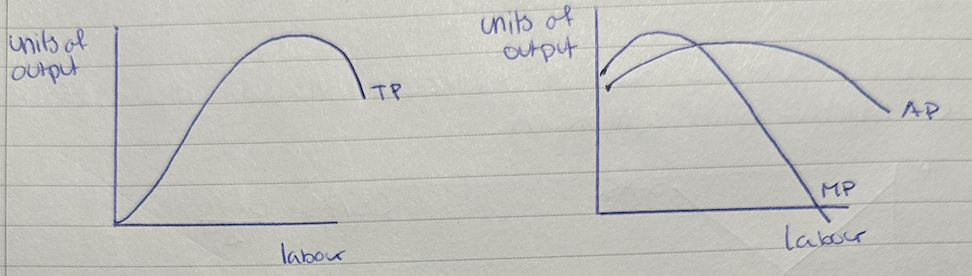

total product (TP)

total amount of output produced by a firm

marginal product (MP)

the additional output produced by a firm from one additional unit of variable input (labour)

average product (AP)

total quantity of output per unit of variable input

marginal cost (MC)

cost of producing an additional unit of output

non price determinants of supply

subsidies and taxes

tech advancements

other related goods prices

resource costs

future price expectations

size of market

the law of diminishing marginal returns

as more units of variable inputs (labour) are added to fixed inputs (capital), the marginal product of the variable input will increase, but at a certain point, decrease.

equilibrium

market quantity supplied = market quantity demand and there is no incentive for the price to change.

disequilibrium

surplus or shortage

signals

price changes are signals to producers/consumers when market circumstances change

rationing

price alleviates problems or scarce resources

incentive

if there is a surplus or shortage, it signals to producers to lower/higher price

allocative efficency

producing the combination of goods most wanted by society

consumer surplus

benefit consumers get form paying less than what they were willing to pay

producer surplus

benefit producers get from selling at higher price than willing to

social surplus

sum of producer and consumer surplus, reached when market is in equilibrium

elasticities

measures the responsiveness of a variable to change in price or any of the variables determinants.

Price elasticity of demand (PED)

measures the responsiveness of consumers of a good/service to a change in price of that good/service

PED=0

perfectly inelastic demand

Qd is not responsive to change in price.

0 < PED < 1

inelastic demand

Qd is relatively unresponsive to change in price.

PED = 1

unit elastic demand

Qd is proportionally responsive to change in price.

1 < PED < infinity

elastic demand

Qd is relatively responsive to change in price.

PED = infinity

perfectly elastic demand

Qd is infinitely responsive to change in price.

determinants of PED

substitutes

proportion of income

luxury/necessity

addictiveness

time .

primary sector

raw materials

secondary sector

manufactured goods

tertiary sector

services

income elasticity of demand (YED)

measures the responsiveness of demand to change in income

YED > 0

normal good

YED > 1

luxury

YED < 0

inferior good

YED < 1

necessity

price elasticity of supply (PES)

measurement of responsiveness of the quantity of a good supplied to changes in that goods price.

0 < PES < 1

inelastic supply

Qs is relatively unresponsive to a change in price

PES = 0

perfectly inelastic supply

Qs is not responsive to a change in price

1 < PES < infinity

elastic supply

Qs is relatively responsive to a change in price

PES = 1

unit elastic supply

Qs is proportionally responsive to a change in price

PES = infinity

perfectly elastic supply

Qs is infinitely responsive to a change in price

determinants of PES

time

mobility of resources

ability to store stocks

unused capacity

rate of cost of production.

negative externality of production

external costs created by producers

tradable permits

market based policy where gov. sets amount of permits that can be bought and sold by polluters.

limitations of gov. intervention

size of externality

amount of tradable permits allowed

difficulty of enforcing regulations

externality remains with regulations

regulations

age restrictions,

where you product can be used

gov. interventions

subsidies

taxes

price controls

negative externality of consumption

the external costs created by consumers

demerit goods

goods that have harmful effects on the consumer and creates negative spill over effects on society

positive externalities of production

the external benefits created by producers

positive externalities of consumption

the external benefits that are created by consumers

merit goods

goods that are beneficial to consumer and created positive spill over effects on society

public goods;

non rivalrous and non excludable

non rivalrous

consumption by one person does not limit consumption by other person.

non excludable

no one is excluded from using the product

direct gov. provision

gov fully funds goods (public)

contracting out

gov. asks private company to do a task for them

asymmetric information

buyers and sellers don’t have equal access to information

adverse selection

one party has more info on quality of product than the other party

moral hazard

one pary takes risks but the other party faces the effects of those risks.

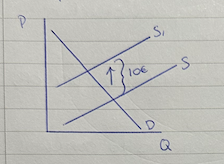

price ceiling diagram

price floor diagram

burden diagram

specific tax diagram

ad valorem tax diagram

diminishing marginal returns diagram(s)

consumer and producer surplus diagram

negative production externality diagram

MSC > MPC