Lecture 6(2) - Measuring Market Strength

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

Market Breadth Indicators

Measures internal strength of the market by considering whether stocks are gaining/losing strength in price

Why - Breadth leads price

Advance-Decline (A-D) Line, A-D Ratio, Breadth Difference, Breadth thrust

Advance-Decline Line (A-D)

Best way to measure internal strength of the market index

Cumulative sum of advancing issues minus declining ones

It should follow and move to new highs with the index for confirmation - if not, there is a divergence which will lead to a price reversal

A-D Tip

Look for 2 consecutive negative divergences - double negative divergence signals a peak within a year

A-D Breadth Line

McClellan Oscillator

Difference of 2 exponential moving averages (19 & 39 day EMAs) of [advances - declines]

Difference between advances-declines

Overbought: +100 to +150

Oversold: -100 to -150

Zero line cross is also important

McClellan Summation Index

Measure of area under the McClellan Oscillator curve by acucmulating the daily McClellan Oscillator figures into a cumulative index

Oscillates between 0 and 2000, neutral is 1000

Ratio adjusted Summation Index (RASI) is used to factor for increases in number of issues, and oscillated between +500 (overbought) and -500 (oversold)

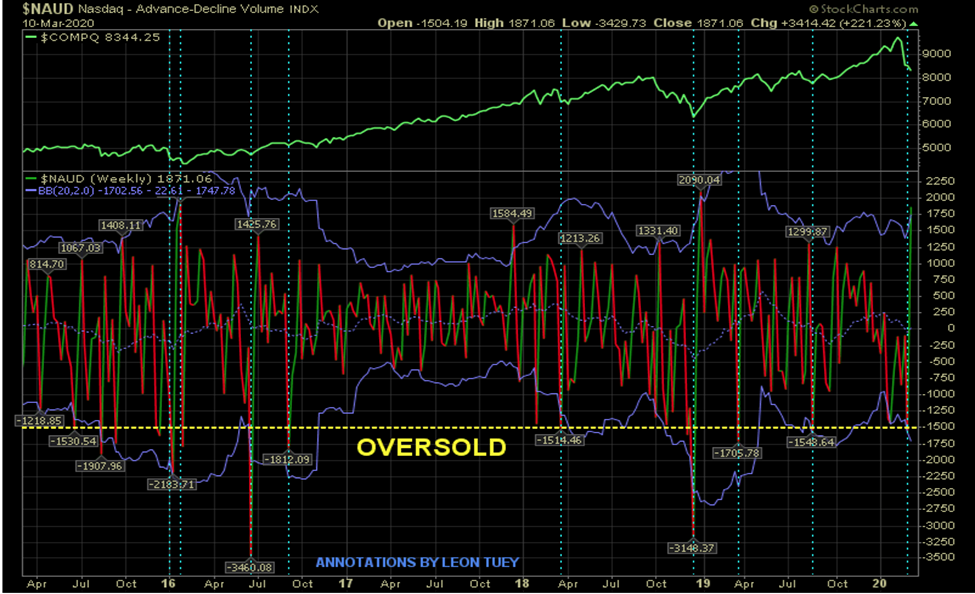

McClellan Summation Index Graph

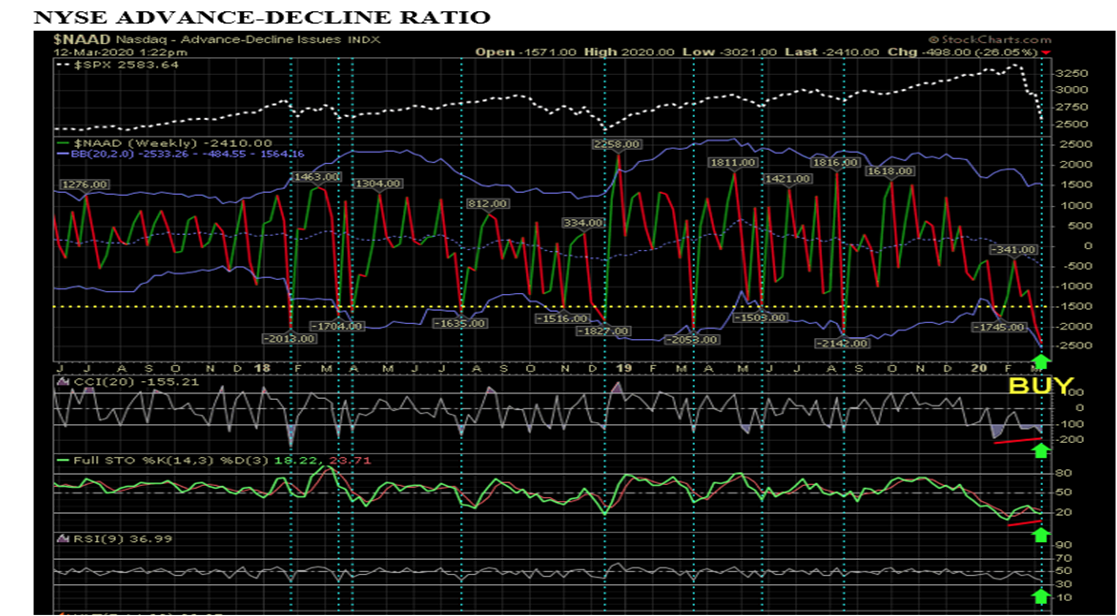

Advance-Decline Ratio Graph

A-D Ratio

Number of Advancing issues

Number of Declining issues → and smooth it over a time period → a ratio above 1 shows that more stocks are advancing than declining

Breadth Thrust

10 day SMA of advances

(Advances + declines when it goes above 0.61)

Arms Index

Measures relative volume in advancing stocks vs declining stocks

Interpretation: large volume in declining stocks, market likely at bottom. Large volume in advancing stocks, market is healthy

(Advances/declines)

(Advancing volume/declining volume)

Arms index ABOVE one means a declining volume and price is leading the market

90% downside days (NPDD)

Reliable may to identfy major market bottoms

Occurs when on a particular day the % of downside volume > total of upside and downside points exceeds total of gained points and lost points by 90%

A 90% upside day occurs when both the upside volume and points gained are 90% of their respective totals

Up and Down Volume Indicators

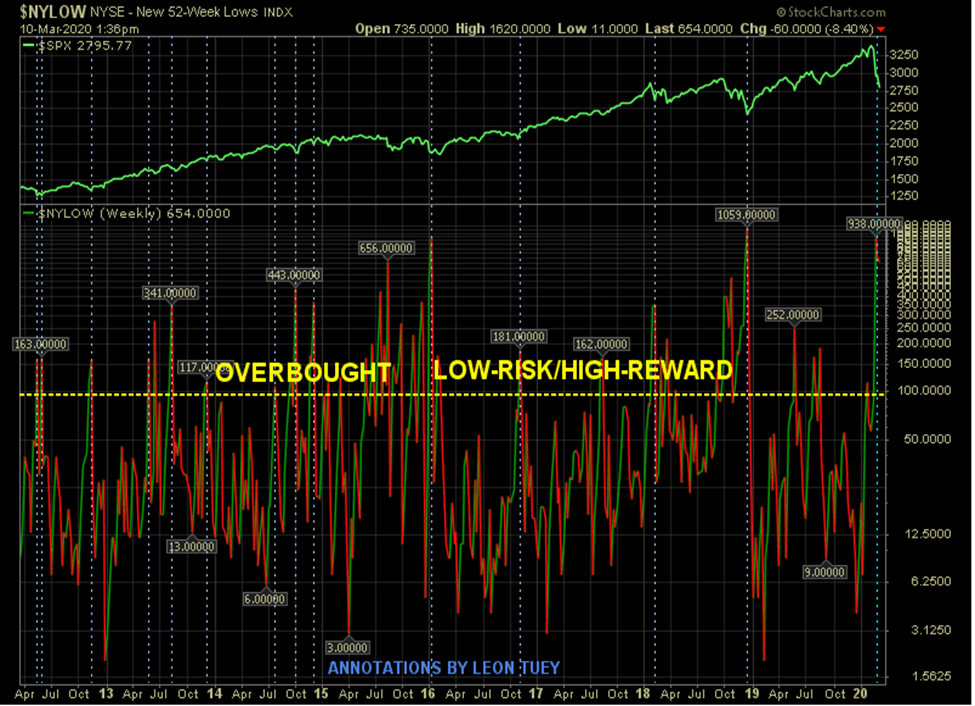

Net new 52-week highs and Net New 52-week lows

When stock market index is rising, most individual stocks should be rising to new highs, when the market index is declining, most stocks should go lower and make new lows

Up and down volume indicators graph

Hindenburg Omen (HO) → part of Up and Down Volume

Signals a reversal downward and potential crash in the market just like the Hindenburg blimp crash

Rare technical signal, attempts to predict crashes

Must meet conditions

Conditions for HO to go off

52 week highs & lows each have to be greater than 2.2% of stocks

Small number of new highs or lows > 75

10 week moving average of NYSE comp is rising

McClellan oscillator is negative

New highs cannot be >2 x of new lows

Confirmation: 2 or more occurences within a 36-day period

Using Moving Averages

Number of stocks >30 week moving average

Looking at how many stocks are trending by seeing if their price is above a N-day moving average