Interest Rates & Banking Test #1

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

32 Terms

How to find the total amount of money borrowed

# of shares x price of shares = total price

total price x initial margin requirement = margin price

total price - margin price = amount to be borrowed

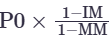

How to find the price when you receive a maintenance margin call

P0 = Initial price

IM = Initial margin

MM= Maintenance margin

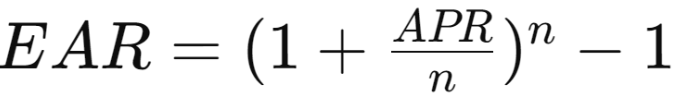

How to find EAR

What is considered a banks assets and liabilities?

Assets:

cash, loans, investments in securities, mortgages

Liabilities:

deposits, money borrowed from other institutions

What is the main role of financial intermediaries and what are examples?

borrow funds from savers and lend them to borrowers

ex: banks

What is the Federal Reserve System?

the central bank of the United States

conducting monetary policy, supervising and regulating financial institutions, ensuring the safety and efficiency of payment systems, and promoting community development

Who carries out monetary policy?

the federal reserve system

M1 aggregate

representing "narrow money" and includes the most liquid components of the money supply used for everyday transactions: currency in circulation (physical cash and coins) and checkable deposits (such as checking and most savings accounts)

M2 Aggregrate

broader and slightly less liquid form of money M1

includes everything in the narrower M1 aggregate (currency in circulation, traveler's checks, demand and other checkable deposits)

plus savings deposits

small-denomination time deposits (like certificates of deposit under $100,000)

balances in retail money market funds

which aggregate includes money market mutual fund shares?

M2

What is the velocity of money?

the number of times each dollar in the money supply is used to buy goods and services included in GDP

What are all the financial assets?

Money

Bonds

Stocks

Foreign exchange

Securitization

What are examples of financial institutions?

commercial banks

brokerages

insurance companies

credit unions

What are the key functions of money?

-medium of exchange

-unit of measure

-store of value

-it offers a standard of deferred payment

what are examples of payment systems?

Automated clearing house (ACH)

Blockchain / bitcoin

CBCD

Spike

CLOVER

What is a margin call?

•Notification from broker that you must put up additional funds or have position liquidated

This happens when the value of your investments, bought with borrowed money (margin), falls below a certain threshold, meaning your account no longer has enough of your own money to cover the outstanding loan

What is the moral hazard problem?

•financial firms, especially large ones, make riskier investments if they believe the government will save them from bankruptcy

What are the four main sources of inefficiency in a barter economy?

double coincidence of wants increase the transactions costs

each good has many prices

a lack of standardization exists for goods and services

it is difficult to accumulate wealth

What does buying on margin mean?

using only a portion of the proceeds for an investment

borrow remaining component

margin arrangements differ for stocks and futures

What is the quantity of money theory?

a theory about the connection between money and prices that assumes that the velocity of money is determined mainly be institutional factors and so is roughly constant in the short run.

What are debt instruments

•methods of financing debt, including simple loans, discount bonds, coupon bonds, and fixed payment loans.

–also known as credit market instruments or fixed income assets

Explain the relationship between the yield to maturity on a bond and its price.

Bond price and yield to maturity (YTM) have an inverse relationship: when one goes up, the other goes down

What is a financial arbitrage?

is the process of buying and selling securities to profit from price changes over a brief period of time

What are the determinants of portfolio choice?

investors wealth

the expected rates of returns from different investments

the degrees of risk in different investments

the liquidity of different investments

the costs of acquiring information about different investments

Important factors for explaining shifts in the supply curve for bonds:

expected pretax profitability of physical capital investment

business taxes

expected inflation

government borrowing

The treasury yield curve

shows the relationship among the interest rates on treasury bonds with different maturities

upward sloping = short term rates lower than long term rates

downward sloping = short term rates are higher than long term interest rates

Why do banks have a maturity mismatch?

because they borrow short term from depositors and lend long term to households and firms

banks face a liquidity risk because they may be unable to meet their depositors’ withdrawals

How to fix maturity mismatch

immunization

intuition

duration matching

Expectations theory

1.Investors have the same investment objectives.

2.For a given holding period, investors view bonds of different maturities as being perfect substitutes for one another.

theory assumes that the returns from the two strategies must be the same

The liquidity premium theory

–Investors demand risk premium on long-term bonds

–fn must be > E(rN) to induce investment on the forward rate fn

–Liquidity premium

▪Extra expected return demanded by investors as compensation for greater risk of long-term bonds

–Spread between forward ROI and expected short sale

▪f_n=E(r_n )+Liquidity premium

The segmented markets theory of term structure

holds that the interest rate on a bond of a particular maturity is determined only by the demand and supply of bonds of that maturity

investors in the bond market do not all have the same objectives

.Investors do not see bonds of different maturities as being perfect substitutes for each other.

What is duration analysis?

an analysis of how sensitive a bank’s capital is to changes in market interest rates