Addendum CH 5 Derivatives (DONE)

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

18 Terms

Notation

c: | European call option price |

p: | European put option price |

S0: | Stock price today |

K: | Strike price |

T: | Life of option |

σ: | Volatility of stock price |

C: | American call option price |

P: | American put option price |

ST: | Stock price at option maturity |

D: | PV of dividends paid during life of option |

r | Risk-free rate for maturity T with cont. comp. |

Effect of Variables on Option Pricing (Table 11.1)

Variable | c | p | C | P |

S0 | + | − | + | − |

K | − | + | − | + |

T | ? | ? | + | + |

σ | + | + | + | + |

r | + | − | + | − |

D | − | + | − | + |

An American option is worth at least as much as the corresponding European option

C ≥ c

P ≥ p

Calls: An Arbitrage Opportunity?

Suppose that

c = 3 | S0 = 20 |

T = 1 | r = 10% |

K = 18 | D = 0 |

Is there an arbitrage opportunity?

Lower Bound for European Call Option Prices; No Dividends (Equation 11.4)

c ≥ max(S0 –Ke –rT, 0)

Puts: An Arbitrage Opportunity?

Suppose that

p= 1 | S0 = 37 |

T = 0.5 | r =5% |

K = 40 | D = 0 |

Is there an arbitrage opportunity?

Lower Bound for European Put Prices; No Dividends (Equation 11.5)

p ≥ max(Ke -rT–S0, 0)

Put-Call Parity: No Dividends

Consider the following 2 portfolios:

Portfolio A: European call on a stock + zero-coupon bond that pays K at time T

Portfolio C: European put on the stock + the stock

|

| ST > K | ST < K |

Portfolio A | Call option | ST − K | 0 |

| Zero-coupon bond | K | K |

| Total | ST | K |

Portfolio C | Put Option | 0 | K− ST |

| Share | ST | ST |

| Total | ST | K |

The Put-Call Parity Result (Equation 11.6)

Both are worth max(ST , K ) at the maturity of the options

They must therefore be worth the same today. This means that c + Ke -rT = p + S0

Arbitrage Opportunities

Suppose that

c= 3 | S0= 31 |

T = 0.25 | r = 10% |

K =30 | D = 0 |

What are the arbitrage possibilities when

p = 2.25 ?

p = 1 ?

Early Exercise

Usually there is some chance that an American option will be exercised early

An exception is an American call on a non-dividend paying stock

This should never be exercised early

An Extreme Situation

For an American call option:

S0 = 100; T = 0.25; K = 60; D = 0

Should you exercise immediately?

What should you do if

You want to hold the stock for the next 3 months?

You do not feel that the stock is worth holding for the next 3 months?

Reasons For Not Exercising a Call Early (No Dividends)

No income is sacrificed

You delay paying the strike price

Holding the call provides insurance against stock price falling below strike price

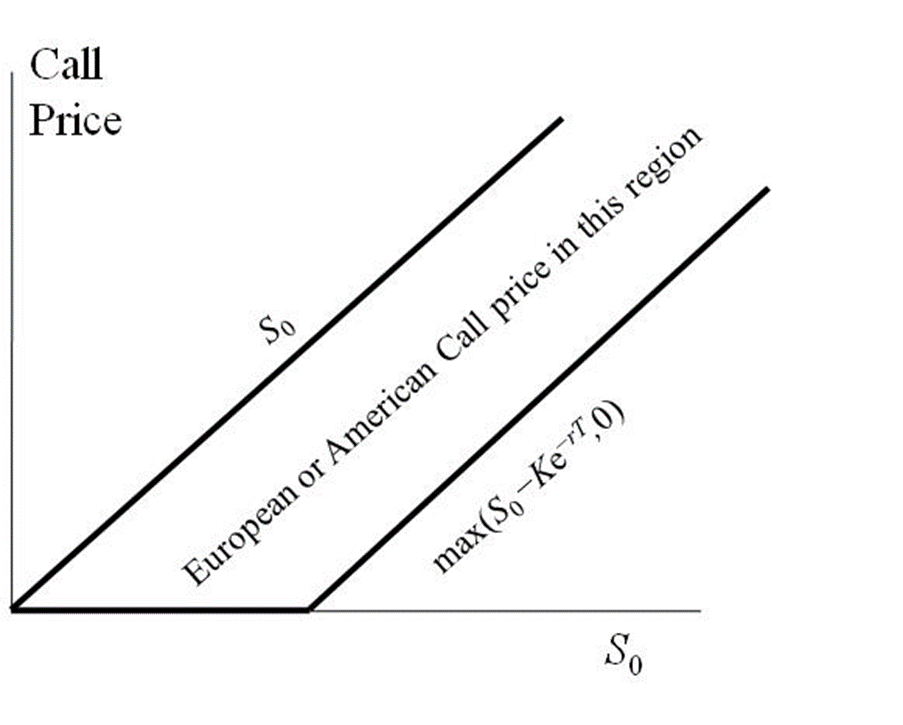

Bounds for European or American Call Options (No Dividends) Figure 11.3

Should Puts Be Exercised

Early ?

Are there any advantages to exercising an American put when

S0 = 60; T = 0.25; r=10%

K = 100; D = 0

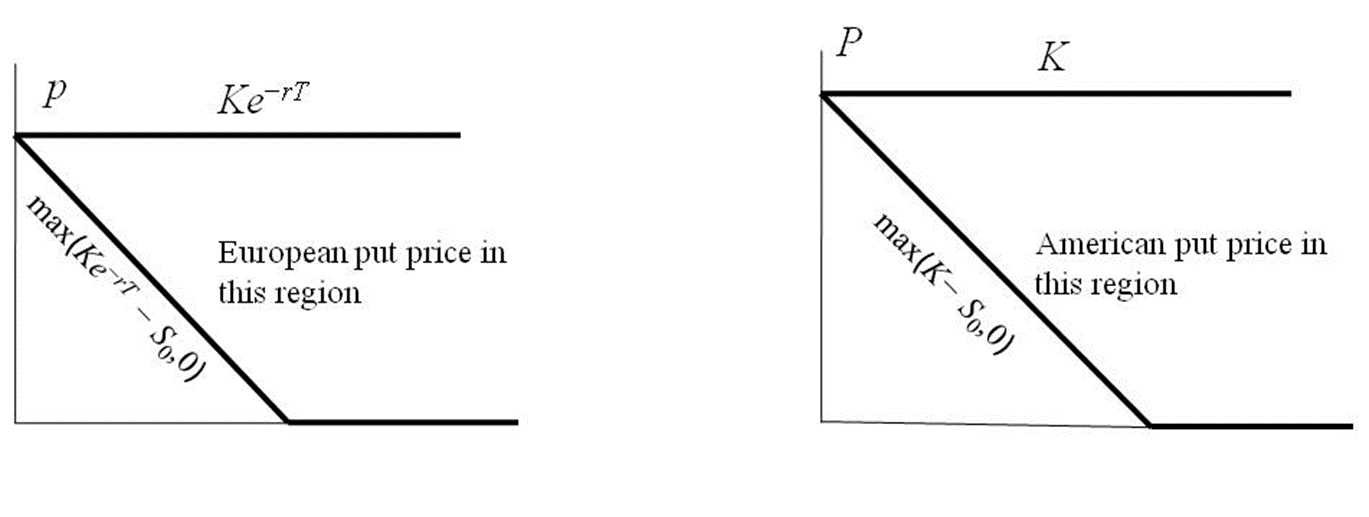

Bounds for European and American Put Options (No Dividends) Figure 11.4

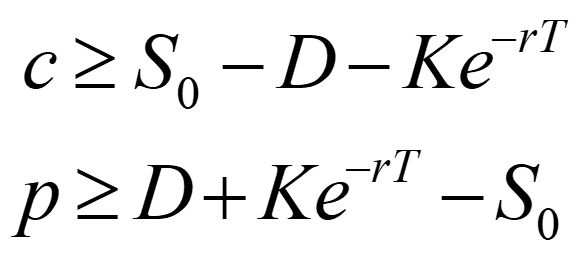

The Impact of Dividends on Lower Bounds to Option Prices

(Equations 11.8 and 11.9)

Extensions of Put-Call Parity

American options; D = 0

S0 − K < C − P < S0 − Ke−rT

Equation 11.7

European options; D > 0

c + D + Ke −rT = p + S0

Equation 11.10

American options; D > 0

S0 − D − K < C − P < S0 − Ke −rT

Equation 11.11