Far 2 Chapter 14

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

Differences between C Corp. and S Corp.

Taxation

C Corp faces double taxation

income tax on earnings

income tax on the dividends

S Corp pays no income tax

the taxable income from the corporation is taxed directly to the S corporation stockholders

Number of stockholders

C Corp has no restrictions

S Corp is limited to 100 stockholders

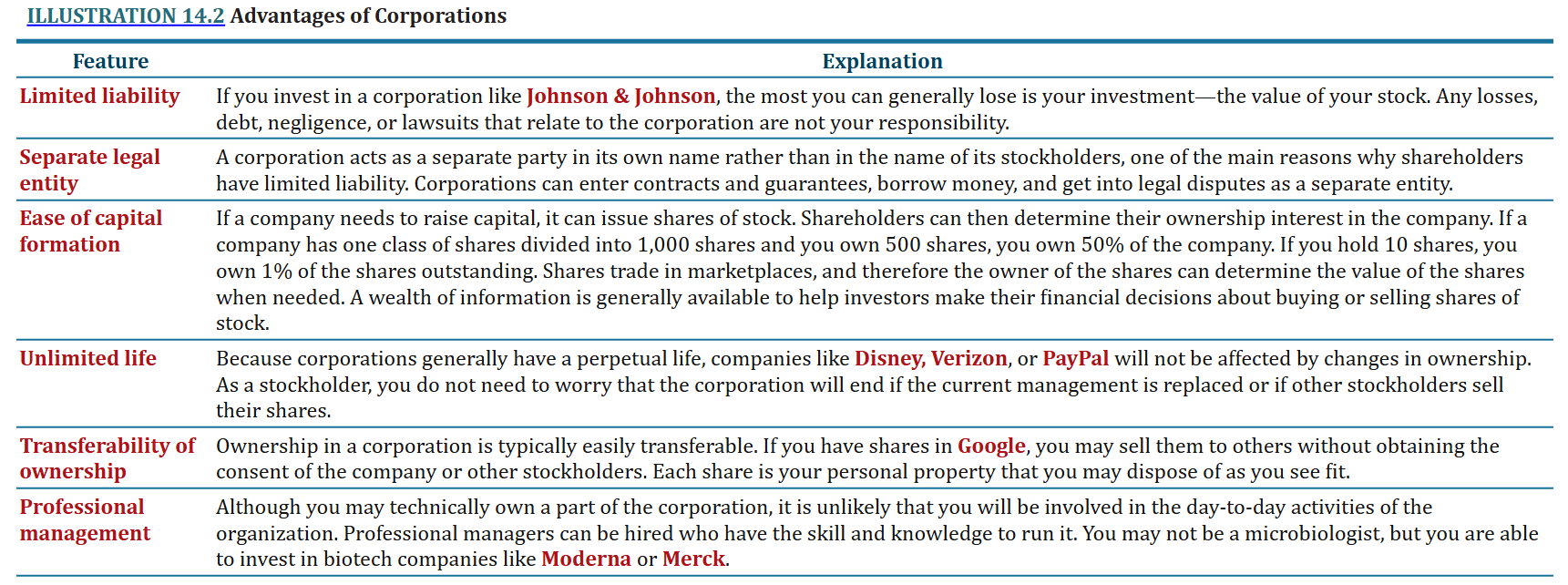

Advantages of Corporations

Limited liability

Separate legal entity

Ease of capital formation

Unlimited life

Transferability of ownership

Professional management

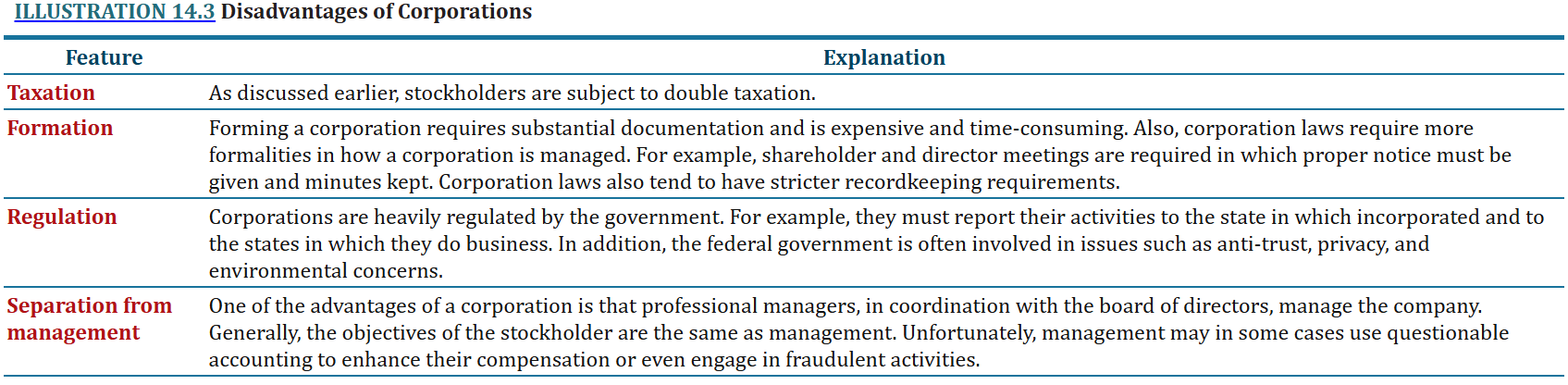

Disadvantages of Corporations

Taxation

Formation

Regulation

Separation from management

Articles of Incorpoation

A set of legal documents that contain general information about the business, such as name, location, address, names of directors, and areas of operation.

Corporate Charter

A document that describes the name and purpose of the corporation, the type and number of shares authorized, the names of the individuals who are forming the corporation, and the number of shares these individuals agree to purchase.

Stockholders’ (Owners’) Equity

Represents the cumulative net contributions by stockholders plus retained earnings and accumulated comprehensive income.

Capital Stock

Combination of common stock and preferred stock.

Contributed (Paid-in) Capital

The total amount paid in on capital stock—the amount provided by stockholders to the corporation for use in the business.

Earned Capital

Capital that develops from profitable operations. It consists of all undistributed income that remains invested in the company.

Retained Earnings

The earned capital of the company.

Accumulated Other Comprehensive Income

Reflects the aggregate amount of the other comprehensive income items. It includes such items as unrealized gains and losses on available-for-sale debt investments and unrealized gains and losses on certain derivative transactions.

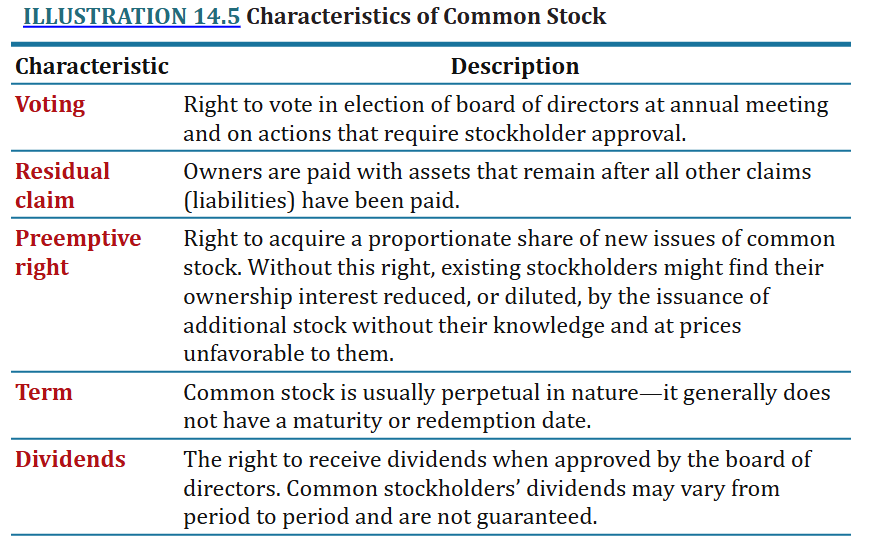

Common Stock

The residual corporate interest that bears the risk of loss and receives the benefit of success. The key characteristics:

Voting

Residual claim

Preemptive right

Term Dividends

Paid-in Capital in Excess of Pay—Common Stock

Indicates any excess over par value paid in by stockholders in return for their shares issued to them.

No-Par Stock

Issuance of common stock without par value. Should be carried in the accounts at issue price.

Allowed to avoid confusion over the relationship, or lack of relationship between par value and fair value.

Major disadvantage is a high tax on these issues.

Stated Value

A requirement for no-par stocks by some states.

Creates the same issues as par value stock

accounts the same if it were par value stock

Proportional Method

If the fair value or other sound basis for determining relative value is available for each class of security, the company allocates the lump sum received among the classes of securities on a proportional basis.

Incremental Method

In instances where a company cannot determine the fair value of all classes of securities, it may use the incremental method. It uses the fair value of the securities as a basis for those classes that it knows, and allocates the remainder of the lump sum to the class for which it does not know the fair value.

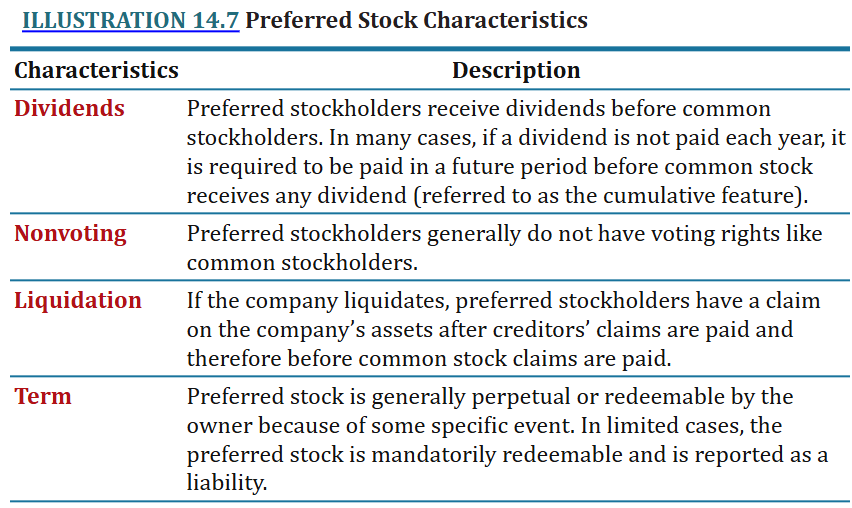

Preferred Stock

A special class of shares that possess certain preferences, characteristics, or features no possessed by common stock.

Money is oftened used for special projects, like R&D or to fund an acquisition.

Cumulative Preferred Stock

If a corporation fails to pay a dividend in any year, it must make it up a later year before paying any dividends to common stockholders.

Participating Preferred Stock

Holders share ratably with the common stockholders in any profit distributions beyond the prescribed rate.

Convertible Preferred Stock

Allows stockholders, at their option, to exchange preferred shares for common stock at a predetermined ratio.

Callable Preferred Stock

Permits the corporation, at its option, to call or redeem the outstanding preferred shares are specified future dates and at stipulated prices.

Redeemable Preferred Stock

Allows the stockholder to redeem it at any time; the stockholder can “return” the stock to the company and be paid a set amount for the return of the stock.

Treasury Stock

Stock the company buybacks and plans to reissue.

contra-equity account

essentially the same as unissued capital stock

Cost Method

One of two general methods of handling treasury stock in the accounts.

A company will debit the Treasury Stock account for the reacquisition cost of the stock. On the balance sheet, this account is a deduction from the total paid-in capital and retained earnings.

Par (stated) Value Method

One of two general methods of handling treasury stock in the accounts.

All transactions in Treasury Stock are recorded at their par value. On the balance sheet, Treasury Stock is reported as a deduction from capital stock only.

Outstanding Stock

The number of shares of issued stock that stockholders own.

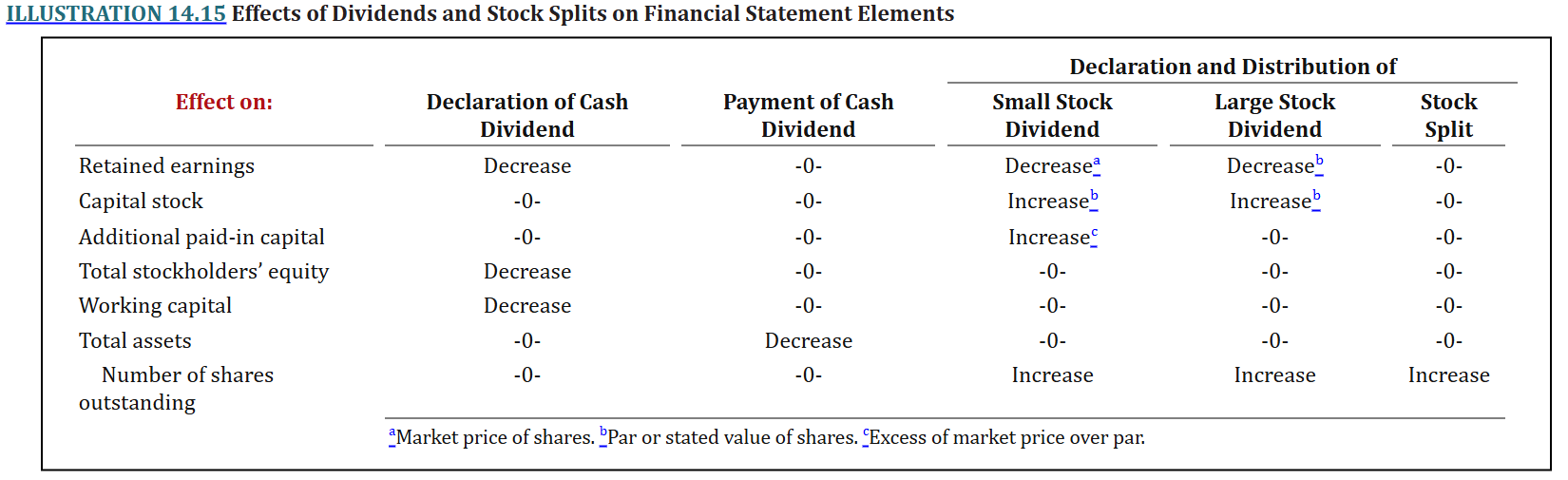

Types of dividends

Cash dividends

Property dividends or dividends in kind

Liquidating dividends

Property Dividends (dividends in kind)

Dividends payable in assets of the corporation other than cash.

may be:

merchandise

real estate

investments

Whatever form the board of directors designates

Liquidating Dividends

Dividends are a return of the stockholder’s investment rather than of profits; any dividend not based on earnings reduces corporate paid-in capital and to that extent.

Stock Dividend

The issuance by a corporation of its own stock to its stockholders on a pro rata basis, without receiving any consideration

par value of stock issued

fair value of the stock issued

Small (Ordinary) Stock Dividends

When a stock dividend is less than 20-25% of the common shares outstanding at the time of the dividend declaration, the company is therefore required to transfer the fair value of the stock issued from retained earnings.

Large Stock Dividend

A distribution of 25% or more of the common shares outstanding.

Difference between stock dividend and stock split

A stock dividend, although it increases the number of shares outstanding, does not decrease the par value; thus, it increases the total par value of outstanding shares.

Statement of Stockholders’ Equity basic format

balance at the beginning of the period

additions

deductions

balance at the end of the period