introduction to law, lectue 20 - module 3

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

20 Terms

What is conditio sine qua non?

Concequence wouldn’t have happened without the first event

What is adequate causation?

Act in question is likely to produce such an effect (more normative perspective)

What is equivalence theory?

(used in French law)

Also called the “but for” test.

A cause is legally relevant if the damage wouldn’t have happened without it.

Even minor or indirect causes are accepted as long as they were necessary for the outcome.

This can lead to very broad liability, since a single event could trigger far-reaching legal consequences.

📌 Example:

If A forgot to close a gate, and days later a dog escaped and caused an accident, A’s omission might still be considered a cause.

What is adequacy theory?

(used in German law, but not universally accepted)

Focuses on whether the act is a normal and adequate cause of the damage — not just any cause.

Filters out highly unusual or improbable chains of events.

The act must be something that typically leads to that kind of damage under normal circumstances.

Similar to the English test of reasonable foreseeability.

📌 Example:

If A’s small act only led to damage through an extremely rare chain of events, it would not be considered an adequate cause.

What is the Eggshell skull rule?

If someone causes harm to another person, they are fully liable for all the consequences, even if the victim had a pre-existing vulnerability or condition that made the injury worse than expected.

What is contributory negligence?

Explain reparation

What is commercial law?

What is company law?

What 4 things make a company?

Involvement of 2 or more persons

Investment (consideration in cash or in kind)

Project = “object” = activity

Purpose = return, distribution to shareholders

What is an association? 4

What is corporate law?

What three agency conflicts are there?

1st agency conflict: directors vs shareholders holders

2nd agency conflict: majority vs. Minority shareholders

3rd agency conflict: shareholders vs. Creditors

What are the two ways to run a business? As a …

What is PLLC?

Private limited liability company

What do you have to do if you don’t than t your business stuff in your own patremonium?

You need to create a legal person (corporation or association) that is the owner of the assets. This is how you can asset partition.

What three subtypes are there of companies?

Explain (simple) partnership or personal company?

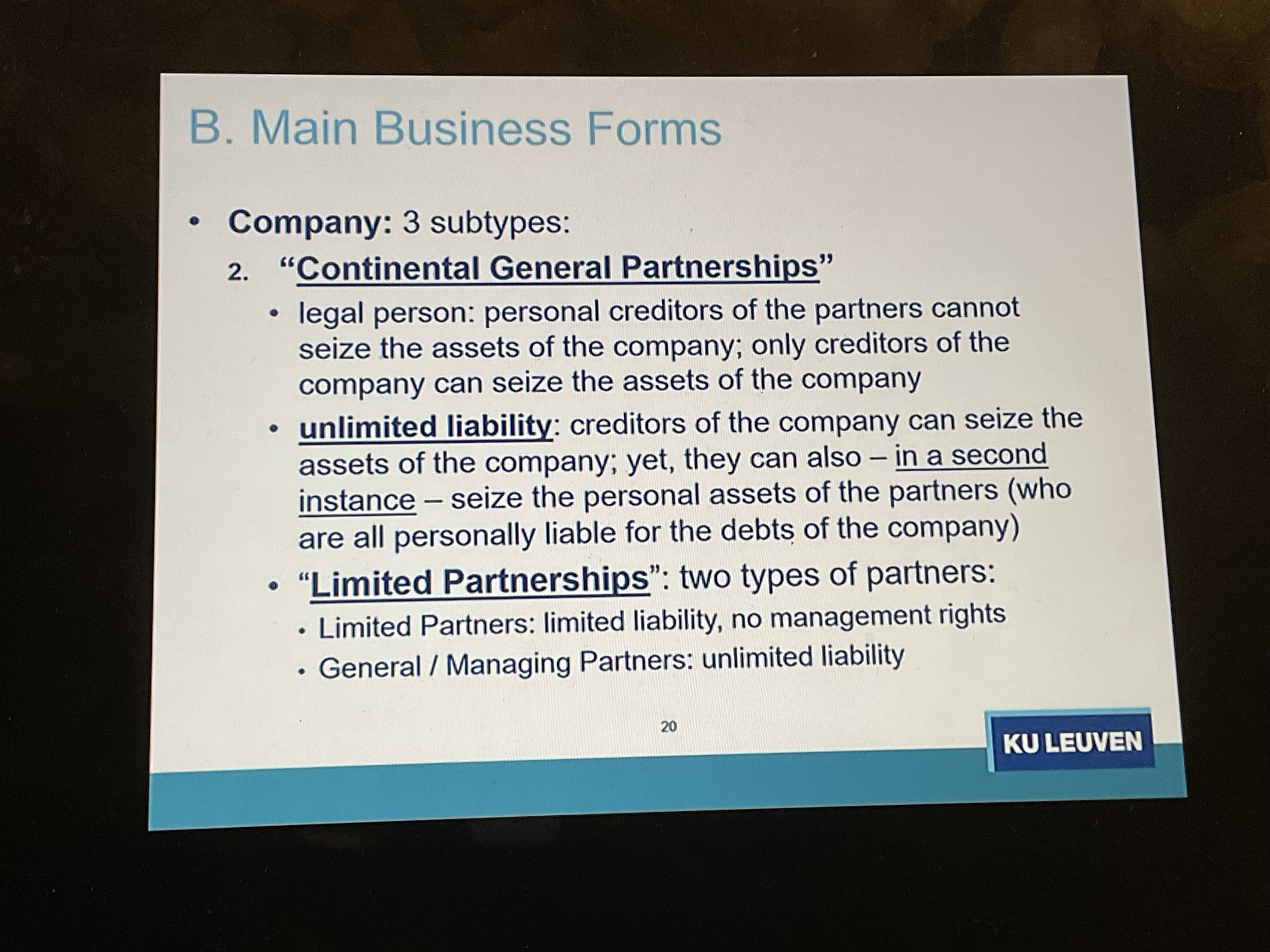

Explain continental general partnership (and limited partnerships)

The company is a legal person:

Creditors of partners cannot touch company assets.

Creditors of company cannot touch personal assets — unless liability applies.

⚠ Unlimited liability:

First, creditors go after company assets.

Then, in a second instance, they can go after the personal assets of the partners.

Limited Partnerships (a subtype):

Limited partners:

❌ No management rights

✅ Have limited liability

General/managing partners:

✅ Have control

❌ Have unlimited liability

Think: more formal than simple partnerships, but still risky for managing partners.

Explain private limited or public limited

✅ Has legal personality

Shareholders’ personal creditors cannot touch company assets

🛡 Limited liability:

Creditors can only seize company assets

Shareholders are not personally liable for company debts

Their liability is limited to the amount they invested

Think: safest and most structured — preferred for startups, corporations, and international business.