micro ch 8 perfect competition

1/91

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

92 Terms

firms in perfect competition

many firms produce identical products

many buyers are available to buy the product, and many sellers are available to sell product

sellers and buyers have all relevant info to make rational decisions about the product that they are buying and selling

firms can enter and leave the market wo any restrictions (free entry and exit into and out of the market)

price taker

a perfectly competitive firm is known as ? bc the pressure of competing firms forces it to accept the prevailing equilibrium price in the market

not be considered

when a firm sets diff prices for their product, either at or above the equilibrium price it will be/will not be considered as a perfectly competitive market?

perfect competition used as a benchmark

provides a useful comparison to markets that operate in more complex, real-world conditions.

short run

perfectly competitive firm will seek the qty of output where profits are highest, or if profits aren’t possible, where losses are lowest

long run

positive economic profits will attract competition as other firms enter the market

economic losses will cause firms to exit the market

ultimately, perfectly competitive markets will attain long-run equilibrium when no new firms want to enter the market and existing firms bc their economic profits have been driven down to zero

perfectly competitive firm

can sell as large a qty as it wishes, so long as it accepts the prevailing market price

if firm sells a higher qty of output, then total revenue will increase

if the market price of the product increases, then total revenue also increases whatever the qty of output sold

what quantity to produce

perfectly competitive firm has only 1 major decision to make

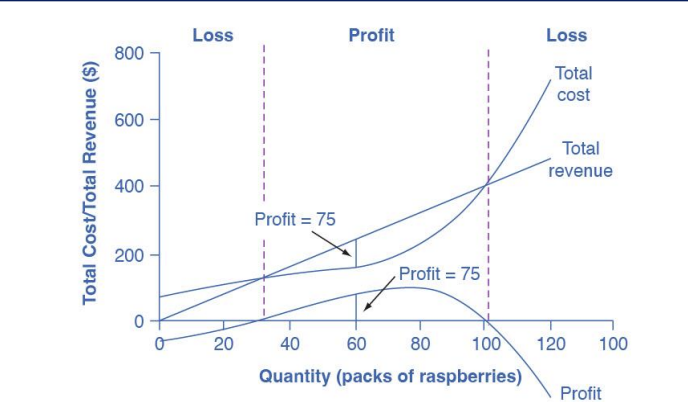

profit

total revenue-total cost

(price)(qty produced)-(avg cost)(qty produced)

note: perfectly competitive firm must accept the price for its output as determined by the product’s market demand and supply, it can’t choose the price it charges

total cost

slopes up but w some curvature

at higher levels of output, ? begins to slope upward more steeply bc of diminishing marginal returns

the max profit will occur at the qty where the difference btw total revenue and total cost is largest

total revenue

for a perfectly competitive firm, this is a straight line sloping up

the slope is equal to the price of the good

most profitable qty

what qty total revenue exceeds total cost by the largest amount

marginal revenue curve

shows the additional revenue gained from selling 1 more unit

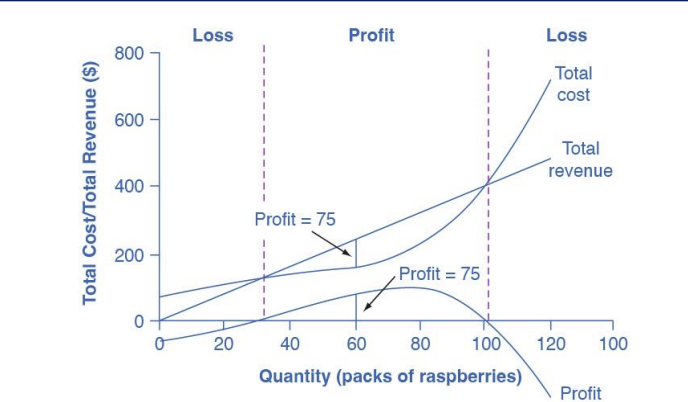

marginal revenue

= price

= change in total revenue/change in qty

marginal cost

change in total cost/change in qty

firm in perfect competition

faces a perfectly elastic demand curve for its product- firm’s demand curve is a horizontal line drawn at the market price level

means that firm’s marginal revenue curve is the same as the firm’s demand curve

every time a consumer demands 1 more unit, the firm sells 1 more unit and revenue increases by exactly the same amount equal to the market price

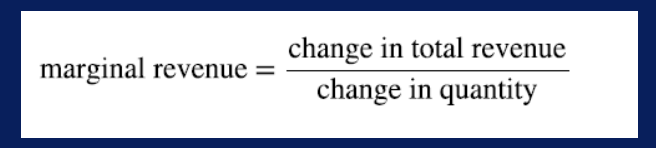

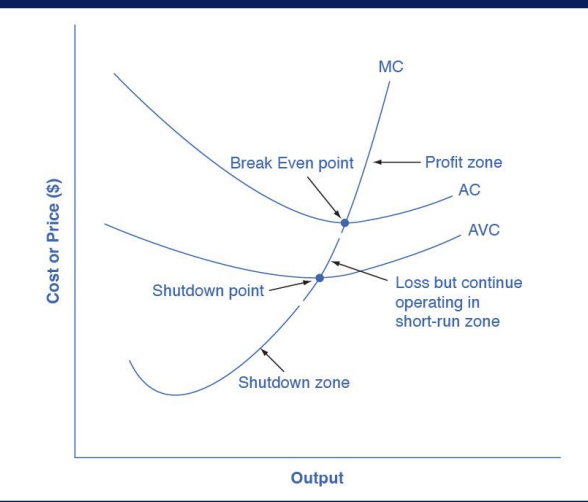

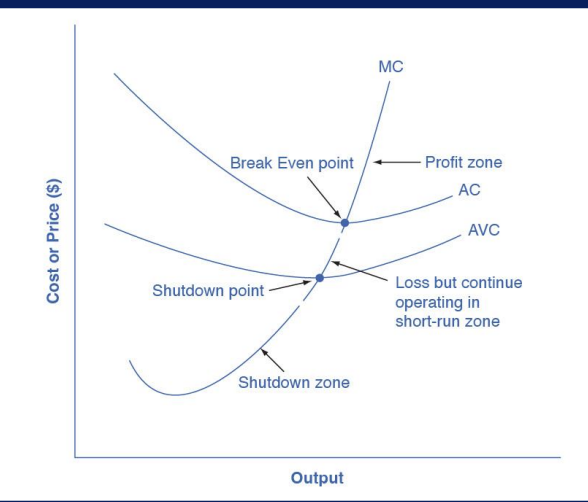

price>avg total costs

profit maximizing condition for a purely competitive firm is when

profit margin is positive (earn profit) if market price is higher than the firm’s avg cost of production for that qty produced

conversely, if the market price is lower than the avg cost of production, the profit margin is negative and the firm will suffer losses “the firm may want to shut down immediately”

make profit

price intersecting marginal cost at a level above the avg cost curve

since marginal cost is lower than marginal revenue..

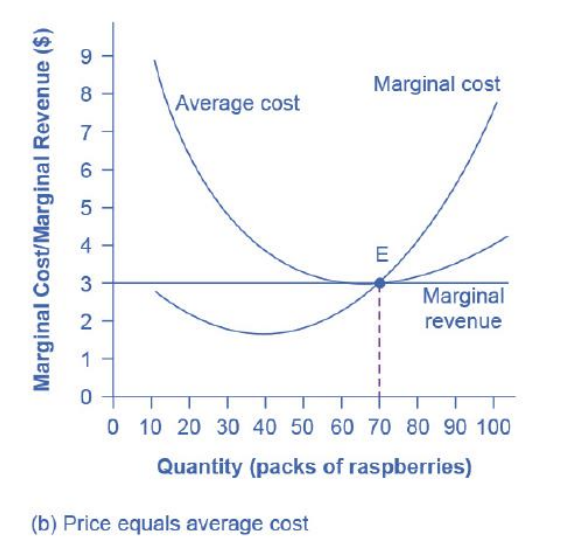

break even

where price intersects marginal cost at a level equal to the average cost curve

since marginal cost is equal to marginal revenue, firm is in optimum status ?

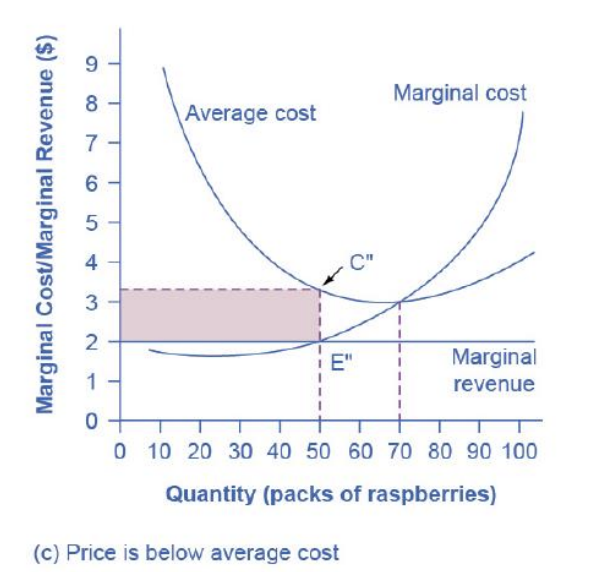

loss

price intersects marginal cost at a level below the avg cost curve

since marginal cost is higher than marginal revenue, that means the firm ?

profit

price>average total cost

break even

price=avg total cost

min point of average cost curve

loss

price<average total cost

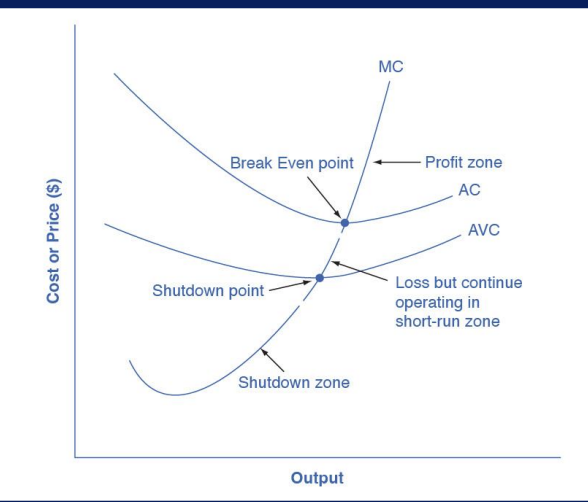

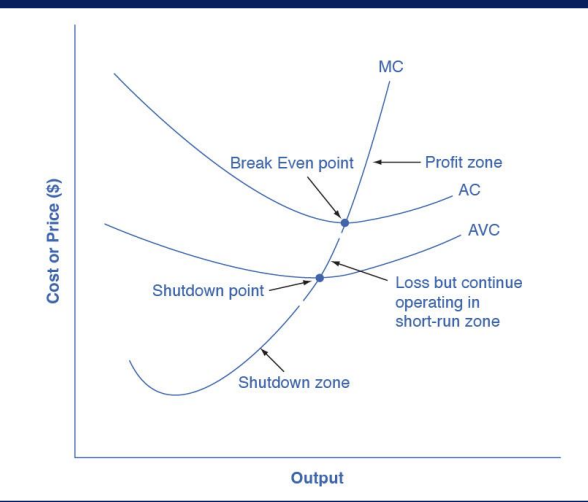

shutdown point

point where the firm will decide to shut down their business due to losses

shutting down can reduce variable costs to zero, but in short run, firm has already paid for fixed costs so if firm produces 0 qty, it would still make losses bc it would still need to pay for its fixed costs

why can the firm not avoid losses by shutting down and not producing at all?

Firms set different prices for their product, either at or above the equilibrium price

Which of the following characteristics does NOT describe a perfectly competitive market?

A. Firms set different prices for their product, either at or above the equilibrium price.

B. Many firms are producing identical products

c. There are many people who desire and have the ability to purchase the product.

d. Companies are able to enter and exit the market without any restrictions.

stay in business

price>min avg variable cost

shut down

price<min avg variable cost

firm earns profit

firm is operating where the market price is at a level higher than the break even point, then price will be greater than avg cost and the firm is ?

zero profit

if the price is exactly at the break even point, then firm is making ?

losses

if price falls in the zone btw the shutdown point and the break even point, then the firm is making ?

will continue to operate in the short run, since it is covering its variable costs, and more if price is above the shutdown price point

shut down immedately

if price falls below the price at the shutdown point, then the firm will ?, since it isn’t even covering its variable costs

to the R

lower price of key inputs or new tech that reduce production costs cause supply to shift to ?

upward and to L

bad weather or added government regulations can add to costs of certain goods in a way that causes supply to shift to the L

we can also interpret these shifts in the firm’s supply curve as shifts of the marginal cost curve

a shift in costs of production that increases marginal costs at all levels of output and shifts MC ?will cause a perfectly competitive firm to produce less at any given market price

supply curve

the marginal cost curve above the minimum point on the avg variable cost curve becomes the firm’s ?

downward to the R

a shift in costs of production that decreases marginal costs at all levels of output will shift MC (marginal cost) ? and as a result, a competitive firm will choose to expand its level of output at any given price

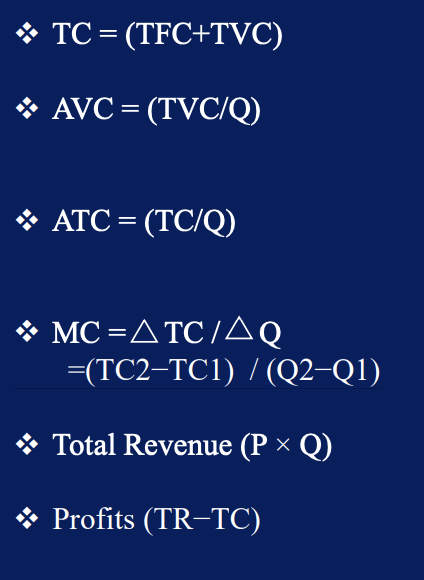

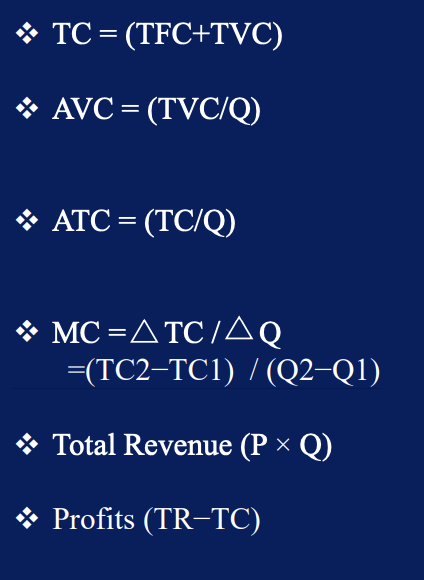

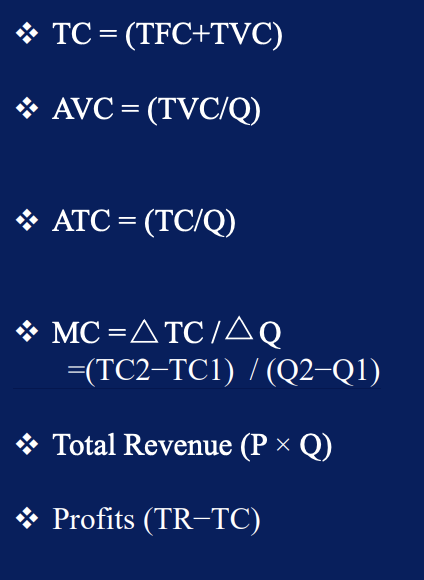

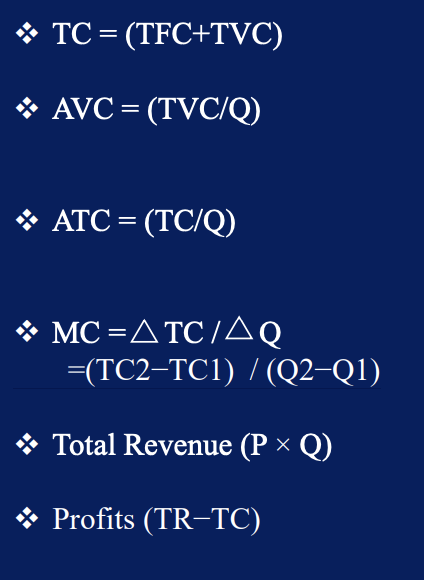

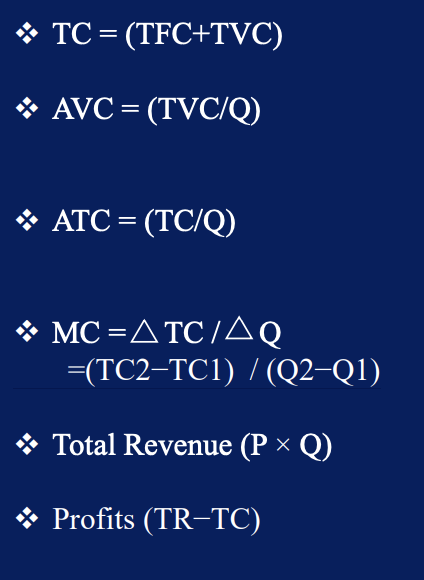

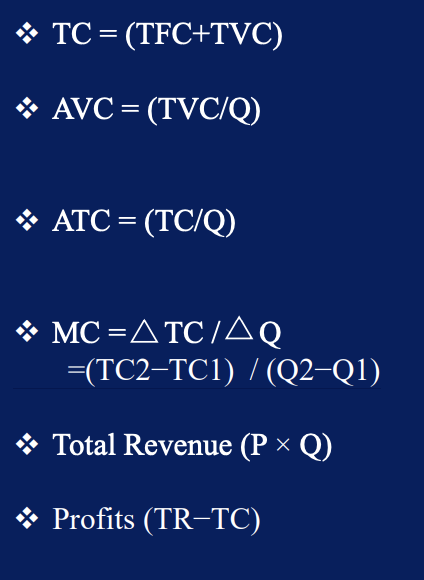

TC

TFC+TVC

AVC

TVC/Q

ATC

TC/Q

MC

= deltaTC / deltaQ

=(TC2−TC1) / (Q2−Q1)

total revenue

PxQ

profits

TR-TC

profit-maximizing output level

output level where (market) price =marginal cost

firm produces in short run, making losses

if P>AVC, but P<ATC then ?

firm stop producing and only incur fixed costs

if P< AVC

short vs long run

short run: firms can’t change the usage of fixed inputs

long run: firm can adjust all factors of production

entry

when new firms enter the industry in response to increased industry profits

exit

the long run process of reducing production in response to a sustained pattern of losses

zero profit

entry and exit to and from the market are the driving forces behind a process that, in the long run, pushes the price down to min avg total costs so that all firms are earning ?

short run profits in perfectly competitive firm evaporate in long run

Market starts in long-run equilibrium: P = MR = MC and P = AC → zero economic profits.

(pretend) Demand increases → market price rises.

Existing firms respond by increasing output where P = MR = MC.

Price > AC → firms earn positive economic profits (temporarily).

New firms enter due to profit opportunity → supply increases (shifts right).

Increased supply → market price falls.

Entry continues until price returns to P = AC → zero economic profits again.

Long-run equilibrium restored: no incentive for entry/exit.

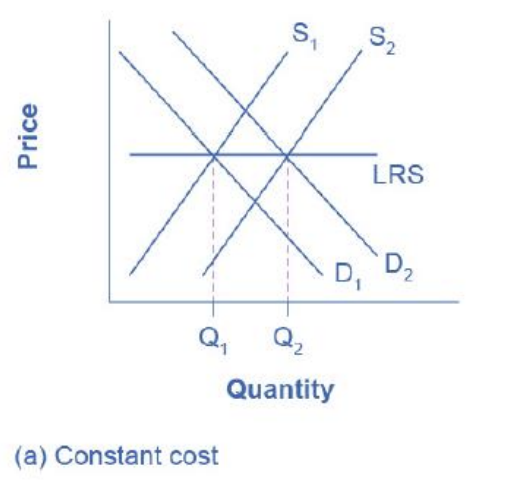

constant cost industry

as demand increases, the cost of production for firms stay the same

long-run outcome implies more output produced at exactly the same og price. note that supply was able to increase to meet the increased demand.

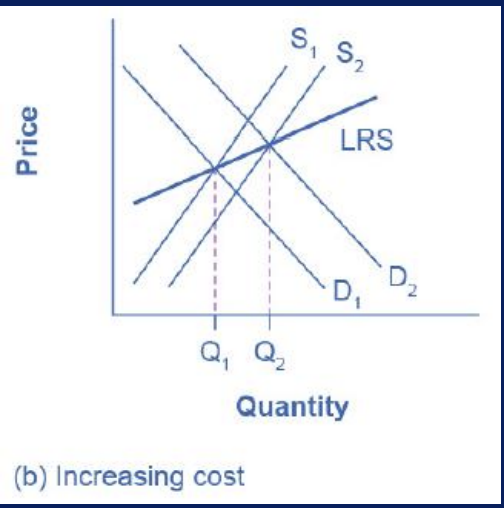

increasing cost industry

as demand increases, the cost of production for firms increases

LRS (long run supply) curve is upward sloping

industry supply curve in this type of industry is more inelastic

ex., as market expands, companies may have to deal with limited inputs like skilled labor. as demand for these workers rises, wages rise and this increases the cost of production for all firms.

note: sellers not able to increase supply as much as demand

some inputs were scarce, or wages were rising

equilibrium price rises

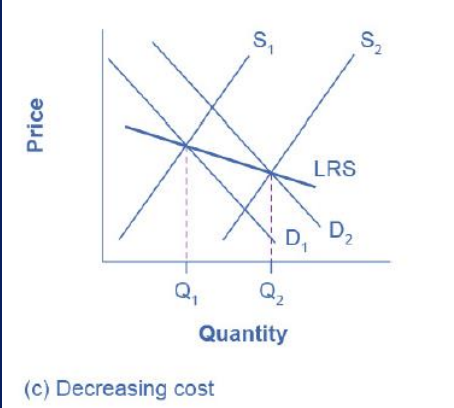

decreasing cost industry

as demand increases the cost of production for the firms decreases

falling average total costs, declining equilibrium price

due to improvement in tech or increase in employee education etc., economies of scale…

sellers easily increase supply in response to demand increase

allocative efficiency in purely competitive market structure

firms produce the qty where the price consumers pay = cost to society to produce it

productive and allocative efficiency

when profit-maximizing firms in perfectly competitive markets combine with utility maximizing consumers

firms in a perfectly competitive market produce less than the efficient quantity

Price > Marginal Cost (P > MC)

Consumers value extra units more than they cost to produce

Society benefits from producing more

Not allocatively efficient

firms produce more than the efficient quantity

Price < Marginal Cost (P < MC)

It costs more to produce extra units than consumers are willing to pay

Society loses value

Better to produce less

p=mc

When is allocative efficiency achieved in a perfectly competitive market?

The benefit to consumers equals the cost to society of producing the last unit

Resources are used most effectively

No overproduction or underproduction

if marginal costs exceed marginal revenue, then the firm will reduce its profits for every additional unit of output it produces.

Why a profit-maximizing firm will not choose to produce at a quantity where marginal cost exceeds marginal revenue

Option A

Profit would be greatest if it reduces output to where MR = MC.

Option B

The firm may produce when MC exceed MR because their profit will increases.

Option C

If marginal costs exceed marginal revenue, then the firm will reduce its profits for every additional unit of output it produces.

Price > average total costs

The profit maximizing condition for a purely competitive firm is when...

Option A

Price elasticity of demand is positive.

Option B

Price < average total costs

Option C

Price > average total costs

Option D

Price = average total costs

consider shutting down or stopping production

A strawberry farm operating in a perfectly competitive market is operating below the break-even point. What is the best thing to do in the short run?

Option A

Borrow money and buy more capital equipment.

Option B

consider shutting down or stopping production

Option C

Increase the price of its strawberries.

Option D

Hire more workers.

the average product of labor is always equal to the marginal product of labor.

In Sam's greenhouse operation, labor is the only short term variable input. After completing a cost analysis, if the marginal product of labor is the same for each unit of labor, this will imply that

Option A

as more labor inputs are used, the average product of labor inputs will fall.

Option B

the average product of labor is always greater that the marginal product of labor

Option C

the average product of labor is always less than the marginal product of labor.

Option D

the average product of labor is always equal to the marginal product of labor.

short run; the quantity of output where profits are highest

In the _______________, the perfectly competitive firm will seek out _______________.

Option A

long run; methods to reduce production and shut down

Option B

short run; the quantity of output where profits are highest

Option C

short run; profits by ignoring the concept of total cost analysis

Option D

long run; the quantity of output where profits are highest

Firms set different prices for their product, either at or above the equilibrium price.

Which of the following characteristics does NOT describe a perfectly competitive market?

Option A

Companies are able to enter and exit the market without any restrictions.

Option B

Firms set different prices for their product, either at or above the equilibrium price.

Option C

There are many people who desire and have the ability to purchase the product.

Option D

Many firms are producing identical products

They sell each package of strawberries for $5, and the average variable cost is $4.75.

In the short run, a strawberry farm operating in a perfectly competitive market would produce strawberries at a profit if...

Option A

Their fixed costs are less than their variable costs.

Option B

They sell each package of strawberries for $5, and the average variable cost is $4.75.

Option C

They sell each package of strawberries for $5, and the average cost is for each package is $5

Option D

Set the price for each package of strawberries above the prevailing equilibrium price.

long run; increasing its production

In the _____________, the perfectly competitive firm will react to profits by

__________________.

Option A

long run; tailoring their quality controls

Option B

long run; increasing its production

Option C

short run; increasing quality of products

Option D

short run; reducing its labor inputs

provided each is willing to accept the prevailing market price

Idaho farmers can sell as large a quantity of their potato crop as they wish,

Option A

provided each is willing to accept the prevailing market price.

Option B

provided quality is perceptible and determines the market price.

Option C

if they set their own price in the long run, but in the short run, the market sets the price.

Option D

if they set their own price in the short run, but in the long run, the market sets the price.

Shifts to the right with new firms’ entry and stops at the point where the new long-run equilibrium intersects at the same market price as before.

For a constant cost industry in a purely competitive market structure, whenever there is an increase in market demand and price, then the supply curve

Option A

The supply curve becomes unstable. and firms leave the market because management costs become very high

Option B

Shifts to the right with new firms’ entry and stops at the point where the new long-run equilibrium intersects at a lower market price.

Option C

Shifts to the right with new firms’ entry and stops at the point where the new long-run equilibrium intersects at the same market price as before.

Option D

Shifts to the left as some firms leave the market and the market price rises to a new level.

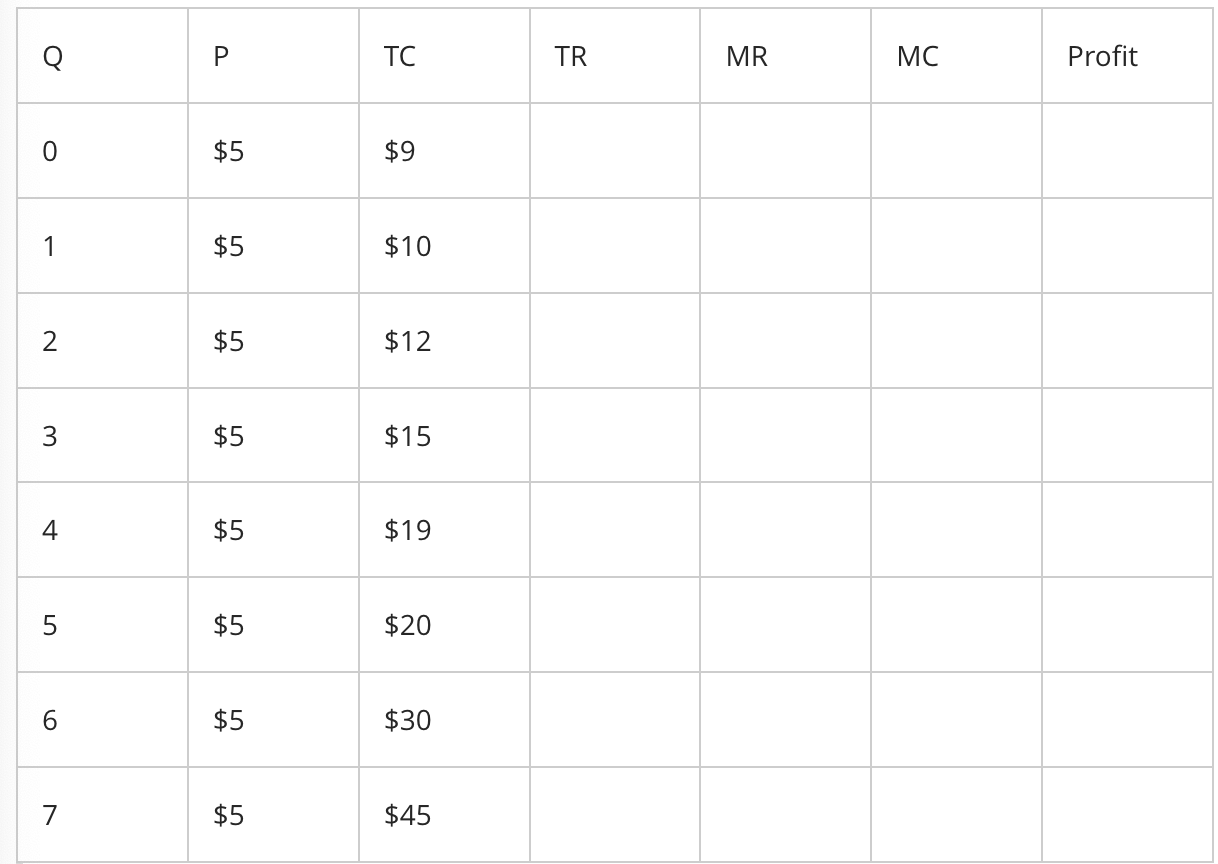

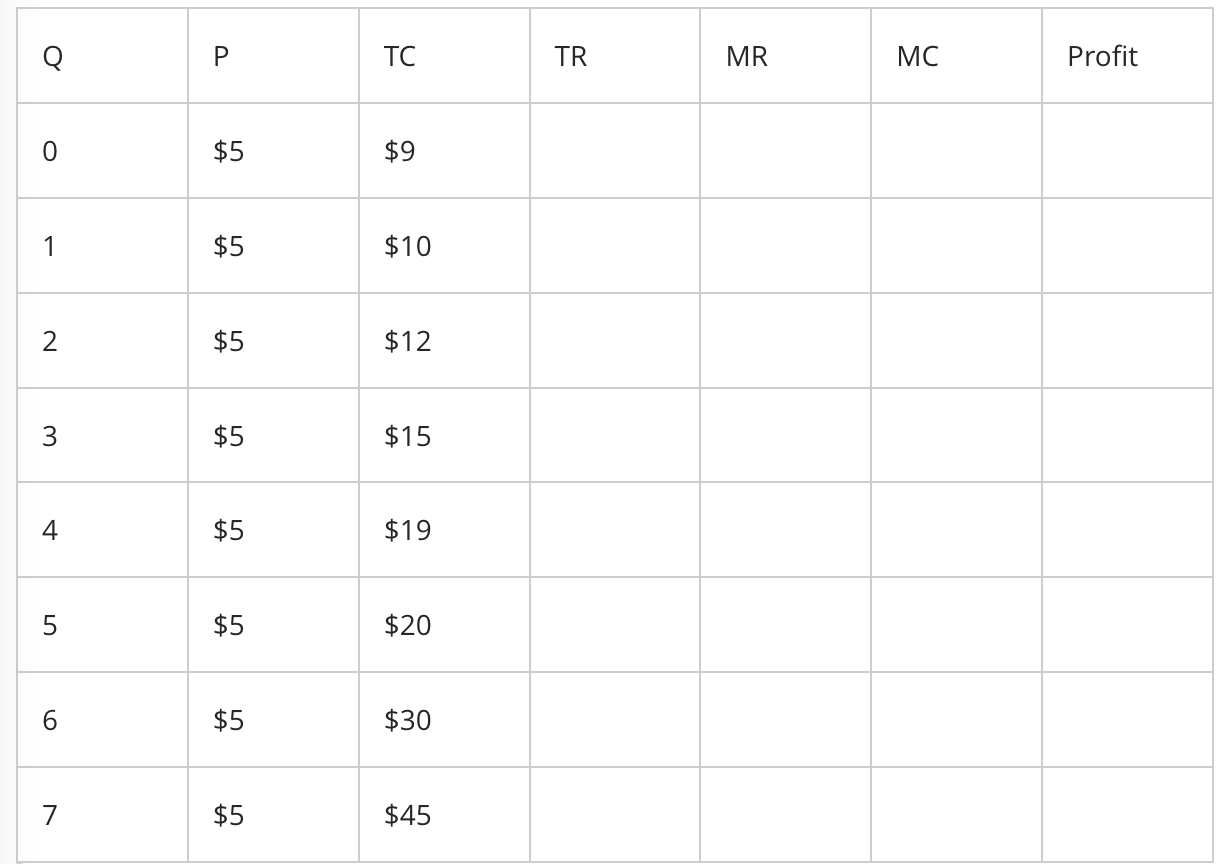

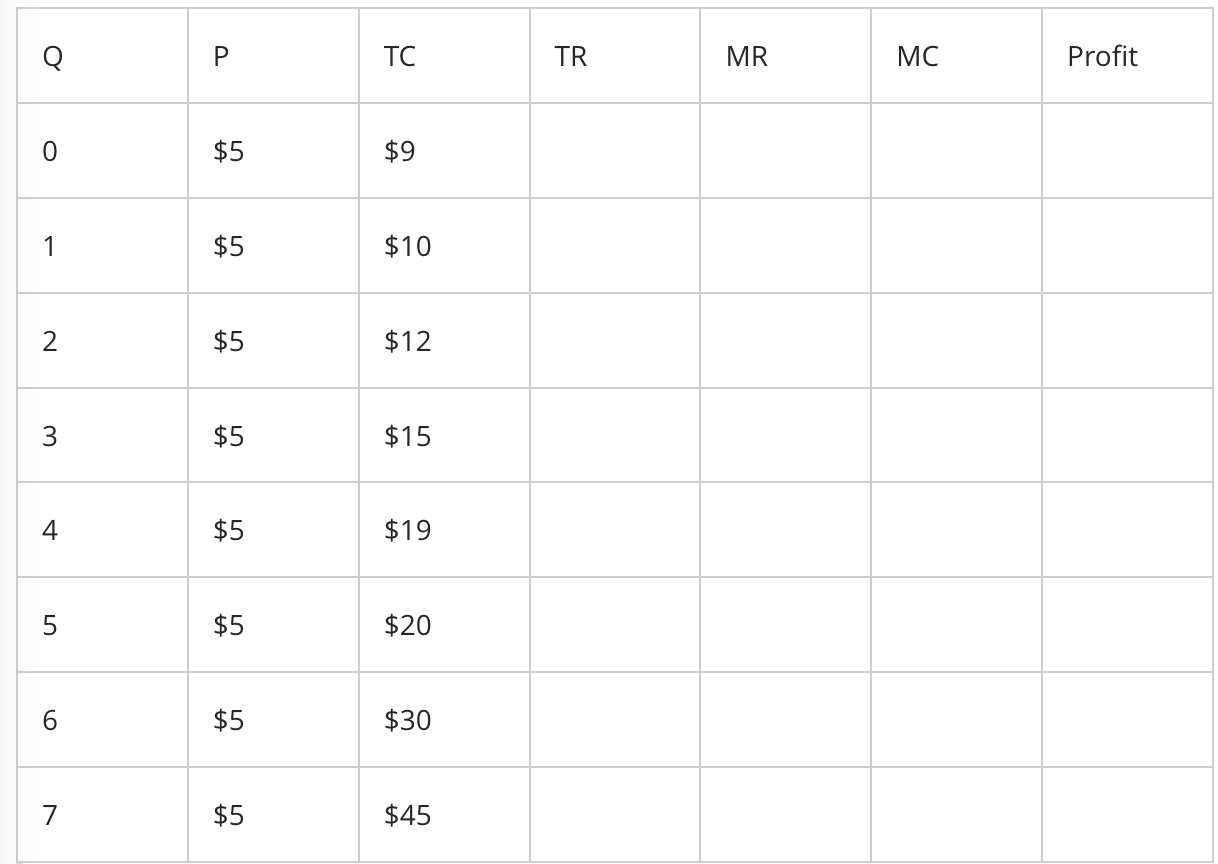

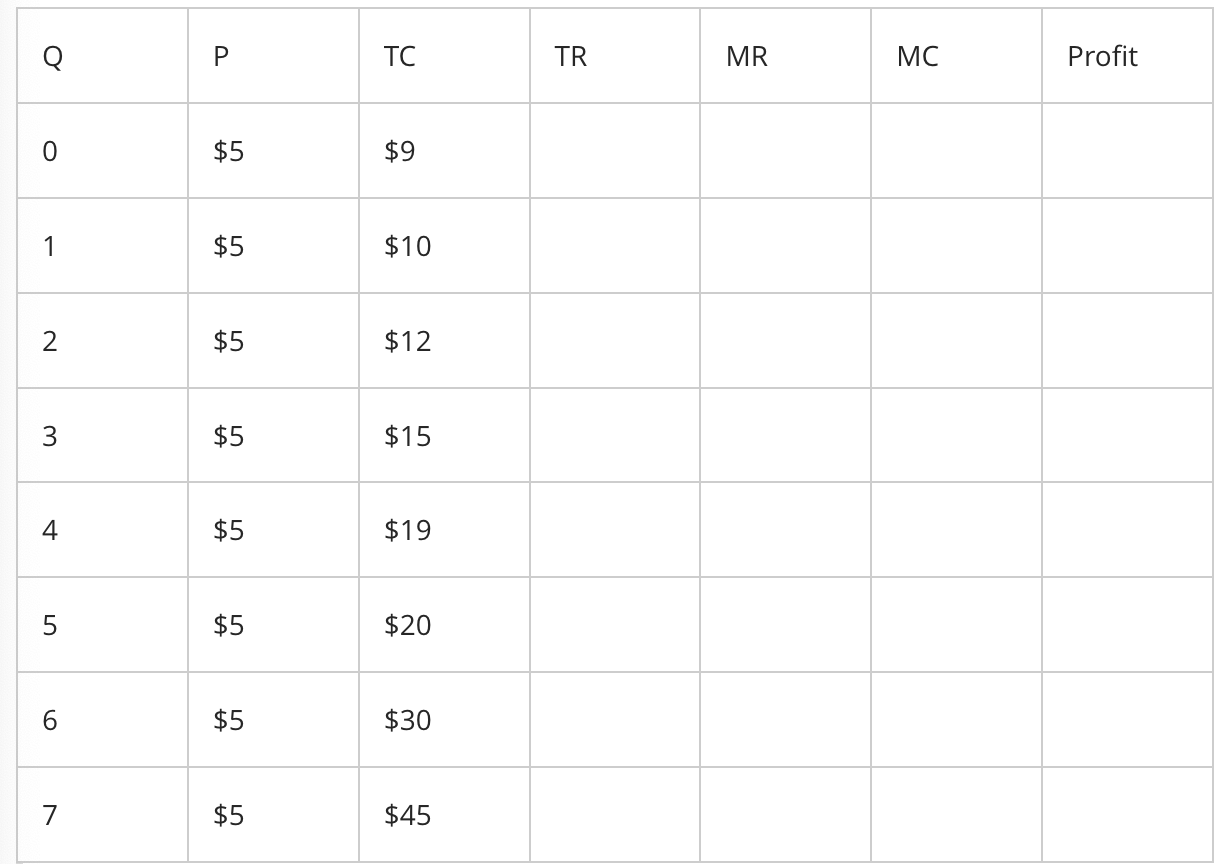

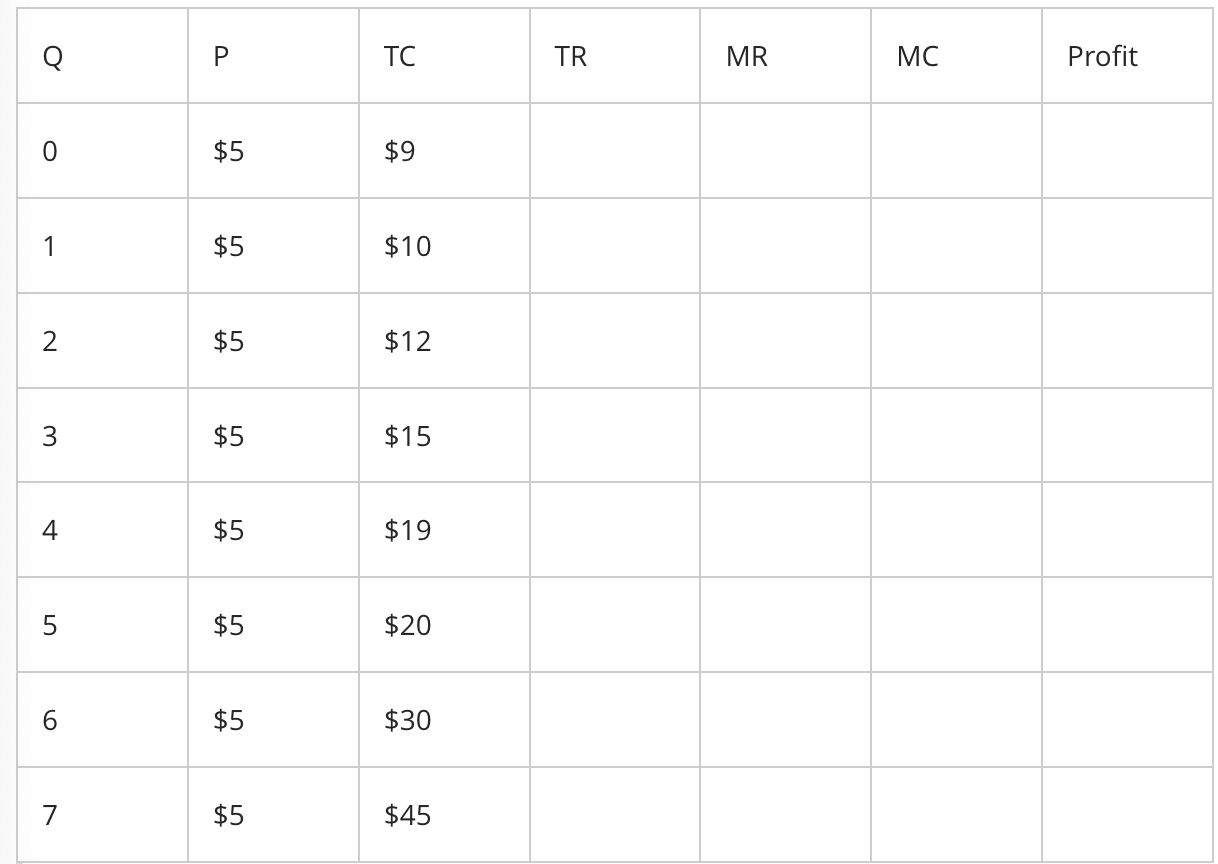

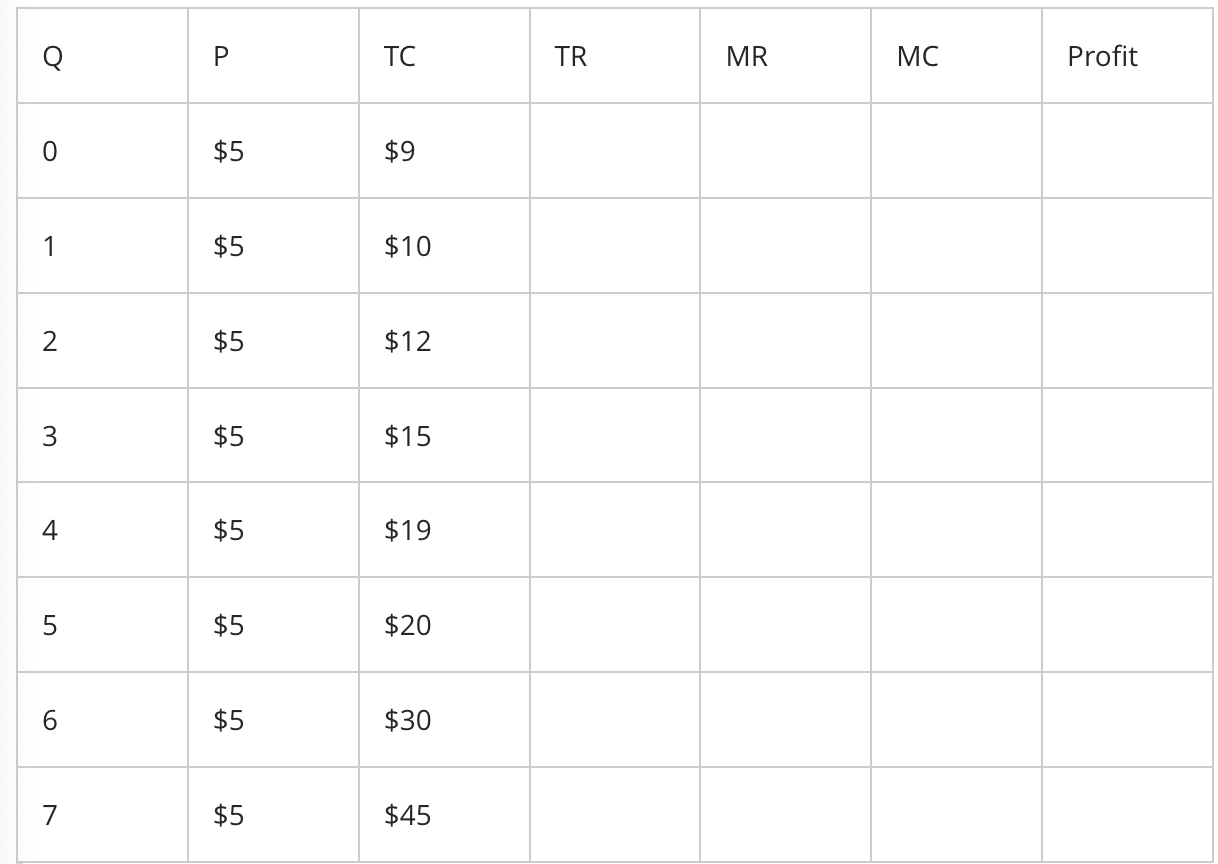

$9.00

what will the fixed costs equal for production at quantity (Q) level 4?

Option A

$35.00

Option B

$4.00

Option C

$9.00

Option D

$36.00

$4.00

what will the marginal cost equal for production at quantity (Q) level 4?

Option A

$1.00

Option B

$5.00

Option C

$3.00

Option D

$4.00

can also be interpreted as shifts of their respective marginal cost curves.

Temperatures have persisted below freezing levels in Florida throughout the months of December and January. As a result, demand for electricity sharply increased and the price of electricity rose sharply. The price of coal also rose. In these circumstances, any resulting shifts in the supply curves for coal miners and electricity producers

Option A

will determine what price to produce at given the market demand.

Option B

at all levels of output shifts marginal costs to the right.

Option C

can also be interpreted as shifts of their respective marginal cost curves.

Option D

shifts marginal costs to the right enabling both to produce more at any given market price

$20.00

Given the data provided in the table below, the total revenue (TR) for production at quantity (Q) level 4 equals to

Option A

$zero

Option B

$15.00

Option C

$1.00

Option D

$20.00

At first, all firms would achieve economic profit, but eventually economic profit would fall back to zero as new firms enter the market.

Assume the purely competitive market is in long-run equilibrium. For some reason market demand increases. What would happen?

Option A

At first, all firms would achieve economic profit, but eventually economic profit would fall back to zero as new firms enter the market.

Option B

Market price would increase, and producers would band together to prevent new entrants to the market.

Option C

Market prices would fall, causing producers to reduce output. All economic losses are incurred, firms start leaving the market.

Option D

An increase in market demand would not produce any change in price, production, or the movement of firms in and out of the market.

could likely result in a notable loss of sales to competitors

It is said that in a perfectly competitive market, raising the price of a firm's product from the prevailing market price of $179.00 to $199.00, ________________________.

Option A

will cause the firm to recover some of its opportunity costs

Option B

will likely cause the firm to reach its shutdown point immediately

Option C

could likely result in a notable loss of sales to competitors

Option D

is a sure sign the firm is raising the given price in the market

what quantity to produce

In a free market economy, firms operating in a perfectly competitive industry are said to have only one major choice to make. Which of the following correctly sets out that choice?

Option A

what quantity of labor is needed

Option B

what quantity to produce

Option C

what quality to produce

Option D

what price to charge

Firms produce that quantity where the price consumers pay equals the cost to society to produce it.

How would you explain allocative efficiency in a purely competitive market structure?

Option A

Allocative efficiency is a concept involving only two goods, so it cannot be applied to a perfectly competitive market..

Option B

Firms produce the quantity where the price consumers pay is less than the cost to society to produce it.

Option C

Firms ensure that they produce enough quantity so that everyone who wishes to buy the product can do so.

Option D

Firms produce that quantity where the price consumers pay equals the cost to society to produce it.

$5.00

what will the marginal revenue equal for production at quantity (Q) level 4?

Option A

$20.00

Option B

$15.00

Option C

$5.00

Option D

$1.00

quantity (Q) level 5

At what quantity (Q) level the profit will be maximized?

Option A

quantity (Q) level 2

Option B

quantity (Q) level 7

Option C

quantity (Q) level 5

Option D

quantity (Q) level 4

price taker

the term _______________ refers to a firm operating in a perfectly competitive market that must take the prevailing market price for its product.

Option A

trend setter

Option B

business entity

Option C

price taker

Option D

price setter

It will eventually reach long-run equilibrium.

In a perfectly competitive market...

Option A

It will eventually reach long-run equilibrium.

Option B

Firms will compete for business by setting different prices at or above the prevailing equilibrium price

Option C

A few firms will dominate the market share.

Option D

Economic profits will be driven down to zero in the short run

$200.00

In order to produce 100 pairs of oven gloves, Marcia incurs an average total cost of $2.50 per pair. Marcia’s marginal cost is constant at $1.00 for every pair of oven gloves produced. The total cost to produce 50 pairs of oven gloves is

Option A

$300.00

Option B

$200.00

Option C

$250.00

Option D

$500.00

-$10.00

what will the amount of profit be for production at quantity (Q) level 7?

Option A

zero

Option B

$1.00

Option C

-$5.00

Option D

-$10.00

$20

In order to produce 100 oatmeal cookies, GoodieCookieCo incurs an average total cost of $0.25 per cookie. The company’s marginal cost is constant at $0.10 for all oatmeal cookies produced. The total cost to produce 50 oatmeal cookies is

Option A

$60

Option B

$50

Option C

$20

Option D

$25

Marginal revenue

____________ refers to the additional revenue gained from selling one more unit.

Option A

Total revenue

Option B

Accounting profit

Option C

Economic profit

Option D

Marginal revenue

is dictated by the forces of demand and supply.

I'maSolarPanelCo. manufactures and distributes solar panels in the US market. Two years ago, it had 5 US competitors, but government stimulus in the industry has encouraged 7 new US competitors to enter the market. In these circumstances, I'maSolarPanelCo.'s price for its output

Option A

can be tailored to exceed the price of its inputs.

Option B

can be set by management to maximize profits.

Option C

can be tailored to meet the price of its inputs.

Option D

is dictated by the forces of demand and supply.

It provides a useful comparison to markets that operate in more complex, real-world conditions.

Why is the perfect competition often used as a benchmark?

Option A

It provides a useful comparison to markets that operate in more complex, real-world conditions.

Option B

The perfect competition model is more frequently observed in the real world compared to other market models

Option C

In the real world, all markets are perfectly competitive, so this model allows us to compare them to one another.

Option D

It accounts for a variety of issues like pollution, inventions of new technology, poverty, and government programs that other models do not account for.

Profit = total revenue – total cost

A firm in a purely competitive market structure calculates profit using the following equation:

Option A

Profit = average total cost

Option B

Profit = total revenue – total cost

Option C

Profit = price times quantity sold

Option D

Profit = total revenue divided by output