MACRO - Protectionism

1/3

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

4 Terms

Protectionism

Government impose trade barriers on international trade (USA) to limit imports & protect domestic production.

Reasons for protectionism

Protect domestic producers

Improve BOP

Earn government revenue

Protect infant (sectors that have just started) & sunset (sectors that have matured) industries

Prevent goods w/ negative externalities being imported (cigarettes)

Strategy to retaliate - When a country impose barriers on another’s products, they retaliate through protectionism

Prevent dumping

Arguments against protectionism

Limits consumer choice

Higher prices - import inflation

May result in domestic monopoly —> less foreign competition - less firms in market - market power increases - domestic monopolies

Retaliation - if a country restricts imports - other countries act like spoiled rich kids and become petty

Protectionism policies

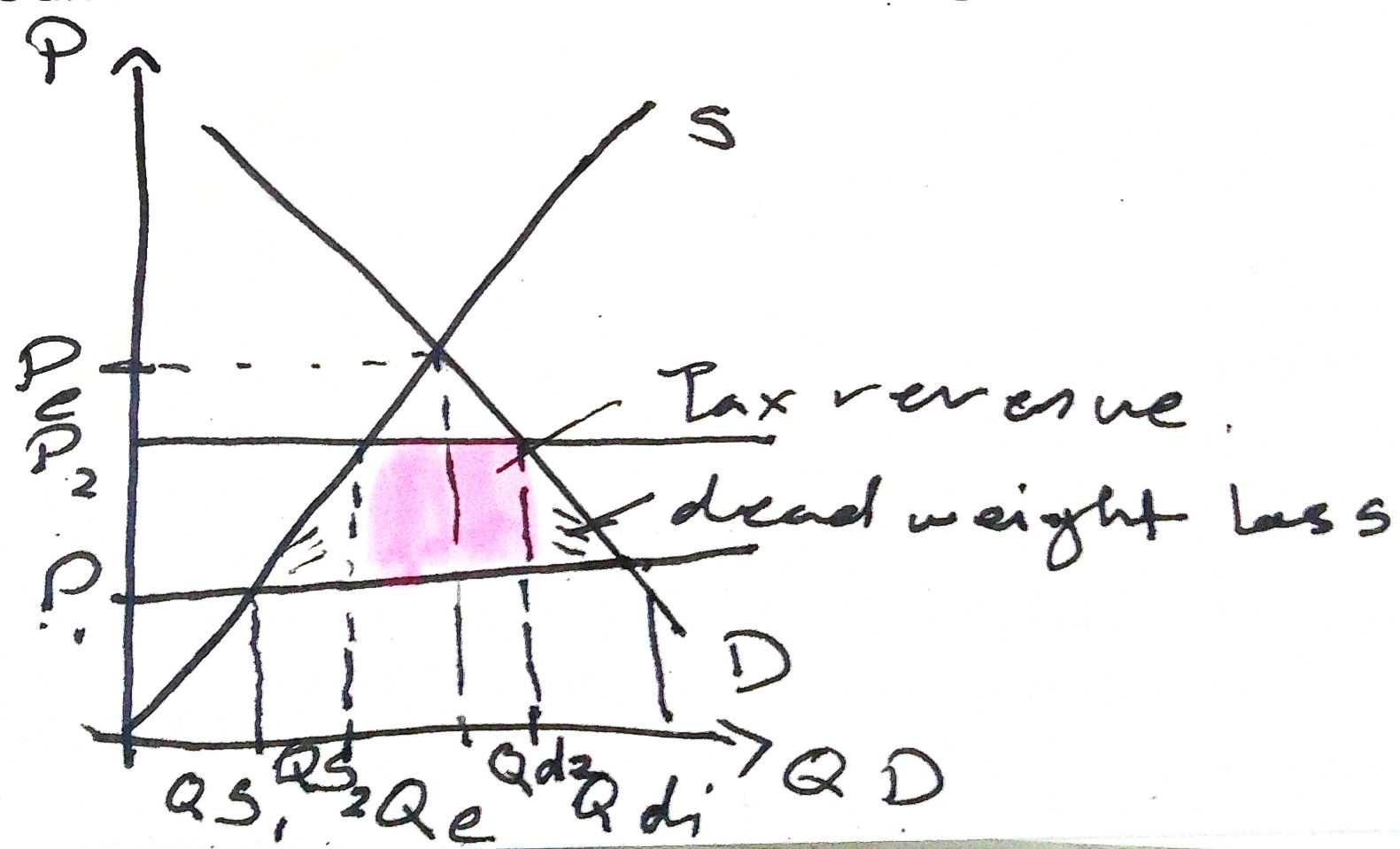

Tariffs - Tax on imports

Makes goods relatively expensive

However, if demand is inelastic people will still buy at higher prices (essential goods - petrol) - import inflation

Quotas - Physical limit on imports

Consumers would therefore, purchase locally

However, effectiveness depends on size of quota & governments assurance illegal purchases don’t happen.

Subsidies to local firms

Admin barriers - Rules & regulations set of importing goods to make it harder for foreign goods to enter the country

Voluntary export restrictions - Importing country requests exporting country to limit their export to said country

Devaluation of currency - imports more expensive - less demand - less imports

Sanctions (penalties/restrictions placed on a country) & embargos (complete ban on trade with a particular country)