Important Terms

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

4 goals of monetary policy

Price Stability

High Employment

Stability of financial markets and institutions

Economic growth

Federal Funds Rate

the interest rate banks charge each other for overnight loans

Repurchase Agreements

short-term contract between two parties that involves the sale and repurchase of securities. The seller agrees to sell the securities to the buyer at a specific price, with a commitment to buy them back at a later date for a higher price

Reverse Repurchase Agreements

a transaction where a seller agrees to buy back securities from a buyer at a specified price and time in the future

Expansionary Monetary Policy

The Fed takes actions to decrease interest rates to increase real GDP

Contractionary Monetary Policy

increasing interest rates to reduce inflation and encourage price stability

Liquidity Trap

the Fed was unable to push rates any lower to encourage investment.

Quantitative Easing

buying securities beyond the normal short-term Treasury securities, including 10-year Treasury notes and mortgage-backed securities.

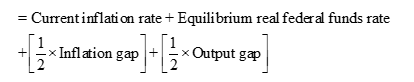

Taylor Rule

is a rule developed by John Taylor of Stanford University that links the Fed’s target for the federal funds rate to economic variables

Equilibrium Real Federal Funds Rate

the estimate of the inflation-adjusted federal funds rate that would be consistent with maintaining real G D P at its potential level in the long run

Inflation Gap

difference between current inflation and the Fed’s target rate of inflation (could be positive or negative)

Output Gap

the difference between current real G D P and potential G D P (could be positive or negative)

Inflation Targeting

A framework for conducting monetary policy that involves the central bank announcing its target level of inflation.

Bubble

a situation in which prices are too high relative to the underlying value of the asset.

Herding Behavior

failing to correctly evaluate the value of the asset and instead relying on other people’s apparent evaluations

Speculation

believing that prices will rise even higher and buying the asset intending to sell it before prices fall

Troubled Asset Relief Program (TARP)

providing funds to banks in exchange for stock